Andhra Pradesh Shatters Records with Highest-Ever GST Growth: In July 2025, Andhra Pradesh achieved a historic milestone by recording its highest-ever Goods and Services Tax (GST) collections, showcasing a remarkable surge in the state’s revenue. The state’s net GST revenue soared to ₹2,930 crore, with gross collections touching ₹3,803 crore, marking an impressive 12.12% and 14% increase, respectively, compared to the previous year. This achievement places Andhra Pradesh among the top performers in India, making it a shining example of fiscal resilience and economic growth. But what’s behind this record-breaking performance?

Andhra Pradesh Shatters Records with Highest-Ever GST Growth

Andhra Pradesh’s historic GST performance in July 2025 is a reflection of the state’s strategic focus on tax compliance, consumer spending, and inter-state trade. With record revenues and a robust fiscal policy, the state is well-positioned for sustained growth. Other states can learn valuable lessons from Andhra Pradesh’s success, especially in terms of effective tax administration and economic management. By continuing to prioritize transparency and accountability, Andhra Pradesh has set a high bar for fiscal discipline and economic progress in India.

| Statistic | July 2025 | Growth Compared to July 2024 | Source |

|---|---|---|---|

| Net GST Revenue | ₹2,930 Crore | 12.12% Increase | Times of India |

| Gross GST Revenue | ₹3,803 Crore | 14% Increase | Deccan Chronicle |

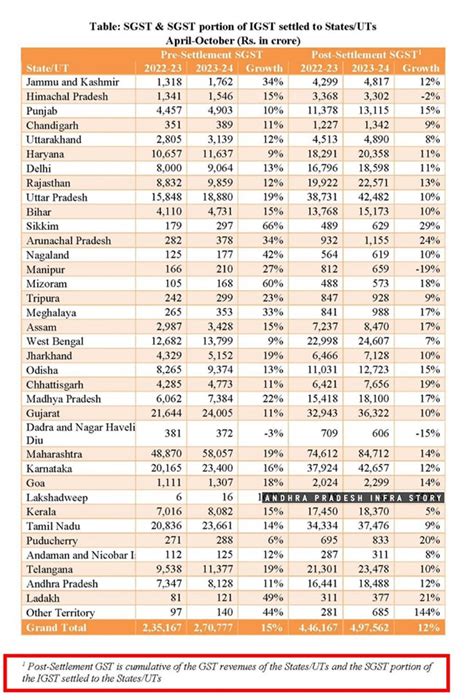

| State GST (SGST) Collections | ₹1,226 Crore | 14.47% Increase | New Indian Express |

| IGST Settlements | ₹1,704 Crore | 10.69% Increase | Deccan Chronicle |

| Professional Tax Growth | 51% Increase in July 2025 | 55% Increase (FY-to-date) | Deccan Chronicle |

These figures not only reflect a boom in the state’s revenue collection but also provide an essential snapshot of Andhra Pradesh’s economic vitality. So, what’s driving this record-breaking GST performance? Let’s break it down.

What’s Fueling Andhra Pradesh Shatters Records with Highest-Ever GST Growth?

1. Increased Tax Compliance and Enforcement

One of the primary factors behind Andhra Pradesh’s record GST collection is the significant improvements in tax compliance. The state has adopted advanced data analytics tools and enhanced audit processes to ensure a broader tax base. These improvements allow the state government to better track economic activities, identify underreporting, and crack down on tax evasion. With the help of these measures, the government has managed to expand its tax net, bringing in more businesses into the formal tax fold.

For example, businesses in industries like retail, manufacturing, and construction are now more regularly filing GST returns and complying with the state’s tax regulations. This has led to a steady increase in GST collections year after year.

Example in Action:

Retail giants and tech companies now report transactions more transparently, making it easier for the tax department to track and enforce compliance. This has improved revenue generation while creating a level playing field for all businesses.

2. Boost in Consumer Spending

The 14.47% surge in State GST (SGST) collections, which amounted to ₹1,226 crore in July 2025, highlights a significant uptick in consumer spending. With rising incomes, increased disposable income, and more people participating in the formal economy, consumption has risen across multiple sectors. Products like electronics, clothing, and vehicles saw a notable boost, directly contributing to the jump in GST revenue.

