Businessman Arrested in ₹34 Crore GST Scam: In a jaw-dropping development from Nagpur, a businessman was arrested for engineering a ₹34 crore Goods and Services Tax (GST) scam. The arrest of Mahesh Keshwani, proprietor of K&K Brothers, has ignited discussions about the vulnerabilities in India’s indirect taxation system. More than just a headline, this case exposes how businesses can manipulate GST systems, claim false Input Tax Credit (ITC), and siphon off public funds through a network of fake invoices and ghost vendors.

For the average citizen, ₹34 crore might sound like Monopoly money—but for the Indian government, it’s a very real hole in the national treasury. And if you’re a business owner, accountant, or even just a curious taxpayer, there are real lessons here about what not to do and how to avoid trouble. Let’s break it all down—clearly, simply, and professionally.

Businessman Arrested in ₹34 Crore GST Scam

The ₹34 crore GST scam involving K&K Brothers isn’t just about one businessman. It’s a story about how loopholes in digital systems, weak vendor verification, and human greed can undermine an entire tax regime. As someone who has worked in tax consulting for years, here’s what I’ll say—integrity is cheaper than jail time. Don’t cut corners. Avoid shady shortcuts. And always ask: “Can I explain this to a tax officer tomorrow?” GST is not just a tax—it’s a trust. When you break it, the cost is paid by everyone.

| Category | Details |

|---|---|

| Person Arrested | Mahesh Keshwani, Proprietor, K&K Brothers |

| Location | Jaripatka, Nagpur, Maharashtra |

| Fraud Amount | ₹33.93 crore (~₹34 crore) |

| Crime Type | Fake Input Tax Credit (ITC) under GST |

| Law Violated | Section 132(1)(b) & 132(1)(c) of the CGST Act |

| Punishment | Non-bailable, up to 5 years imprisonment and monetary penalties |

| Investigation By | Maharashtra State GST Department’s Investigation Wing |

| Evidence Found | Bogus invoices, canceled GSTIN vendors, backend system manipulations |

| Official Source | https://mahagst.gov.in/en |

What Is GST and Input Tax Credit, in Simple Terms?

The Goods and Services Tax (GST) is a unified tax system that replaced older indirect taxes like VAT, excise duty, and service tax in India. Businesses that purchase goods or services for commercial use can claim back the GST they paid. This is called Input Tax Credit (ITC).

For example, if your company buys raw materials worth ₹1,00,000 and pays ₹18,000 as GST, you can claim that ₹18,000 back when filing your GST returns. However, this only works if:

- The goods/services were actually bought

- The vendor is registered and compliant

- The invoice is legitimate

Fake ITC happens when none of those conditions are met—yet the business still claims tax refunds or adjustments.

How the Businessman Arrested in ₹34 Crore GST Scam Was Orchestrated?

According to GST officials, Mahesh Keshwani created a complex web of fake vendors and fraudulent transactions. Here’s how the scam worked:

- Non-Existent Suppliers

He claimed purchases from vendors whose GST numbers were already canceled. These were shell companies or defunct firms, used only on paper. - No Movement of Goods

No trucks. No warehouses. No inventory. No deliveries. Just paper invoices claiming transactions that never occurred. - Bogus Invoices Used to Claim ITC

The company submitted these invoices during GST returns to claim nearly ₹34 crore in ITC. - Digital Data Manipulation

Upon inspection, officials found that K&K Brothers’ backend accounting software showed signs of manipulation—ledger entries, fake purchase records, and missing documentation trails. - Audit Trail Concealment

Internal audits appeared “clean” on the surface because digital systems were tampered with to avoid detection. That’s why manual inspection was crucial in catching this scam.

The Legal Side: What the CGST Act Says

Under Section 132 of the Central Goods and Services Tax (CGST) Act, 2017, the offense of claiming fraudulent ITC or issuing fake invoices is a criminal offense.

- Section 132(1)(b): Punishes issuance of invoices without actual supply of goods/services.

- Section 132(1)(c): Punishes availing ITC using fraudulent means.

