Proposed US Outsourcing Tax Bill May Dent Cost Edge Of Indian IT Giants: When we talk about global business, outsourcing has always been a controversial subject in the United States. Recently, the proposed U.S. HIRE Act (Halting International Relocation of Employment Act) has triggered debates across boardrooms and government offices. If this bill goes through, it could impose a heavy 25% tax on U.S. companies that outsource work overseas. That puts Indian IT giants like Infosys, TCS, Wipro, and HCLTech right in the line of fire. Think about it like this: outsourcing is similar to ordering a pizza from across town because it’s cheaper than your local shop. But if a new “delivery tax” suddenly makes that faraway pizza cost more than the one around the corner, you’d quickly change your order. That’s the situation U.S. companies may face if outsourcing suddenly becomes too expensive due to the new tax. And the consequences could be enormous for India’s $250+ billion IT industry.

Proposed US Outsourcing Tax Bill May Dent Cost Edge Of Indian IT Giants

The proposed U.S. HIRE Act could reshape the global outsourcing landscape. For Indian IT, it threatens the very cost advantage that fueled decades of growth. For U.S. companies, it could mean higher costs, hiring challenges, and slower innovation. While the bill’s chances of becoming law remain slim, its mere existence is forcing companies to rethink strategies. The future of outsourcing lies not in low-cost labor alone, but in innovation, diversification, and high-value services.

| Point | Details |

|---|---|

| Proposed Bill | U.S. HIRE Act (Halting International Relocation of Employment Act) |

| Tax Proposal | 25% excise tax on outsourcing payments + denial of tax deductions |

| Effective Date | Proposed for payments made after December 31, 2025 |

| Impact on Indian IT | Shrinks cost advantage, pressures margins, may cause deal delays |

| U.S. Market Share | U.S. accounts for 50–60% of Indian IT export revenues |

| Global Ripple | Philippines, Mexico, and Eastern Europe may gain from nearshoring |

| Political Status | Faces hurdles in U.S. Congress, lacks full White House backing |

| Official Reference | U.S. Congress |

What Exactly Is the U.S. HIRE Act?

The HIRE Act, introduced by Senator Bernie Moreno, is designed to bring jobs back to American soil. The key provisions are:

- A 25% excise tax on payments by U.S. companies to foreign service providers.

- Denial of tax deductions for outsourcing-related expenses.

- Establishing a Domestic Workforce Fund to retrain American workers and expand apprenticeships.

The bill, if passed, would apply to all qualifying payments made after December 31, 2025.

For U.S. companies that depend heavily on outsourcing for IT, customer service, and software development, this bill could make offshore services far more expensive. For Indian IT firms, which generate the majority of their revenue from the U.S. market, it represents a serious business risk.

Why Indian IT Firms Are Deeply Concerned?

The Cost Advantage Shrinks

Indian IT companies have built their global reputation on a cost advantage. Highly skilled engineers in India can deliver the same work for a fraction of U.S. labor costs. But with the HIRE Act’s 25% tax, that advantage shrinks dramatically.

According to analysts, outsourcing costs could rise by 50–60% when the tax and loss of deductibility are combined. A contract worth $10 million could suddenly balloon to $12.5 million or more, eroding the very reason U.S. companies outsource in the first place.

Margins and Deals at Risk

Indian majors like TCS, Infosys, Wipro, HCLTech, and Tech Mahindra are especially vulnerable. Many of their contracts are large-scale, long-term deals with thin profit margins. Even a small increase in costs can throw off profitability.

Commoditized services such as application maintenance, helpdesk support, and routine software testing could be the hardest hit. Clients may try to renegotiate contracts, delay new projects, or shift work back onshore.

On the other hand, premium services — such as cloud migration, artificial intelligence, machine learning, and cybersecurity — are more insulated because they require specialized expertise that the U.S. labor market struggles to provide at scale.

