AAR Declares Property Surveys & Tax Assessment Aren’t Municipal Functions: When the Authority for Advance Ruling (AAR) in Maharashtra declared that property surveys and tax assessments aren’t municipal functions, it sent shockwaves through legal, tax, and municipal circles. If you think this is just another technical ruling, think again—this decision has serious financial consequences for consultants, municipalities, and taxpayers across India. Imagine you’re playing Monopoly with friends. Suddenly, someone changes the rules and says every time you land on “Property Tax,” you also owe an extra service fee. That’s how this ruling feels: the game looks the same, but the costs just went up.

AAR Declares Property Surveys & Tax Assessment Aren’t Municipal Functions

The AAR’s ruling that property surveys and tax assessments aren’t municipal functions is more than a technical interpretation. It reshapes how municipalities manage finances, how consultants structure contracts, and how taxpayers may feel the impact. For professionals, the message is clear: factor GST into your planning, stay compliant, and prepare for higher costs. For citizens, the takeaway is equally simple—city services might cost more, and transparency will matter more than ever. As the saying goes, “If you don’t read the fine print, the fine print will read you.” And in this case, the fine print says: pay the GST, or pay the price later.

| Point | Details |

|---|---|

| Ruling Body | Authority for Advance Ruling (AAR), Maharashtra Bench |

| Decision | Property survey, numbering, and tax assessment services are not municipal functions under Article 243W (Twelfth Schedule) of the Constitution |

| Impact on GST | Services tied to property tax assessment are taxable and not exempt under GST Notification No. 12/2017 |

| Affected Stakeholders | Municipalities, consultants, taxpayers indirectly |

| GST Rate | 18% on consulting and survey services |

| Official Reference | Goods and Services Tax Council |

What Exactly Is a Municipal Function?

To break it down simply: municipal functions are like a city’s job description. They include:

- Urban planning and town development.

- Regulating land use and building construction.

- Public health, sanitation, and solid waste management.

- Providing water, electricity, and transportation.

These duties are listed in the Twelfth Schedule of Article 243W of the Constitution. But here’s the catch: property tax assessment doesn’t appear on that list.

Yes, municipalities are responsible for collecting property taxes, but the Constitution frames that as a financial responsibility—not a “function” in the sense of city planning or development. That’s the fine line the AAR has drawn.

Historical Context: Property Taxes in India

Property taxes in India go way back—colonial-era municipalities relied on them heavily. Fast forward to today, and they remain the backbone of local government revenue, making up 35-40% of municipal income in major cities.

Here’s the problem: many municipalities don’t have the manpower, technical know-how, or digital infrastructure to carry out large-scale surveys. So they outsource to private consultants. Until now, those consultants often argued their services were “municipal functions” and thus exempt from GST. The AAR has shut that door.

Why AAR Declares Property Surveys & Tax Assessment Aren’t Municipal Functions Ruling Matters?

1. Consultants Lose Their Tax Shield

Consulting firms must now charge 18% GST on survey and assessment services. A job quoted at ₹10 lakh now costs ₹11.8 lakh.

2. Municipal Budgets Take a Hit

Cities running on thin budgets will have to cough up more. For smaller towns, this could mean cutting back on other services.

3. Citizens Indirectly Pay the Price

Higher costs for cities often trickle down into higher property tax bills, increased service fees, or reduced local amenities.

U.S. vs. India: How Property Tax Is Handled

In the United States, property tax assessment is carried out directly by county assessors’ offices. These are government employees—not outside consultants. Because it’s an in-house function, there’s no question of sales tax or GST-type levies being applied.

In India, however, many municipalities outsource property tax-related work, creating this gray area. The AAR’s ruling clarifies that once private firms step in, their work is taxable—even if the ultimate goal is municipal revenue.

The Legal Fine Print

- Article 243W & Twelfth Schedule: Defines municipal functions like planning, sanitation, and public health.

- Notification No. 12/2017: Grants GST exemption for services directly linked to municipal functions.

- AAR’s Stand: Tax administration (like property surveys) = financial duty, not a listed municipal function.

Real-World Example

Suppose a city hires a consultant for a ₹1 crore property survey.

- Before ruling: Consultant might have claimed GST exemption. City pays ₹1 crore.

- After ruling: Consultant must add 18% GST. City pays ₹1.18 crore.

That ₹18 lakh difference could have funded:

- Thousands of school meals.

- A new drainage system in a flood-prone area.

- Hundreds of LED streetlights.

The impact isn’t abstract—it hits real services and citizens.

