Calcutta HC Rules Cancelling GST Registration Harms Revenue: When the Calcutta High Court speaks, people in the business and tax world tend to listen. And in a recent ruling, the Court sent a clear message: cancelling a business’s GST registration just because they failed to file returns — without accusing them of fraud — can actually hurt the government’s revenue more than it helps. Think of it like this: you’ve got a small-town diner that’s late paying its property taxes. Instead of working out a payment plan, the city shuts it down entirely. Sure, the city makes a point about rules, but now it also loses out on sales tax from every burger and coffee that would have been sold. That’s essentially the problem the Court addressed — stopping operations can stop the very tax flow the government is trying to collect.

Calcutta HC Rules Cancelling GST Registration Harms Revenue

The Calcutta High Court’s decision marks a turning point in how GST compliance lapses are handled. Instead of shutting down businesses and losing future tax revenue, the ruling focuses on bringing taxpayers back into the system — provided they clear their dues promptly. For business owners, the lesson is clear: stay on top of GST filings, and if you slip, act quickly to fix it.

| Point | Details |

|---|---|

| Case | Calcutta High Court ruling on GST registration cancellation |

| Decision Date | August 11, 2025 |

| Core Ruling | Cancelling GST registration for non-filing (without fraud) hurts revenue |

| Conditions for Revival | File all pending returns, pay all taxes, interest, penalties, and fines within 4 weeks |

| Impact | Keeps businesses running, supports steady tax inflow |

| Official Source | Central Board of Indirect Taxes and Customs (CBIC) |

The Court’s Reasoning: Why This Matters

The Court’s logic was straightforward:

- Once a business’s GST registration is cancelled, it cannot issue tax invoices.

- Without invoices, there’s no GST collection on sales.

- No GST collection means the government loses potential tax revenue.

This is especially counterproductive when the business is still operational or willing to comply if given the chance. Cancelling the GST registration might check a compliance box, but it doesn’t actually solve the underlying issue — getting the money owed into the government’s account.

The Legal Side: Which GST Law Provisions Apply

Under Section 29 of the CGST Act, 2017, a GST registration can be cancelled if:

- A taxpayer does not file returns for a continuous period (6 months for monthly filers, 2 quarters for quarterly filers).

- They violate certain provisions of the Act.

However, Section 30 of the same Act allows for revocation of cancellation if:

- The taxpayer applies within 30 days from the date of service of the cancellation order.

- All pending returns are filed and dues paid.

The Calcutta HC’s ruling effectively reinforced the importance of Section 30, emphasizing that the law already provides a way to bring taxpayers back into compliance without cutting off revenue streams.

Revival Conditions in Detail

The Court didn’t just restore GST registration automatically. Businesses must:

- File All Pending Returns – This includes both GSTR-3B and GSTR-1 forms for all months missed.

- Pay All Outstanding Amounts – Taxes, interest (usually at 18% p.a. for late payment), late fees, and penalties.

- Meet the Deadline – Four weeks from receipt of the Court’s order.

- Work with the GST Office – The jurisdictional GST officer must restore the registration upon compliance.

Step-by-Step Process to Get GST Registration Restored

Step 1: Calculate Your Total Liability

Pull up your GST portal account and review missed returns, interest, and late fees.

Step 2: File All Pending Returns

File GSTR-3B and GSTR-1 for every missed month or quarter. Even NIL returns must be filed if no sales occurred.

Step 3: Make Full Payment

Use the GST portal’s payment feature to clear dues. Payments can be made through net banking, NEFT, or over-the-counter at authorized banks.

Step 4: Apply for Revocation

File Form GST REG-21 for revocation, attaching proof of filing and payment.

Step 5: Follow Up with Your Jurisdictional Officer

Once all is in order, the officer will process the revocation and issue a GST REG-22 order to restore your registration.

