US Treasury Secretary Denies Trump Tariffs Are Tax On Americans: The US Treasury Secretary denies Trump tariffs are a tax on Americans, a statement that has sparked intense debate across political, economic, and business circles. Treasury Secretary Scott Bessent, speaking on national television, rejected the idea that tariffs—particularly those imposed during former President Donald Trump’s administration—are simply hidden taxes passed on to U.S. consumers. The conversation couldn’t come at a more crucial time. With the global economy shifting, supply chains still recovering from the pandemic, and inflation lingering, Americans are more aware than ever of how trade policies impact the prices they pay every day. But are tariffs really a shield for American jobs, or are they a burden for families at the checkout line?

US Treasury Secretary Denies Trump Tariffs Are Tax On Americans

The US Treasury Secretary denies Trump tariffs are a tax on Americans, but the evidence paints a more complicated picture. While Scott Bessent highlights growth and stock gains, economists and consumers see higher costs at home. With a Supreme Court decision looming, the debate over tariffs is about more than economics—it’s about the balance between protecting American workers and keeping everyday goods affordable. The outcome will shape not just trade policy, but the daily budgets of millions of American families.

| Topic | Details |

|---|---|

| Main Claim | Treasury Secretary Scott Bessent denies tariffs are a tax on Americans. |

| Economic Data | U.S. GDP growth at 3.3% in Q2 2025; stock markets at record highs. |

| Business Pushback | Nike, John Deere, and Black & Decker say tariffs cost billions. |

| Legal Challenge | Appeals court ruled Trump may have exceeded authority under IEEPA; case heads to the Supreme Court. |

| Possible Refunds | Treasury may refund about half of tariff collections if overturned. |

| Historical Note | Past tariffs, like Smoot-Hawley (1930), worsened global trade tensions. |

| Consumer Examples | Washing machines rose 12% after tariffs; packaging costs raised food and beverage prices. |

| Official Reference | U.S. Department of Treasury |

What Exactly Did the Treasury Secretary Say?

During his interview on NBC’s Meet the Press, Bessent was pressed with a direct question: “Do you acknowledge that these tariffs are a tax on American consumers?”

His reply was firm:

“No, I don’t.”

He went on to challenge corporate complaints, arguing that businesses often present worst-case, “draconian” scenarios to shareholders during earnings calls. Instead, he pointed to 3.3% GDP growth and record-breaking stock market performance as evidence that tariffs haven’t slowed down the broader economy.

But critics argue that looking at national averages doesn’t reflect the reality of working families who feel the pinch in everyday goods.

