Assam Scores Big in Tax Evasion Fight: In a major breakthrough, Assam scores big in tax evasion fight—and we’re not just talking peanuts. The state government recently recovered a whopping ₹7.5 crore (around $900,000 USD) from Kaluwala Construction Private Limited, a Haryana-based construction company caught red-handed trying to pull a fast one on the taxman. If you’re wondering, “Why should I care about a road project audit in India?”—stick around. This isn’t just about numbers—it’s a real-world example of how governments crack down on tax cheats and what you, as a taxpayer, business owner, or professional, can learn from it.

Assam Scores Big in Tax Evasion Fight

Assam’s ₹7.5 crore recovery from Kaluwala Construction Pvt Ltd isn’t just another headline. It’s a case study in effective governance, sharp enforcement, and the real-world impact of financial compliance. The message is clear: tax fraud won’t be tolerated, and states like Assam are leading the charge in cleaning up the system.

| Topic | Details |

|---|---|

| Incident | ₹7.5 crore ($900,000) recovered by Assam govt from Haryana-based Kaluwala Construction Pvt Ltd |

| Suspected Tax Evasion | Over ₹64 crore (~$7.7 million USD) under investigation |

| Company Involved | Kaluwala Construction Private Limited |

| Project | Four-lane road construction from Dhemaji (Assam) to Oyan (Arunachal Pradesh) |

| Investigation Team | 12-member GST enforcement team from Guwahati |

| Duration of Raid | 6 days |

| Official Source | ThePrint.in |

The Backstory – How Assam Scores Big in Tax Evasion Fight

Kaluwala Construction was building a major four-lane road connecting parts of Assam and Arunachal Pradesh. But behind the scenes, the books weren’t adding up.

Assam’s GST Intelligence team detected discrepancies in tax filings, which kicked off a six-day raid involving 12 officers. Their findings? Over ₹64 crore in suspected tax evasion—and ₹7.5 crore recovered on the spot.

This wasn’t just a paperwork review. The team traced every invoice, bank transaction, and subcontractor bill, piecing together the fraud trail like forensic accountants in a Hollywood heist movie—only this was real, and taxpayer money was at stake.

Legal Implications – What Could Happen Next?

Under Section 132 of India’s GST Act, tax evasion over ₹5 crore can lead to up to 5 years of imprisonment. Kaluwala Construction Pvt Ltd may not just face fines—it could also be dragged into court.

“This is not just about recovery; it’s about deterrence. When the law steps in fast, it sends a message to all sectors,” said Advocate R.K. Sharma, a senior tax litigation expert.

If convicted, company executives could lose their licenses, bank accounts could be frozen, and projects stalled indefinitely.

Why This Matters – For Professionals and the Public

Tax evasion isn’t just a government issue—it hits everyone’s wallet. That uncollected tax could’ve funded roads, hospitals, clean water, and even free textbooks for kids.

For professionals:

- Accountants risk losing licenses by helping clients fudge GST.

- Business owners may face audits for partnering with non-compliant vendors.

- Freelancers and gig workers need to understand compliance to avoid surprise penalties.

And for citizens? It’s your money. You deserve to know where it’s going.

How Governments Catch Tax Evaders – Step by Step

Step 1: GST Mismatch Analysis

Filed tax returns vs. actual invoices = red flags.

Step 2: Physical Inspection

Officers check business locations, suppliers, documents.

Step 3: Bank and IT Integration

Banks share suspicious transactions with GST authorities.

Step 4: Recovery and Legal Action

Cash recovered. FIR filed. Further proceedings launched.

Practical Advice – How to Stay Compliant

Whether you’re a startup founder or a solo consultant, these tips will keep you in the clear:

- Register on the GST Portal and keep your details updated.

- Use accounting software like Tally, Zoho Books, or ClearTax.

- Don’t claim input tax credit unless you have real invoices.

- File returns on time—monthly or quarterly based on your turnover.

- When in doubt, consult a certified GST practitioner.

Voices from the Ground – Public and Business Reactions

This bold move by Assam’s government has struck a chord.

“Finally, someone’s watching where our tax money goes,” said Ayesha Das, a school teacher in Dibrugarh. “If big companies can be held accountable, it gives hope to honest taxpayers like us.”

However, some business owners urged caution, saying enforcement should be balanced with ease of doing business. They fear honest mistakes might be penalized as fraud.

