Central GST Authorities Clarify No Notices Issued Based on UPI Transactions: If you’ve been following Indian business news lately, you might have seen the headline: “Central GST authorities clarify no notices issued based on UPI transactions amid Karnataka row.” That’s quite a mouthful, but here’s the plain-English version: the central tax folks in India are saying, “Hey, we’re not sending you GST notices just because you’re using UPI to get paid.” Still, in Karnataka, thousands of small vendors did receive notices from the State GST department—triggering fear, anger, and even boycotts of digital payments. For people who depend on UPI for their day-to-day sales, it felt like a sucker punch. The situation turned into one of the biggest payment-related public backlashes India has seen in recent years.

Central GST Authorities Clarify No Notices Issued Based on UPI Transactions

The GST-UPI controversy in Karnataka is a reminder that digital transparency comes with responsibilities. Central GST authorities have made it clear they don’t send notices based solely on UPI use, but state departments can—and do—use such data to enforce existing laws. For small vendors, the path forward isn’t to abandon UPI, but to understand the thresholds, track turnover, and engage with tax authorities early. India’s digital payment system is too valuable to be derailed by fear and misinformation.

| Key Point | Details |

|---|---|

| Central GST stance | No notices issued solely on UPI data |

| State GST (Karnataka) | Used UPI receipts to identify vendors crossing ₹40 lakh (goods) / ₹20 lakh (services) turnover threshold |

| Reason for row | Thousands of traders got pre-registration notices based on UPI transactions |

| Govt response | State announced amnesty for past arrears; launched “Know GST” campaign |

