Bombay HC Says GST Kicks In Only When Possession Transfers: Taxes can feel like quicksand—confusing, sticky, and hard to escape. In the U.S., we’re used to filing our federal returns every April, property taxes coming in hot from county offices, and maybe even fighting the IRS on an audit. But in India, there’s another tax beast—Goods and Services Tax (GST)—that just got a major reality check. In a landmark judgment, the Bombay High Court ruled that GST liability arises only when property possession is actually transferred—not when an agreement is signed. This might sound like a minor technicality, but trust me, it’s a game-changer for real estate developers, landowners, and homebuyers.

Bombay HC Says GST Kicks In Only When Possession Transfers

The Bombay High Court’s ruling that GST applies only on possession transfer, not at agreement signing, is more than a legal win. It’s a signal of fairness in taxation. For developers, it means breathing room for cash flow. For landowners, it means no premature tax burdens. For buyers, it means transparency and possibly lower prices. The principle is simple: if no keys have changed hands, no tax should be charged. That’s common sense, whether you’re in Mumbai, Manhattan, or Minneapolis.

| Point | Details |

|---|---|

| Court | Bombay High Court (India) |

| Decision Date | September 4, 2025 |

| Case Example | Provident Housing Ltd. v. GST Department |

| Key Ruling | GST liability applies only on transfer of possession, not at signing |

| Refund Ordered | ₹7 crore (~$850,000) plus 6% annual interest |

| Relevant Notification | Notification No. 4/2018 – Government of India |

| Broader Impact | Relief for developers, landowners, and homebuyers |

| U.S. Comparison | In America, property taxes are assessed when ownership changes, not when a contract is signed |

The Provident Housing Case

The case that sparked this ruling involved Provident Housing Ltd., a developer that signed a Joint Development Agreement (JDA) in 2017. Fast-forward to 2021: the GST Department demanded a whopping ₹7 crore in taxes, even though no possession of land or property had been transferred.

Reluctantly, Provident paid under protest. But they took the fight to court. The Bombay High Court reviewed the situation and concluded:

- Signing a JDA is not the same as handing over possession.

- Taxation without transfer violates GST’s core principle: tax applies on supply, not on intent.

- The government must refund ₹7 crore, with 6% annual interest, within six weeks.

That’s like signing a contract to buy a house in California, but the keys never change hands—and yet the county insists on full property tax. The court said, “No way. Tax follows possession, not paperwork.”

Why There Was Confusion About GST?

When India launched GST in 2017, it was marketed as a simple, unified tax replacing a messy system of sales tax, VAT, service tax, and more. For most sectors, the rules were straightforward. But real estate was a gray zone.

