Big GST Cuts: When the Indian government rolls out big GST cuts, the message is simple: products should become cheaper, consumers should save money, and the economy should get a much-needed boost. But here’s the million-rupee question—are those savings actually reaching you, the consumer? Or are businesses quietly keeping the benefits for themselves? Welcome to the world of GST profiteering, where the intention of tax relief often gets lost somewhere between policy and price tags. This article breaks it down for everyone—from curious school kids to small business owners and financial professionals.

Big GST Cuts

GST rate cuts are a powerful tool to ease inflation, improve affordability, and stimulate economic growth. But without transparent pricing and enforcement, the intended benefits often don’t reach the consumer. Profiteering is real—and it’s costly. For India’s GST system to truly serve its people, it needs:

- Strong watchdogs

- Public awareness

- Accountable pricing

If that doesn’t happen, tax relief risks becoming just another press headline—with no real impact on the prices we pay.

| Topic | Details |

|---|---|

| What’s Happening | The Indian government announced major GST rate cuts across sectors including food, insurance, batteries, and services. |

| Why It Matters | The move is aimed at controlling inflation, reducing costs for consumers, and reviving economic activity. |

| The Concern | Without strict oversight, companies may not reduce retail prices after tax cuts—this is known as profiteering. |

| Enforcement Gap | India dissolved its National Anti-Profiteering Authority (NAA) in 2022. After April 1, 2025, no new profiteering complaints can be filed. |

| Who Benefits | Upper-income consumers, large corporates with pricing control, and export-driven sectors. |

| Who May Lose | Consumers in low-income brackets and smaller retailers who pass on the benefits but compete with profiteering brands. |

| Source | GST Council Official Website |

What Is GST, and Why Do Rate Cuts Matter So Much?

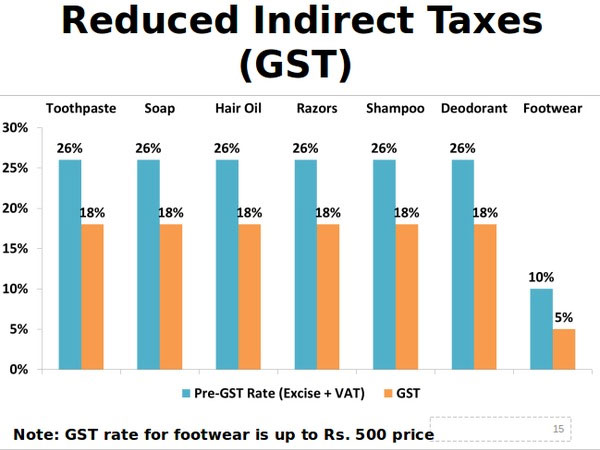

The Goods and Services Tax (GST) was introduced in India on July 1, 2017, with the goal of creating a unified indirect tax system. It replaced a confusing mix of central and state taxes such as VAT, excise duty, and service tax.

Instead of paying different taxes at every step, GST ensures that taxes are paid only on the value added at each stage.