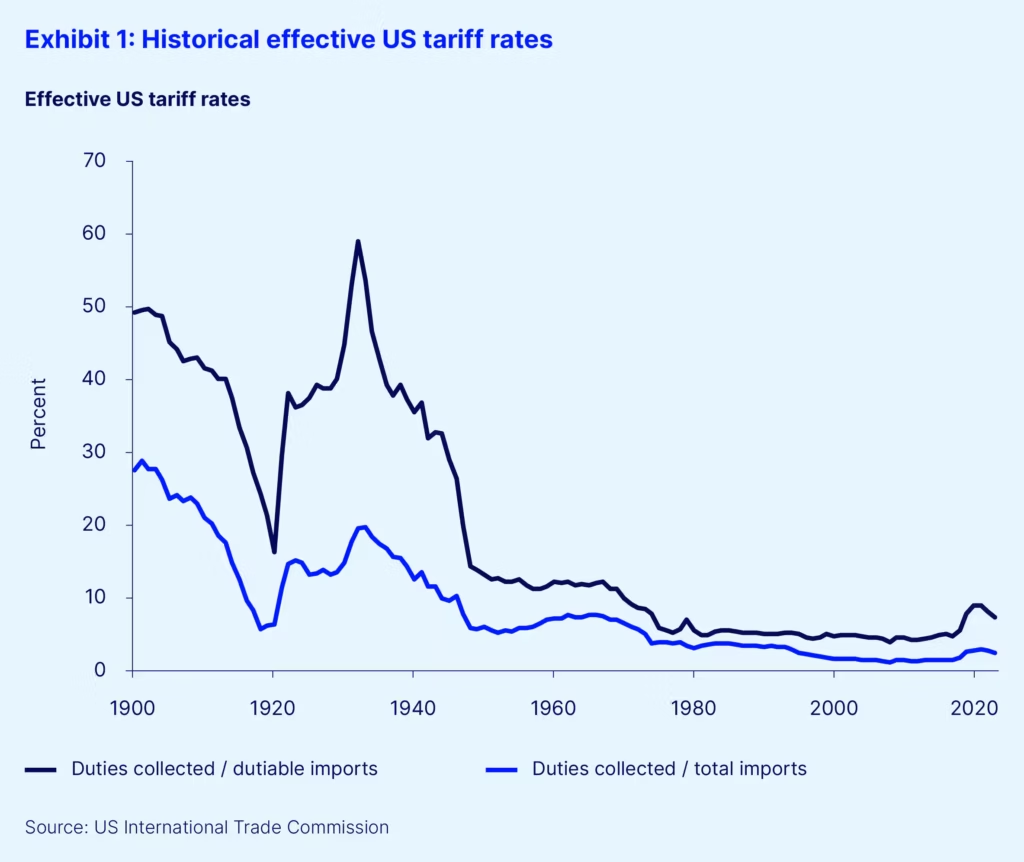

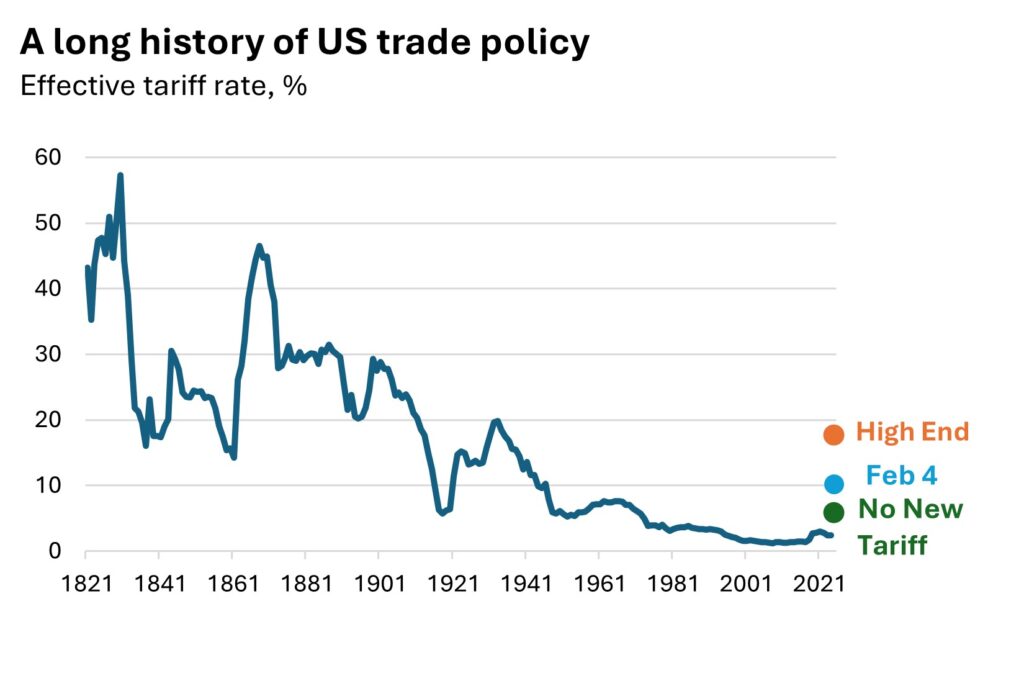

A Look Back: Tariffs in U.S. History

Tariffs have shaped America’s economy for centuries. Understanding the past helps us make sense of the present debate.

- The Tariff of 1816: Designed to protect young American industries from British imports after the War of 1812.

- The Smoot-Hawley Tariff Act (1930): Raised tariffs on over 20,000 goods. Many historians believe it deepened the Great Depression as countries retaliated with tariffs of their own.

