Banks Propose New GST Slab of ₹1 Crore: India’s digital payments story has been nothing short of revolutionary. From kirana stores to street-side chai stalls, Unified Payments Interface (UPI) has made cashless transactions a way of life. But in recent months, a worrying trend has emerged: some small merchants are stepping back from digital payments due to fears of Goods and Services Tax (GST) scrutiny. To address this, banks have proposed a bold change — raising the GST registration threshold from ₹40 lakh for goods (₹20 lakh for services) to ₹1 crore in annual turnover. The goal is simple: remove the fear factor, keep small traders in the digital fold, and maintain India’s rapid cashless momentum.

Banks Propose New GST Slab of ₹1 Crore

Raising India’s GST registration threshold to ₹1 crore could reshape the small business landscape. It would ease compliance burdens, encourage digital payment adoption, and align India with international tax norms. While some risks remain, strategic implementation and targeted monitoring can ensure this change boosts both merchant confidence and the national digital economy.

| Aspect | Details |

|---|---|

| Proposed GST Threshold | Increase from ₹40 lakh (goods) / ₹20 lakh (services) to ₹1 crore annual turnover |

| MDR on UPI | Suggested reintroduction only for merchants with turnover above ₹1 crore |

| Reason for Proposal | To prevent merchants from shifting to cash due to GST scrutiny |

| Stats & Trends | Karnataka traders saw a drop in UPI use after GST notices (Times of India) |

| Impact on Small Biz | Less compliance burden, more incentive to accept digital payments |

| Official Sources | Department of Financial Services, NPCI |

Why This Proposal Matters?

The GST framework, launched in July 2017, simplified India’s indirect tax system by replacing multiple levies with one unified tax. But it also brought in strict compliance requirements for registered businesses.

Right now, if you sell goods and your annual turnover exceeds ₹40 lakh (or ₹20 lakh if you provide services), GST registration is mandatory. Registration means filing monthly or quarterly returns, maintaining digital invoices, reconciling purchase and sales data, and responding to notices from the tax department.

For small merchants, especially in semi-urban and rural areas, this compliance can feel overwhelming. The process often requires hiring accountants, paying for GST software, and spending valuable time on paperwork instead of growing the business.

The situation worsened when some state tax departments, like in Karnataka, started using UPI transaction data to identify potential GST non-compliance. Merchants selling GST-exempt goods — like unbranded rice, fruits, or vegetables — still received queries if their UPI payments seemed high.

Faced with such scrutiny, many simply reverted to cash, undercutting years of progress in digital adoption.

The Numbers in Context

- Current GST Threshold: ₹40 lakh (goods) / ₹20 lakh (services)