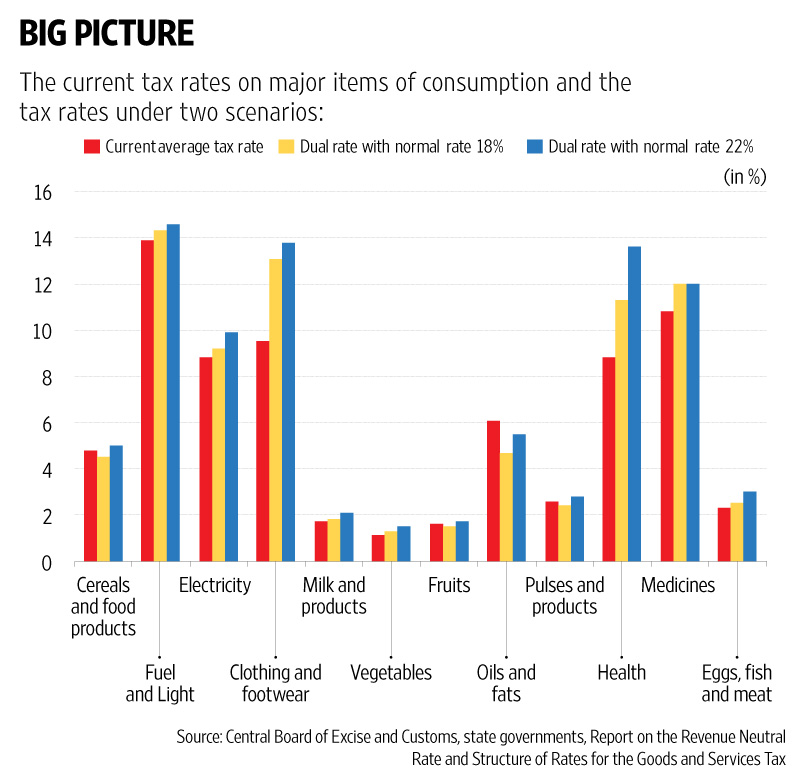

GST is divided into multiple tax slabs: 0%, 5%, 12%, 18%, and 28%, depending on the type of good or service. So when the GST Council reduces tax rates, it’s expected that final prices will drop too. The catch? That only happens if businesses choose to pass on the savings.

Recent Big GST Cuts: What’s Cheaper Now?

The latest GST announcements include several significant cuts, such as:

- Health and Life Insurance Premiums: Reduced from 18% to 12%

- Electric Vehicle (EV) Batteries and Chargers: Slashed from 18% to 5% and 12%

- Unbranded Packaged Foods: Dropped to 5%

- Hotel Room Tariffs: Reduced to 12% for tariffs up to ₹7,500

- Cinema Food Services: Reduced from 18% to 12%

- Hospital Room Rents (Shared Rooms): GST fully removed

These changes are expected to reduce consumer costs and boost sectors like EVs and health insurance. However, economists and consumer groups have raised red flags that many businesses are not reflecting these cuts in their pricing.

Profiteering: A Quiet But Costly Problem

Profiteering under GST refers to when businesses do not pass on the benefit of tax rate reductions or input tax credits to consumers.

For example, if the GST on a product drops from 18% to 12%, the price should ideally fall. But if a company increases the base price (pre-tax value) to offset the cut, the final price remains the same or even goes up. This defeats the whole purpose of the tax relief.

Profiteering is not just unfair—it’s deceptive. It reduces consumer trust and undermines policy effectiveness.

A Real-Life Example: Hindustan Unilever Limited (HUL)

In 2019, the National Anti-Profiteering Authority (NAA) ordered HUL to pay back ₹230 crore to consumers. Why? The company did not reduce the retail prices of its products even after the government reduced the GST rates.

Instead of lowering the final price, HUL increased its base price—effectively canceling the benefit of the tax cut. The NAA called this out as profiteering and mandated reimbursement.

