Assam’s ₹500 Crore GST Fraud Busted: When the news broke that Assam’s ₹500 crore GST fraud was busted in Beltola, Guwahati, it felt like the script of a high-stakes crime drama. Except this wasn’t Hollywood—this was real life, with the Directorate General of GST Intelligence (DGGI) uncovering one of the biggest scams Northeast India has ever seen. At the heart of the bust were fake invoices, shell companies, and illegal businesses. The story is shocking not only for the scale of money involved but also for the way it was orchestrated across multiple states in India. Four individuals—Gaurav Agarwal, Deepak Agarwal, Vinod Agarwal, and Guddu Singh—now face serious charges. But the significance of this case extends beyond Assam. It reflects how tax fraud undermines economies, hurts honest taxpayers, and challenges governments to strengthen compliance frameworks.

Assam’s ₹500 Crore GST Fraud Busted

The ₹500 crore GST fraud bust in Beltola, Guwahati isn’t just another crime story—it’s a mirror showing how fraud undermines growth and trust in the system. With four men arrested and a nationwide network uncovered, this case is a wake-up call for regulators, businesses, and citizens alike. The fight against GST fraud isn’t only about catching criminals. It’s about protecting public resources, ensuring fair competition, and building a transparent system where development isn’t derailed by corruption.

| Aspect | Details |

|---|---|

| Fraud Amount | ₹500 crore (over $60 million) in fake GST billing scams |

| Arrested Individuals | Gaurav Agarwal, Deepak Agarwal, Vinod Agarwal, Guddu Singh |

| Main Location | Beltola, Guwahati (raids at Shangrila Towers, Lalmati, and other sites) |

| Links to Other States | Meghalaya, Arunachal Pradesh, West Bengal, Delhi |

| Modus Operandi | Fake companies, false invoices, GST evasion, illegal coke plants |

| Operation Conducted By | DGGI Guwahati Zonal Unit Official Website |

| Impact | One of the largest GST scams uncovered in Northeast India |

Why Beltola? A Surprising Hub for Fraud

Beltola, a buzzing neighborhood in Guwahati, is better known for its markets, real estate growth, and rising commercial activity. Yet beneath the surface, its mix of high-rise apartments and semi-commercial spaces has also made it attractive for people looking to operate paper-based businesses without raising immediate suspicion.

The raid at Shangrila Towers, a premium residential complex, was especially symbolic. It showed that financial fraud isn’t just tucked away in dusty back offices—it can be orchestrated from modern, upscale apartments.

What Investigators Found?

During the simultaneous raids across 10 locations, officials discovered:

- A network of shell companies, many with no real offices or employees.

- Fake invoices issued to claim massive Input Tax Credits (ITC).

- Connections to illegal coke plants in neighboring Meghalaya and Arunachal Pradesh.

- Links to businesses in West Bengal and Delhi, making this a pan-India operation.

The fraudsters used clever tricks: fake documentation, layering of companies, and a chain of bogus financial transactions that made it look like legitimate trade was happening.

How Shell Companies and Fake Invoices Work?

To understand the scam, let’s break it down:

- Create Shell Companies: Fraudsters register multiple firms under different names, sometimes even using stolen or fabricated identities.

- Issue Fake Invoices: These companies “sell” goods or services to one another, even though no real transaction occurs.

- Claim Input Tax Credits: By showing these bogus purchases, they claim tax refunds or reduce their GST liability.

- Launder the Money: The “profits” are rotated through different firms, making it hard to trace.

This method lets fraudsters siphon off huge sums while leaving almost no physical trail of goods or services.

Why Assam’s ₹500 Crore GST Fraud Busted Matters?

This bust isn’t just about numbers on paper. Here’s why it matters:

- ₹500 crore equals $60 million—money that could fund highways, schools, and healthcare projects.

- Tax fraud undermines trust in the business ecosystem. Honest companies can’t compete with fraudsters inflating margins through illegal means.

- For ordinary people, fraud means less money for public services and potentially higher taxes down the road.

According to India’s Ministry of Finance, tax evasion costs the country billions every year, slowing down development and straining government resources.