This growth in consumer spending is reflective of a broader economic recovery in Andhra Pradesh, driven by improved confidence in the state’s fiscal policies and economic environment. As more consumers spend on goods and services, the state’s GST receipts continue to rise, ensuring a solid revenue base for the government.

3. Growth in IGST (Integrated GST) Settlements

Andhra Pradesh also benefited from an increase in IGST settlements, which accounted for ₹1,704 crore in July 2025. This represents a 10.69% growth compared to the previous year. IGST is collected on inter-state transactions and is a vital part of the overall GST structure. The increase in IGST collections indicates a rise in cross-border trade and business transactions. This growth could be due to factors like better inter-state cooperation and more effective monitoring of GST compliance across states.

Real-World Example:

The rise in IGST reflects an increase in the number of businesses engaging in interstate trade. For example, companies that source raw materials from other states and export their products benefit from this inter-state tax structure.

4. Higher Professional Tax Revenues

In addition to GST, Andhra Pradesh saw a significant boost in professional tax collections, which grew by an impressive 51% in July alone. This increase reflects the state’s successful enforcement measures targeting professionals, including lawyers, doctors, and consultants. Through a more stringent approach to tax compliance in this sector, Andhra Pradesh has been able to collect more taxes from high-income individuals and professionals.

Moreover, this growth in professional tax collections is expected to continue, contributing to the state’s overall fiscal health. The 55% increase in professional tax revenues for the first few months of FY 2025-26 further demonstrates how well the state’s administration has worked to expand its revenue sources.

5. Sustained Growth in Petroleum Tax Revenue

While the global petroleum prices remain volatile, Andhra Pradesh has seen consistent growth in petroleum tax revenues over the last few months. As fuel consumption remains steady, the state’s revenue from petroleum taxes continues to grow. This growth in fuel tax receipts is a crucial component of Andhra Pradesh’s overall tax revenue, helping the state achieve its record-breaking GST collections.

With the rising number of vehicles and increased transportation activity, fuel consumption has been on the rise, contributing to the steady stream of tax revenue. This trend is expected to continue as long as consumption remains stable.

Additional Factors Contributing to Growth

6. Government’s Proactive Policies and Investments

A proactive government strategy that focuses on attracting investment, improving infrastructure, and incentivizing new industries has also played a major role in boosting the state’s economy. For instance, the government’s push for green energy projects and the development of industrial hubs has helped create new revenue streams while attracting more businesses to the state. This strategy has not only diversified the economy but also contributed to the expansion of the formal tax base.

Example of Impact:

The industrial development in the state’s new economic zones has attracted large multinational corporations to set up manufacturing units. These businesses contribute significantly to both GST and other state revenues, creating a healthy economic cycle.

7. Technological Advancements in Tax Collection

The use of technology in tax collection has been another significant factor in Andhra Pradesh’s success. The state has adopted digital platforms for filing returns, making the process faster, more transparent, and easier to track. By reducing the complexities involved in filing taxes, the government has made it easier for businesses to comply, resulting in higher tax receipts.

How Technology Helps:

The implementation of e-invoicing and real-time data analytics has made it easier for both the businesses and tax authorities to spot discrepancies and improve tax collection. This digital leap has resulted in quicker filings and more efficient tax revenue monitoring.

How the Record GST Performance Benefits the State?

1. Increased Government Revenue

The surge in GST collections directly benefits the state government by increasing the funds available for infrastructure development, public services, and welfare programs. This extra revenue can be used to fund critical projects, such as road construction, healthcare improvements, and educational initiatives.

2. Economic Growth and Job Creation

Higher tax revenues indicate a thriving economy. As businesses report higher earnings and more people pay taxes, the government can invest in job-creating programs, boosting employment opportunities. This, in turn, can lead to further economic growth, creating a virtuous cycle that benefits everyone.

3. Fiscal Discipline and Policy Success

The record GST performance is a testament to the state government’s effective fiscal policies and management. By prioritizing tax compliance, encouraging investment, and creating an environment conducive to business growth, Andhra Pradesh has demonstrated fiscal discipline that other states can learn from. This success reinforces the state’s reputation as a leader in financial management.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!