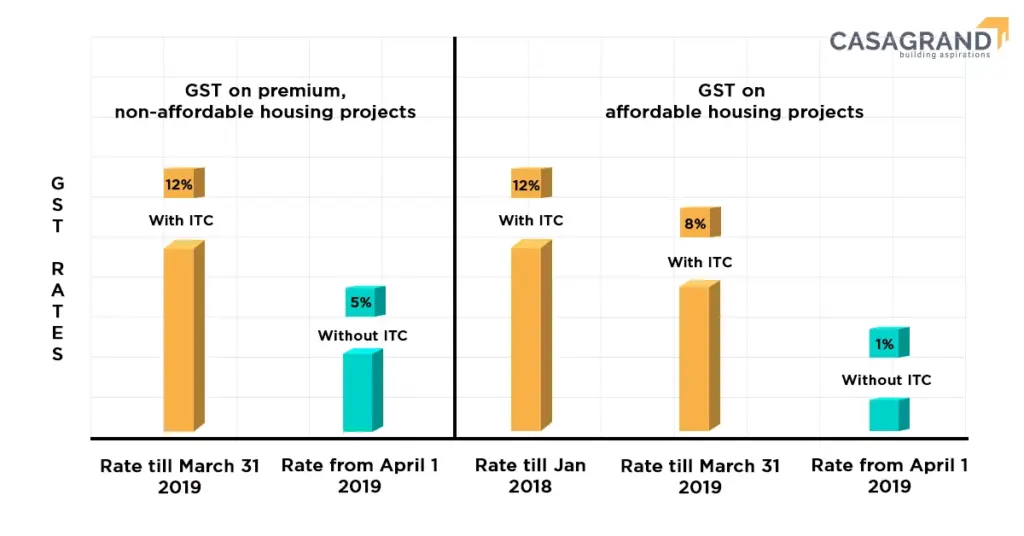

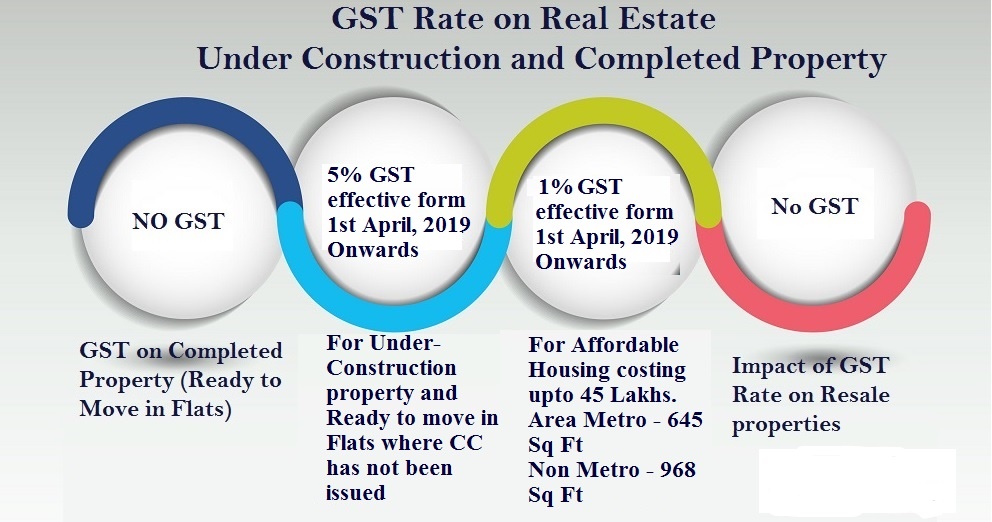

- Under-construction properties were taxed at 12%.

- Ready-to-move-in homes generally escaped GST.

- But no one was sure whether signing the agreement or handing over the keys started the tax clock.

The government tried to fix this with Notification No. 4/2018, which clarified that GST applies only when possession or rights are transferred. But on the ground, tax officers often demanded payments upfront—leading to costly disputes.

Why Bombay HC Says GST Kicks In Only When Possession Transfers Ruling Matters?

For Developers

- They can now manage cash flow better, avoiding premature tax outflows.

- Projects won’t get choked because money is tied up in unnecessary GST payments.

- Refunds for wrongly paid GST could bring fresh liquidity.

For Landowners

- No more fear of being taxed just for signing a JDA.

- Tax liability arises only if and when property rights are actually handed over.

For Homebuyers

- Developers won’t have to pass on inflated tax costs.

- Deals become more transparent, as buyers know exactly when GST is factored in.

Comparing India’s GST to U.S. Tax Norms

For American readers, think of GST as a hybrid of sales tax and service tax, applied nationwide. The confusion in India was whether it should be applied like a down payment (at signing) or like a title transfer fee (at possession).

In the U.S., here’s how it would compare:

- Property Tax: You don’t pay until you legally own the property.

- Sales Tax: Applied at the point of sale, not when you reserve the item.

- Lesson: India’s ruling now aligns with the global principle—tax when something real changes hands, not when intentions are put on paper.

Real Estate Terms Simplified

- Joint Development Agreement (JDA): A deal where landowners provide land and developers provide construction. They share profits or property units.

- Transferable Development Rights (TDR): Rights given to landowners to build extra space or transfer unused space.

- Floor Space Index (FSI): A measure of how much you can build on a given plot.

Earlier in 2025, the Nagpur Bench of the Bombay HC ruled that GST doesn’t apply on TDR or FSI transfers unless they’re actually executed. Combined with this ruling, the message is clear: taxation follows action, not intention.

Step-by-Step Guide: How to Handle GST Post-Ruling

For Developers

- Mark Possession Clearly: Ensure possession dates are documented in agreements.

- Invoice Smartly: Issue GST invoices only at possession, not before.

- Cash Flow Planning: Redirect funds from premature GST payments into actual construction.

- Refund Applications: If you paid GST on signing without transfer, file for refunds.

For Landowners

- Negotiate Smart Clauses: Make sure agreements specify when GST liability arises.

- Stay Informed: Keep tabs on possession handovers; that’s your tax event.

- Avoid Disputes: Use this ruling as legal backing in case of tax department pushbacks.

For Buyers

- Watch for Early GST Charges: Developers shouldn’t charge GST on booking or signing.

- Ask for Proof: Demand possession letters or transfer documents before paying GST.

- Budget Correctly: Know that GST applies at possession—factor this into your cash flow.

What Experts Are Saying?

Tax Consultants

Chartered accountants across Mumbai are calling this a “taxpayer-friendly ruling.” According to CA Ramesh Gupta:

“The court reaffirmed GST’s intent—it’s a consumption tax, not a contract tax. Developers now have certainty, and landowners won’t be unfairly burdened.”

Real Estate Industry

Builders’ associations believe this will revive stalled projects. By freeing up cash that was earlier locked in premature GST payments, developers can fund construction and deliver homes faster.

Economists

Policy experts compare this to how a Federal Reserve rate cut boosts U.S. housing activity. The ruling injects confidence, reduces risk, and could attract foreign investment.

Broader Impact on India’s Real Estate Market

- More Affordable Housing: Reduced tax burden may keep property prices stable.

- Legal Precedent: This ruling, combined with earlier ones, strengthens taxpayer rights.

- Investment Growth: Global investors may view India’s market as more predictable.

- Better Compliance: Developers will find it easier to align taxation with project milestones.

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

Banks Propose New GST Slab of ₹1 Crore to Prevent Merchants from Avoiding Digital Payments

Auto Companies Want New GST Rates Before Navratri – What This Means For Buyers

Pro Tips for Staying Compliant

- Developers: Tie GST compliance to possession milestones in contracts.

- Landowners: Keep records of actual transfers—signatures alone don’t trigger GST.

- Buyers: Don’t let anyone charge GST at booking. Push back and cite this ruling.