Centre Promises a Consumer-Centric GST Makeover: The Centre’s promise of a consumer-centric GST makeover has stirred discussions across India, from chai stalls to boardrooms. This is not just another tax tweak—it’s being called a “Diwali gift” for ordinary citizens and businesses alike. With the government set to simplify the Goods and Services Tax (GST) structure, the ripple effects could touch everything you buy, from your daily bread to your next refrigerator.

Centre Promises a Consumer-Centric GST Makeover

The Centre’s consumer-centric GST makeover is not just a tax change—it’s a reset for India’s economy. By simplifying slabs, easing compliance, and reducing litigation, GST 2.0 aims to put more money in people’s pockets while boosting long-term growth. Yes, there are risks, but if implemented smoothly, this could truly be remembered as India’s “Diwali gift of the decade.”

| Feature | Details |

|---|---|

| New GST Structure | From 4 slabs to just 2 (5% and 18%), with a 40% “luxury/sin tax” on select items |

| Implementation Timeline | Expected rollout: October 2025 (around Diwali) |

| Items Affected | 99% of 12% goods → 5% bracket; 90% of 28% goods → 18% bracket |

| Consumer Impact | Essentials cheaper, simpler compliance, less litigation |

| GDP Boost | Expected rise by 0.6% next year |

| Official Info | Visit GST Council Official Website for updates |

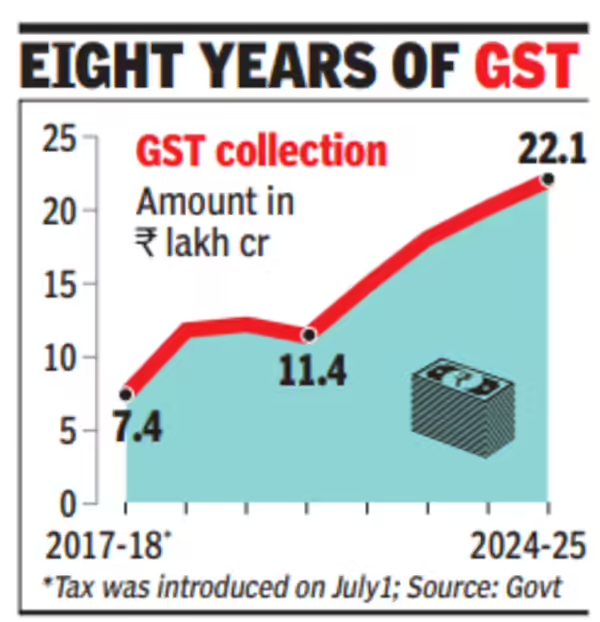

GST in India: A Quick Background

Before GST was rolled out in 2017, India’s tax landscape looked like a maze. You had excise duty, VAT, service tax, octroi, entertainment tax—the list was endless. Buying the same product in two different states often meant paying different taxes. GST was introduced as a “one nation, one tax” system to unify markets and improve compliance.

But there was a catch. Instead of one or two simple tax rates, GST introduced four slabs (5%, 12%, 18%, 28%). Over time, this created disputes. Was a pizza base taxed at 5% or a finished pizza at 18%? Should footwear below ₹1,000 be at 5% while those above be at 18%?

For ordinary citizens, this complexity meant prices often didn’t make sense. For businesses, it meant endless paperwork and litigation. That’s why the Centre is now pushing for GST 2.0.

