Big GST Cut on Cars Could Change India’s Auto Market Overnight: The buzz is real: a big GST cut on cars in India is making headlines, and if it goes through, it could flip the country’s auto market on its head overnight. Whether you’re a first-time car buyer, an industry insider, or just curious about how taxes shape consumer behavior, this move has the potential to shake things up big time. So, what’s the deal? The Indian government is planning to slash Goods and Services Tax (GST) on small cars from 28% down to 18%, while also restructuring the entire GST system into a simpler, two-tier format. Sounds boring? Not really—because this could mean cheaper cars, booming sales, and yes, some unintended consequences too.

Big GST Cut on Cars Could Change India’s Auto Market Overnight

The proposed GST cut on cars in India isn’t just a tax reform—it’s a potential market reset. From cheaper cars to surging auto stocks, the ripple effects could transform the industry and consumer behavior alike. But the move isn’t without risks: slower EV adoption, state revenue shortfalls, and possible political wrangling. Still, for millions of Indian families, this could be the long-awaited break that makes car ownership a reality. The Indian auto market may soon be racing into its biggest boom in decades.

| Aspect | Details |

|---|---|

| Proposed GST Cut | From 28% to 18% on small cars |

| Impact on Prices | Small cars may become cheaper by ~8%, big cars by 3–5% |

| Stock Market Reaction | Auto stocks surged: Maruti Suzuki up 9%, Hyundai Motor India up 9%, Tata Motors up 3% |

| Consumer Impact | Lower upfront costs, cheaper insurance, and easier ownership |

