Atlassian Executives Forced To Sell Shares: When you hear that Atlassian executives were forced to sell shares, your first thought might be, “Dang, are they losing confidence in the company?” But hold up—this isn’t a doom-and-gloom story. It’s not about panic, lack of faith, or bailing on stock. Nope. The real reason is taxes. That’s right. Some of Atlassian’s top leaders had to part ways with chunks of their stock to cover tax obligations from Restricted Stock Units (RSUs). It’s a super common move in the corporate world, especially in tech, and it doesn’t signal trouble. Instead, it shows the everyday realities of how compensation works when your paycheck comes with a side of company shares.

Atlassian Executives Forced To Sell Shares

Atlassian executives being “forced to sell shares” might sound alarming at first glance, but it’s really just the reality of RSU compensation and tax obligations. These moves were routine, non-discretionary, and perfectly normal for tech executives. For investors, the takeaway is clear: don’t panic over insider sales without understanding the context. Instead, focus on the fundamentals, plan for taxes if you’re in a similar situation, and remember that diversification is key.

| Topic | Details |

|---|---|

| Why Execs Sold Shares | To cover tax obligations from vested RSUs (sell-to-cover transactions). |

| Executives Involved | CFO Joseph Binz, President Anutthara Bharadwaj, CTO Rajan Bashyam, CRO Brian Duffy, CCO Gene Liu. |

| Frequency of Sales | Insider trades reported on 18 out of 20 trading days in August 2025. |

| Amount Sold | Some execs sold thousands of shares; co-founders Mike Cannon-Brookes & Scott Farquhar liquidated over $3.6B combined under pre-set plans. |

| Stock Price Context | Atlassian (NASDAQ: TEAM) traded around $190–$200 in mid-2025 with a market cap near $50B. |

| Historical Pattern | Insider sales have occurred annually, typically during RSU vesting cycles in Q1 and Q3. |

| Risk Factor | None unusual—these sales were non-discretionary and tax-driven. |

| Source | SEC Filings – Form 4 |

| Official Website | Atlassian |

What’s Really Going On?

Atlassian isn’t just another software company; it’s the Aussie-born powerhouse behind Jira, Confluence, and Trello—tools that keep businesses, dev teams, and even schools running smoothly. The company has been on fire in the tech world, especially with its cloud-first and AI-driven strategy.

So, why would its C-suite leaders suddenly dump shares? The answer lies in how they’re paid. Top execs often don’t just get salaries; they get RSUs, which are basically promises of stock that vest over time. But when those RSUs vest? Uncle Sam comes knocking.

Understanding RSUs and Taxes (Without the Jargon)

Think of RSUs like a bonus pizza from your favorite restaurant. You don’t get to eat it all at once—it’s given in slices over time. But here’s the kicker: every time you get a slice, you’ve got to pay tax on it.

In the corporate world, when an RSU vests, it’s treated as income. The IRS says, “Hey, you just got something of value. Pay up!” That’s where sell-to-cover transactions come in. Executives sell just enough shares to cover the tax bill, keeping the rest.

So, when Atlassian execs sold stock in February, May, and August of 2025, it wasn’t because they were nervous. It was because they had no choice. The government doesn’t care if your wealth is tied up in shares—you owe taxes in cash.

U.S. vs Australia: Different Tax Rules, Same Outcome

Since Atlassian is dual-listed in the U.S. (NASDAQ: TEAM) and Australia (ASX: TEAM), execs face slightly different systems:

- U.S. Tax System: RSUs are taxed as ordinary income on vesting, then capital gains tax applies if you hold and sell later.

- Australian Tax System: The Australian Tax Office (ATO) also taxes RSUs at vesting, but often at marginal tax rates that can exceed 45% for top earners.

Whether in Sydney or San Francisco, execs don’t escape the taxman. That’s why “sell-to-cover” isn’t optional—it’s necessary.

A Closer Look at the Atlassian Executives Forced To Sell Shares

- February 2025: CTO Rajan Bashyam, President Anutthara Bharadwaj, and CFO Joseph Binz all sold shares to meet RSU tax requirements.

