Andhra Govt Steps In to Pay GST on Handlooms: The Andhra Pradesh government has made a bold and unprecedented move in India’s textile policy space: it will pay the Goods and Services Tax (GST) on all handloom products produced and sold by the state’s registered weavers. Starting August 7, 2025—coinciding with National Handloom Day—this initiative promises to be a game-changer for over 1.5 lakh handloom weavers across the state. From Mangalagiri cottons to Venkatagiri silks, Andhra’s handloom tradition is rich, beautiful, and deeply rooted in its cultural history. But with growing industrial competition, rising input costs, and GST taxes eating into profits, the state’s weavers have struggled to stay afloat. So, is this GST exemption a lifeline, or could it trigger new economic challenges down the road? In this article, we break it all down—plain and simple.

Andhra Govt Steps In to Pay GST on Handlooms

Andhra Pradesh’s move to pay GST for handloom products is a rare example of a state-level intervention aimed at economic justice for traditional artisans. Backed by practical benefits like free electricity, pensions, thrift savings, and health coverage, the policy could be a template for other states and even a national model if executed effectively. For now, it’s a ray of hope in a sector that has long been overlooked. But the real test lies in implementation, transparency, and sustained support.

| Aspect | Details |

|---|---|

| Policy Initiative | Andhra Pradesh to pay 100% GST on handloom products |

| Effective Date | August 7, 2025 (National Handloom Day) |

| Electricity Support | 200 free units/month for pit looms, 500 units/month for power looms |

| Thrift Fund for Weavers | ₹5 crore allocated for emergency financial support |

| Weavers’ Pension | ₹4,000/month for weavers aged 50 and above |

| Health Insurance | Planned for all registered handloom workers |

| Target Beneficiaries | 1.5+ lakh weavers across Andhra Pradesh |

| Official Website | Andhra Pradesh Handlooms Portal |

The Reason Behind the Move

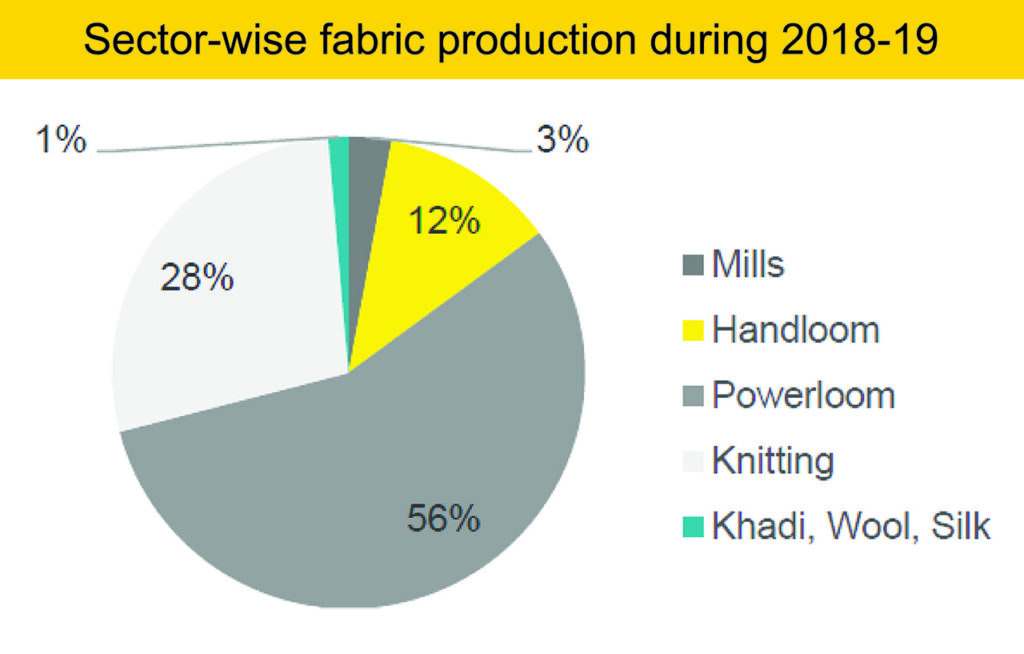

For years, weavers and handloom cooperatives in India have raised their voices against the imposition of GST on handloom products—particularly since the sector is seen as eco-friendly, labor-intensive, and heritage-based. When GST was introduced in 2017, most handmade textiles were placed in the 5% to 12% slab, affecting affordability and forcing small producers to compete unfairly with machine-made goods.

By absorbing the GST cost at the state level, Andhra Pradesh effectively makes these products cheaper for consumers and more profitable for weavers.

The goal, according to the government, is to revive the handloom sector, retain its labor force, and make it competitive in both domestic and international markets.

How GST Hurt the Sector Before?

A report by the Handloom Export Promotion Council (HEPC) shows that over 60% of Indian handloom weavers earn less than ₹5,000 per month. Add the cost of raw materials, electricity, marketing, and taxes—and it’s clear why thousands of weavers have quit the profession altogether.