A Bigger Picture: The Cost of GST Fraud in India

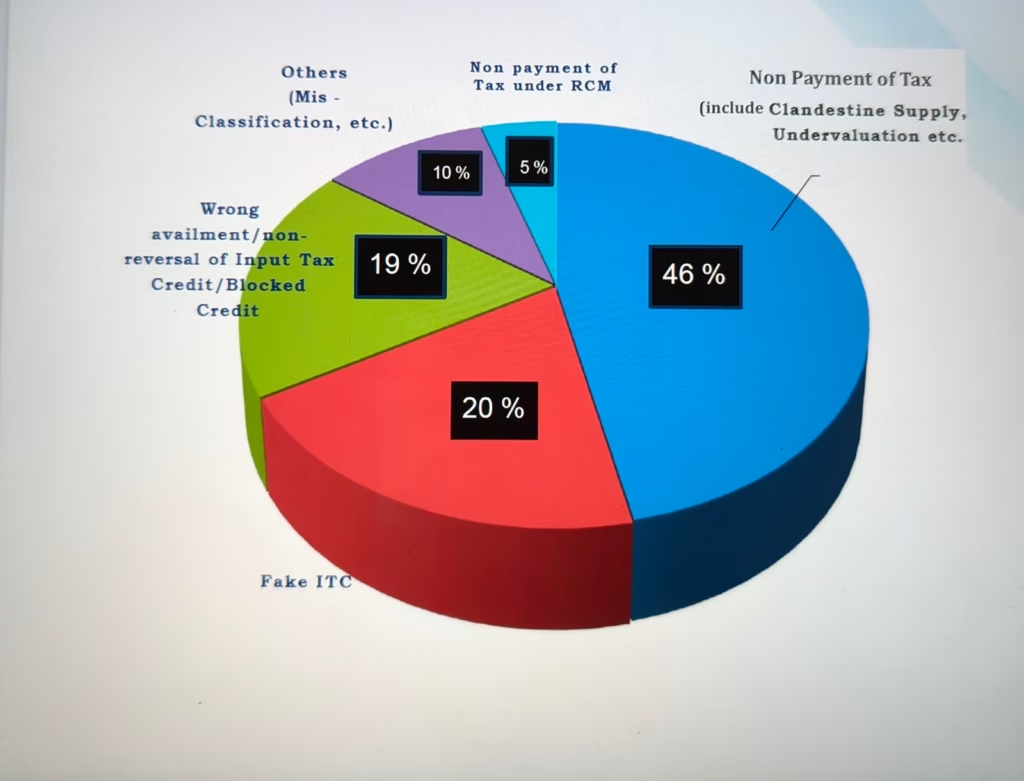

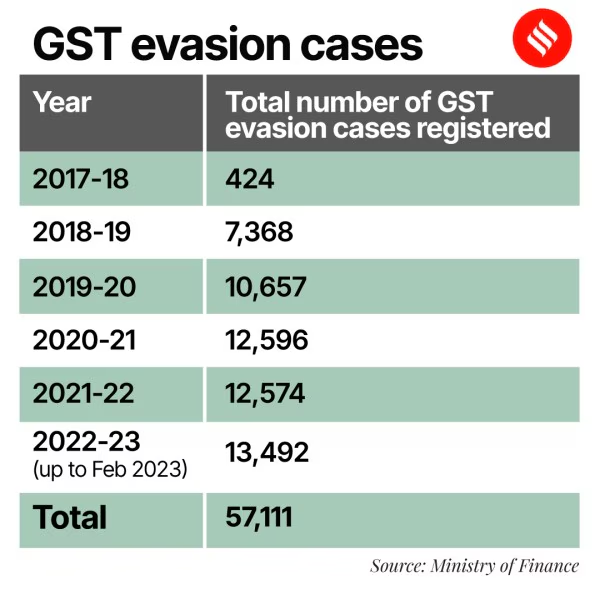

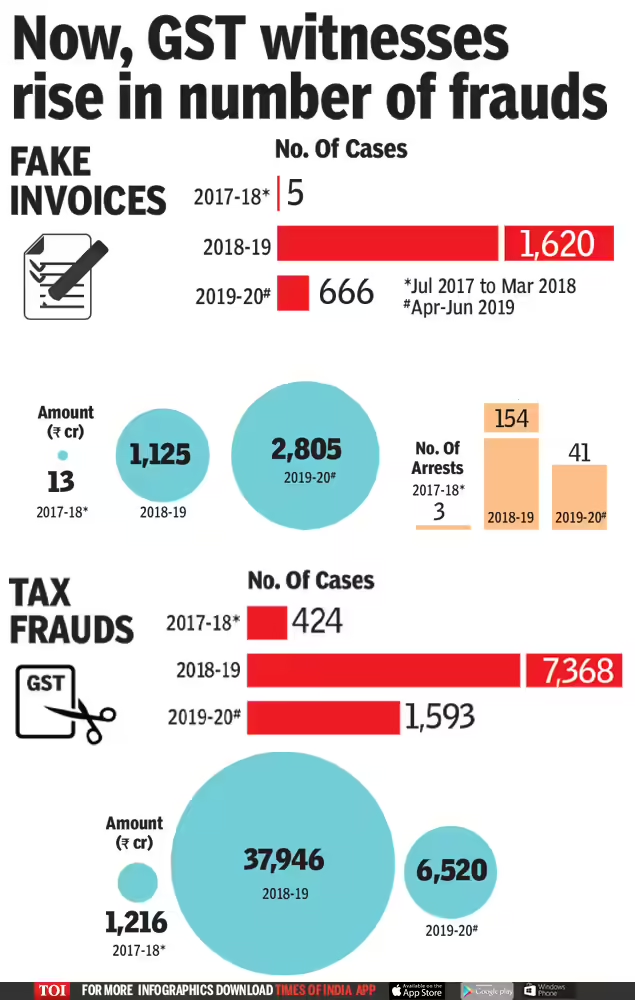

Since its rollout in 2017, the Goods and Services Tax (GST) was intended to simplify taxation and increase compliance. But fraudsters found ways to exploit it.

- By 2023, the Government of India had unearthed fake ITC claims worth over ₹1.5 lakh crore nationwide.

- GST fraud contributes to India’s estimated tax gap of nearly 20%, according to official data.

- Large-scale scams like the Beltola case highlight why data analytics and enforcement are becoming central to tax administration.

Technology: A Weapon Against Fraud

Authorities are fighting back using technology. Here’s how:

- AI and Data Analytics: GST systems now flag suspicious invoice patterns automatically.

- E-invoicing: Reduces the scope for creating fake paper invoices.

- Linking PAN, Aadhaar, and GST: Makes it harder to use stolen identities.

- Cross-border monitoring: Ensures interstate scams are tracked more effectively.

The Beltola case shows that despite fraudsters’ sophistication, data-driven investigations can still crack down on elaborate scams.

Lessons for Businesses and Professionals

Here’s what professionals and businesses should take away from this case:

- Always verify suppliers on the GST portal.

- Maintain transparent digital records for all transactions.

- Regularly audit vendors and invoices to avoid being dragged into fraud unknowingly.

- Train staff to spot red flags like mismatched invoice details, unusually high-value trades, or companies with no real operations.

