August 2025 GST Compliance Calendar: As August 2025 rolls in, businesses across the United States and India are gearing up for a critical month in terms of compliance with Goods and Services Tax (GST). Whether you’re a seasoned professional or just starting out, understanding the nuances of GST filing can save you time, money, and stress. This article breaks down everything you need to know to stay ahead of deadlines, from key filing dates to common pitfalls and how to avoid them. In this guide, we’ll explore the upcoming deadlines for GST returns, TDS/TCS payments, and other important obligations. We’ll also discuss the role of GST in streamlining tax processes and why meeting these deadlines is crucial for maintaining smooth business operations.

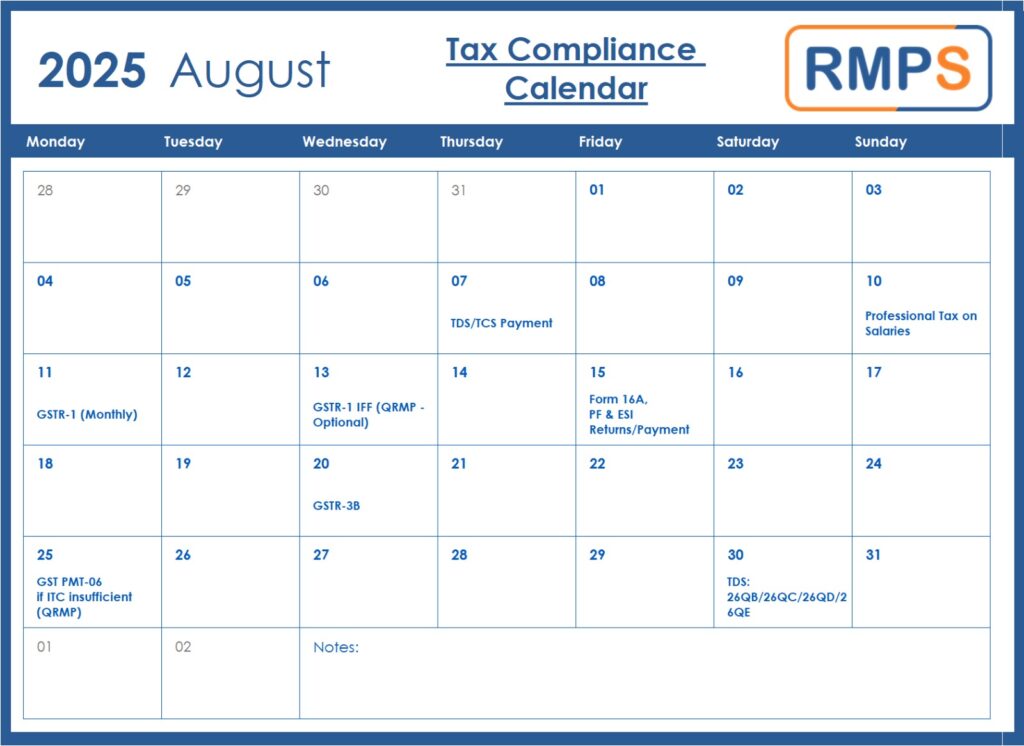

August 2025 GST Compliance Calendar

August 2025 is a critical month for businesses to stay compliant with GST filing deadlines. From TDS/TCS payments to GSTR-1 and GSTR-3B filings, each deadline is crucial for ensuring that your business remains in good standing with the tax authorities. By staying organized, using the right tools, and keeping track of these dates, you can avoid penalties and ensure smooth tax compliance.

| Topic | Details |

|---|---|

| GST Filing Deadlines | Key filing dates for August 2025, including GSTR-1, GSTR-3B, and TDS. |

| TDS/TCS Payments | Payment deadlines for Tax Deducted at Source (TDS) and Tax Collected at Source (TCS). |

| GSTR-3B Filing | Monthly and quarterly filing obligations for GSTR-3B. |

| Penalty Risks | Late filings and the penalties you could face. |

| Practical Tips | Actionable advice on how to keep track of your GST filings. |

| Official Resources | Links to relevant official sites for direct reference. |

Understanding GST and Why Compliance Matters

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax system. It applies to the sale of goods and services and is one of the most significant reforms in India’s tax structure. In the United States, the term GST is often used interchangeably with VAT (Value Added Tax), but in India, it is specific to the Goods and Services Tax system.