Calcutta HC Rules Cancelling GST Registration Harms Revenue: Economic Impact

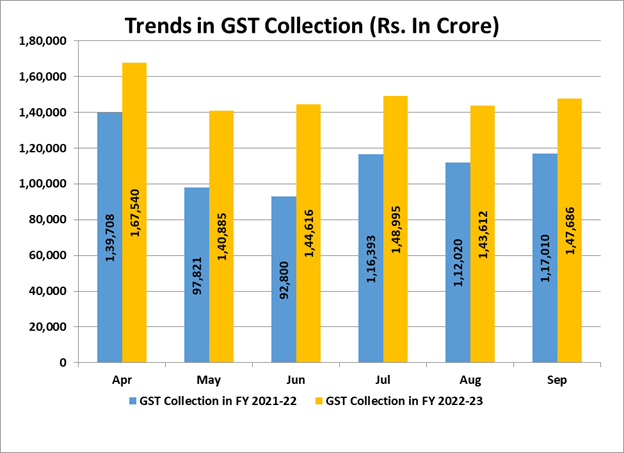

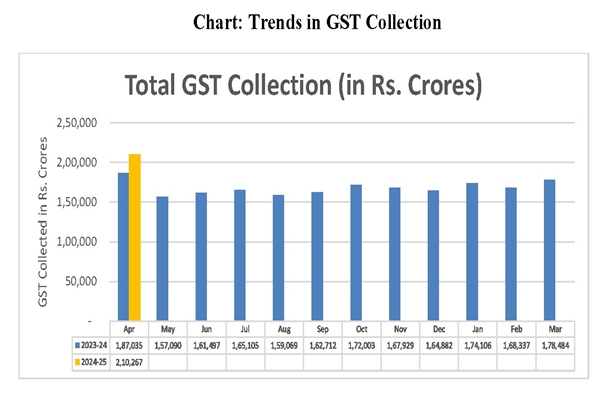

India’s GST system is the government’s primary indirect tax revenue source, pulling in around ₹1.65 lakh crore in July 2025 alone.

When a business is deregistered:

- Revenue from that business stops immediately.

- Employees may lose jobs, reducing income tax collections.

- Suppliers lose a client, causing a ripple effect across the supply chain.

The Court’s approach — restore registration upon compliance — supports both immediate recovery of dues and ongoing future collections.

Real-World Case Example with Numbers

Consider Ravi, who owns a printing press in Kolkata.

- He missed filing returns for six months.

- His GST registration was cancelled.

- Total dues: ₹1,20,000 tax + ₹15,000 interest + ₹8,000 late fees = ₹1,43,000.

Under the Court’s conditions:

- Ravi files all six returns.

- Pays ₹1,43,000 in dues.

- Applies for revival within four weeks.

Once restored, Ravi resumes billing and generates ₹8 lakh in monthly sales, leading to about ₹1,44,000 in monthly GST for the government. Without revival, that monthly revenue stream is lost.

Legal Precedent Timeline

- 2023: Delhi High Court strikes down GST cancellations issued without proper hearing.

- 2024: Pranabesh Sarkar v. Superintendent, CGST & CX — Calcutta HC revives registration upon dues clearance.

- January 2025: C.P. George & Anr. vs State of West Bengal — Similar revival after prolonged non-filing.

- August 2025: Current ruling — reaffirms revenue-first approach.

Professional Insights

Tax consultant Meera Kulkarni, with 20 years of compliance experience, puts it this way:

“From a purely revenue standpoint, keeping a taxpayer active — even if they’ve slipped up — makes far more sense than throwing them out of the system. This ruling nudges the tax administration toward a more business-friendly, yet still strict, model.”

Compliance Checklist for Businesses

- File GST returns on or before due dates.

- Even if unable to pay, submit NIL returns to avoid cancellation triggers.

- Maintain a dedicated GST reserve fund to avoid last-minute cash crunches.

- Use accounting software with GST integration to track liabilities in real time.

- Respond to GST notices promptly and maintain open communication with tax officers.

International Comparison: How Other Countries Handle It

- USA (Sales Tax): Late filers often get payment plans instead of losing permits. Revocation is rare unless fraud is involved.

- UK (VAT): HMRC imposes surcharges and penalties but doesn’t cancel registration for late filing alone unless there’s serious non-compliance.

- Australia (GST): The ATO suspends accounts temporarily, encouraging voluntary disclosure before permanent cancellation.

India’s ruling now aligns more closely with these models, balancing enforcement with economic pragmatism.

Practical Advice for Entrepreneurs

- Don’t ignore notices — they’re your early warning.

- Use automated reminders for GST due dates.

- If you miss a filing, address it within the same month to limit penalties.

- Consult a CA or GST practitioner if you’re falling behind — early intervention saves money.

Telangana High Court Delivers Major Relief for NRSC in GST Dispute

Calcutta HC Rules GST Adjudication Invalid Without Mandatory Hearing Under Section 75(4)

Raymond Apparel Wins Big: Calcutta HC Upholds ₹7.98 Crore Customs Refund After Protest