Ahmedabad Tribunal Clears Man in ₹4 Lakh Cash Gift Case: If you’ve ever been to a big fat Indian wedding, you know the scene—people laughing, drums beating, food flowing like a Vegas buffet, and envelopes of cash being passed hand-to-hand. But in the world of taxes, that joy can quickly turn into a headache. That’s what happened recently in Ahmedabad, where a father was grilled by the Income Tax Department for receiving ₹4.31 lakh (about $5,200) in cash gifts at his son’s wedding.

The tax authorities claimed this money was “unexplained income” under Section 69A of the Indian Income Tax Act. But the Income Tax Appellate Tribunal (ITAT) Ahmedabad just gave its verdict: the cash was genuine, properly documented, and not taxable. This case has sparked a lot of chatter in finance and tax circles. And honestly, it’s not just an “Indian wedding” issue—it’s a wake-up call for anyone who receives large cash gifts, whether you’re in Mumbai, Manhattan, or Montana.

Ahmedabad Tribunal Clears Man in ₹4 Lakh Cash Gift Case

The Ahmedabad Tribunal’s ruling in the ₹4.31 lakh wedding gift case is more than courtroom drama—it’s a financial lesson for all of us. Documentation, transparency, and smart planning aren’t just tax strategies; they’re peace-of-mind strategies. Whether you’re receiving envelopes at an Indian wedding or Venmo transfers for a U.S. graduation, remember: log it, declare it, and relax. The taxman will have nothing left to question.

| Aspect | Details |

|---|---|

| Case | Ahmedabad Tribunal clears father of ₹4.31 lakh cash gift case from son’s wedding |

| Law Involved | Section 69A of the Indian Income Tax Act |

| Disputed Amount | ₹18.51 lakh total (₹4.31 lakh as gifts, ₹14.2 lakh as contract income) |

| Evidence Submitted | Donor list, marriage certificate, wedding invite, bank deposit slips |

| Verdict | ITAT ruled in taxpayer’s favor (August 2025) |

| Lesson | Proper documentation of gifts can protect you from tax scrutiny |

| Official Reference | Income Tax Department of India |

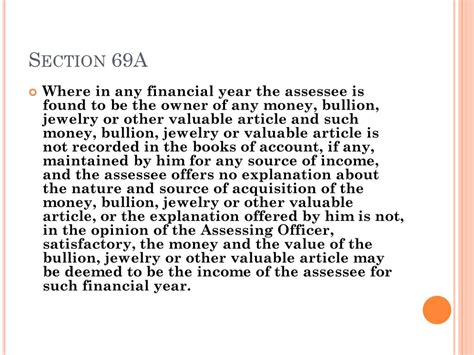

Section 69A: What Does the Law Say?

Section 69A of India’s Income Tax Act is one of those rules that keeps tax officers busy and taxpayers nervous. It basically says:

- If you have money, jewelry, or valuables that aren’t recorded in your books, and you can’t explain them satisfactorily, they can be treated as income.

- Once treated as income, they are taxed at one of the highest effective rates—over 60 percent with penalties.

The law was designed to prevent black money circulation. But in practice, it sometimes catches innocent people who simply don’t have their paperwork straight.

The Ahmedabad Wedding Case

The taxpayer, Mr. Manubhai, deposited ₹18.51 lakh in his bank account, out of which ₹4.31 lakh came as wedding gifts during his son’s marriage.

- The Assessing Officer (AO) refused to accept the explanation, saying the gifts seemed suspicious—especially those received before the actual wedding date.

- The Commissioner of Income Tax (Appeals) sided with the AO.

- The matter then went to the ITAT bench in Ahmedabad, which reviewed the case in detail.

The Tribunal noted:

- The father produced a guest list with names of gift-givers, copies of the wedding invitation, the marriage certificate, and the exact bank slips.

- The AO did not bother to verify the donors or conduct any further inquiries.

- The timing of receiving gifts, even if before the wedding, is not proof of falsity.

The ITAT struck down the tax addition under Section 69A, giving a clear message: evidence matters more than assumptions.

Why Ahmedabad Tribunal Clears Man in ₹4 Lakh Cash Gift Case Matters?

Documentation is Everything

The father’s win proves that solid paperwork beats suspicion. Without his careful documentation, the ₹4 lakh might have been taxed heavily.