When GST was introduced, it aimed to simplify tax compliance for businesses. However, the system requires strict adherence to deadlines and accurate filing, or else penalties, fines, and interest could stack up quickly. Understanding these compliance deadlines is crucial for keeping your business in good standing with the government and avoiding unnecessary penalties.

The Role of GST in Business Operations

GST has significantly altered the way businesses operate. It has simplified the tax structure, reduced cascading taxes, and improved the ease of doing business in India. Businesses now have to follow a uniform process for tax payment, making tax compliance much easier across the country. It’s crucial to stay updated with all filing requirements to ensure your business reaps the full benefits of this system.

Key August 2025 GST Compliance Calendar

Let’s take a closer look at the major deadlines you need to be aware of this August to ensure you don’t miss out on any critical compliance dates.

1. TDS/TCS Payment – 7 August 2025

The first key deadline is for the Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) payments, which must be made by August 7, 2025. This applies to taxpayers who are responsible for deducting or collecting tax at the source for various transactions. This includes businesses paying wages, contractors, rent, or service providers.

Filing and remitting the TDS/TCS on time helps you avoid interest and penalties under GST law.

2. GSTR-1 Filing – 11 August 2025

The GSTR-1 is the form used to file details of outward supplies (sales) for the month of July 2025. This is due on 11th August 2025 for businesses with a turnover greater than ₹5 crore, or those who have opted for monthly filing. It’s crucial to file this form on time to ensure your customers can claim the Input Tax Credit (ITC) on time.

For businesses under the Quarterly Return Monthly Payment (QRMP) scheme, filing the GSTR-1 IFF (Invoice Furnishing Facility) is optional but highly recommended. It helps in providing detailed B2B invoice information.

Pro Tip: Make sure all sales data is accurate and up-to-date to prevent discrepancies that might delay the filing process.

3. GSTR-3B Filing – 13 August 2025

The GSTR-3B is a simplified return that businesses must file monthly or quarterly, depending on their turnover. This form contains a summary of all sales and purchases made in the month of July 2025, along with the tax payable.

For monthly filers, this form is due by 13th August 2025. Businesses that have opted for the QRMP scheme will file this return on a quarterly basis, with the filing for the April–June 2025 quarter due by the end of August 2025.

4. GSTR-5A for Non-Resident Taxable Persons – 13 August 2025

If your business deals with foreign services, you’ll need to file the GSTR-5A for Non-Resident Taxable Persons. This applies to any foreign entity providing online services to Indian customers. The filing deadline for this return is 13th August 2025, so make sure all details related to international services are properly documented.

5. GSTR-6 Filing for Input Service Distributors – 13 August 2025

Input Service Distributors (ISD) are required to file GSTR-6 if they are distributing the Input Tax Credit (ITC) to their branches. The filing deadline for GSTR-6 is 13th August 2025.

6. GST PMT-06 Payment for QRMP Taxpayers – 25 August 2025

If your business is registered under the QRMP scheme, you’ll need to make your tax payment for the month of July 2025 by 25th August 2025 using GST PMT-06. It’s important to ensure that the payment is done within the specified period to avoid any penalties or interest.

7. GST Late Fees and Penalties

Late filing of GST returns can attract penalties ranging from ₹50 to ₹200 per day depending on the nature of the return, plus interest on the overdue tax amount. The interest rate on delayed payments is 18% per annum. These penalties can quickly add up, so adhering to deadlines is key to minimizing costs and maintaining a clean compliance record.