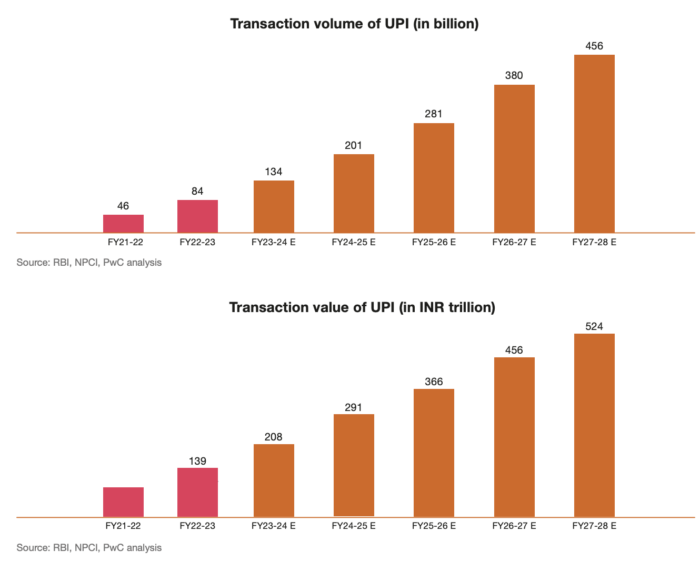

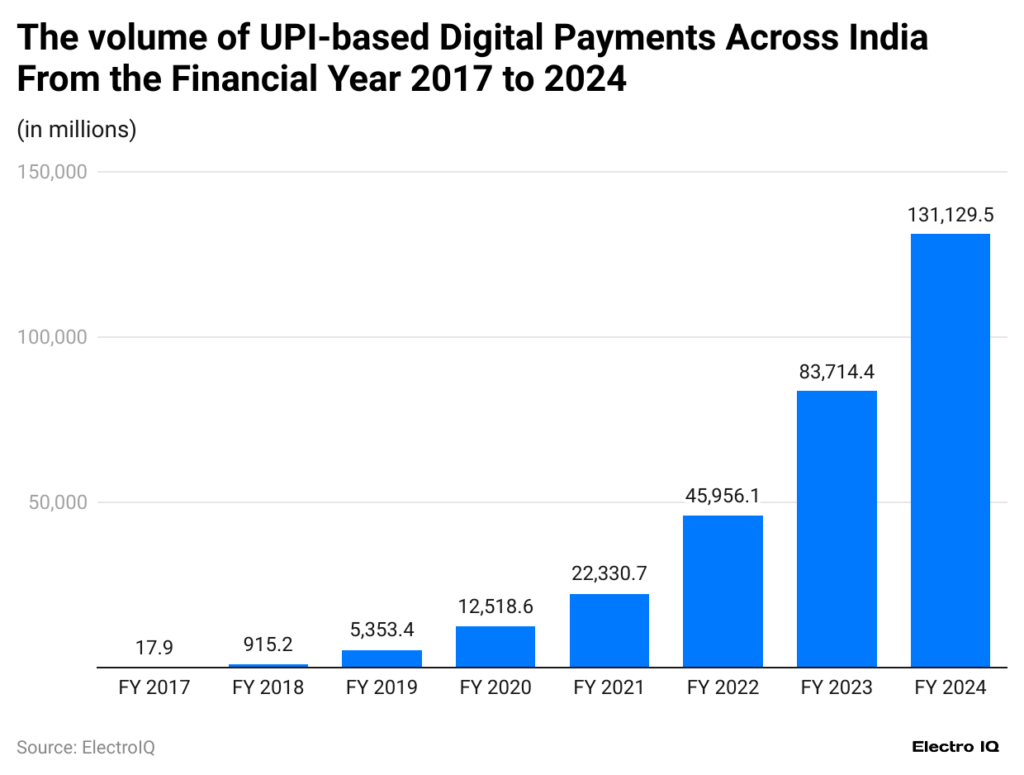

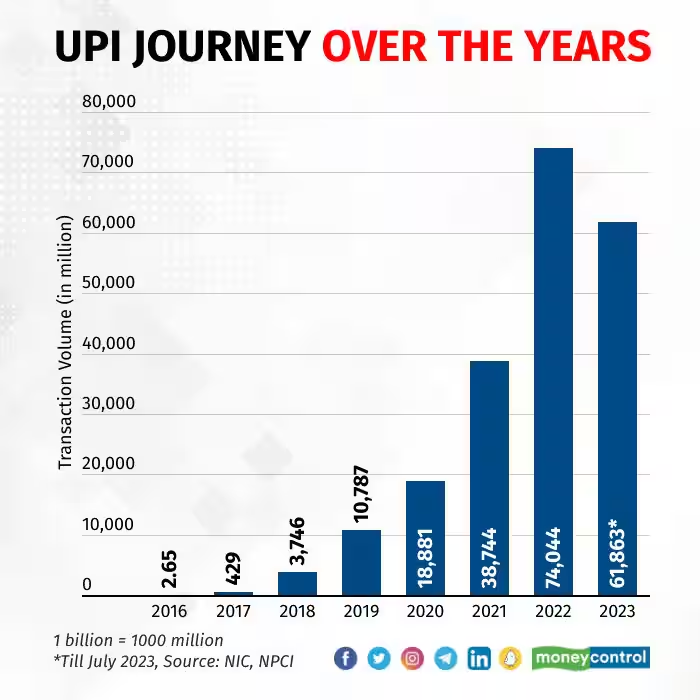

| UPI adoption in India | 12.2 billion transactions in June 2025 (NPCI data) |

| Official GST site | https://gst.gov.in |

Understanding the Basics: UPI and GST in Simple Terms

If you’re from the U.S., think of UPI (Unified Payments Interface) as a mix between Venmo, Zelle, and Cash App—but more universal. It lets you send or receive money instantly using a phone number or QR code. No fees for most transactions, no swiping cards—just quick, easy, and wildly popular.

According to the National Payments Corporation of India (NPCI), UPI processed over 12.2 billion transactions in June 2025, moving a total value of ₹19.8 trillion (about $240 billion). That’s bigger than the GDP of many countries.

GST (Goods and Services Tax) is India’s unified indirect tax system. Instead of juggling different state and central taxes, GST rolls them into one. The key thing here: any business with an annual turnover above ₹40 lakh for goods or ₹20 lakh for services has to register for GST and file returns.

How the Central GST Authorities Clarify No Notices Issued Based on UPI Transactions?

In early 2025, Karnataka’s State GST department analyzed UPI transaction data from payment processors. They spotted thousands of small traders—vegetable sellers, snack shops, small service providers—whose total digital receipts crossed the GST threshold. So, they sent pre-registration notices saying, in effect, “Our records suggest you may need to register for GST.” The notices weren’t bills, but they felt threatening to folks who’d never had to deal with formal tax compliance before. The result? Panic. Traders’ associations started advising members to stop using UPI altogether. Some shops hung signs saying “Cash Only.” Social media hashtags like #BoycottUPI began trending locally.

