Canada Extra Tax Refund Incoming in Next 2025: If you’ve been scrolling through TikTok, chatting with neighbors, or catching headlines lately, you’ve probably noticed all the buzz about a “Canada extra tax refund incoming in 2025.” It’s got people talking from Vancouver to Halifax. The big questions are obvious: Who’s getting it? How much is it? And when does it land in my account? Here’s the scoop: there’s a mix of truth, speculation, and outright misinformation. But don’t worry—I’ve been digging into the official sources, breaking down government updates, and cross-checking the data so you don’t have to. This guide will walk you through what’s real, what’s rumor, and how you can make sure you don’t miss out.

Canada Extra Tax Refund Incoming in Next 2025

So, is there a Canada extra tax refund incoming in 2025? The short answer: yes and no. Confirmed payments include the final Carbon Rebate in April 2025, ongoing GST/HST, CCB, CPP, and OAS payments, plus a middle-class tax cut in July 2025. The $500 one-time refund remains rumor until CRA makes it official. The smart move? File your taxes, check CRA’s website regularly, and set up direct deposit. If Ottawa does green-light more relief, you’ll be at the front of the line to get it.

| Topic | Details |

|---|---|

| Refund Type | Canada Carbon Rebate (confirmed), GST/HST Credit, CCB, CPP/OAS (ongoing), rumored $500 one-time refund (unconfirmed) |

| Confirmed Dates | Carbon Rebate: April 22, 2025; GST/HST: Sept 5, 2025; OTB: Sept 10, 2025; CCB: Sept 20, 2025; CPP & OAS: Sept 27, 2025 |

| Eligibility | Based on filing 2024 tax return, income thresholds, and benefit qualifications |

| Rumor Watch | CRA $500 one-time payment by November 30, 2025 – not officially confirmed |

| Official Source | Canada Revenue Agency |

What’s the Real Deal With This “Extra Refund”?

Let’s clear the air: there isn’t an official program called the Canada Extra Tax Refund. Instead, what people are talking about is a mashup of several real government benefits rolling out in 2025, combined with a rumored payment that hasn’t yet been confirmed.

1. The Canada Carbon Rebate (CCR) – Final Payment

The CCR was designed to offset costs of the federal carbon tax for households. For years, families have been receiving quarterly payments, but here’s the catch: the program is ending in 2025.

- The final rebate payment began rolling out April 22, 2025.

- If you filed your 2024 income tax return on time, the money should have already hit your account.

- Filed late? Don’t sweat it—you’ll still get your rebate once your return is processed.

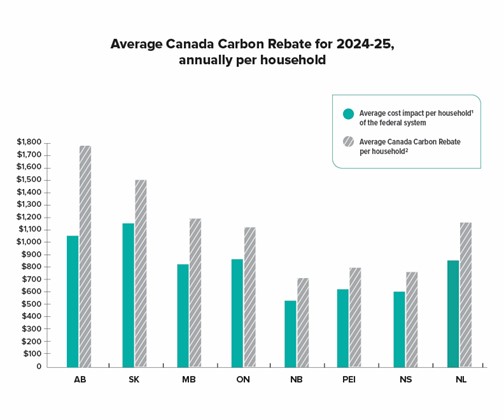

Example: In Ontario, a family of four typically received over C$1,000 annually in CCR payments. This final payout puts the last bit of cash back in households’ hands before the program sunsets.

2. Regular CRA Benefits: The Dependables

Sometimes, what’s hyped as “extra” is just the regular, scheduled benefits Canadians already receive. Still, these payments make a big difference for households.

Here are the September 2025 payment dates:

- GST/HST Credit: September 5

- Ontario Trillium Benefit (OTB): September 10

- Canada Child Benefit (CCB): September 20

- CPP & OAS: September 27

To put this in context, the GST/HST credit supports about 11 million Canadians annually, with an average yearly benefit of roughly C$496 for individuals and C$650+ for couples with kids.

3. The Rumored $500 One-Time Refund

Now to the juicy part—the supposed $500 refund.

