Bengaluru Man’s PAN Card Misused in ₹43 Crore GST Fraud: That’s the headline making waves across India this week, and it’s not just another boring finance story—it’s about real people, real fraud, and real consequences. Imagine waking up one day, logging into your tax portal, and seeing that your PAN card—basically your financial fingerprint—has been used to rack up shady transactions worth ₹43 crore (about $5 million USD). Yep, that’s what happened in Bengaluru, and it has everyone talking about identity theft, tax fraud, and how to protect yourself. The police are on the case, but the situation opens up bigger conversations: how vulnerable are everyday taxpayers? How can professionals and businesses protect themselves from similar scams? And why should you care, even if you’re not based in India? Let’s break it down, American-style—straight talk, no fluff.

Bengaluru Man’s PAN Card Misused in ₹43 Crore GST Fraud

The Bengaluru PAN card fraud is more than a local crime story—it’s a warning about how fragile our financial identity systems are. With ₹43 crore ($5 million) in fake transactions, it highlights the urgent need for better verification, tighter monitoring, and personal vigilance. Whether it’s PAN in India, SSN in the U.S., or Tax IDs in Europe, the message is clear: protect your financial identity like your life depends on it—because in many ways, it does.

| Aspect | Details |

|---|---|

| Fraud Amount | ₹43 crore (~$5 million USD) |

| City | Bengaluru, India |

| Date of Discovery | August 16, 2025 |

| Complaint Filed | September 2, 2025 |

| How Fraud Happened | Fake GST registrations using stolen PAN |

| Who’s Investigating | Bengaluru Police |

| Related Case | UP shopkeeper hit with ₹141 crore ($16.9 million) tax notice from PAN misuse |

| Official Portal | GST Portal |

What Exactly Happened in Bengaluru?

During his annual tax filing on August 16, 2025, a Bengaluru man discovered that his PAN card (Permanent Account Number) had been misused to generate fake GST (Goods and Services Tax) registrations. Fraudsters had orchestrated transactions worth ₹43 crore, all tied to his identity. His family filed a formal police complaint on September 2, 2025.

The shocking part? He wasn’t involved in any of it. This was pure identity theft. For Indians, a PAN is like the combination of a driver’s license and Social Security Number in the U.S.—without it, you can’t do much in the financial world. And when it’s misused, the fallout can be devastating.

Why This Story Matters Globally?