How to Stay on Top of GST Deadlines?

Keeping track of GST deadlines can feel like a full-time job. Here are a few tips to help you stay on top of it:

1. Use Digital Reminders and GST Filing Software

There are several GST filing software platforms available, like Tally or ClearTax, that send automatic reminders for upcoming deadlines. By using these tools, you can ensure you’re always in the know about important filing dates.

2. Maintain Proper Records

Keep a running record of all your business transactions, including sales, purchases, and taxes paid. This makes it much easier to compile the necessary data when filing your returns and helps you avoid last-minute rushes.

3. Regularly Check for Updates

GST laws and deadlines can change, so it’s important to stay updated with official notifications. The GST Portal and the Income Tax Department regularly release updates, so check them frequently for any changes that might affect your filing schedule.

Understanding the QRMP Scheme

The Quarterly Return Monthly Payment (QRMP) scheme was introduced to make the GST filing process more manageable for smaller businesses. It allows taxpayers with a turnover of less than ₹5 crore to file quarterly returns for GSTR-3B while making monthly tax payments.

This scheme was designed to reduce the burden of filing monthly returns and ease the cash flow for businesses. However, businesses under QRMP still need to ensure that they are making timely payments using GST PMT-06 by the 25th of each month, even though the actual returns are filed quarterly.

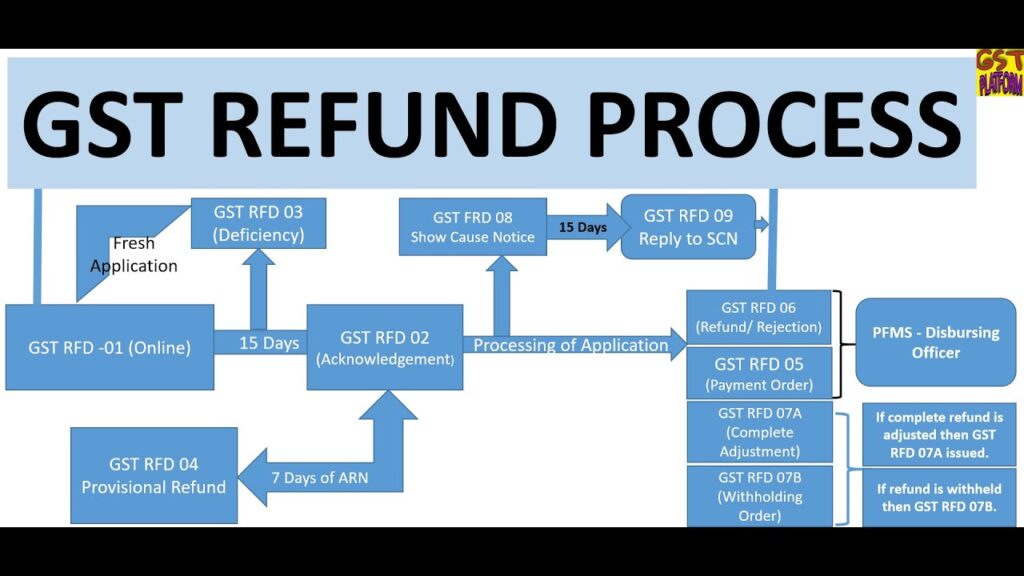

GST Refund Process: What You Need to Know

Another important aspect of GST compliance is the refund process, especially for businesses that deal with exports or make substantial purchases. If your GST input tax exceeds your output tax (in the case of exports or excess payments), you may be eligible for a refund.

The process for claiming a GST refund involves the following steps:

- File GSTR-1 and GSTR-3B: Ensure that all your returns are filed, as this is required to initiate a refund.

- Apply for Refund: Use the GST RFD-01 form available on the GST portal to apply for a refund.

- Verification and Processing: The authorities will verify your claim and process it within 60 days.

- Refund Credit: If approved, the refund amount will be credited to your bank account.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!