If the fraud amount exceeds ₹5 crore, it becomes:

- A non-bailable offense

- Cognizable, meaning arrests can be made without a warrant

- Punishable by up to five years of imprisonment and fines

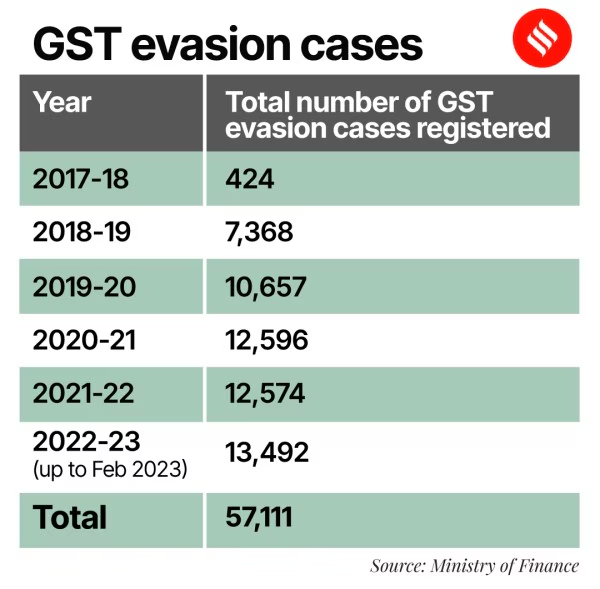

Past GST Frauds: This Isn’t an Isolated Case

Frauds of this nature aren’t new. Several similar scams have rocked the GST regime in the past few years:

- Delhi (2021): A ₹220 crore scam involving 115 fake firms and circular trading.

- Madhya Pradesh (2023): ₹150 crore fake GST credit claimed using PAN cards of poor villagers.

- Hyderabad (2024): ₹100 crore of fraudulent invoices uncovered during an inter-state operation.

According to a recent Finance Ministry report, more than ₹1.2 lakh crore in GST fraud has been unearthed since the inception of the GST system in 2017.

Economic Impact: Why These Frauds Matter

GST fraud isn’t just a “tax office” problem. Here’s how it hurts the economy:

- Loss of Public Revenue: Money that should have gone to roads, healthcare, schools, and subsidies is siphoned off.

- Greater Scrutiny on Honest Businesses: Legitimate businesses face stricter audits and compliance requirements.

- Undermining of Tax Reforms: GST was launched to streamline taxation. Large-scale frauds defeat its purpose.

- Hindrance to GDP Growth: Fraudulent ITC claims inflate company profits and distort real GDP indicators.

In short, every ₹1 of fake credit is a ₹1 loss to India’s development.

How Is the Government Fighting Back?

To counter such growing threats, Indian tax authorities have rolled out several anti-fraud initiatives:

National Anti-Evasion Drive

Launched by the CBIC (Central Board of Indirect Taxes and Customs), this initiative has busted over 1,200 shell companies and flagged thousands of questionable GST registrations.

AI & Big Data

The government uses AI to cross-match invoice data with e-way bills, transport records, and bank transactions. Any mismatch triggers an alert for investigation.

Mandatory Aadhaar Verification

As of 2022, Aadhaar authentication is mandatory for GST registration. This makes it harder for fraudsters to open fake firms using false identities.

Rule 86B

This rule restricts businesses from using more than 99% of ITC to discharge their tax liability, ensuring cash flow and reducing dependence on ITC fraud.

What Can Businesses Learn? Practical Tips for Staying Compliant

Whether you’re a startup or an enterprise, these compliance practices can save your business from serious trouble:

1. Verify Your Suppliers

Use the GST Portal to confirm that your vendor’s GSTIN is valid and active.

2. Avoid Cash Deals

Ensure all transactions are properly documented and done through traceable digital or banking channels.

3. Use Registered GST-Compliant Software

Accounting tools like Tally, Zoho Books, Marg ERP, and ClearTax automatically flag discrepancies.

4. Train Your Team

Your accounts and procurement teams should know how to verify invoices, e-way bills, and vendor documents.

5. Hire a Certified GST Consultant

Don’t rely solely on internal teams. External audits help catch mistakes before the authorities do.

6. Report Suspicious Activity

You can report suspected tax fraud anonymously at https://cbic-gst.gov.in or email helpdesk@gst.gov.in.

GST Collections for July 2025: You Won’t Believe Which State Tops the List!

How Local Trade Helped July GST Collections Reach an Impressive Rs 1.96 Lakh Crore—The Inside Story

Madras HC Strikes Down GST Order Issued Just Before Hearing—A Major Violation of Natural Justice!