Andhra Pradesh Sets New Record for Monthly GST Growth: In a remarkable economic stride, Andhra Pradesh has shattered its previous benchmarks and set a new all-time high in Goods and Services Tax (GST) collections. In July 2025, the state reported ₹3,803 crore in gross GST revenue, making it the highest-ever monthly collection in the state’s history. This is more than just a number — it’s a clear signal of the state’s economic vitality, administrative efficiency, and growing taxpayer participation. Whether you’re a business owner, accountant, policymaker, or just someone interested in how tax systems reflect economic health, this article breaks down what happened, why it matters, and what you can learn from it.

Andhra Pradesh Sets New Record for Monthly GST Growth

Andhra Pradesh’s record-breaking ₹3,803 crore GST collection in July 2025 is more than just a statistical feat — it’s a case study in successful tax governance. From AI-backed audits to a rapidly growing taxpayer base, the state is proving that when smart policy meets strong enforcement, the results are undeniable. For businesses, this is a wake-up call to level up their compliance game. For governments, it’s a roadmap to economic resilience. And for citizens, it’s a hopeful sign that efficient governance can lead to better public services and long-term prosperity.

| Topic | Details |

|---|---|

| State | Andhra Pradesh |

| Month of Record | July 2025 |

| Gross GST Collection | ₹3,803 crore |

| Net Revenue (SGST + IGST inflows) | ₹2,930 crore |

| YoY Growth (Gross) | 14% |

| YoY Growth (Net) | 12.12% |

| Professional Tax Growth | 51% (YoY) |

| IGST Settlement | ₹1,704 crore |

| National Rank (Large States) | 3rd |

| South India Rank | 1st |

| Source | AP Commercial Taxes Department |

What is GST, and Why Is It Important?

Goods and Services Tax (GST) is a single, unified tax levied across India on the supply of goods and services. It replaced a bunch of older taxes like excise duty, VAT, and service tax, and it’s collected at every step of the supply chain.

GST in India is divided into three parts:

- CGST (Central GST): goes to the Central Government

- SGST (State GST): goes to the State Government

- IGST (Integrated GST): used for interstate transactions and then split between center and state

So why does GST matter so much?

Because it’s a barometer of economic activity. Higher GST collections generally mean more goods are being sold, services are being used, and businesses are running well — which means jobs, investments, and public services are all benefiting.

What’s Driving Andhra Pradesh Sets New Record for Monthly GST Growth?

Let’s explore the factors responsible for Andhra Pradesh’s explosive GST growth. This isn’t luck — it’s the result of several targeted reforms and strategic execution.

1. AI-Powered Compliance and Smarter Enforcement

One of the biggest changes in recent years is Andhra’s focus on data analytics and AI-based tax intelligence. The state’s Commercial Taxes Department rolled out:

- Automated fraud detection systems

- Real-time analytics on GSTR mismatches

- Audit flagging tools for high-risk filers

- Integration with e-way bill systems for transport monitoring

In July alone, the state recovered ₹357 crore in pending IGST by reconciling data discrepancies and acting swiftly on compliance gaps.

This new AI-driven strategy is catching non-compliant businesses that used to fly under the radar, while also making it easier for honest taxpayers to file correctly.

2. Strong Policy and Administrative Reforms

The success of Andhra’s GST program is also due to bold policy moves, such as:

- Introducing performance-linked incentives for tax officers based on quality of compliance, not just revenue targets.

- E-way bill blocking for taxpayers with consistent non-filing behavior.

- Fast-track settlements for input tax credit (ITC) claims to improve business liquidity.

This is a big shift from the old days where departments focused only on revenue collection. Now, the state is focusing on sustainable and accurate revenue, and that’s a game changer.

3. A Broader and More Active Taxpayer Base

Over the last fiscal year, the state has seen:

- An 8.6% increase in registered GST taxpayers

- Many small and medium-sized businesses crossing the ₹40 lakh turnover threshold

- A surge in voluntary registrations from digital services, freelancers, and e-commerce sellers

What does that mean? More businesses are joining the formal economy. And when more people play by the rules, everyone wins.

For example, a local bakery that used to operate offline now accepts digital payments, files regular GST returns, and claims ITC on ingredients — reducing their overall tax burden while contributing to state revenue.

4. Rise in Professional and Petroleum Taxes

Though petroleum is not under GST, the associated duties and taxes help the state’s coffers indirectly. The July collections show:

- A 51% jump in professional tax collections

- Increase in petroleum-based consumption, feeding into broader tax visibility

These non-GST revenues help bridge fiscal gaps and complement overall collections, especially during months when commercial activity is high.

5. Higher Consumption Across Sectors

The data points to stronger economic activity in key sectors:

- Retail and FMCG saw higher invoice volumes

- Real estate reported increased compliance following new registration rules

- Hospitality and transportation sectors rebounded after a post-pandemic lull

- Digital services like app development, SaaS, and consultancy services registered newer GST profiles

This sectoral diversity has ensured that GST collections aren’t riding on just one economic pillar — they’re backed by a solid, multi-sector foundation.