Central vs. State GST: Clearing the Confusion

One big reason for the uproar was the public mixing up Central GST (CGST) with State GST (SGST). Here’s how it works:

| Central GST (CGST) | State GST (SGST) |

|---|---|

| Collects tax on inter-state sales | Collects tax on intra-state sales |

| Administered by the Union Finance Ministry | Managed by each state’s tax department |

| Clarified they do not send notices based on UPI alone | Did send notices based on UPI turnover data |

| Focuses on compliance for cross-border and national-level trade | Focuses on local/state-level transactions |

On August 11, 2025, Finance Minister Nirmala Sitharaman told Parliament that CGST notices are not triggered solely by UPI data and that there is no GST on UPI transactions themselves. This was a direct attempt to squash misinformation spreading online.

The Real-Life Impact: Stories From the Ground

One widely shared example was a vegetable vendor in Bengaluru. She’d been selling through UPI for years, not realizing that the total money received—even if most of it went toward buying fresh produce from wholesalers—was being counted as turnover. Her UPI receipts crossed ₹45 lakh for the year.

Technically, she was required to register for GST even though her actual profit margins were razor-thin. She got a notice, panicked, and almost stopped accepting UPI payments entirely until local officials explained her options.

Other examples include:

- Small cafes and tea stalls receiving notices after tourist season sales surged.

- Milk delivery businesses whose high-volume but low-margin operations tipped them over the threshold.

- Tuition centers collecting fees via UPI and unknowingly crossing the services turnover limit.

Government’s Efforts to Calm the Storm

Recognizing the risk of eroding trust in digital payments, Karnataka’s Chief Minister Siddaramaiah announced several measures in late July 2025:

- Amnesty for traders who register now, waiving past dues for non-compliance.

- Special exemption for GST-free items like vegetables, fruits, and milk.

- “Know GST” campaign—community workshops, call centers, and explainer videos.

Meanwhile, the Union Finance Ministry doubled down on clarifying that there is no separate tax for using UPI and that businesses should focus on total sales, not the payment method.

Why This Matters for India’s Digital Economy?

India’s government has spent years pushing digital payments to reduce cash dependency. UPI’s success is seen as a global model—fast, free, and scalable. If traders start abandoning it out of tax fears, it could stall progress.

For comparison:

- In the U.S., digital payments adoption is still fragmented across PayPal, Venmo, Zelle, and card-based systems.

- India’s UPI is state-backed and integrated with nearly every bank account, creating a single, universal payment highway.

That’s why clear communication on tax rules vs. payment methods is critical.

Practical Advice for Vendors and Small Businesses

If you’re a small business owner in India, here’s what to keep in mind:

- Track Your Turnover, Not Just Profit

GST registration is based on total sales (before expenses), not net profit. - Understand Your Thresholds

₹40 lakh for goods, ₹20 lakh for services—these are annual, not monthly. - Don’t Fear UPI

Digital payment transparency is good for business and safety. - Maintain Clear Records

Use accounting software or even a spreadsheet to log daily sales. - Respond to Notices

Ignoring them can lead to penalties and forced registration. - Get Professional Help

A tax consultant can guide you through exemptions and compliance.

Step-by-Step: What to Do If You Receive a GST Notice

- Read It Fully

Determine if it’s a pre-registration advisory or a demand. - Verify Its Authenticity

Cross-check the GST number and official email source. - Calculate Your Turnover

Include all receipts: UPI, cash, bank transfers, cards. - Check for Exemptions

Many goods/services are GST-free—verify with the official GST portal. - File a Timely Response

Even a simple clarification letter can avoid escalation. - Consider Voluntary Registration

This can sometimes open up benefits like input tax credits.

The Bigger Picture: Compliance Without Fear

The Karnataka GST-UPI row highlights a key challenge in tax enforcement: balancing compliance with public trust. Digital payments make it easier to detect tax evasion, but they also expose small vendors who may lack awareness of the rules.

This is similar to what happened in the U.S. when platforms like PayPal started reporting income to the IRS—small sellers on Etsy or eBay were suddenly pulled into formal tax systems they’d never dealt with before.

The solution lies in education first, enforcement second.

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

Vodafone Idea Faces ₹21.39 Crore GST Penalty for Alleged Short Payment Under RCM!

Supreme Court Denies Plea Challenging GST ECL Blocking Relief