- Proposed GST Threshold: ₹1 crore annual turnover

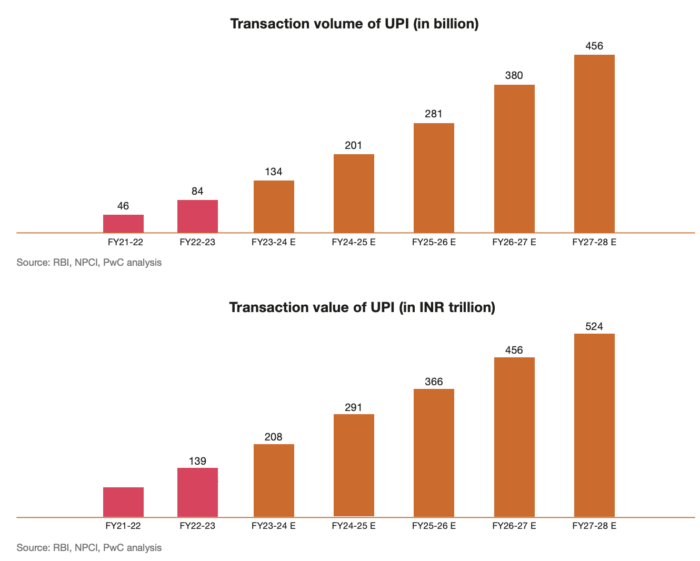

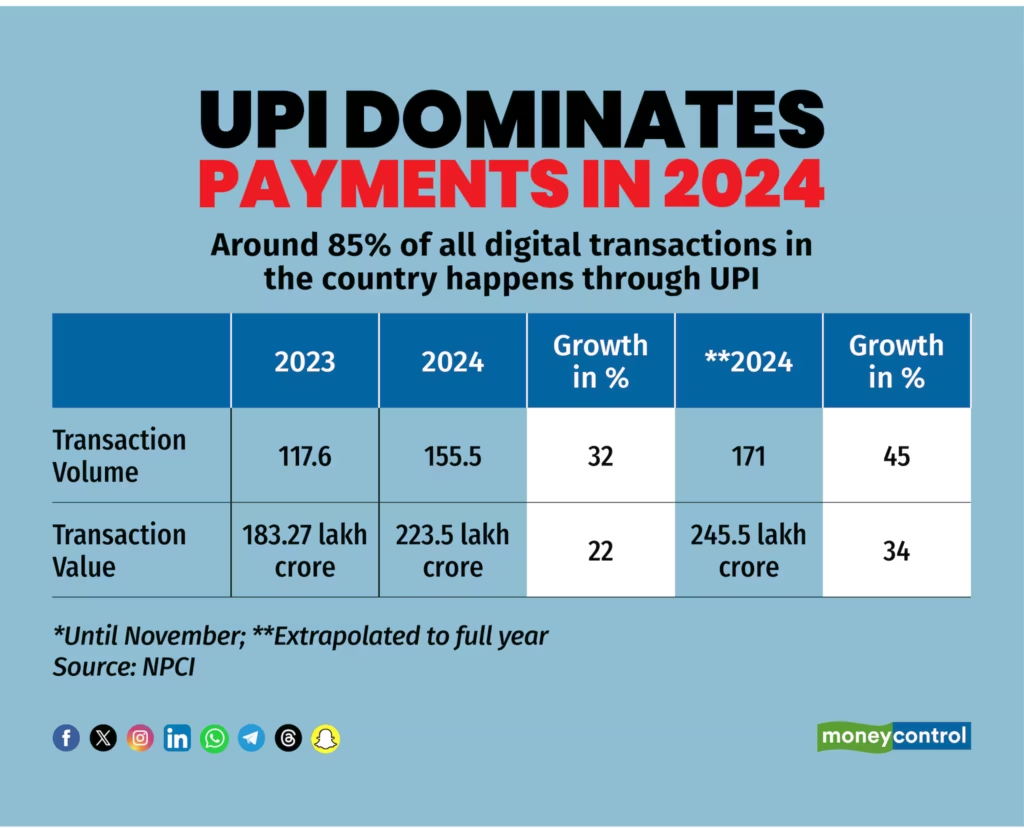

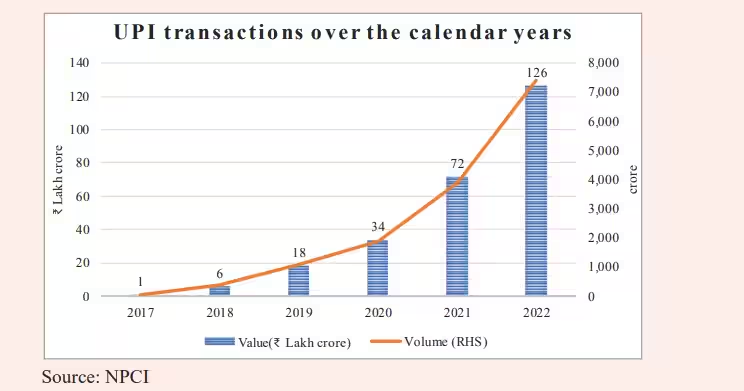

- UPI Usage: 14.04 billion transactions worth ₹21.7 lakh crore in July 2025 (NPCI data)

- MSME Impact: Could exempt over 70% of small merchants from GST obligations (MSME Ministry data)

- Karnataka Trend: Times of India reported a visible drop in UPI acceptance in Bengaluru and Mysuru after GST notices

How Banks Propose New GST Slab of ₹1 Crore Could Help Small Businesses?

1. Reducing the Compliance Burden

Filing GST returns isn’t just about uploading sales numbers. Businesses must reconcile invoices with their suppliers’ filings, track input tax credits, and meet strict deadlines. Non-compliance can lead to penalties of ₹100 per day or even suspension of GST registration.