Some online sources claim that the federal government is preparing a one-time payment of C$500 for low- to middle-income households, to be released by November 30, 2025. The idea is to provide relief from rising costs of living.

But here’s the kicker: as of now, the CRA hasn’t confirmed this. It could be real, or it could be misinformation circulating online. Until the government issues an official statement, treat this like hearsay at a family barbecue—interesting, but not bankable.

4. The Middle-Class Tax Cut – 100% Confirmed

This isn’t a refund, but it’s one of the biggest changes coming in 2025:

- Starting July 1, 2025, the lowest federal income tax bracket rate drops from 15% to 14%.

- That means if you earn under about C$114,750 annually, you’ll see a reduction in how much tax is withheld from your paycheck.

- Instead of waiting for a year-end refund, you’ll notice slightly larger paychecks every pay period.

This is long-term financial relief, not a one-time payout.

How This Stacks Up Against U.S. Stimulus Checks?

For my friends in the States, the Canadian system feels different. In the U.S., the government mailed out stimulus checks during the pandemic—big, headline-grabbing lump sums. Canada tends to spread relief out through credits and rebates.

Example: While Americans cashed $1,200 checks in 2020, Canadians quietly got boosted GST/HST credits and enhanced child benefits. The end goal is the same: easing financial strain. The delivery just looks different.

Historical Context: Canada’s One-Time Refunds

This isn’t the first time Ottawa has cut checks to Canadians:

- 2020: One-time top-up of GST/HST credit. Families got an extra C$400–600.

- 2022: Canada Dental Benefit gave families up to C$650 per child.

- 2023: Grocery Rebate rolled out, with families of four getting up to C$467.

So while a $500 payment hasn’t been confirmed yet, history shows that one-time top-ups are totally possible when the economy demands it.

How to Check If You’re Getting Canada Extra Tax Refund Incoming in Next 2025?

Here’s your action plan:

Step 1: File Your Taxes

This is non-negotiable. Even if you had zero income, file your 2024 return. Filing ensures CRA calculates your eligibility.

Step 2: Log Into CRA My Account

Your personal dashboard is the hub for payments, balances, and benefit eligibility.

Step 3: Set Up Direct Deposit

Checks are slow and sometimes lost. Direct deposit ensures you get money faster and safer.

Who Qualifies for What?

Here’s a snapshot:

- Carbon Rebate: Residents in eligible provinces who file taxes.

- GST/HST Credit: Based on household income and size. For instance, single adults under about C$50,000 usually qualify.

- CCB: Parents of children under 18.

- CPP & OAS: Seniors who’ve contributed and meet age criteria.

- $500 Refund (rumored): Unknown—likely low- and middle-income families if confirmed.

Case Study: A Household Example

Meet Jordan, a 32-year-old single parent with two kids in Toronto:

- CCB: Roughly C$6,800 annually.

- GST/HST Credit: About C$1,000.

- Carbon Rebate (Final): Around C$500.

- Middle-Class Tax Cut: Will save about C$350 yearly starting mid-2025.

- If the $500 refund arrives: That’s icing on the cake.

For families like Jordan’s, these credits stack up to thousands in support—proof that staying on top of CRA updates pays off.

Avoiding Scams

Every year, scammers pretend to be CRA reps. Don’t fall for it.

- CRA will never text or email you asking for banking info.

- If you get a call demanding payment via gift cards, hang up.

- Always check your CRA account or call directly.

Remember: if it smells fishy, it’s probably a scam.

Pro Tips: Making the Most of Refunds

Here’s how smart folks use refunds:

- Knock out debt. Even a $500 refund wipes out a big chunk of high-interest credit card balance.

- Boost your savings. Toss it in a TFSA or RRSP for long-term gains.

- Plan for back-to-school or holidays. Budget that cash so it covers real needs, not just impulse buys.

- Treat yourself responsibly. It’s okay to grab dinner out—just don’t blow it all.

Outrage Erupts as Federal Union Slams Cuts to CRA Call Centres

Costly Mistake: CRA Penalizes Taxpayer for Not Reporting Home Sale

$496 GST/HST Credit Confirmed for 2025—Here’s Who Qualifies and When You’ll Get Paid