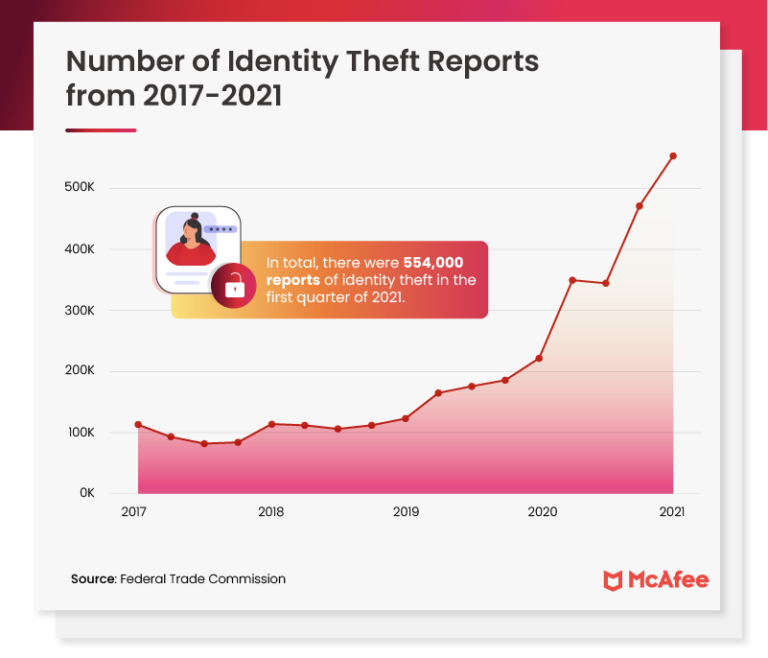

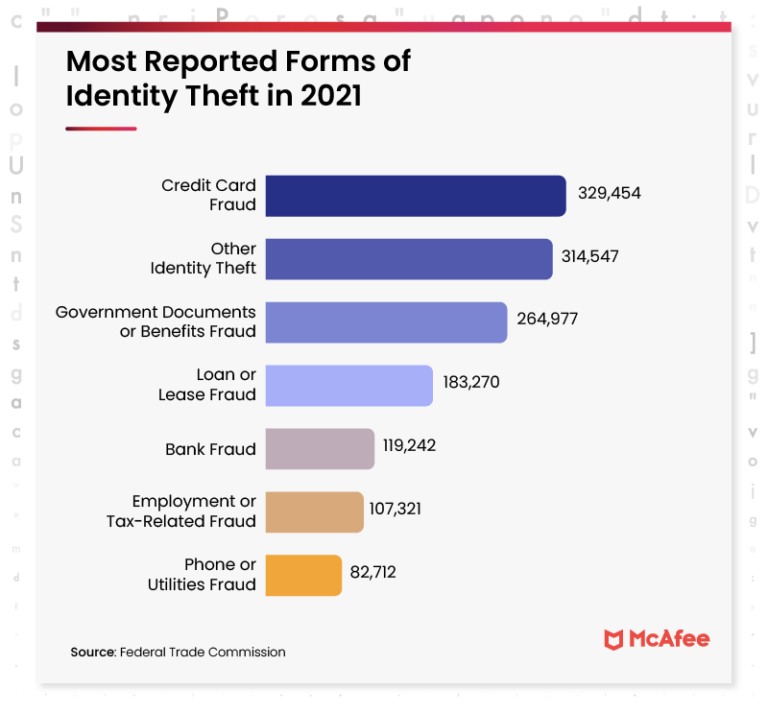

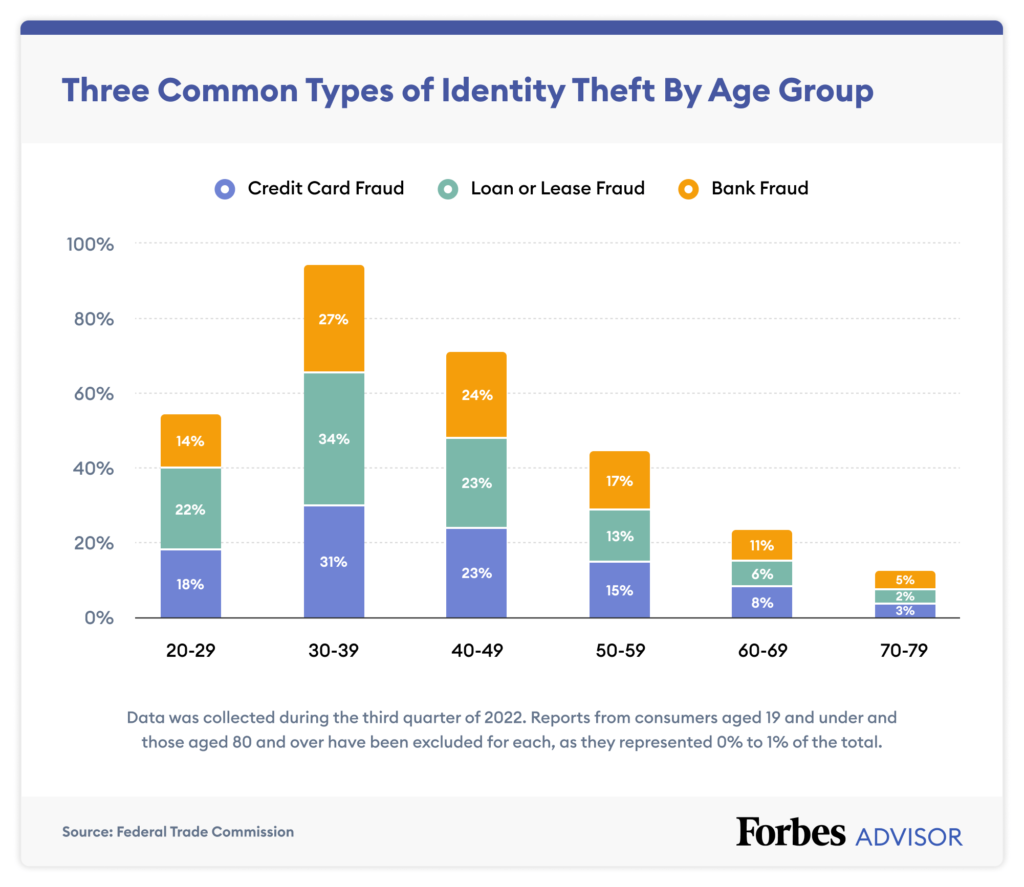

Identity theft is not just an Indian issue. In the U.S., the FTC reported over 1.1 million cases of identity theft in 2022. In Europe, VAT fraud costs member states over €50 billion annually, according to the European Commission. Criminals exploit weak verification systems worldwide.

The Bengaluru case isn’t just about one man—it’s a reminder that fraudsters are always looking for new loopholes. Your SSN in the U.S., your Tax ID in the EU, or your PAN in India—all are high-value targets.