- Bush’s Steel Tariffs (2002): Imposed to protect U.S. steelmakers, but struck down by the World Trade Organization (WTO) after pushback from the European Union.

- Trump’s Tariffs (2018–2020): Targeted hundreds of billions in Chinese imports, sparking a trade war. Supporters claimed they protected U.S. jobs; critics highlighted higher consumer prices.

The lesson? Tariffs often begin with protective intent but can spiral into broader economic consequences.

Consumer Impact: What Tariffs Mean at the Checkout

For families, the debate isn’t theoretical—it’s about how much a shopping cart costs.

- Washing Machines: In 2018, tariffs raised prices on washers by about 12%, adding roughly $86 per unit. Dryers, not even tariffed, went up too because manufacturers bundled pricing.

- Groceries: Tariffs on aluminum drove up packaging costs for everything from soda cans to soup, nudging grocery bills higher.

- Cars & Electronics: Parts from China made vehicles and electronics more expensive, adding costs that ripple through dealerships and retail chains.

So while the Treasury Secretary insists tariffs aren’t a tax on consumers, for many families, the price tags tell another story.

US Treasury Secretary Denies Trump Tariffs Are Tax On Americans: The Legal Storm Ahead

The biggest fight may not be in the marketplace, but in the courtroom.

Trump imposed tariffs under the International Emergency Economic Powers Act (IEEPA), a law meant for national emergencies. A federal appeals court has since ruled that he may have stretched that power too far.

- Supreme Court Showdown: The case is now headed to the highest court in the land.

- Financial Fallout: If the tariffs are overturned, the Treasury could be forced to refund roughly half of the tariff revenue collected. That could amount to hundreds of billions of dollars.

- Budget Implications: Such refunds could disrupt government spending, debt reduction plans, and even social programs.

Bessent himself acknowledged the scale of the risk:

“We would have to refund enormous amounts of money if the Court overturns these tariffs.”