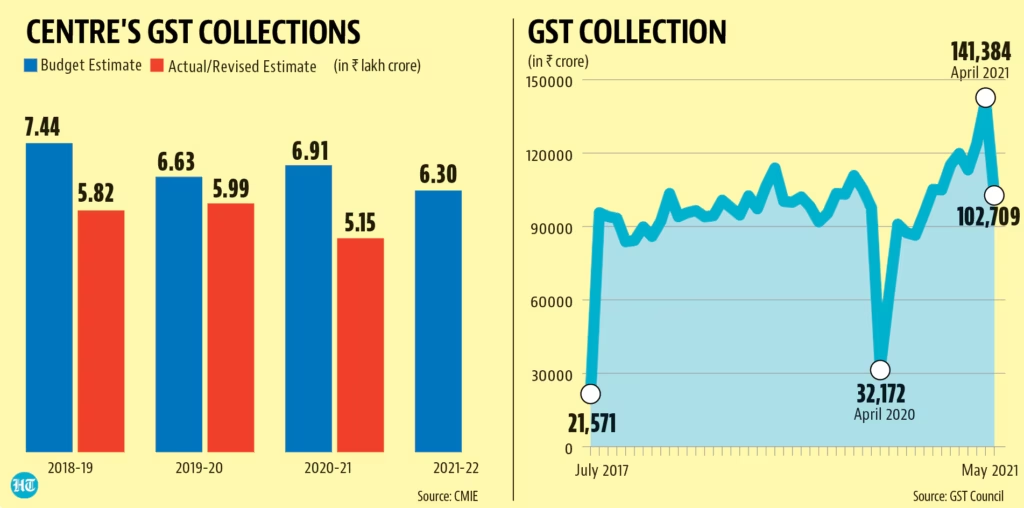

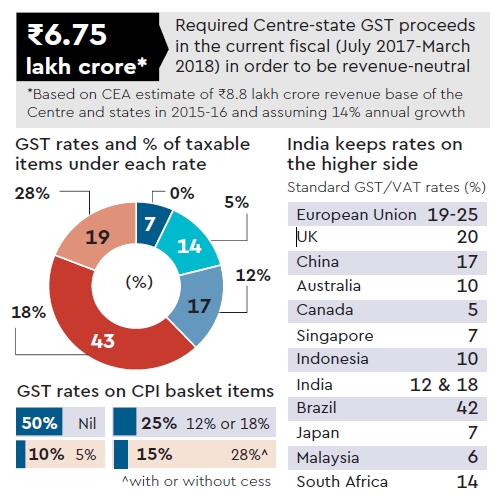

Data That Puts Things in Perspective

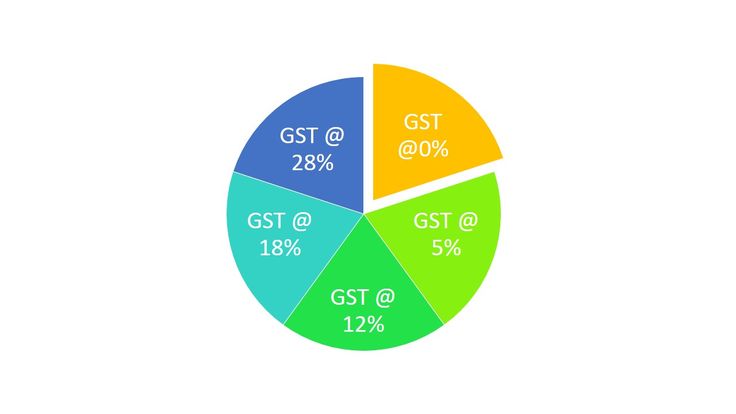

- India’s GST system currently applies 18% tax on most professional services.

- Municipalities already face a 30-40% budget shortfall, according to PRS India.

- The World Bank notes that Indian cities collect far less property tax (around 0.15% of GDP) compared to OECD countries (over 1% of GDP). This gap makes every rupee count.

Practical Guidance for Professionals

For Consultants

- Revise Contracts: Always include GST clauses.

- Educate Clients: Make sure municipalities know they must pay GST.

- Stay Compliant: Late GST payments can attract hefty fines.

- Add Value: Explore offering digital solutions to justify higher costs.

For Municipalities

- Budget Realistically: Don’t underestimate service costs.

- Build In-House Expertise: Train staff in GIS mapping and digital surveys.

- Communicate Transparently: Let citizens know why property tax bills may rise.

Broader Impact on Urban Development

The ruling might slow down digital upgrades in cities. Why? Because higher outsourcing costs discourage municipalities from modernizing. Delays could crop up in:

- Updating property records.

- Implementing smart-city technologies.

- Rolling out online tax portals.

This could widen the gap between India’s ambitious Smart Cities Mission and on-the-ground reality.

Expert Views

- TaxScan observed that the AAR’s decision reinforces a strict interpretation of constitutional functions—keeping financial duties out of the “municipal” bucket.

- Analysts at PRS Legislative Research warn that the ruling could deepen funding gaps, forcing municipalities to rethink outsourcing.

- Some tax professionals believe this may spark more automation in municipal tax administration, reducing reliance on third-party consultants.

International Lessons

Countries like the U.S., Canada, and the U.K. handle property tax in-house, ensuring stability in tax administration. India’s model of outsourcing creates flexibility but also legal ambiguities.

This ruling could push Indian cities to adopt more Western-style practices: hire permanent staff, invest in digital platforms, and minimize external dependency.

Future Outlook

- Appeals Likely: Service providers may challenge this decision in higher courts.

- Policy Adjustments: The GST Council could step in with clarifications.

- Digital Push: Cities may accelerate tech adoption to cut outsourcing costs.

- Taxpayer Impact: Property owners might see higher bills if cities pass on costs.

Property Tax Defaulters Alert — New Rebate Scheme Announced by NMC

Madurai Corporation Hikes Property Tax on Buildings Converted to Commercial Use

Government Institutions Named Among Top Tax Defaulters in Rajkot