Timing Doesn’t Make Gifts Fake

Just because money came a few weeks before the wedding didn’t mean it wasn’t genuine. Gifts often arrive early—think about holiday gifts in America that people mail before Christmas.

Transparency Saves You Later

Even though wedding gifts for children aren’t always exempt in India, the man declared them. This honesty worked in his favor.

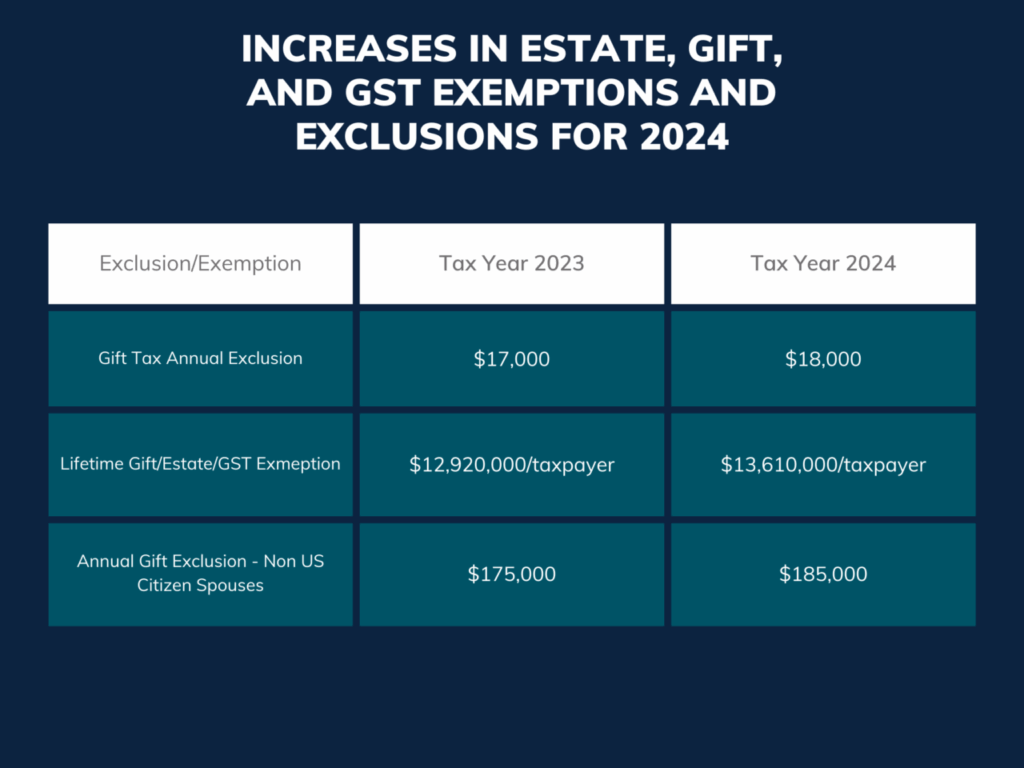

India vs. USA: How Do Gift Taxes Differ?

| Aspect | India | USA |

|---|---|---|

| Gift Tax | Abolished in 1998; recipient may be taxed | Gift tax exists; giver files, not the recipient |