How Does PAN Card Fraud Work?

Think of your PAN card as your financial DNA. Once it’s compromised, criminals can:

- Create fake GST registrations – like shady shell companies in the U.S.

- Generate bogus invoices – to claim fraudulent tax credits.

- Run phantom transactions – inflating turnover and moving black money.

- Apply for loans – leaving victims with debt they never took.

In the Bengaluru case, fraudsters used the stolen PAN to register ghost companies, funnel money, and disappear before tax authorities caught on.

A Look Back: Past PAN & Tax Fraud Cases

This isn’t new. India has seen several high-profile cases:

- In 2022, authorities busted a ₹1,200 crore GST invoice racket in Delhi involving fake firms and PAN misuse.

- A 2023 CBI report highlighted that over 3,500 fake companies had been registered using stolen or fabricated PAN data.

- In the U.S., the IRS battled tax refund fraud in the 2010s, losing billions of dollars annually until stricter verification slowed it down.

Patterns are eerily similar—fraudsters thrive when oversight is weak and digital systems expand faster than security controls.

Red Flags and How to Spot Them?

In this Bengaluru case, the fraud was caught during annual tax filings when the man’s Annual Information Statement (AIS) and Form 26AS showed massive, unfamiliar transactions.

Signs of compromise include:

- Tax notices for companies you’ve never heard of.

- Strange credits, debits, or invoices in official statements.

- Banks or vendors contacting you for accounts you didn’t open.

- IRS-style notices in the U.S. about tax returns you never filed.

Practical Advice: Protecting Yourself from PAN/SSN Fraud

Step 1: Monitor Your Records

- India: Check AIS and Form 26AS regularly on the Income Tax Portal.

- U.S.: Pull your free annual credit reports and IRS transcripts.

Step 2: Lock It Down

- U.S.: Use credit freezes with Equifax, Experian, and TransUnion.

- India: Ensure PAN-Aadhaar linkage and secure your tax login credentials.

Step 3: Two-Factor Authentication

Turn on 2FA for banking, tax portals, and even your email.

Step 4: File Taxes Early

The sooner you file, the less opportunity fraudsters have to slip in fake returns.

Step 5: Report Immediately

- India: Report to cybercrime police and flag it on the GST portal.

- U.S.: Use IdentityTheft.gov and IRS Fraud Units.

Psychological and Social Impact on Victims

Beyond money, the toll is personal. Victims often face:

- Stress and anxiety from legal notices.

- Stigma—friends and relatives assuming wrongdoing.

- Lost opportunities—loans rejected or jobs delayed due to tainted records.

A Bengaluru CA shared that clients spend “months proving their innocence,” which damages mental health just as much as finances.

Expert Opinions

Cybersecurity professionals say this fraud is part of organized crime rings that buy leaked data from the dark web. KPMG’s 2023 Fraud Risk Survey noted a 30% rise in identity-related scams in India.

In the U.S., the IRS reported $5.7 billion lost to identity-related refund fraud in 2021, though measures have since reduced the damage. Globally, the fight is ongoing, with criminals always innovating faster than governments.

Legal Consequences

Victims often need to:

- Hire lawyers to appeal wrongful tax demands.

- Engage forensic accountants to untangle fraudulent activity.

- Seek court relief to remove tainted entries.

Fraudsters, if caught, face charges under India’s IT Act and Indian Penal Code, with penalties ranging from hefty fines to 10+ years in prison. In the U.S., similar crimes fall under wire fraud and money laundering laws, which carry even harsher penalties.

What Businesses and Professionals Should Learn from Bengaluru Man’s PAN Card Misused in ₹43 Crore GST Fraud

If you’re an accountant, auditor, or entrepreneur:

- Audit AIS and Form 26AS quarterly.

- Train clients and employees on phishing awareness.

- Use digital hygiene protocols like password managers and 2FA.

- Vet vendors thoroughly to prevent fraudsters entering your supply chain.

Global Parallels: U.S. and EU Cases

- U.S. Tax Refund Fraud (2010–2015): Fraudsters filed returns using stolen SSNs, costing billions. IRS improved authentication after public outrage.

- EU VAT Carousel Fraud: Criminals moved goods across borders, reclaiming VAT fraudulently. Losses still exceed €50 billion annually.

The Bengaluru case is part of the same global puzzle: weak oversight + stolen IDs = massive fraud.

Retail Sales Take a Hit This Festive Season—Is the Wait for GST Cuts to Blame?

Bidar Youth Arrested For ₹9.25 Crore GST Evasion Using Fake Bills

GST Reforms Update — Will Insurance Finally Get Tax Exemption?