AAR Rules No GST on Printing Post-Examination Items for Educational Institutions: In a groundbreaking ruling by the Tamil Nadu Authority for Advance Ruling (AAR), services related to the printing of post-examination materials such as mark sheets, certificates, grade sheets, and rank cards are now exempt from Goods and Services Tax (GST) when supplied to educational institutions. This development brings relief to many schools, colleges, and universities that had to navigate complex tax obligations related to essential post-exam services. But what does this really mean for educational institutions? Let’s break it down and explore how this decision will affect both institutions and service providers.

AAR Rules No GST on Printing Post-Examination Items for Educational Institutions

In conclusion, the AAR ruling offering a GST exemption on the printing of post-examination materials for educational institutions is a significant step forward. This decision not only provides financial relief but also simplifies compliance for schools and colleges. Vendors, too, benefit from clear guidelines on the GST exemption. Ultimately, this ruling creates a win-win situation for educational institutions and their service providers, making it easier to focus on their core mission: educating the next generation.

| Topic | Details |

|---|---|

| AAR Ruling | No GST on printing post-examination items like mark sheets, degree certificates, and grade cards for educational institutions. |

| Exemption Scope | Covers printing, scanning, and result processing services provided to educational institutions. |

| Why Important? | Educational institutions save on operational costs, simplifying compliance and reducing financial burdens. |

| Legal Backing | Refer to Notification No. 12/2017-Central Tax (Rate) for further clarification. |

| Impact | Schools, colleges, and universities can now avoid GST on these services, making budgeting more straightforward. |

| For More Details | Visit the official GST Council website. |

Context and Background

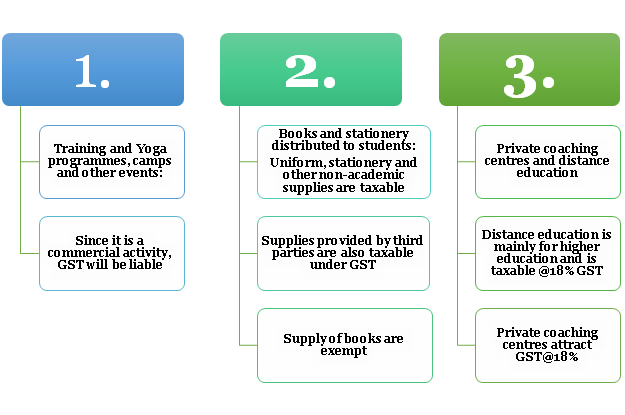

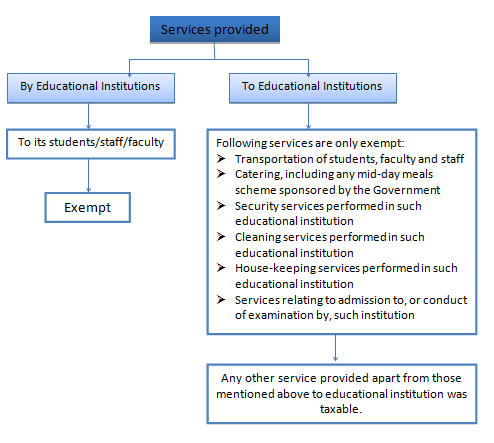

The GST regime in India was designed to streamline the taxation process, but it’s not always easy to understand, especially when it comes to specific services like those provided to educational institutions. Schools and colleges have long struggled with the complexities of GST as it applies to various services, including printing post-examination materials. While the education sector is generally exempt from GST, some services related to examinations were left in a gray area.

The new ruling from the Tamil Nadu AAR clears this up by categorizing services like printing mark sheets, certificates, and grade cards as exempt from GST when these services are provided to educational institutions. This has been a crucial development for educational institutions, helping them to avoid an added financial burden that could have otherwise increased their operational costs.

Understanding the Implications for Schools and Colleges

Now, let’s get into the nitty-gritty of how this decision impacts schools, colleges, and universities.

1. Cost Savings for Educational Institutions

One of the biggest benefits of this ruling is the cost savings. Schools, colleges, and universities often have to print large volumes of post-examination materials like degree certificates, rank cards, and mark sheets. These tasks usually involve outsourcing the printing and related services to vendors.

