Big Boost for Defence Innovation: The Ministry of Defence (MoD) in India has announced a major step that could transform the way private companies engage in defence technology research and development (R&D). The government plans to refund the 18% Goods and Services Tax (GST) levied on eligible defence R&D projects undertaken by private companies, start-ups, and MSMEs (Micro, Small, and Medium Enterprises). This isn’t just another routine policy update. For innovators, especially smaller firms, this could mean the difference between shelving a promising idea and seeing it through to a market-ready defence product. By effectively removing a significant tax burden, the MoD aims to create a more level playing field and encourage wider participation in India’s growing defence ecosystem.

Big Boost for Defence Innovation

The MoD’s plan to refund 18% GST on defence R&D projects is more than just a tax adjustment — it’s a signal of intent. By creating a fairer and more encouraging environment for private innovators, India could unlock new waves of defence technology, reduce import dependence, and position itself as a global player in this high-stakes sector. The ball is now in the court of the GST Council and Finance Ministry. A timely green light could be the spark that lights up India’s defence innovation landscape for years to come.

| Key Point | Details |

|---|---|

| Policy Change | Refund of 18% GST on MoD-funded defence R&D projects for private sector firms |

| Eligible Schemes | iDEX (Innovations for Defence Excellence), DRDO’s Technology Development Fund (TDF) |

| Purpose | Remove tax burden, boost private sector innovation, align with Aatmanirbhar Bharat |

| Impact | Encourages start-ups/MSMEs, makes indigenous defence tech more competitive |

| Approvals Needed | GST Council, Finance Ministry, Fitment Committee |

| Official Resource | Ministry of Defence |

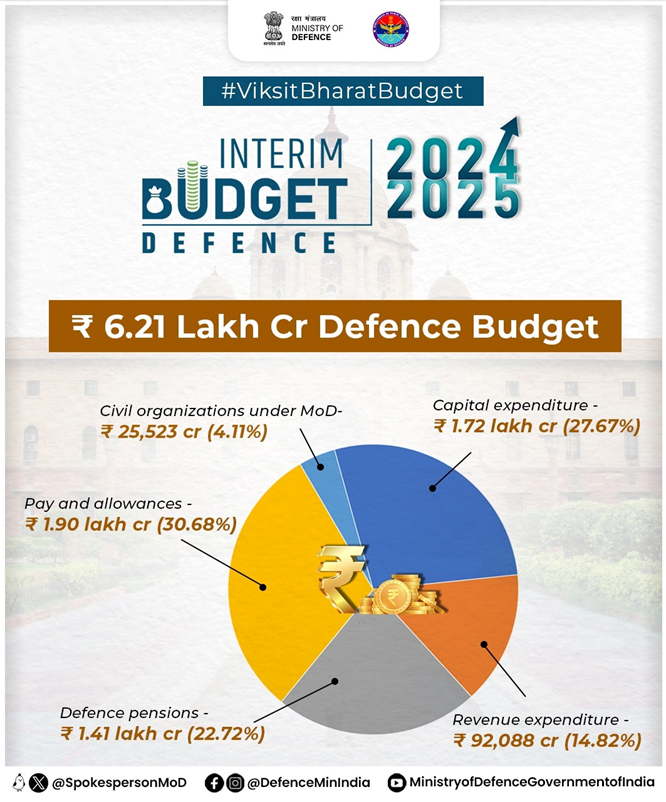

| Budget Allocation | DRDO R&D budget: ₹14,923.82 crore for FY 2025–26 |

| Industry Sentiment | Positive; industry bodies urge speedy approval and rollout |

How GST Became a Problem for Defence Innovators?

For years, India’s defence innovation ecosystem has been expanding, with programs like iDEX and TDF funding projects from small, agile private companies. But starting in March 2025, many of these innovators began receiving notices from the GST department, demanding 18% GST on grants they had received from the MoD.

That meant if you secured a ₹1 crore grant, you were suddenly liable for ₹18 lakh in taxes before you even bought your first piece of equipment. For start-ups and MSMEs operating on tight budgets, that was a serious setback.

Adding to the frustration, government-run R&D institutions registered under the Department of Scientific and Industrial Research (DSIR) had already been exempt from this tax since October 2024. This created an uneven playing field, where private players were essentially penalized for participating in national defence innovation

The MoD’s Big Fix

Defence Minister Rajnath Singh took the issue directly to Finance Minister Nirmala Sitharaman, calling it a “tax on innovation.” After extensive discussions involving the GST Council, Defence Research and Development Organisation (DRDO), and industry groups like the Society of Indian Defence Manufacturers (SIDM), the MoD proposed a fix:

- Refund the full 18% GST on eligible R&D projects

- Cover projects under iDEX and TDF

- Apply the refund to start-ups, MSMEs, and other private innovators

- Require proper documentation and proof of Input Tax Credit

- Implement the process after clearance from the GST Council and Finance Ministry

This move, once implemented, would not only save companies money but also send a strong signal that India is serious about supporting private innovation in defence.

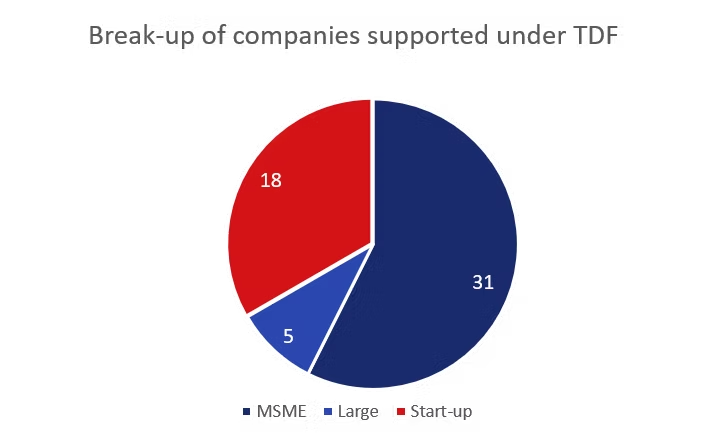

Understanding iDEX and TDF

iDEX (Innovations for Defence Excellence) is essentially a government-backed platform to help start-ups and MSMEs develop innovative solutions for defence needs. Think of it as a “Shark Tank” for military technology, with mentorship and funding support.