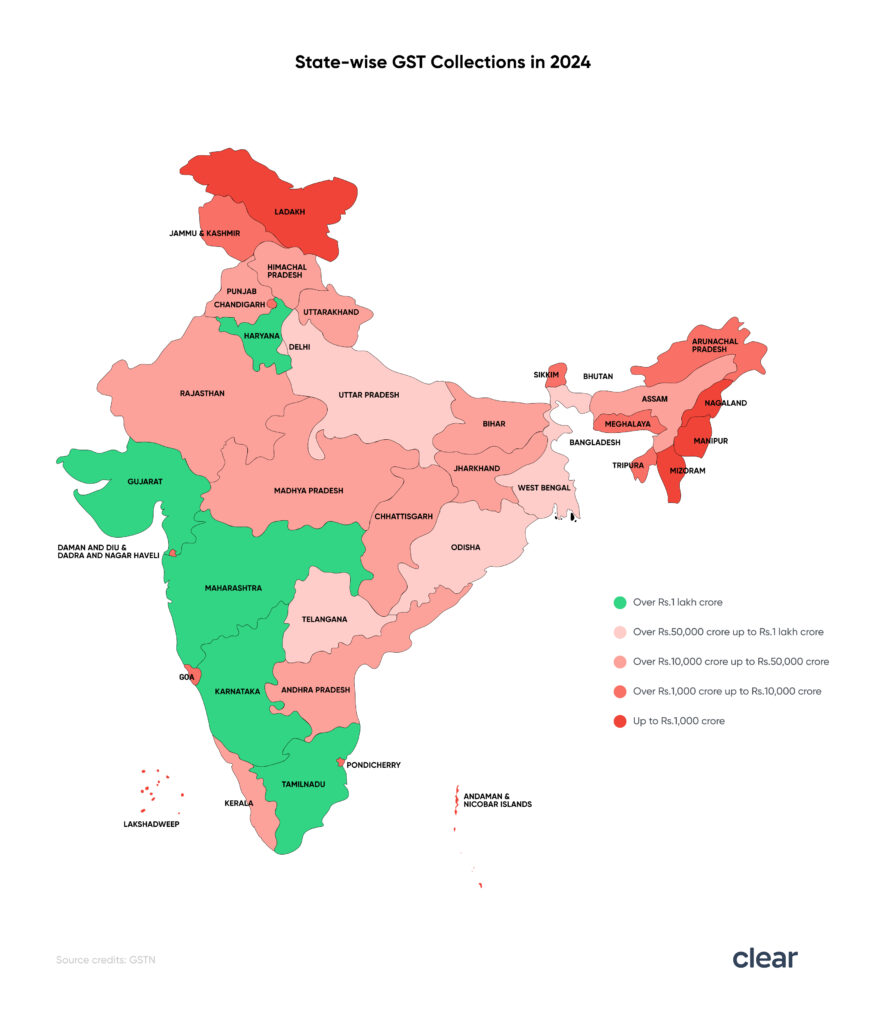

Andhra Pradesh vs. the Rest of India

Let’s look at how Andhra stacks up nationally:

| State | YoY GST Growth (Net) | Gross GST (July 2025) |

|---|---|---|

| Andhra Pradesh | 12.12% | ₹3,803 crore |

| Maharashtra | 9.4% | ₹27,150 crore |

| Karnataka | 10.2% | ₹12,040 crore |

| Tamil Nadu | 6.8% | ₹9,880 crore |

| Gujarat | 5.9% | ₹9,630 crore |

According to CBIC, Andhra Pradesh ranks 3rd among large states and is now outpacing Tamil Nadu and Gujarat in year-over-year growth — a first in the state’s fiscal history.

Practical Advice for Businesses and Professionals

If you’re a business operating in Andhra Pradesh — or even elsewhere in India — these developments are a sign that stronger enforcement and digitization are here to stay. Here’s how you can stay ahead:

1. Ensure GSTR Reconciliation

- Match your GSTR-1 (sales) and GSTR-3B (summary returns) monthly.

- Mismatches could lead to blocked ITC or notices from tax officials.

2. Monitor E-Way Bills

- Non-compliance with e-way bill requirements can result in penalties or shipment delays.

- Use systems like Zoho Books, Tally, or ClearTax for automation.

3. Adopt E-Invoicing Early

- From October 2025, e-invoicing will be mandatory for businesses above ₹5 crore turnover.

- Get your systems in place now to avoid last-minute chaos.

4. File GSTR-9 Timely

- Annual returns are essential for compliance scores.

- Businesses with poor return history are more likely to face audits and scrutiny.

5. Use the Official GST Portal for Updates

- Bookmark the GST Portal to track filings, notices, and tax ledger information.

How This Impacts Stakeholders?

Whether you’re a citizen, investor, or professional, this record-setting GST performance affects you too:

- Citizens can expect improved infrastructure and social programs due to higher state revenues.

- Investors see Andhra as a more creditworthy and business-friendly state.

- Entrepreneurs benefit from a more stable and predictable tax environment.

- Policymakers can use Andhra as a model for implementing compliance reforms in other states.

Punjab Achieves Staggering 32% GST Growth in July—Finance Minister Harpal Singh Cheema Reveals

Manufacturing Activity Soars to 16-Month High, Driving GST Inflow Up by 7.7%