Before this ruling, educational institutions had to pay GST on these outsourced services, which could quickly add up. With the new exemption in place, institutions can save a significant amount of money, allowing them to allocate resources to other important areas like infrastructure, student welfare, or academic programs.

2. Simplified Compliance

Compliance with GST laws can be a hassle for educational institutions. Keeping track of GST payments, maintaining records, and filing returns can consume valuable time and resources.

By removing GST from the equation for certain services, the ruling simplifies the compliance process for schools and colleges. Now, these institutions don’t have to worry about paying GST on services like printing and result processing. This reduction in administrative complexity can free up time and resources to focus on their core mission: educating students.

3. Clarification on Vendor Responsibilities

For vendors who provide services like printing post-examination documents, this ruling brings clarity about what qualifies for the GST exemption. Service providers must ensure they meet the criteria set forth by the AAR to qualify for the exemption.

Educational institutions can also now confidently engage with vendors knowing that they won’t face any unexpected GST charges. This certainty helps both schools and service providers plan their operations more effectively.

4. Further Legal Clarification

The AAR ruling aligns with the official GST circulars and legal notifications, particularly Notification No. 12/2017-Central Tax (Rate). This official notification clearly exempts services related to examinations and result processing from GST when provided to educational institutions.

Understanding the official legal framework gives both educational institutions and service providers peace of mind when it comes to their tax obligations.

The Ruling in Simple Terms

Let’s break it down even further in layman’s terms. Imagine you’re running a school or a college, and you’ve just completed your final exams for the year. You now need to print out mark sheets, degree certificates, and possibly rank cards for your students. In the past, you’d have to pay extra tax on these services, making the process a bit more expensive.

Now, thanks to this new AAR ruling, you no longer need to pay that extra tax. This makes things simpler for the institution, reduces operational costs, and makes it easier for schools and colleges to plan their budgets. No more worrying about unexpected GST bills when outsourcing these services!

What Can Schools and Colleges Do with the Savings?

It’s not just about saving money on GST—it’s about reinvesting those savings back into the institution for the benefit of students and staff. Here’s how the savings could be put to good use:

- Improved Student Infrastructure: Savings could be invested into campus improvements such as new classrooms, sports facilities, or learning tools.

- Educational Programs: Funds can be allocated to upgrade teaching materials, online learning resources, or specialized programs for students.

- Faculty Development: Schools and colleges could use the funds to train teachers, making sure they are up-to-date with the latest educational practices.

- Student Welfare: Reinvesting in scholarships, counseling services, or extracurricular activities could help improve the student experience.

A Step-by-Step Guide to Understanding the AAR Rules No GST on Printing Post-Examination Items for Educational Institutions

To help you fully understand this ruling, here’s a step-by-step guide on how it impacts schools and colleges:

Step 1: Understand the Types of Services Affected

The ruling specifically applies to services like:

- Printing of mark sheets and certificates.

- Printing of degree certificates and grade cards.

- Scanning and processing of OMR (Optical Mark Recognition) sheets.

- Result processing and publication.

If your educational institution uses any of these services, it’s time to review your vendor contracts to ensure you’re not being overcharged.

Step 2: Review Your Vendor Contracts

If you’ve been outsourcing printing or result processing services to vendors, it’s essential to review your contracts and ensure they reflect the new ruling. The GST exemption applies to these services, so your vendors should adjust their prices accordingly.

Step 3: Update Your Budgeting

With the exemption now in place, educational institutions can update their budgets to reflect the savings. These savings could be reinvested into student resources, new technology, or facility upgrades—areas that will directly benefit students and staff.

Step 4: Stay Informed on Legal Updates

While this ruling provides much-needed clarity, it’s always important to stay informed about any further legal developments. The GST landscape can evolve, and it’s important to ensure that your institution remains compliant with the latest tax laws.

GST Collections for July 2025: You Won’t Believe Which State Tops the List!

Groundbreaking High Court Ruling on GST and Expat Employee Secondments—What It Means for Businesses!

MOF Pankaj Chaudhary Reveals 12% GST on Renewable Energy Devices—Is This a Step Forward or Backward?