Big Changes in Tiny Packs: If you’ve ever grabbed a Rs 5 biscuit pack or a Rs 10 shampoo sachet, you know just how important those tiny packs are in India’s consumer market. For millions of families—especially in rural towns and smaller cities—these small-ticket buys aren’t just convenient; they’re a lifeline. But lately, folks have been scratching their heads: “Why does my Rs 5 snack feel smaller than before?” Behind every Rs 5 or Rs 10 pack lies a mix of inflation, tax reforms, global supply chains, and consumer psychology. And right now, those small packs are going through some of the biggest changes in decades. Let’s unpack this story together.

Big Changes in Tiny Packs

The Rs 5 and Rs 10 FMCG packs are more than just small purchases—they’re the foundation of India’s consumer economy. From Parle-G biscuits to Rasna juice sachets, these packs reflect how companies balance affordability, consumer trust, and profitability. After years of shrinkflation, the GST reforms and brand innovation promise better value for buyers. The tiny packs aren’t going anywhere—in fact, they’re about to play an even bigger role in the evolving FMCG landscape. For consumers, that means more grams in your packs and more variety on the shelves. For companies, it’s a reminder that in India, sometimes the smallest packs carry the biggest weight.

| Point | Details |

|---|---|

| Shrinkflation | Rs 5 and Rs 10 packs reduced in size due to rising costs. Example: Rs 5 biscuit pack fell from 100g to ~55g. |

| Market Size | Rs 5 and Rs 10 packs contribute to 30–35% of FMCG volumes in India (Financial Express). |

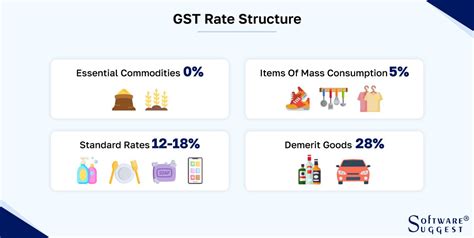

| GST Reform | New GST structure (5% & 18%, scrapping 12%) to restore grammage. |

| Consumer Impact | Brands to increase pack weights without raising prices. |

| Innovation | Rasna, Mother Dairy, PepsiCo, Amul launching Rs 10 beverages, lassis, and no-sugar options. |

| Official GST Portal | www.gst.gov.in |

A Little History: The Rise of Tiny Packs

The Rs 5 and Rs 10 price points didn’t appear overnight. Back in the late 1980s and early 1990s, companies like Parle, Britannia, and Hindustan Unilever began experimenting with sachets and low-unit packs. It was a radical move that made branded products accessible to India’s masses.

- Parle-G biscuits were sold at Rs 2 and Rs 5 packs, becoming a must-have with chai across households.

- Clinic Plus shampoo sachets priced at Re 1 allowed villagers to access branded personal care.

- Pepsi and Coke rolled out 200 ml glass bottles at Rs 5 in the early 2000s to reach small towns.

By the 2000s, the Rs 5 and Rs 10 categories exploded. Market researchers called this the “sachet economy”, where even low-income families could afford branded goods daily. This model became the backbone of FMCG distribution, accounting for over one-third of industry volumes by the mid-2010s.

Shrinkflation: The Bitter Reality

Fast forward to the 2020s, and inflation hit hard. Input costs rose across the board:

- Palm oil (used in biscuits, noodles, soaps) saw a price hike of more than 40% between 2021–2022.

- Wheat and sugar surged due to global supply disruptions.

- Packaging costs went up as plastic, paper, and transport became more expensive.

For FMCG giants, raising prices beyond Rs 5 or Rs 10 was risky—these numbers are deeply tied to consumer psychology. So, they chose shrinkflation.

- A Rs 5 Parle-G pack that once weighed 100g now hovers around 55g.

- Shampoo sachets are smaller than ever—just enough for one wash.

- Packets of chips look puffy but contain fewer crisps inside.

This practice allowed companies to hold onto their customer base without breaking trust too visibly, but it also triggered frustration among buyers.

Global Parallels: Shrinkflation Isn’t Just Indian

Shrinkflation isn’t unique to India. Globally, it’s a known corporate strategy.

- In the US, Doritos reduced their bags by five chips, Gatorade slimmed down bottles, and toilet paper rolls lost sheets.

- In the UK, chocolate bars like Mars and KitKat became smaller even as prices remained the same.

- In Japan, snack makers cut portion sizes but market them as “health-conscious” alternatives.

In other words, India’s Rs 5 and Rs 10 dilemma is part of a worldwide battle against inflation.

