Andhra Pradesh Will Now Pay GST on Handlooms: Starting August 7, 2025, the state of Andhra Pradesh will officially take over the responsibility of paying Goods and Services Tax (GST) on all handloom products made and sold by weavers and cooperatives across the state. That’s a big deal. Because in India, where GST can eat up 5–12% of the sale price, this change is more than just tax reform—it’s a move to rescue an industry that’s been struggling for survival. Whether you’re a policymaker, a handloom buyer, a rural artisan, or someone launching a textile startup, this new direction affects you. In this article, we’ll walk through exactly what this policy means, who it impacts, how it works, and why Andhra Pradesh’s handloom sector might just be headed for a much-needed revival.

Andhra Pradesh Will Now Pay GST on Handlooms

Andhra Pradesh’s decision to absorb GST for handloom products is more than a financial maneuver—it’s a lifeline for an endangered art. This policy recognizes the economic and cultural value of handloom artisans and aims to empower them with more income, less bureaucracy, and better access to markets. It could transform how India views its rural economy—putting power back in the hands of people who make something real, something beautiful, and something timeless.

| Topic | Details |

|---|---|

| Policy Announcement | Andhra Pradesh to cover 100% GST on handloom products |

| Effective Date | August 7, 2025 – National Handloom Day |

| Why It Matters | Weavers keep full earnings, products become more affordable |

| Additional Benefits | ₹5 crore thrift fund, free electricity for looms |

| Impacted Stakeholders | Weavers, buyers, cooperatives, online retailers |

| Official Website | handlooms.ap.gov.in |

A Legacy Industry on the Brink

Handloom weaving in India is one of the oldest and most traditional industries, dating back thousands of years. Andhra Pradesh, in particular, is known for iconic weaves like Pochampally Ikat, Dharmavaram silks, Mangalagiri cottons, and Venkatagiri sarees. These aren’t just garments—they’re cultural artifacts.

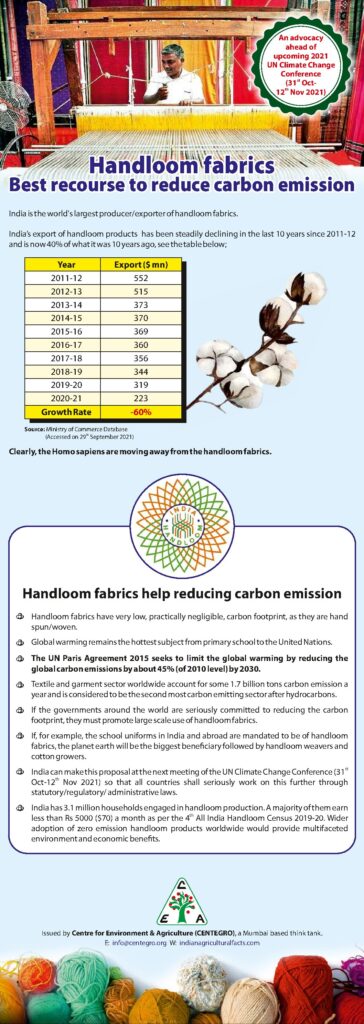

But despite its artistic richness, the handloom sector has been in deep decline. Here’s why:

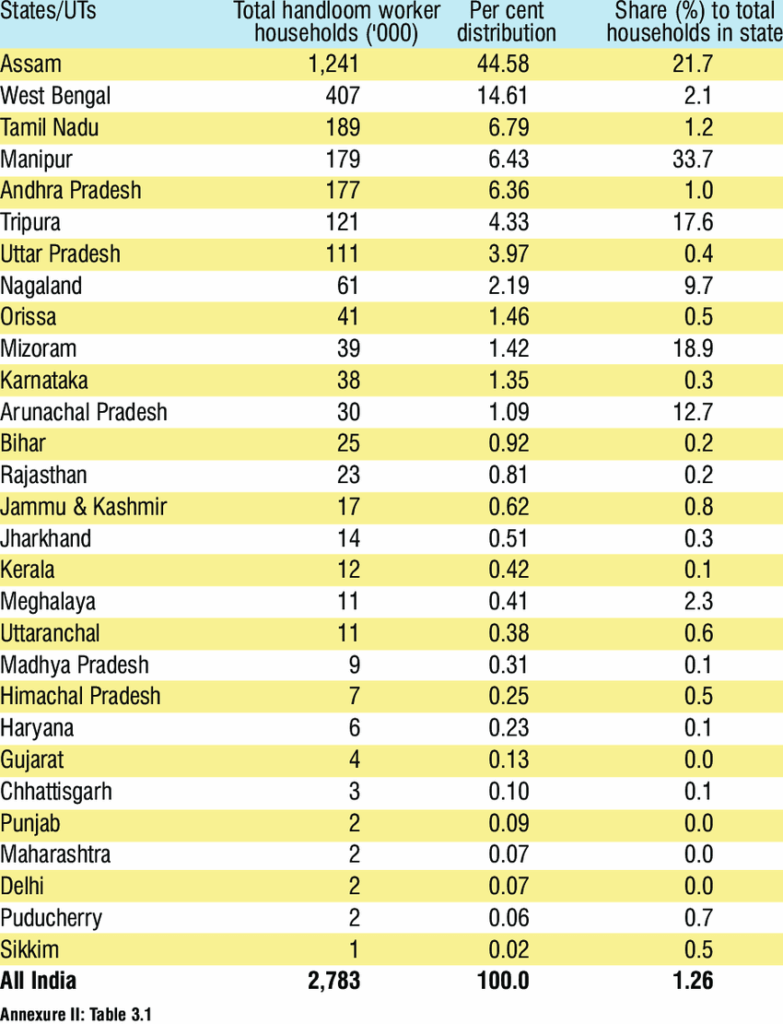

- Over 43 lakh handloom workers exist across India, and over 2.5 lakh reside in Andhra Pradesh.