- May 2025: Another round of sell-to-cover trades hit, this time involving Bharadwaj, Binz, CRO Brian Duffy, and CCO Gene Liu.

- August 2025: CFO Binz sold over 3,000 shares in multiple tranches, again under a non-discretionary plan.

For context, insiders were active on 18 of the past 20 trading days in August—a big spike compared to earlier months. But again, this was mostly automated under Rule 10b5-1 trading plans, which allow executives to schedule sales ahead of time to avoid conflicts of interest.

What About the Billion-Dollar Founders?

Founders Mike Cannon-Brookes and Scott Farquhar (who are basically rock stars in Australia’s tech scene) also sold massive stakes—over $3.6 billion worth. That number sounds scary, but here’s the deal: these guys still own huge chunks of Atlassian. The sales were about wealth management, diversification, and liquidity—not a lack of confidence.

As any financial advisor would tell you, it’s risky to keep all your eggs in one basket. Even if that basket is Atlassian.

Historical Context: Not the First Time

This isn’t the first headline about Atlassian insiders selling shares. Since going public in 2015, the company has reported regular RSU-related insider sales:

- 2017–2019: Early exec sales were smaller but followed the same RSU-tax logic.

- 2021: Multiple execs sold during the pandemic tech boom when Atlassian stock hit record highs.

- 2023–2024: The trend continued, especially in Q1 and Q3 when RSUs typically vest.

Pattern? Absolutely. This has been business as usual for nearly a decade.