| Timeline | Final approval by GST Council before Diwali 2025 |

| Official Reference | Government of India – GST Council |

GST and the Indian Auto Market: A Quick History

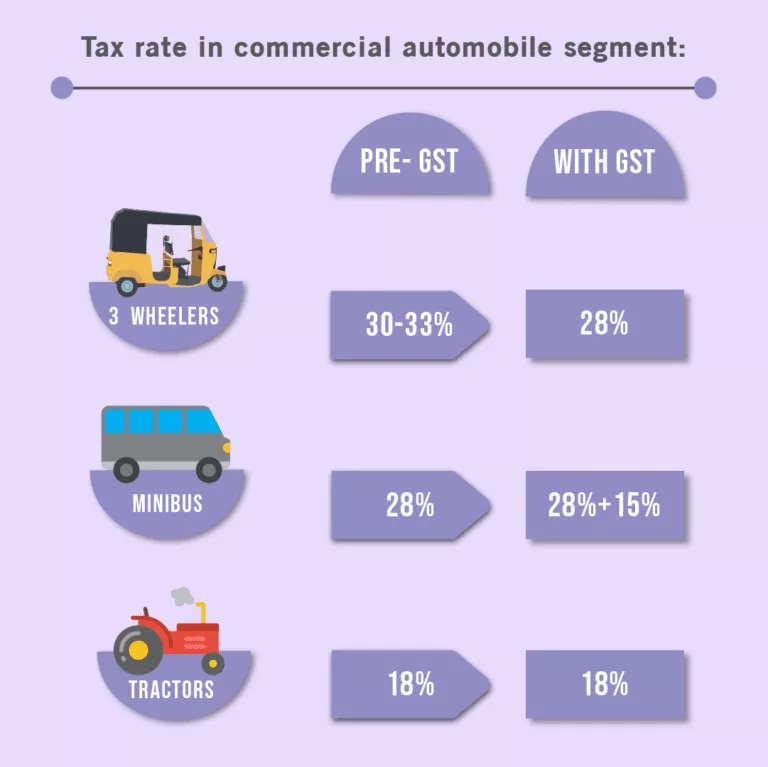

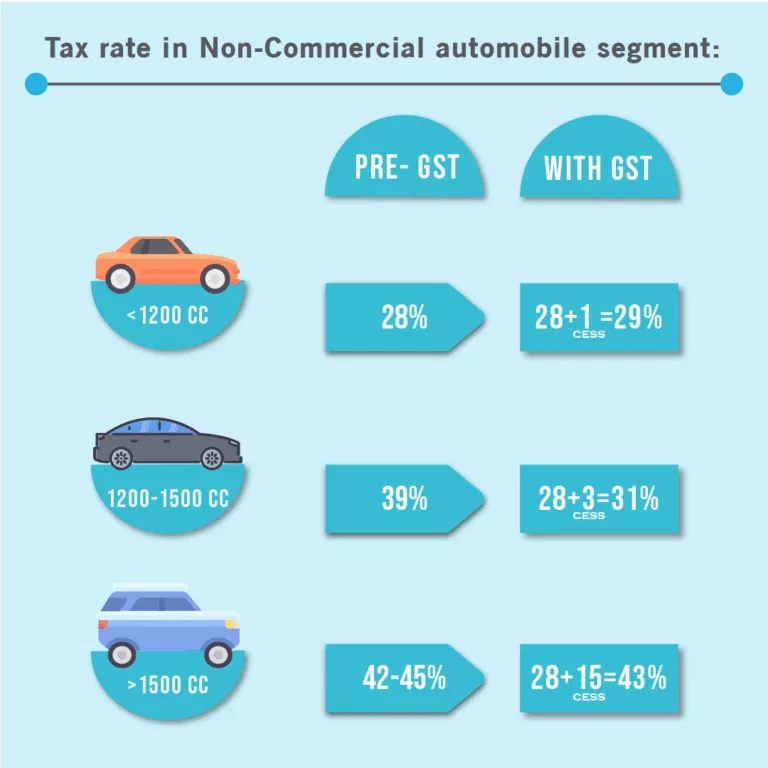

When India rolled out GST in 2017, the auto industry braced for impact. Cars were placed in the highest tax slab—28% GST plus an additional cess for SUVs and luxury vehicles. For a market where cars are often a necessity rather than a luxury, this was a tough pill to swallow.

Sales did grow in pockets, but the high taxation slowed down adoption of small, entry-level cars—the bread and butter of India’s middle class. To put things in perspective, while car ownership in the United States hovers around 800 vehicles per 1,000 people, India’s figure is closer to 30 vehicles per 1,000 people. Affordability has always been a roadblock.

With this proposed GST cut, India is aiming to unlock latent demand and put millions more families on the road.

What’s Changing Under the New Proposal?

The government is looking to simplify and energize the system. Here’s what’s proposed:

- Small Cars: GST slashed from 28% → 18%.

- SUVs & Larger Cars: Modest cuts of 3–5%, depending on engine size and category.

- Insurance Premiums: GST on life and health insurance may drop from 18% → 5% or even zero, directly lowering the cost of mandatory motor insurance.

- GST Restructure: A simplified two-slab system (5% and 18%) instead of the current multiple slabs. For high-end items like luxury imports, alcohol, and tobacco, a 40% sin/luxury tax will remain.

This isn’t just a car story—it’s about a tax revolution. But the auto sector is expected to feel the first and biggest jolt.

How Much Cheaper Will Cars Get?

Let’s break down the numbers with real-world examples:

- Small Cars: Analysts estimate a price drop of around 8%. Example: If a Maruti WagonR costs ₹600,000 today, it could drop to ₹552,000. That’s ₹48,000 in savings.

- SUVs & Mid-Segment Cars: Hyundai Creta, Maruti Brezza, and Mahindra XUV700 may see a 3–5% cut, translating to savings of ₹30,000–₹75,000 depending on the model.

- Nomura’s Projection: Demand could rise by 5–10%, and models like the Mahindra Bolero could get as much as a 10% cut in price.

Think of it like a nationwide Black Friday sale—but on cars, not flat-screen TVs.