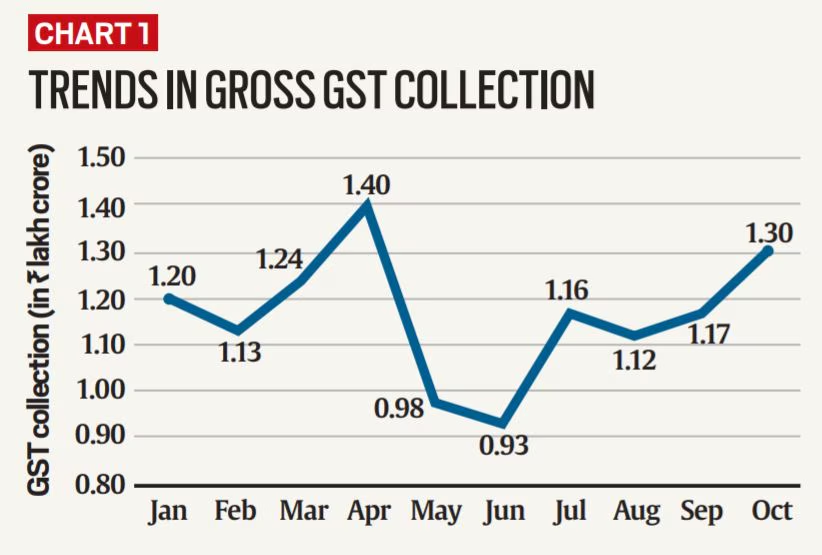

Enforcement Trouble: Where Is the Watchdog Now?

India had a dedicated anti-profiteering watchdog—the NAA—which was set up under Section 171 of the CGST Act. Its job was to ensure companies passed on the benefits of tax reductions.

However, in November 2022, the NAA was officially dissolved. While its pending cases were handed over to the GST Appellate Tribunal (GSTAT), there is no active body accepting new profiteering complaints after April 1, 2025.

This leaves a major gap in enforcement. Without monitoring or consequences, companies have little incentive to reduce prices, especially in markets with limited competition.

Who Gains the Most—and Who Doesn’t?

Let’s break down the winners and losers in this new tax landscape.

Beneficiaries:

- Middle and Upper-Income Households: With higher monthly expenditure, these consumers save more from rate cuts.

- Large Corporations: They benefit from lower tax outflows and often retain a portion of those savings.

- Exporters and SMEs: Lower input taxes can enhance international competitiveness.

Left Behind:

- Low-Income Consumers: They primarily consume zero-rated or non-GST goods like raw vegetables, so GST cuts don’t impact them as much.

- Small Retailers: These businesses typically pass on tax benefits but struggle to compete with profiteering brands.

- Consumers in Rural Areas: With less access to formal retail, pricing transparency is harder to enforce.

What Does the Data Say?

According to a report from the National Institute of Public Finance and Policy (NIPFP), wealthier households receive the bulk of benefits from GST exemptions and tax cuts. That’s because their spending is skewed toward taxable goods and services.

The same study suggests that price benefits from rate cuts often don’t reach low- and middle-income consumers unless strong enforcement ensures compliance.

What Can Be Done? Real, Practical Solutions

Policy-Level Fixes:

- Bring Back a Strong Monitoring Authority: Reinstate or replace NAA with an empowered watchdog.

- Mandate Transparent Pricing Audits: Businesses must show price changes post-GST cuts.

- Use Technology to Track Price Movements: AI-based retail scanners could monitor compliance.

- Public Disclosure Platforms: A public dashboard showing MRP before and after GST cuts for key products.

Business Responsibility:

- Update Price Tags Promptly: Businesses must reflect tax cuts in MRPs.

- Train Sales Teams: Frontline staff should understand and communicate pricing changes.

- Use Invoicing Software: Automate GST calculation and adjustment through billing systems.

Consumer Actions:

- Check Receipts Carefully: Look at base price vs GST portion.

- Report Issues on Consumer Helpline: File complaints on consumerhelpline.gov.in.

- Support Ethical Brands: Choose sellers who advertise GST benefits clearly.

How Do Other Countries Handle This?

| Country | Anti-Profiteering Measures |

|---|---|

| United Kingdom | VAT reductions must be passed to consumers in regulated sectors like energy and fuel. |

| Australia | Australian Taxation Office can audit businesses for non-compliance. |

| Malaysia | Has an active Price Control and Anti-Profiteering Act. |

| United States | No national VAT, but Federal Trade Commission monitors deceptive pricing. |

Compared to global norms, India now lacks a functioning mechanism to protect consumers post-GST cuts.

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

Odisha’s GST Act Set for Major Overhaul: Simplification & Flexibility Are Coming