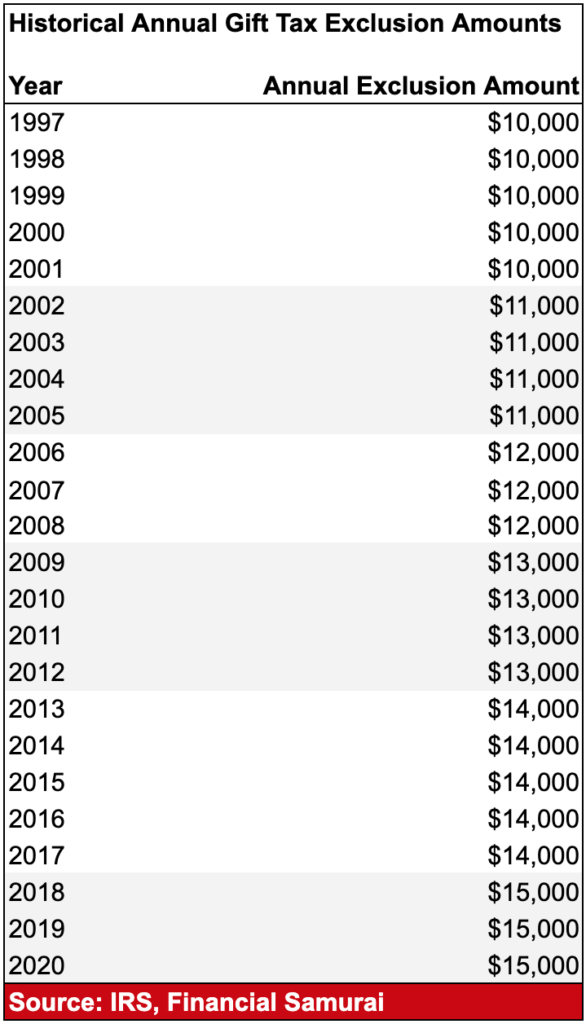

| Exemption | Own marriage gifts are exempt. Gifts from relatives tax-free. Above ₹50,000 from non-relatives is taxable. | Annual exclusion $18,000 (2025). Above this, giver files Form 709. |

| Cash Gifts | Highly scrutinized, must prove source | Recipient not taxed, but IRS watches big transfers |

| Penalty for Non-disclosure | Up to 85% of the amount | IRS penalties, audits, and interest |

Lesson: Whether you’re in Delhi or Dallas, if you’re getting big gifts, don’t ignore reporting rules.

Historical Context: Section 69A in Action

Section 69A has been used in several controversial cases:

- In 2016, after demonetization, thousands of Indians depositing old ₹500 and ₹1000 notes faced scrutiny under this section.

- In 2020, a Mumbai businessman was penalized for ₹2 crore deposits when he couldn’t prove they were from legitimate business sales.

- Courts have repeatedly said the burden of proof is on the taxpayer to show money isn’t unexplained income.

The Ahmedabad case adds nuance by showing that wedding gifts, with evidence, are valid and defensible.

What Happens If You Don’t Declare Gifts?

- In India: Failure to explain deposits can lead to tax plus penalties exceeding 80 percent. For example, on ₹5 lakh, you might lose over ₹4 lakh.

- In the U.S.: The IRS may demand late filing penalties if a gift return (Form 709) is skipped. Interest adds up quickly, and repeated failure may trigger audits.

- Banks worldwide: Under anti-money laundering rules, banks file suspicious transaction reports if large unexplained cash deposits are made.

Simply put: hiding is more costly than declaring.

Practical Tips for Handling Wedding Gifts and Taxes

Know the Rules

In India, only your own marriage gifts are automatically exempt. In the U.S., the giver has to report if crossing the threshold.

Keep Records

Maintain a gift register. Include names, addresses, amount, and mode of payment. Staple receipts or online confirmations.

Use Bank Transfers

Checks, UPI transfers, or apps like Venmo/Zelle are better than hard cash. They create an automatic paper trail.

Declare Properly

In India, show them under “Exempt Income” in your return. In the U.S., remind the giver to file Form 709 if needed.

Consult Experts

Hire a tax professional. A 30-minute consultation can prevent months of disputes.

Real-World Examples

- India: A Delhi family in 2019 was fined over ₹20 lakh when they failed to prove wedding gifts came from relatives. Their lack of donor details cost them dearly.

- U.S.: A California resident received $100,000 from overseas relatives. The IRS demanded disclosure under Form 3520. Failure to file led to a $25,000 penalty.

- Cross-border: NRIs often face double compliance—declaring in both India and the U.S. or U.K. where they live. Not reporting can lead to global reporting issues under FATCA.

Expert Commentary

CPA Michael Santos (USA): “The IRS doesn’t tax recipients of gifts, but they sure want a record. Documentation is your safety net.”

CA Neha Shah (India): “In India, families often underestimate how serious unexplained income rules are. If you’re hosting a wedding, maintain a gift log like you maintain a guest list.”

Wedding Gifts Not Taxable! ITAT Scraps ₹10 Lakh Cash Deposit Addition

GST Overhaul Ahead Of Diwali – Relief For Consumers, Risk For Revenue

Rs 200 Crore Tax Evasion Case – Coke Plant Owner From Meghalaya Arrested By DGGI