Market Reactions: Big GST Cut on Cars Could Change India’s Auto Market Overnight

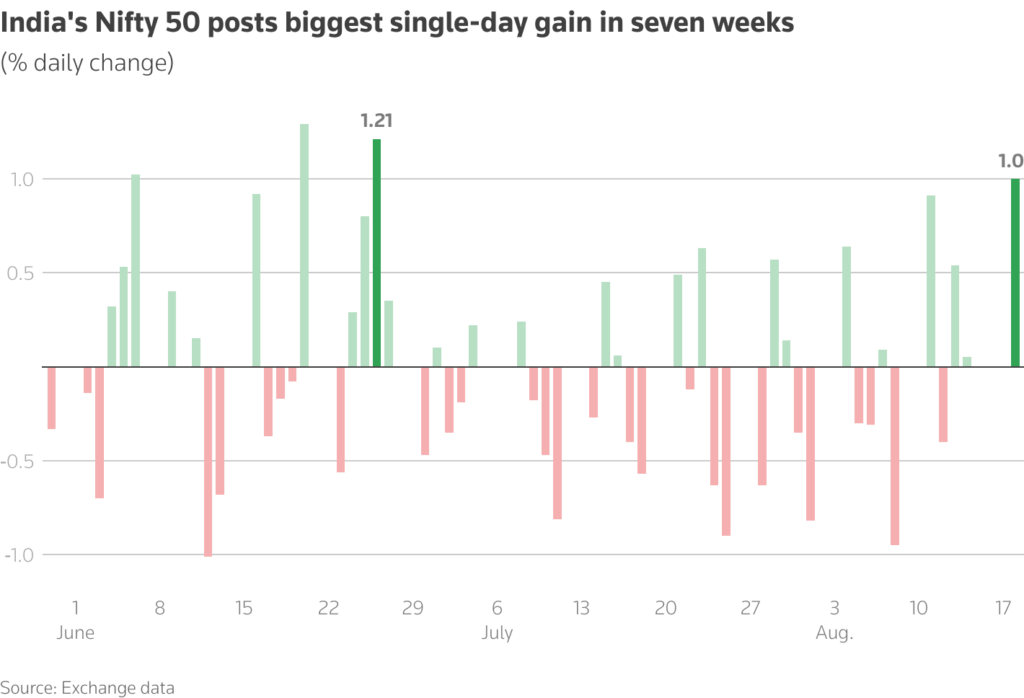

The moment news of the GST cut surfaced, the Indian stock market lit up:

- Maruti Suzuki jumped nearly 9% in one session.

- Hyundai Motor India, preparing for its IPO, saw a sharp 9% rise in valuation.

- Tata Motors climbed 3%, boosting investor confidence.

- The Auto Index reached a 10-month high.

This mirrors the U.S. market’s reaction whenever Tesla slashes its EV prices—Wall Street cheers, expecting demand to surge. India’s investors are making a similar bet.

Industry and Expert Opinions

- HSBC Analysis: Predicts an 8% reduction in small car prices, making them much more attractive for middle-class buyers.

- Nomura: Suggests the cuts could trigger a 5–10% boost in auto demand across segments.

- Auto Dealers Association: Anticipating record showroom traffic during the festive season if the cuts are approved.

- Critics: Worry that while this is good for consumers, it could slow down the government’s push for electric vehicles (EVs).

What This Means for Consumers?

This isn’t just about saving money—it changes the entire buying experience:

- First-Time Buyers Win Big

Families who have been waiting to afford their first car could finally enter the market. - Lower Cost of Ownership

Cheaper insurance premiums and lighter EMIs mean cars won’t be a financial burden. - Financing Gets Easier

Banks and lenders will see smaller loan sizes, making approvals easier for middle-income buyers. - Festive Season Timing

Diwali is the prime car-buying season in India. If the cuts roll out by then, demand could skyrocket.

The Flip Side: Challenges & Risks

Of course, every big policy shift comes with side effects.

- Revenue Loss: States depend on car sales for tax revenue. A GST cut means less income, which could spark political debates.

- EV Adoption at Risk: India is heavily promoting EVs, but if traditional cars get cheaper, many buyers may postpone switching to electric.

- Luxury Cars Still Costly: High-end imports will still fall under the 40% tax slab, keeping them expensive.

- Implementation Hurdles: Even if approved, rollout could face delays or opposition.

Comparison: India vs USA vs Global

- India (Now): 28% GST on small cars, plus cess on bigger cars.

- India (Proposed): 18% GST on small cars, modest cuts on larger vehicles.

- USA: Car taxes vary by state, but typically 7–10% sales tax—far lower than India.

- Europe: Cars usually face around 20% VAT, though strong subsidies make EVs very attractive.

This shift brings India closer to global norms, especially when compared with Europe.

Step-by-Step Guide: Should You Buy Now or Wait?

- Don’t Rush – Hold off until the GST Council officially approves the cuts.

- Know Your Segment – Small cars will get the biggest discounts, SUVs less so.

- Calculate Savings – Use car loan calculators to factor in EMI reductions.

- Track Insurance Rates – If GST on insurance drops, total cost of ownership will be even lower.

- Target Festive Season – Buying around Diwali could mean double benefits: GST savings plus dealer discounts.

Career & Professional Angle: Who Benefits the Most?

- Auto Dealers: Expect higher sales, more hiring, and bigger showrooms.

- Finance Professionals: Car loans could rise sharply, boosting portfolios.

- Manufacturers: Companies like Maruti, Tata, and Hyundai may see record sales volumes.

- Stock Market Investors: Auto-related sectors—batteries, tires, steel—may also benefit.

Long-Term Outlook: The Road Ahead

If implemented, the GST cuts could reshape India’s auto landscape over the next five years:

- Car Penetration Rises: More families owning cars, especially in rural and semi-urban areas.

- Auto Sector Boom: Demand jumps could add billions to GDP.

- EV Transition Slows: Cheaper petrol/diesel cars may delay EV adoption, unless EV incentives are strengthened.

- Government Balancing Act: Striking a balance between boosting demand and managing tax revenues will be key.

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials

Banks Propose New GST Slab of ₹1 Crore to Prevent Merchants from Avoiding Digital Payments

Centre Plans Major GST Overhaul — Four Slabs May Shrink to Just Two