For a merchant with ₹60–70 lakh turnover, this is a significant cost and distraction. Raising the threshold to ₹1 crore would remove this hassle for a large segment of traders.

2. Protecting Digital Payments Growth

India’s UPI story has been a global case study in financial inclusion. But the fear of tax scrutiny is reversing some gains. If the GST limit is raised, merchants will have less reason to reject UPI payments, keeping customers happy and transactions transparent.

3. Targeted MDR Instead of Blanket Charges

Banks are also pushing for a selective return of Merchant Discount Rate (MDR) — a small fee charged on digital payments — but only for merchants above ₹1 crore turnover. This would allow banks to recover costs from large players without burdening small shops.

Real-Life Merchant Perspectives

Sunita, Sari Shop Owner, Lucknow

“I switched to UPI during the pandemic. But last year, I got a notice asking for GST details even though my products are mostly exempt. It was stressful. If they raise the threshold, I’ll happily take digital payments again.”

Ravi, Tea Stall Owner, Bengaluru

“People want to pay ₹10 for chai via UPI, but I worry it will flag me to the tax department. Cash feels safer. I’d prefer UPI if I knew I was below the limit.”

Historical GST Threshold Changes

- 2017: ₹20 lakh for goods and services (₹10 lakh in some states)

- 2019: Raised to ₹40 lakh for goods; services stayed at ₹20 lakh

- 2025 (Proposed): ₹1 crore for both goods and services

If approved, this would be the most significant threshold hike since GST began.

Global Comparison

- USA: Many states exempt small businesses with sales under $100,000 (~₹83 lakh)

- Australia: GST threshold is AUD 75,000 (~₹40 lakh)

- UK: VAT threshold is £85,000 (~₹90 lakh)

- Singapore: GST threshold is SGD 1 million (~₹61 lakh)

India’s proposed ₹1 crore threshold would put it among the most generous globally for small business tax exemption.

Risks and Trade-offs

- Short-term Revenue Loss: Fewer registered businesses may reduce GST collections initially.

- Risk of Splitting Businesses: Larger entities might split operations into smaller units to stay under the limit.

- Compliance Gap: A bigger informal sector could slow India’s tax-to-GDP ratio growth.

Policy experts suggest that advanced data analytics and targeted audits can offset these risks.

MDR Debate: Economics and Fairness

UPI transactions are currently free for merchants, but banks bear infrastructure costs. An MDR of 0.3%–0.5% for merchants above ₹1 crore turnover could generate revenue to maintain and upgrade payment systems, while keeping small merchants exempt.

Countries like the USA routinely charge 1.5%–3% for card transactions, making India’s proposed selective MDR relatively merchant-friendly.

Consumer Benefits

- More merchants accepting UPI and other digital modes

- Faster, smoother transactions with no cash-handling delays

- Digital records for better consumer protection in returns and disputes

Step-by-Step Guide for Merchants

If this GST change is approved:

- Assess Your Turnover: Check if your annual sales are under ₹1 crore.

- Maintain Clean Records: Use a basic accounting app or ledger.

- Adopt Business UPI IDs: Keep personal and business payments separate.

- Monitor Policy Updates: Follow announcements on gst.gov.in.

- Use Digital Payments for Growth: Promote UPI, cards, and QR codes to attract more customers.

Industry Reactions

A senior banking executive told Moneycontrol:

“We need to protect the small merchant base that built UPI’s success. Higher GST thresholds will keep them in the system without fear.”

NPCI officials have also emphasized the trust factor:

“UPI growth is about more than numbers; it’s about ensuring that merchants feel safe using it.”

Policy Outlook: Digital India 2030

This proposal aligns with broader national goals:

- Make UPI a global payment platform

- Reduce cash usage to under 10% of total transactions

- Use AI and analytics for smarter, targeted tax compliance

If approved, the ₹1 crore threshold could be one of the key reforms that make these goals achievable.

Vodafone Idea Faces ₹21.39 Crore GST Penalty for Alleged Short Payment Under RCM!

Government Appoints 33 Experts to GST Appellate Tribunal – What This Means for GST Appeals!

Supreme Court Denies Plea Challenging GST ECL Blocking Relief