Example: Developing AI-powered drones for border surveillance.

TDF (Technology Development Fund) is managed by DRDO and supports projects aimed at developing indigenous technology to replace imports.

Example: Creating advanced lightweight armor materials for soldier protection.

Funding Snapshot for FY 2025–26:

- iDEX: ₹449.62 crore (almost triple from FY 2023–24)

- DRDO total budget: ₹26,816.82 crore

- DRDO R&D allocation: ₹14,923.82 crore

Why This Matters Beyond the Money?

While the tax refund will directly reduce costs for private companies, the broader impact could be even more significant:

- Level Playing Field – Private firms get the same tax benefits as government labs.

- Boost to Innovation – Companies can reinvest tax savings into research, hiring, and faster prototyping.

- Increased Participation – Lower barriers encourage more start-ups to enter the defence sector.

- Global Competitiveness – Enables Indian defence firms to compete internationally with more advanced, cost-effective products.

Global Comparison

India’s move aligns with global practices in incentivizing R&D:

- United States – Offers an R&D Tax Credit allowing deductions for research-related expenses

- United Kingdom – SMEs can claim up to 33% of eligible R&D costs as a cash credit or tax reduction.

- Israel – Offers grants covering 20–50% of approved R&D costs, with special support for defence-related projects.

By adopting similar incentives, India signals its intention to become a global leader in defence technology.

Case Study: The Start-Up Perspective

Take the example of a fictional Bengaluru-based company, SkySentinel Tech. With ₹1.5 crore in iDEX funding to build an AI-driven border surveillance drone system, they would have owed ₹27 lakh in GST under the old rules.

Under the proposed refund policy:

- That ₹27 lakh stays with the company.

- Funds can be used to hire additional engineers or invest in advanced components.

- The development cycle speeds up, with the prototype ready months earlier.

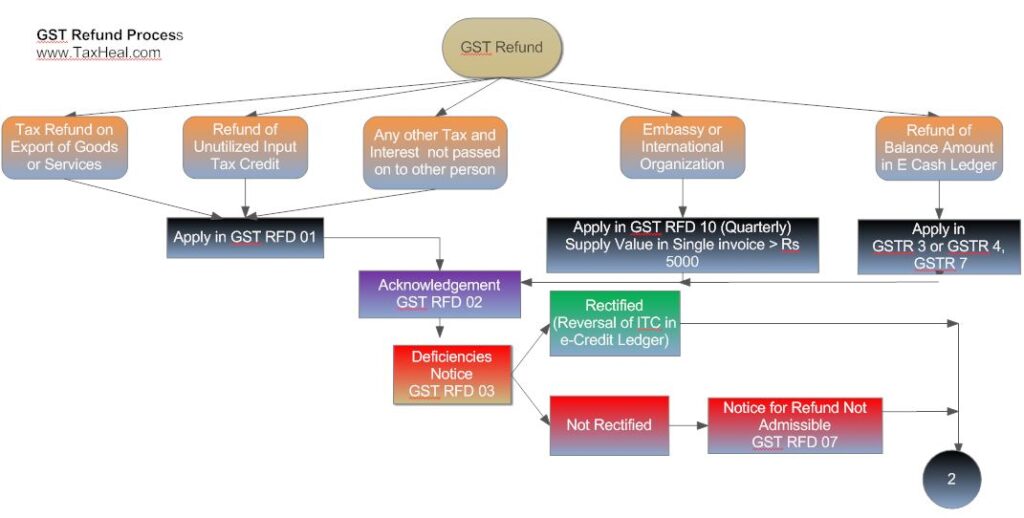

Big Boost for Defence Innovation: How the Refund Process Could Work

While details will follow official approval, here’s how the process might look:

- Project Approval – Your project is selected under iDEX or TDF.

- Grant Disbursement – Funds are released with GST applied.

- GST Payment – Company pays the GST as per rules.

- Documentation – Maintain invoices, GST filings, and proof of tax payment.

- Refund Application – Submit documents through the MoD’s refund portal (to be launched).

- Verification – MoD and tax authorities review the claim.

- Refund Release – 18% GST refunded to your account.

Expert Insights

- Lt. Gen. (Retd) Anil Kapoor, former DRDO director, described the move as “a vital correction that will energize the private defence ecosystem.”

- SIDM representatives have publicly urged quick GST Council approval, warning that delays could stall critical projects.

Challenges Ahead

While promising, there are potential hurdles:

- Approval Timelines – The GST Council meets quarterly, and any delays could push implementation into late 2025 or beyond.

- Administrative Complexity – Refund claims could be slowed by bureaucracy unless processes are streamlined.

- Awareness Gap – Smaller firms in remote areas might miss out unless there’s proactive outreach.

Action Steps for Industry and Policymakers

For Companies:

- Register for GST if not already.

- Keep detailed, compliant financial records.

- Engage with industry bodies for updates and advocacy.

For Policymakers:

- Simplify refund procedures with clear, time-bound steps.

- Create a helpdesk to guide companies through the claim process.

- Publicize the policy widely to ensure maximum participation.

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

Uttarakhand HC Turns Down GST & TDS Relief Plea, Says Matter Beyond Writ Scope

₹16.30 Crore Tax Evasion Bust: Central GST Officers Arrest Key Suspect