Weavers like Rani Kumari, a 48-year-old from Guntur, explain it best:

“We had to sell sarees for lower prices to compete. But we still had to pay GST to the government. Many months, we earned nothing.”

The new decision to remove this burden by paying the GST on behalf of the weavers is seen as a direct income enhancement strategy, without needing to raise product prices.

What Else Is Included in the Package?

This policy is not a standalone measure. The Andhra government has bundled several schemes together to support the entire handloom ecosystem:

Free Electricity

Weaving requires regular power supply—especially for semi-mechanized or power looms.

- Pit Looms: 200 units of electricity free per month.

- Power Looms: 500 units free per month.

That translates to savings of ₹800 to ₹2,000 per family monthly, depending on usage.

Weaver Thrift Fund (₹5 Crore Corpus)

This initiative acts like a rainy-day fund for weavers.

- Weavers contribute a small amount monthly.

- The government matches the contribution.

- In times of distress—like illness, natural disasters, or market crashes—the fund provides emergency assistance.

Pension for Elder Weavers

- Monthly ₹4,000 pension for registered weavers aged 50 years and above.

- This is a significant bump from previous pension schemes that offered only ₹1,000–₹2,000 monthly.

- The money is deposited directly into the weaver’s bank account under the Direct Benefit Transfer (DBT) scheme.

Health Insurance Coverage

Though not fully implemented yet, the plan is to introduce a comprehensive health insurance scheme that:

- Covers in-patient and outpatient care

- Includes family coverage

- Provides cashless hospitalization at government and empaneled private hospitals

This could mirror state models like Arogyasri in Telangana or the Ayushman Bharat scheme at the national level.

Step-by-Step Guide: How to Apply for Benefits As Andhra Govt Steps In to Pay GST on Handlooms

1. Register as a Weaver

To benefit from any scheme, official registration is mandatory.

- Visit https://apcofabrics.com or your local MeeSeva center.

- Submit Aadhaar, bank account details, and proof of loom ownership.

- Join a recognized handloom cooperative society if you haven’t already.

2. Apply for GST Support

- Ensure your products are certified as handloom.

- Submit invoices and sales data through the local handloom officer.

- The government processes the GST payment and credits it to the buyer’s or seller’s account depending on the transaction.

3. Claim Electricity Subsidy

- Apply through your DISCOM (electricity distribution office).

- Attach your latest bill and weaving registration certificate.

4. Join the Weaver Thrift Fund

- Visit your society office.

- Make your monthly deposit.

- The government will contribute the matching amount.

5. Register for Pension

- For those aged 50 and above

- Submit identity, age proof, and bank details at the nearest municipal office or through online application portals.

Voices from the Field

Mahesh Yadav, 34, from Nellore, says:

“I used to sell 10 sarees a week. Now, with this GST relief, I can offer better prices and have already received 20 pre-orders this month.”

Lakshmi Bai, a cooperative leader, adds:

“Our society will finally make a profit after 3 years. We can reinvest in better looms and design training.”

These stories aren’t isolated. Similar reports are coming in from Vizianagaram, Anantapur, and Kurnool.

Comparison with Other States

| State | Major Handloom Support |

|---|---|

| Andhra Pradesh | GST relief, free power, pension, health cover, thrift fund |

| Telangana | Subsidies on yarn, insurance under Nethannaku Cheyutha |

| Tamil Nadu | Free yarn, marketing support through Co-optex |

| Karnataka | Credit and working capital support through Weaver Credit Cards |

| West Bengal | Revival grants, marketing expos, and Bunkar Bima Yojana |

While states like Telangana and Tamil Nadu offer strong production subsidies, Andhra’s GST absorption is unique and potentially trend-setting.

Market Impact and E-Commerce Opportunities

Lower product prices (since GST is not paid by the buyer or weaver) means better margins and greater market competitiveness. This creates huge potential for:

- Online handloom sales via Amazon, Flipkart, Etsy, and state portals

- Export growth, since international buyers now get better pricing

- Collaborations with sustainable fashion brands

Many private players are already approaching Andhra-based cooperatives for bulk tie-ups.

If you’re a startup in eco-fashion or handmade crafts, this is the time to partner with Andhra’s weavers.

Expert Opinions

Dr. Ramesh Patnaik, Economist at NCAER:

“Paying GST on behalf of weavers is a smart move that reduces immediate cash flow stress. But unless there is market development, it’s only a temporary fix.”

Anuradha Rao, Textile Development Consultant:

“The weaver pension is long overdue. If implemented properly, it could reduce poverty significantly in rural areas where handloom is the primary occupation.”

Andhra Pradesh Sets New Record for Monthly GST Growth — Here’s What’s Driving It

Andhra Pradesh Shatters Records with Highest-Ever GST Growth in July—What’s Driving This Surge?

GST Cracks Down on Fake Firms — 11 Bogus Companies Served Notices Amid Ongoing Probe