Beware of Fake Apps: Scammers are at it again, and this time they’re targeting your smartphone with something that looks totally legit. HDFC Bank has issued a serious warning about a rising wave of fake apps, and we’re here to break it all down for you. So buckle up, because this ain’t your average phishing scam. Beware of Fake Apps: HDFC Bank Issues Warning on Dangerous APK Scam — that’s the official word making waves across India and beyond. This warning isn’t just for tech nerds or bankers. It’s for everyone, from your grandma using UPI to your cousin trying to pay traffic fines online.

Fraudsters are sending messages claiming to be from HDFC Bank, Income Tax Department, or even the RTO (Road Transport Office). These messages ask you to download an app via a shady link. It might be for a KYC update, e-challan payment, or a supposed refund. Once downloaded, these malicious APK files can hijack your device and drain your account faster than you can say “What’s going on?”

Beware of Fake Apps

These APK scams are slick, fast, and often go undetected until it’s too late. It doesn’t matter if you’re tech-savvy or just using your phone for UPI. Cybercriminals are leveling up, and so should you. Stay informed, stay skeptical, and when in doubt—close the app, delete the link, and tell someone.

| Feature | Details |

|---|---|

| Scam Type | Fake Android APK download via phishing messages |

| Target Platforms | Android (mostly), via SMS/WhatsApp/Email |

| Main Victims | HDFC customers, general public |

| Risks | Full device control, OTP theft, remote access, financial loss |

| Official Response | HDFC Bank Alert |

| Reporting Channels | Cybercrime Portal, Call 1930 |

| Detection Difficulty | High — apps often mimic real ones |

| Advice | Never download APKs from unknown sources |

Let’s Break It Down: What is an APK Scam?

APK Files 101

APK stands for Android Package Kit. It’s the format Android uses to install apps outside the Play Store. Think of it like a zip file for apps. Now, downloading APKs isn’t always bad. Some developers share beta versions this way.

But here’s the thing: malicious APKs can do serious damage. They can:

- Access your contacts, messages, and photos

- Record keystrokes

- Read OTPs

- Control your screen remotely

- Send out payments via your banking app

Basically, your phone becomes their playground.

How the Scam Works (Step-by-Step)

- Initial Hook: You receive a text, WhatsApp message, or email.

Example: “Your HDFC KYC is outdated. Download the app to update immediately.” - Link to APK: The message includes a link to download an APK file.

- Installation: You install the app, thinking it’s legit.

- Permissions Granted: You’re asked for access to SMS, phone, and more.

- Remote Control: Fraudsters take over, steal OTPs, and initiate transactions.

- Damage Done: You lose control of your device and potentially your bank account.

Real Stats That’ll Make You Think Twice

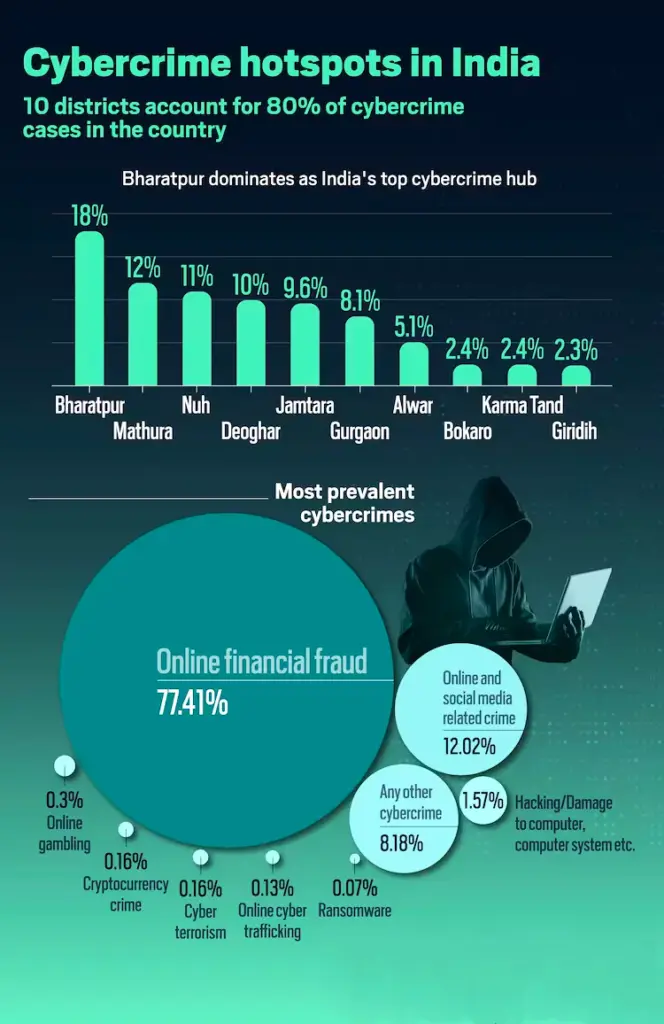

- Indian Cybercrime Unit reports over 27,000 APK fraud cases in the first half of 2025.

- Average loss per victim? Around INR 35,000, according to CERT-In.

- HDFC alone received 2,400+ fraud reports linked to APKs in Q2 2025.