For compliance officers, accountants, and auditors, this is a reminder that vigilance and verification aren’t optional—they’re essential.

Looking Back: Other GST Fraud Cases in India

India has seen a string of massive GST scams over the years:

- 2021 Nationwide Fake Firm Crackdown – Over 4,000 fake firms unearthed, involving ₹1,200 crore fraud.

- 2022 Delhi Case – ₹600 crore lost through bogus ITC claims.

- 2023 Mumbai Steel Trading Scam – ₹450 crore worth of fake invoices detected.

Compared to these, the ₹500 crore Beltola scam stands out as one of the largest in Northeast India, underlining that financial crime networks are spreading beyond metro cities.

Tax Fraud: A Global Challenge

Fraud isn’t unique to India. Globally, governments struggle with similar issues:

- USA: The IRS estimates $1 trillion lost annually to tax fraud and evasion.

- UK: HMRC loses billions to “carousel fraud” involving goods imported and re-exported multiple times.

- EU: Europol reports €50 billion+ lost each year to VAT fraud.

The tactics may vary, but the principle is the same—fraudsters exploit loopholes in tax systems for personal gain.

What Ordinary Citizens Can Do?

Even if you’re not a business owner, you can help fight fraud:

- Always ask for a GST invoice when you buy goods or services.

- Report suspicious vendors using the GSTN grievance portal.

- Educate yourself and others about how fraud affects everyone by reducing government revenue.

By doing small things, citizens play a big role in keeping the system transparent.

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect

Tax Audit Evasion Crackdown Coming—Automated File Selection to Catch More Offenders

12% GST Dodge? Bengaluru PG’s ‘Cash-Only’ Rent Rule Triggers Massive Tax Evasion Uproar