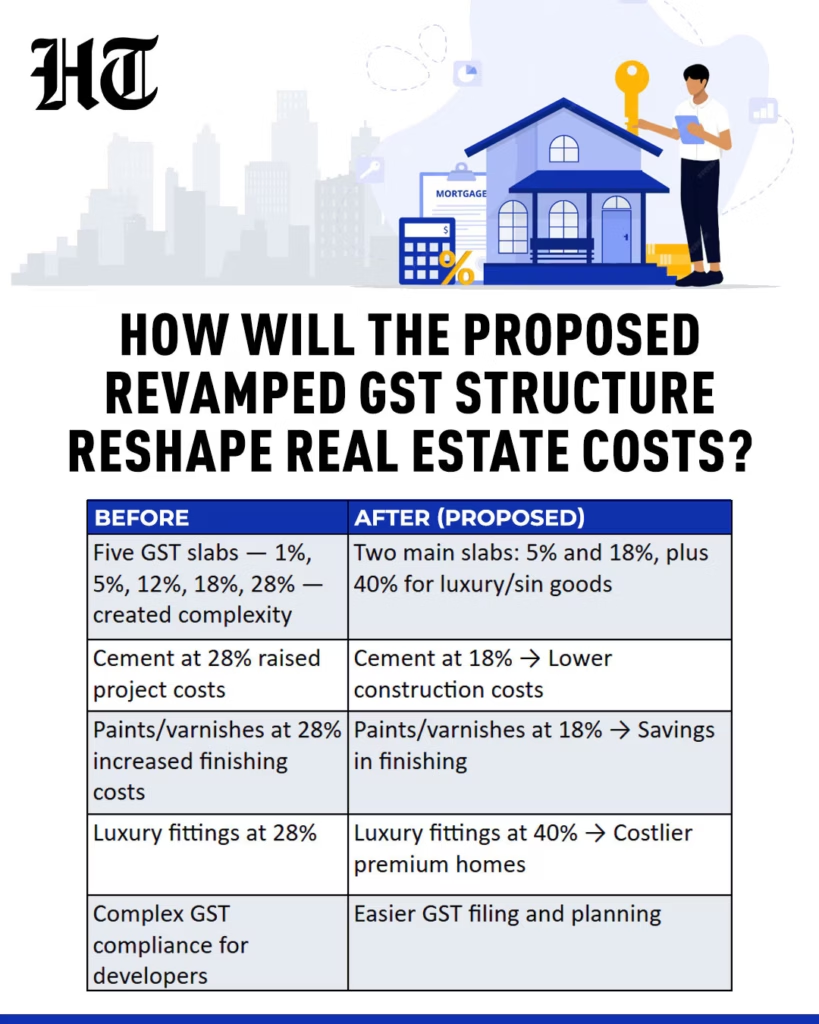

Breaking Down Centre Promises a Consumer-Centric GST Makeover

From Four Slabs to Two (Plus a Luxury/Sin Rate)

- Old system: 5%, 12%, 18%, 28%

- New system: 5% and 18%, plus 40% luxury/sin tax

Practical examples:

- A washing machine costing ₹25,000 earlier fell in the 28% bracket (₹32,000). Under GST 2.0, at 18%, it will cost ₹29,500.

- A restaurant meal that cost ₹1,000 plus 18% tax (₹1,180) could drop to 5% if reclassified, costing ₹1,050.

- A bottle of wine or cigarette pack, however, may become more expensive due to the 40% special rate.

Timeline & Rollout

The changes are expected in October 2025, coinciding with Diwali. This timing is no accident—festive seasons see higher consumer spending. Lower prices during Diwali shopping could give the economy an immediate consumption boost.

The Three-Pillar Strategy

The GST Council is framing reforms around three pillars:

- Structural Reform: Fixing inverted duty structures, which hurt industries like textiles, footwear, and electronics.

- Rate Rationalization: A simpler two-slab system avoids disputes over classification.

- Ease of Living: Pre-filled returns, faster refunds, and reduced red tape for small businesses.

Consumer Impact: What Changes for You

- Grocery Shopping

Staples like flour, edible oil, and packaged food moving to 5% could shave ₹200–300 off an average monthly household bill. - Electronics & Appliances

Big-ticket items such as fridges, TVs, and laptops could see price cuts of 8–10%, encouraging middle-class families to upgrade. - Dining Out

Restaurants in the mid-tier range may now fall under 5%, making dining out more affordable for families. - Healthcare & Education

Currently mostly exempt, but reduced GST on related services (lab equipment, stationery) may bring indirect savings.

Impact on Businesses

- Small Businesses: Easier compliance through digital pre-filled returns reduces dependence on accountants.

- Startups: Less time spent on paperwork, more time on growth.

- Exporters: Faster refund processing boosts liquidity.

- Corporate India: Lower litigation costs, better input credit matching.

State-Level Implications

GST revenues are shared between the Centre and states. Critics worry states may lose revenue with lower rates. For example, states reliant on alcohol and luxury goods may not like the shift. The Centre has promised compensation mechanisms, but negotiations in the GST Council could be intense.

The Economic Angle

According to Reuters, the GST revamp may initially reduce tax revenue by about ₹500 billion (0.15% of GDP). Yet, economists argue that increased consumption could balance this out. India’s GDP growth could see a 0.6% bump next year thanks to GST 2.0.

This reflects the Laffer Curve principle—lower taxes can drive higher revenue by boosting spending and compliance.

Political Angle

Beyond economics, GST 2.0 is also political. Rolling out reforms in October 2025, just before festive season and ahead of state elections, gives the government a chance to highlight its pro-people agenda. Branding it as a “double Diwali bonus” taps into cultural symbolism while addressing middle-class concerns about rising costs.

Global Comparisons

- Canada: GST is 5%, with provinces adding sales tax.

- Singapore: A flat 9% GST.

- Australia: 10% nationwide GST.

India’s simplified two-slab structure still isn’t as lean, but it’s a step closer to global best practices.

Career & Professional Opportunities

- Chartered Accountants: The transition will create demand for advisory services.

- Tax Tech Startups: New compliance tools will be in demand.

- Corporate Professionals: Skills in GST planning and supply chain optimization will become more valuable.

In short, GST literacy could be a career booster in the coming years.

Step-by-Step Guide for Consumers

- Check Your GST Bill: Look at the GST rate applied—most essentials should now show 5%.

- Compare Prices Before & After October: Hold off on appliances and electronics until rollout for maximum savings.

- Ask for GST Invoice: Always demand an invoice—this ensures you’re not overcharged.

- Track Official Announcements: Follow the GST Council Website for rate lists.

Challenges & Risks

- Short-term fiscal strain on state and central revenues.

- Complex transition period as businesses update invoicing and software.

- Risk of non-compliance if small businesses struggle with digital adaptation.

Still, the government is betting on long-term gains outweighing short-term pain.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

Infosys Hit With GST Fine In Singapore – What The Filing Reveals