What’s Next? Assam’s Plan for Stronger Tax Enforcement

Following the success of this raid, Assam plans to launch a statewide audit program targeting contractors and large suppliers. They’re also working with AI platforms to detect suspicious billing patterns.

Finance Minister Ajanta Neog was quoted saying:

“We are not here to hound businesses. We want them to grow—but fairly.”

Assam is also partnering with central GST units and other states to detect inter-state fraud rings.

Call to Action – How You Can Stay Informed and Compliant

- Subscribe to official GST updates from cbic-gst.gov.in

- Attend local workshops on tax literacy and compliance

- Keep invoices and transactions digital and traceable

- Report fake invoicing on the DGGI Whistleblower Portal

Being proactive today can save you from a nightmare tomorrow. Don’t wait for a tax officer at your door.

Assam’s History of Tax Enforcement – A Trend in the Making

This isn’t Assam’s first rodeo when it comes to fighting tax fraud. In 2023 alone, the state recovered over ₹200 crore from fraudulent input tax credit claims through data-driven audits and tip-offs.

A high-profile case in Barpeta district uncovered a fake firm network that had siphoned off ₹48 crore through ghost transactions.

Over the past three years, Assam’s commercial tax department has focused on real-time monitoring systems, encouraging whistleblowers, and leveraging AI-assisted e-way bill tracking—boosting detection rates by 37%, according to the state finance department.

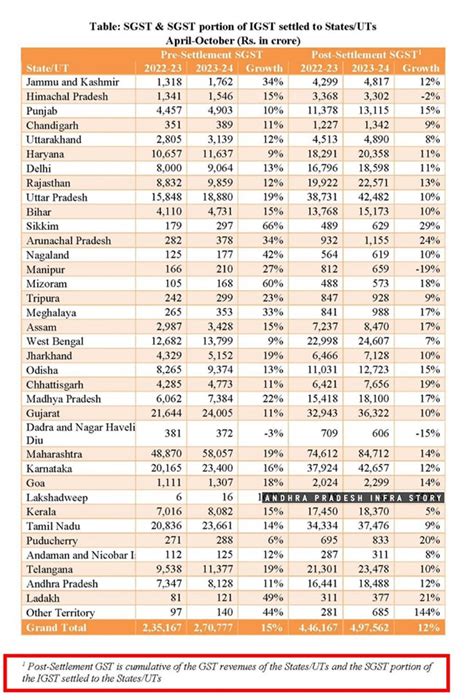

How Assam Stacks Up Against Other Indian States?

While larger states like Maharashtra and Tamil Nadu dominate national revenue figures, Assam ranks among the top five Indian states in GST enforcement efficiency per capita.

For instance, Maharashtra recovered ₹18,000 crore in evasion cases in FY2023-24. Yet Assam is being applauded for its speed of action, citizen engagement, and digital agility.

Several northeastern states are reportedly planning to replicate Assam’s GST enforcement model.

GST System in India – Why It’s Powerful But Complicated

India’s Goods and Services Tax (GST), introduced in 2017, unified state and central levies into a single tax framework. While it streamlined compliance, it also introduced layers of reporting and filing that can trip up even well-meaning businesses.

Key GST features include:

- Input Tax Credit (ITC)

- Monthly/quarterly return filings

- E-invoicing requirements

- E-way bills for goods transport

These can be exploited by faking invoices, inflating purchases, or claiming non-existent credits. Hence, vigilance by the state is crucial.

Expert Views – What India Can Learn from Assam

According to Prof. Mahesh Dutta, an economist at Gauhati University:

“Assam’s ability to trace and recover dues in real-time, using local task forces and central data intelligence, is becoming a benchmark nationally.”

Anjali Mehra, a Mumbai-based tax advisor, says:

“Many clients don’t understand that GST fraud isn’t just a business risk—it’s a criminal offense. Assam’s approach is a much-needed wake-up call.”

She advises quarterly internal audits and vendor verification as best practices.

A Real-World Impact Story – When Tax Collection Helps the People

In 2024, the Assam government used recovered tax funds to open a new primary health center in Lakhimpur, benefiting over 15,000 residents.

Before that, villagers had to travel nearly 50 km for basic medical aid. Today, thanks to the recovered money, they have access to emergency services, maternal care, and medicine—right in their backyard.

This proves that tax enforcement directly funds development.

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

Hostel Inmates Cry Foul as GST Hike Sends Rents Soaring in Chennai

GST Revenue Hits ₹1.96 Lakh Crore in July — But Growth Momentum Slows