- Many of these weavers earn less than ₹10,000 a month, with some reporting monthly incomes as low as ₹3,000–₹5,000.

- The introduction of GST in 2017 placed a tax burden on fabric and garment sales, further squeezing an already thin-margin business.

- Competition from machine-made textiles has pushed handloom workers out of the market.

For many rural families, weaving was once a primary livelihood. Now, it’s often a last resort.

What Was the Problem With GST?

When GST was introduced, the goal was to simplify India’s tax system and replace a patchwork of local taxes. While this worked for many industries, it backfired for handloom artisans.

Under GST:

- Raw handloom fabrics are taxed at 5%.

- Finished handloom garments like sarees or kurtas may be taxed at 12%.

- Every weaver or cooperative needs to register for GST, maintain digital records, file returns, and manage compliance.

That might sound manageable to a big retailer. But for a rural weaver with no smartphone or internet connection, it’s an impossible barrier. The extra cost also made handloom products more expensive, reducing demand among price-conscious consumers.

This is where Andhra Pradesh’s new policy comes in.

What Andhra Pradesh Is Doing As Andhra Pradesh Will Now Pay GST on Handlooms?

The state government of Andhra Pradesh, under Chief Minister N. Chandrababu Naidu, has announced that beginning August 7, 2025, it will:

- Pay 100% of the GST due on handloom products sold by registered weavers and cooperatives.

- Cover this tax directly to the Central government via reimbursement or direct payment.

- Ensure the weavers or cooperatives receive the full sale amount without deduction.

In other words, neither the weaver nor the buyer pays the GST—the state absorbs it fully.

How It Works – Step-by-Step

- A handloom weaver or cooperative produces a product (e.g., a saree).

- They sell it to a customer—either offline at a store or online via a platform like Amazon or Etsy.

- Normally, GST (5–12%) would be added to the price. Now, that tax is paid by the Andhra Pradesh government.

- The buyer pays only the base price, and the weaver/cooperative gets the full amount.

- The state files for reimbursement or settles it with the Centre directly.

This eliminates a major barrier for weavers and makes handloom goods cheaper for consumers.

The Bigger Support Package

This GST move isn’t a standalone act. It’s part of a wider handloom revival package, which includes:

- ₹5 crore Thrift Fund: For weaver welfare, medical emergencies, and small loans.

- Free Electricity: Up to 200 units/month for handlooms, and 500 units for power looms—a major cost saving.

- Skill Development & Marketing: Tapping institutions like NIFT and APCO for better branding and design innovation.

- Online Sales Boost: Encouraging more cooperatives to sell on Amazon Karigar and other D2C platforms.

Benefits for Stakeholders

For Weavers

- Elimination of GST filings and paperwork.

- Increase in take-home income by 5–12%.

- Less reliance on middlemen.

- Better incentive to stay in the trade.

For Buyers

- Handloom goods are now more affordable.

- Easier access to authentic, ethical products.

- Greater variety as more weavers return to the industry.

For Entrepreneurs

- Potential to build new handloom brands.

- Lower sourcing costs = higher profit margins.

- Scope to export under the “Make in India” tag with an ethical angle.

Data & Stats You Should Know

| Metric | Data |

|---|---|

| Handloom workers in India | 43.3 lakh |

| In Andhra Pradesh | ~2.5 lakh |

| GST on handloom fabric | 5% |

| GST on finished garments | 12% |

| Monthly loss per weaver due to GST | ₹300–₹1,200 |

| Avg monthly power cost (previously) | ₹600–₹800 |

| Expected savings under new policy | ₹2,000–₹3,500/month per weaver |

Comparison With Other States

| State | GST Reimbursement | Electricity Subsidy | Dedicated Welfare Fund |

|---|---|---|---|

| Andhra Pradesh | Yes (100%) | 200–500 units free | ₹5 crore |

| Tamil Nadu | No | Partial | Yes |

| Telangana | No | 100 units free | No |

| West Bengal | No | No | Limited support |

| Kerala | No | No | Yes |

Andhra Pradesh is currently the only state in India offering complete GST coverage for its handloom sector.

Challenges to Watch

While the announcement is exciting, it won’t be easy. Key challenges include:

- Implementation Speed: Timely payment of GST by the state to the Centre is crucial.

- Awareness: Many rural weavers still don’t know what GST even is.

- Corruption Risk: Without digital systems, there’s room for manipulation in tax invoices.

- Inclusivity: Ensuring benefits reach small, unregistered weavers, not just cooperatives.

The success of this policy depends on robust execution, training, and digital access in remote areas.

Future Implications and Outlook

This policy could inspire a national movement. If Andhra Pradesh proves that supporting weavers through tax intervention revives local economies, other states—and perhaps the Central government—may follow.

Experts are already calling for:

- Zero-rating handlooms under GST nationwide

- Direct procurement from cooperatives for government schemes

- Digital infrastructure for weaver billing and tracking

The Ministry of Textiles and the GST Council are watching Andhra Pradesh closely. If it works, it could mark the beginning of a new era for India’s rural artisans.

Gauhati HC Rules GST SCN Invalid Without Personal Hearing Date

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

GST Amnesty Scheme Alert — Must-Read Advisory for All Registered Taxpayers