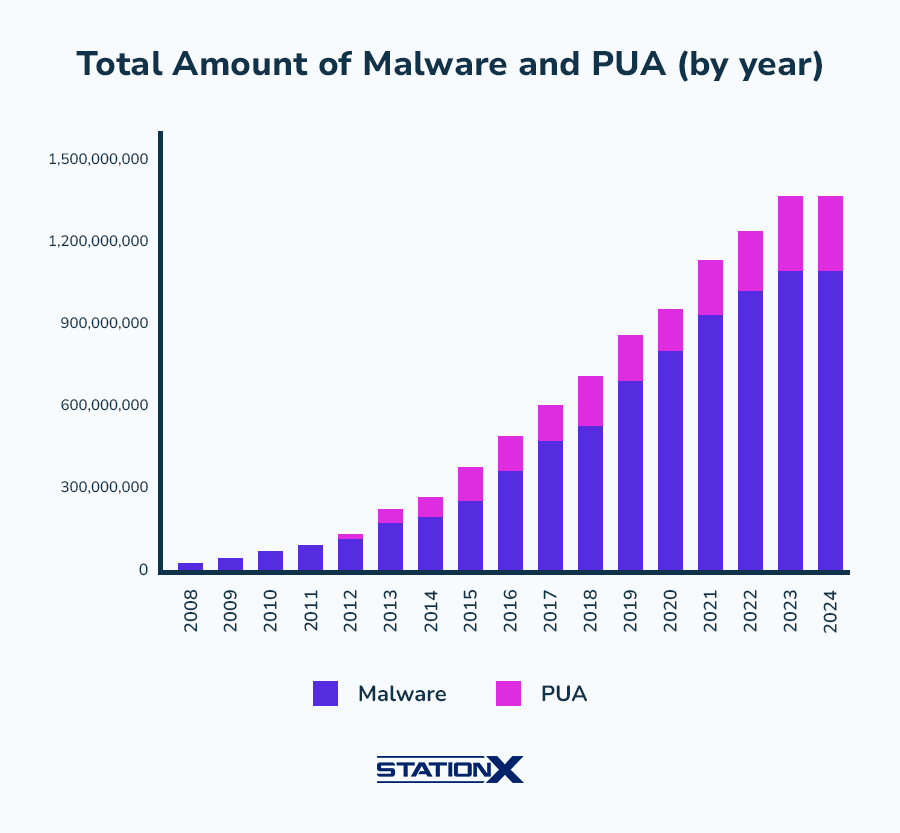

- A 2024 study by Kaspersky found that 91% of malicious mobile malware originated from sideloaded APKs.

- Google’s own Transparency Report showed that non-Play Store APK installs were 8X more likely to carry malware.

How to Stay Safe (And Smart) And Beware of Fake Apps?

Don’t Trust. Verify.

- Never click on links from unknown numbers or sketchy emails.

- If something feels off, go directly to the official website or call the bank.

Only Use Google Play Store

- APKs might seem like a shortcut, but they’re a fast track to trouble.

- Download only from verified sources like the Google Play Store.

Use Anti-Virus Apps

- Free or paid, security apps can scan for malicious code.

- Top picks: Norton Mobile, Avast, Bitdefender, and Malwarebytes.

Block Third-Party Installs

- Go to: Settings > Security > Unknown Sources and toggle it OFF.

- You can also turn on “Play Protect” from Google settings to auto-scan sideloaded apps.

Update Everything

- Keep your Android OS, banking apps, and security software up to date.

- Updates patch security holes that fraudsters love to exploit.

Educate the Family

- Help seniors and kids understand these scams.

- Share this article or local-language resources from RBI.

Report It Immediately

- Visit cybercrime.gov.in

- Call 1930 to report financial cyber fraud

- Use the Sanchar Saathi or Chakshu portal to report suspicious numbers

Expert Insight: Why Scammers Love APKs

From a cybersecurity pro’s POV, APKs are like candy for hackers. Here’s why:

- Android is more flexible (and more open to outside files).

- People are used to installing apps casually.

- Most users don’t read permission prompts.

- OTPs and banking apps are just a few clicks away.

Quote from Cybersecurity Expert, Rohan Mehta:

“These scams thrive on urgency and fear. If someone says ‘act now or lose access,’ that’s your red flag.”

Real-World Case Studies

Case 1: Delhi Resident Loses ₹1.2 Lakh

Meera, a 34-year-old teacher, received a WhatsApp claiming to be from the electricity board demanding payment via a mobile app. She installed the APK and within minutes, her banking credentials were compromised. By the time she called her bank, over ₹1.2 lakh was gone.

Lesson: Even educated users can fall prey if awareness is lacking.

Case 2: Mumbai Businessman Fooled by Tax Refund Scam

Rakesh, a small business owner, got a call from someone pretending to be from the Income Tax Department. The caller said Rakesh was eligible for a refund and asked him to download an app to verify his PAN. He installed the app and unknowingly gave access to his SMS and banking details. ₹48,000 vanished before he even realized something was wrong.

Why This Scam Hits Harder in a Digital-First Economy?

India’s rapid shift toward a cashless, app-driven economy has made everyday tasks—banking, paying bills, renewing documents—depend heavily on mobile devices. With over 850 million smartphone users and UPI clocking over 12 billion transactions monthly (as per NPCI data), scammers see a massive opportunity. As more users trust apps for financial tasks, the margin for error shrinks. That’s why digital literacy and cyber hygiene aren’t optional anymore—they’re essential life skills in 2025 and beyond.

Additional Tips for Businesses

If you’re a business owner, your staff could be targeted too. Here’s what to do:

- Train Employees: Run cybersecurity awareness programs every 6 months.

- Secure Endpoints: Ensure company devices have mobile device management (MDM) software installed.

- Limit App Permissions: Restrict app downloads on corporate devices to verified sources.

- Audit App Access: Regularly review what apps have access to banking and communication channels.

Bhopal Bank Employee Under Scanner After Multi-Crore Fraud Surfaces

After SBI, Bank of India Also Labels Anil Ambani and RCom as Fraud

NC Man Sentenced to 19 Years in Prison for Running Ponzi Scheme