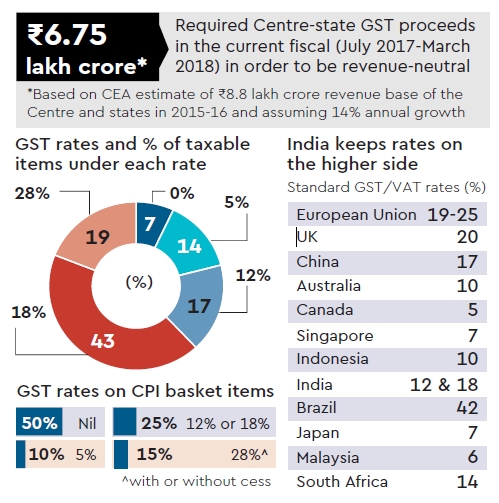

GST Reform: A Silver Lining

The Indian government’s GST restructuring is now offering a breather. The scrapping of the 12% slab and consolidation into just 5% and 18% means many FMCG items—biscuits, tea, shampoo, and snacks—will now fall into the lower tax bracket.

That reduction in tax outflow allows companies to restore grammage (increase pack weights) without changing the price tag.

Reports suggest companies like Britannia, Cremica, and DFM Foods are already preparing to bring back the missing grams. This move could also help repair consumer trust, which has been eroded over years of shrinkflation.

Rural vs Urban: Who Depends on These Packs More?

In urban India, small packs are often impulse buys—snacks for kids, quick chai-time biscuits, or travel-friendly toiletries. But in rural India, these packs are essential.

- NielsenIQ data shows that over 70% of FMCG consumption growth comes from rural areas.

- Kirana shops in villages rely on sachets and low-priced packs to drive daily sales.

- For rural families, a Rs 10 biscuit pack isn’t just a snack—it can be part of a meal.

This heavy dependence explains why companies fight to preserve these price points at all costs.

Case Studies: Brands and Their Tiny Pack Strategies

Let’s look at how some popular brands handled Rs 5 and Rs 10 packs:

- Parle-G: Held onto the Rs 5 price point for decades, reducing pack size gradually but never crossing that psychological barrier.

- Nestlé Maggi: Introduced Rs 5 and Rs 10 noodle packs, ensuring affordability even for single-person households.

- Coca-Cola & Pepsi: Offered Rs 10 mini PET bottles in smaller towns to build penetration.

- Hindustan Unilever: Sachets of Clinic Plus, Fair & Lovely, and Wheel detergent are classic case studies in rural marketing.

Each of these brands used small packs not just to make sales, but to seed brand loyalty that later upgrades consumers to bigger SKUs.

Big Changes in Tiny Packs: Innovation in Rs 10 Packs

Brands are not just restoring grammage—they’re getting creative.

- Rasna: Rs 10 concentrate sachets that make three glasses of juice.

- Mother Dairy: Rs 10 lassi and chaach, designed for summer thirst.

- PepsiCo: Rs 10 no-sugar carbonated drinks for health-conscious youth.

- Amul: Flavored milk packs at Rs 10, targeting students.

These launches prove that companies see Rs 10 as a strategic innovation hub—not just a price cap.

Consumer Reactions: The Social Media Buzz

Consumers are not silent. Social media is filled with posts complaining about smaller packs:

- Tweets like “My Rs 5 chips pack is 80% air, 20% chips.”

- Memes mocking chocolates with “now you see it, now you don’t” sizing.

But here’s the paradox: while buyers grumble, they still buy. Price sensitivity means affordability wins over size every time.

Practical Guide for Consumers

Here’s how you can spot value in tiny packs:

- Check the grammage: Don’t just look at the shiny wrapper, check the weight.

- Compare across packs: A Rs 10 pack often offers better value than two Rs 5 packs.

- Look for new launches: Brands often offer extra grams in new products to attract trial.

- Do unit pricing: Calculate cost per gram or ml—you’ll see the difference.

Guidance for Retailers & Shopkeepers

For shopkeepers, these changes are crucial:

- Stock more Rs 10 SKUs, as they balance affordability with value perception.

- Highlight “restored grammage” when customers complain.

- Use digital payments to push higher-value packs beyond the Rs 5 coin limit.

The Road Ahead: What’s Next for Tiny Packs?

Looking to the future, the Rs 5 and Rs 10 categories face new challenges:

- Eco-friendly packaging: India is tightening rules on single-use plastics. Expect biodegradable sachets or paper-based packs.

- Digital flexibility: With UPI and QR code payments everywhere, companies may break the Rs 5/10 barrier with Rs 6, Rs 8, or Rs 12 packs.

- Healthier alternatives: Low-sugar biscuits, protein-based snacks, and herbal sachets are likely to hit the Rs 10 price point.

- E-commerce tie-ins: Even small packs are now being bundled on online platforms like BigBasket and Blinkit.

GST 2.0 Promises Consumption Boost – Can Lower Taxes Also Tame Inflation?

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

India’s Oldest Citizens Now Contributing More To The Income Tax Kitty