Diversification Is Now a Priority

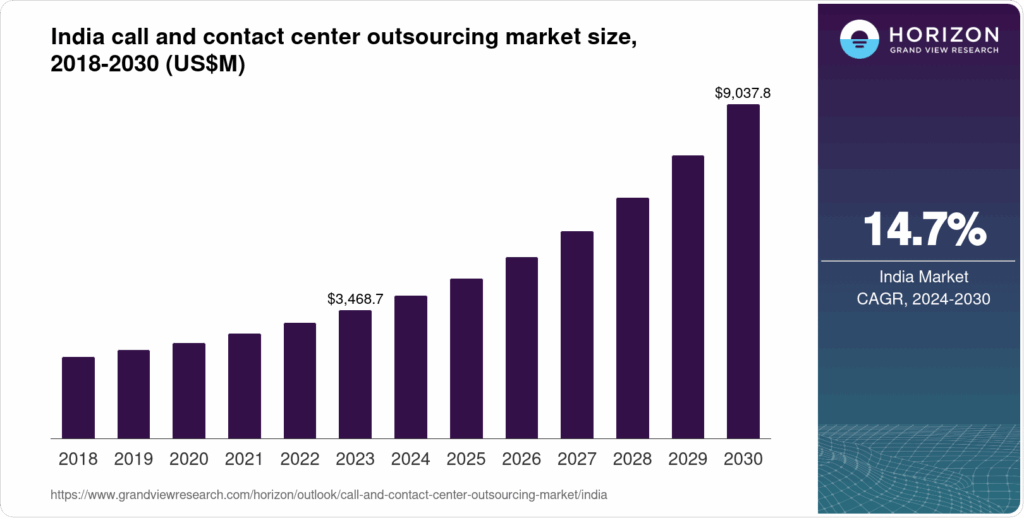

The U.S. market makes up more than half of India’s IT exports. This heavy dependence has long been seen as a risk. With the HIRE Act looming, Indian IT firms are accelerating their push into new markets like Europe, Japan, the Middle East, Australia, and Africa.

Companies are also investing in local delivery centers in the U.S., hiring thousands of American workers to soften the political blow. Infosys, for instance, has opened multiple innovation hubs in the U.S. over the last five years.

The Uncertainty Factor

Even if the bill never becomes law, the uncertainty itself is damaging. Large U.S. corporations may delay signing outsourcing contracts until they have clarity. That means slower deal cycles, deferred projects, and weaker growth for Indian IT in the short term.

Historical Context: This Isn’t the First Time

The U.S. has a history of flirting with anti-outsourcing measures:

- In 2004, during the presidential election, outsourcing became a major talking point, but proposed bills failed after heavy corporate lobbying.

- In 2010, after the global financial crisis, the Obama administration introduced measures to discourage outsourcing, but none included penalties as steep as a 25% tax.

- H-1B visa restrictions have repeatedly forced Indian firms to increase local hiring, adding to their costs.

The takeaway? These proposals often stall in Congress but succeed in reshaping strategy by creating uncertainty.

Reactions from Industry and Analysts

- NASSCOM, India’s top IT industry body, has called the proposal “counterproductive” and warned that it could harm U.S. companies by raising costs and slowing innovation.

- Indian government officials are likely to take this up diplomatically, given that IT exports are one of India’s largest foreign exchange earners.

- Analysts on Wall Street are split. Some dismiss it as political posturing, while others caution that even if it doesn’t pass, the rhetoric itself could impact market sentiment and deal pipelines.

Impact of Proposed US Outsourcing Tax Bill May Dent Cost Edge Of Indian IT Giants on U.S. Businesses and Consumers

This isn’t just an Indian IT problem. U.S. companies also stand to lose:

- Higher IT Costs: Firms may have to spend more for the same services, reducing budgets for innovation.

- Hiring Challenges: The U.S. has a shortage of skilled tech workers. Outsourcing fills that gap. Without it, projects could stall.

- Consumer Prices: Higher business costs often trickle down to consumers. Banking apps, e-commerce platforms, and healthcare systems may all become more expensive to run.

The irony is that while the bill aims to create American jobs, it could also slow down U.S. competitiveness in the global digital economy.

Who Else Could Benefit?

If U.S. firms cut down on Indian outsourcing, other countries may step in:

- Philippines: Strong in call centers and customer support.

- Mexico: Attractive for nearshoring due to proximity and time zone alignment.

- Eastern Europe (Poland, Romania, Ukraine): Known for high-quality software engineers.

This means outsourcing won’t disappear; it will simply shift to different geographies.

Practical Advice for Stakeholders

For U.S. Companies

- Review outsourcing contracts to see if they include tax-adjustment clauses.

- Explore hybrid models that combine offshore delivery with local teams.

- Invest in automation to reduce dependency on low-cost offshore labor.

For Indian IT Firms

- Increase local hiring in the U.S. to show commitment to American jobs.

- Focus on premium services like AI, digital transformation, and cybersecurity.

- Expand aggressively into non-U.S. markets to reduce dependency.

For IT Professionals

- Upskill in areas like cloud, AI, data science, and cybersecurity — roles that are in demand everywhere.

- Focus on consulting and strategic IT services, which are less vulnerable to outsourcing restrictions.

Political Viability: Will the Bill Pass?

The million-dollar question is whether the HIRE Act will actually become law.

- It faces significant hurdles in Congress, especially from lawmakers who fear it will raise costs for American companies.

- Corporate America, which spends billions on lobbying, is unlikely to let such a bill pass without a fight.

- The White House has not formally backed the bill. Without executive support, its prospects are slim.

Most experts believe the bill has a low chance of passing in its current form. However, the growing sentiment against outsourcing means companies can no longer ignore the political risks.

BBC Drops a Tax Secret That Could Save You Thousands in 2025

Former Boston City Councilor Sentenced to Prison in Corruption Case

The Future of Outsourcing: An Evolving Model

Even without this bill, outsourcing is already changing:

- Remote work has blurred the lines between onshore and offshore delivery.

- Artificial intelligence and automation are reducing the need for human labor in routine IT tasks.

- “Follow the sun” models, where work is distributed across time zones, are gaining traction.

In short, outsourcing isn’t going away — it’s evolving into something more complex, more automated, and more global.