Market Context: How Investors See It

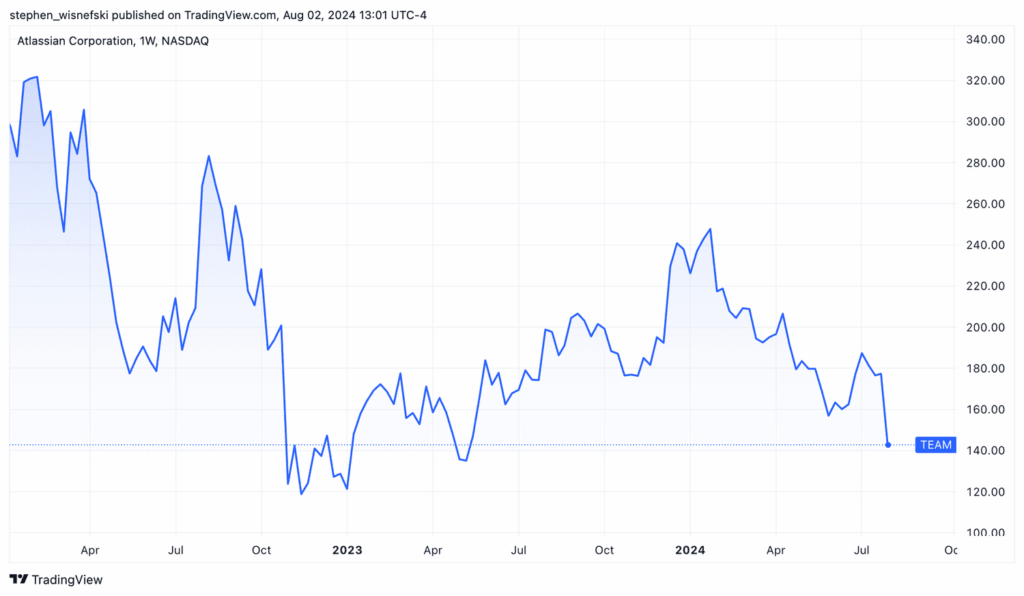

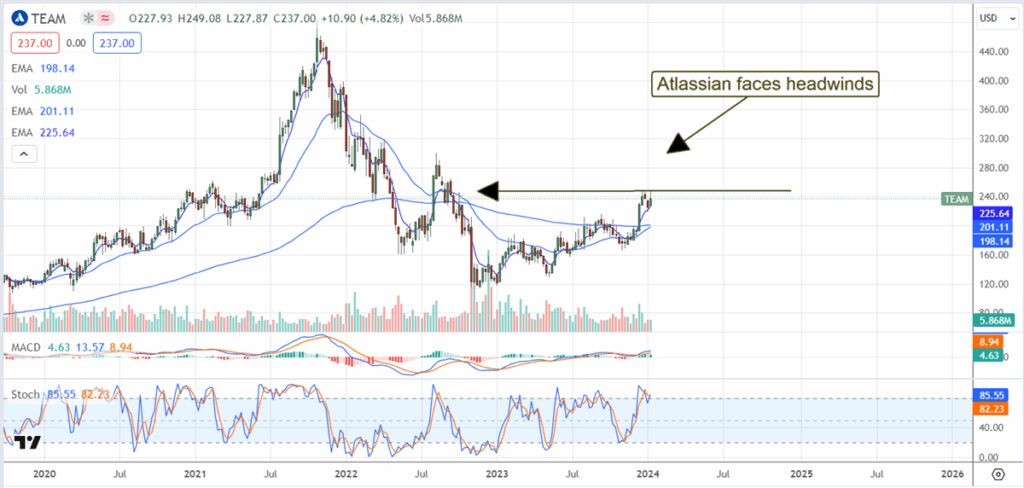

Atlassian stock (NASDAQ: TEAM) has seen ups and downs, trading in the $190–$200 range in mid-2025. The company’s market cap hovers near $50 billion, making it a heavyweight in enterprise software.

Analysts at Morgan Stanley and Goldman Sachs note that insider sales aren’t dampening investor sentiment. Instead, the focus remains on Atlassian’s:

- AI-powered features in Jira and Confluence.

- Strong customer base (over 280,000 organizations worldwide).

- Cloud migration strategy, which fuels recurring revenue.

Bottom line? Wall Street isn’t spooked by these trades.

Employee Morale: The Ripple Effect

When execs sell shares, employees sometimes get jittery. But Atlassian has a unique culture, emphasizing “open company, no bullshit” as one of its core values. Leadership explains these trades transparently, framing them as tax moves, not exits.

For rank-and-file employees with RSUs, it’s also a reminder: don’t forget your tax obligations when those vesting dates come up.

Comparisons: Other Tech Giants Did the Same

If you think this is just Atlassian, think again.

- Apple: Tim Cook regularly sells shares to cover RSU taxes.

- Microsoft: Satya Nadella sold over $285M in stock in 2021 for diversification and tax reasons.

- Meta: Mark Zuckerberg’s planned sales made headlines but were tied to tax and philanthropy.

In other words, it’s business as usual across Silicon Valley and beyond.

Step-by-Step Guide: What to Do If You Get RSUs

If you’re lucky enough to get RSUs at your job, here’s how to handle them like a pro:

Step 1: Know Your Vesting Schedule

Your shares don’t all come at once—they vest over time. Mark those dates.

Step 2: Understand the Tax Hit

Every time shares vest, the IRS (or ATO if you’re in Australia) treats it as income. Plan ahead for that bill.

Step 3: Decide on Sell-to-Cover vs. Paying Out of Pocket

- Sell-to-Cover: Easiest way—sell enough shares to pay taxes.

- Pay Out of Pocket: Riskier, but you keep all shares if you can afford it.

Step 4: Diversify

Don’t hold all your stock in one company (even if you love it). Spread out into ETFs, real estate, or bonds.

Step 5: Talk to a Pro

A financial advisor or tax pro can help you avoid surprises.

Investor Psychology and Media Spin

Let’s be real: headlines about executives “dumping” stock grab attention. But the media often frames these events in a scarier way than reality warrants. The nuance—RSUs, tax compliance, pre-planned trading—isn’t as exciting as “executives cash out.”

Smart investors cut through the noise by checking SEC filings, understanding the tax angle, and comparing insider ownership before and after sales.

Risks to Watch For

While this round of sales isn’t a red flag, investors should always watch for:

- Unplanned, large discretionary sales (signals a change in confidence).

- Executives leaving the company after selling shares.

- Weak earnings reports paired with insider sales.

For Atlassian, none of those risk signals are flashing red right now.

How India’s Broken Tax System Is Crippling the Circular Economy Revolution

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

2025 Tax Slabs Revealed: Find Out How Much You’ll Really Pay