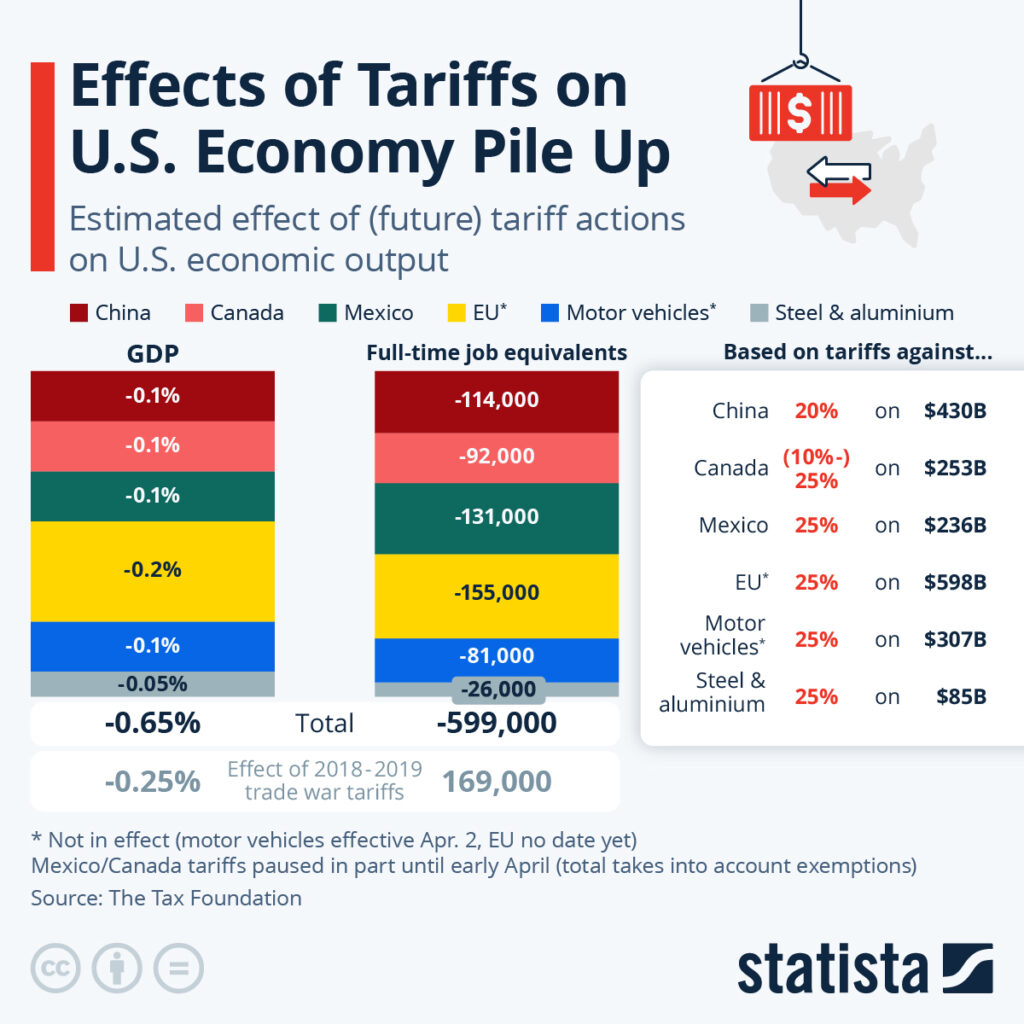

Expert Opinions: What Economists Are Saying

Economists and think tanks are divided:

- Peterson Institute for International Economics (PIIE): Studies show tariffs raised U.S. consumer costs by tens of billions annually.

- Brookings Institution: Argues that while tariffs may help workers in steel or aluminum, they hurt industries like auto manufacturing, which rely heavily on imported parts.

- American Enterprise Institute (AEI): Some analysts argue tariffs can work if paired with long-term industrial strategy, but without that, they risk more harm than good.

The consensus among many mainstream economists? Tariffs tend to be blunt instruments—good at making political statements but less effective at solving complex economic problems.

Global Reactions: A Ripple Effect

Tariffs don’t stop at America’s borders. Other nations often strike back.

- China: Imposed tariffs on U.S. soybeans, pork, and other farm goods. Farmers in the Midwest saw major export markets dry up.

- European Union: Targeted Harley-Davidson motorcycles, bourbon whiskey, and Levi’s jeans—iconic American brands.

- Canada and Mexico: Responded with counter-duties before negotiating under the USMCA deal.

Global retaliation often means that American exporters—farmers, ranchers, and manufacturers—get caught in the crossfire.

Step-By-Step Guide: Understanding Tariffs

Step 1: What Are Tariffs?

Tariffs are taxes on imported goods. Think of them as toll booths on international trade.

Step 2: Who Pays?

- Importers write the check to the government.

- But businesses often pass those costs down the supply chain—eventually reaching consumers.

Step 3: Why Use Tariffs?

- Protect domestic industries from cheaper foreign competition.

- Push trade partners into negotiation.

- Generate government revenue.

Step 4: The Downsides

- Raise consumer prices.

- Trigger retaliation abroad.

- Disrupt global supply chains.

Step 5: What’s Next?

The Supreme Court’s decision will set the future. If tariffs stand, they remain a trade weapon. If struck down, the U.S. may need new tools to handle trade disputes.

Practical Advice for Families, Businesses, and Investors

- For Families: Shop smarter—look for promotions, generic brands, or U.S.-made goods less tied to tariffs.

- For Small Businesses: Diversify suppliers. Avoid relying solely on imports vulnerable to tariff hikes.

- For Farmers: Stay alert to export market shifts—China and Europe are crucial buyers.

- For Investors: Watch stocks in retail, manufacturing, and agriculture, as tariff news often jolts these sectors.

Future Outlook: Two Possible Scenarios

- If the Supreme Court Upholds Tariffs:

- Trump’s approach becomes a precedent.

- Tariffs could become a standard part of U.S. trade strategy.

- Businesses adjust supply chains toward domestic sourcing.

- If the Court Overturns Them:

- Billions refunded to importers.

- Treasury finances take a hit.

- New limits on presidential power over trade emerge.

Either way, the ruling will reshape U.S. trade policy for years to come.

BBC Drops a Tax Secret That Could Save You Thousands in 2025

Former Boston City Councilor Sentenced to Prison in Corruption Case