China’s Super Rich Hit With Surprise Global Tax Crackdown: If you’ve been following global finance news, you’ve probably seen the headline: China’s super rich hit with a surprise global tax crackdown. And this isn’t just business as usual—it’s a game-changing shift. For decades, China’s wealthiest elites parked their money overseas, thinking it was untouchable. But Beijing just flipped the script, demanding a 20% tax on offshore income for anyone living in China more than 183 days a year. What’s shocking isn’t just the rate—it’s how broad the scope is. We’re talking billionaires, yes, but also middle-class investors, employees with stock options, and even small business owners. This is a move that blends economic necessity, global cooperation, and political willpower. And if you think it won’t ripple across the globe, think again.

China’s Super Rich Hit With Surprise Global Tax Crackdown

China’s surprise tax crackdown is bigger than a headline—it’s a fundamental shift. Offshore income, once a safe haven for the wealthy, is now firmly in Beijing’s sights. With CRS data-sharing, AI-driven audits, and strict deadlines, the message is clear: no hiding place remains. For billionaires, mid-level employees, and small business owners alike, the smart move is simple: get compliant, stay ahead, and rethink how global investments fit into your financial future.

| Topic | Details | Source/Link |

|---|---|---|

| Target Group | Residents in China 183+ days/year (from ultra-rich to middle-class) | FT |

| Tax Rate | 20% on offshore income (stocks, dividends, options, property) | Business Standard |

| Scope Expansion | From billionaires (>$10M) to investors with <$1M | IFC Review |

| Deadline | June 30, 2025, for 2024 filings | Business Standard |

| Tools Used | OECD Common Reporting Standard (CRS), AI-driven tax systems | OECD CRS |

Why the Crackdown, and Why Now?

China’s economy has been under strain for years:

- Property prices are slumping nationwide.

- Local governments owe trillions in hidden debt.

- Land-sale revenues—a key income stream—have dried up.

- Social programs like baby subsidies and pensions are demanding fresh funds.

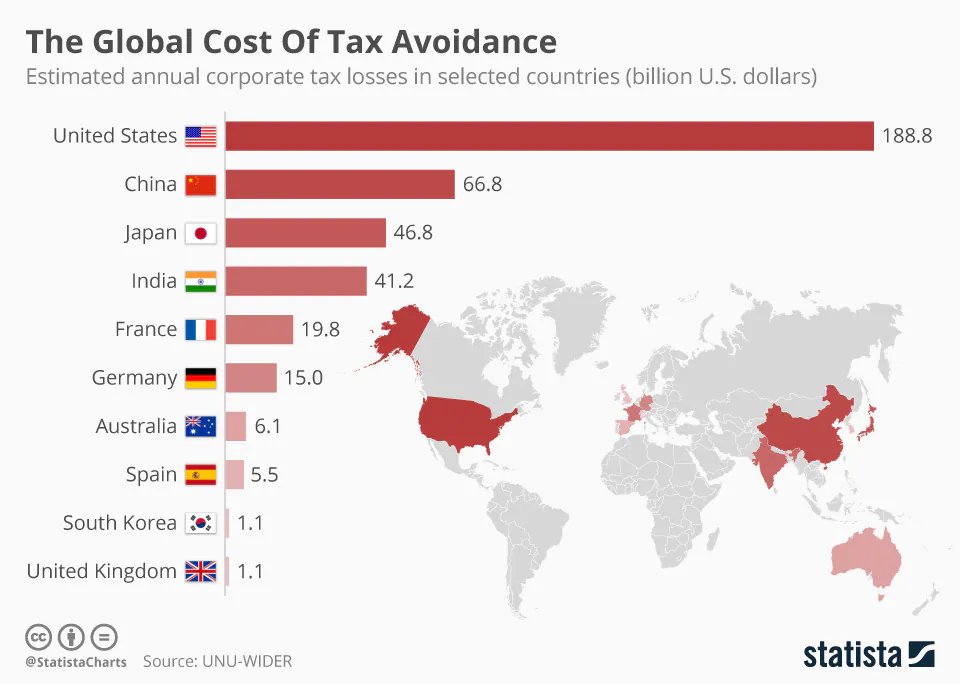

Collecting taxes from offshore wealth solves two problems at once: it brings in revenue and reinforces President Xi Jinping’s “common prosperity” agenda, which emphasizes reducing inequality and curbing the excesses of the wealthy.

This isn’t just about plugging budget holes. It’s about political optics. Cracking down on the rich plays well with a public frustrated by widening wealth gaps.

A Historical Shift in Tax Enforcement

China’s tax policy didn’t get strict overnight. Back in 2019, Beijing updated its Individual Income Tax Law, defining “tax residency” based on the 183-day rule. That was the first sign the government wanted to close loopholes.

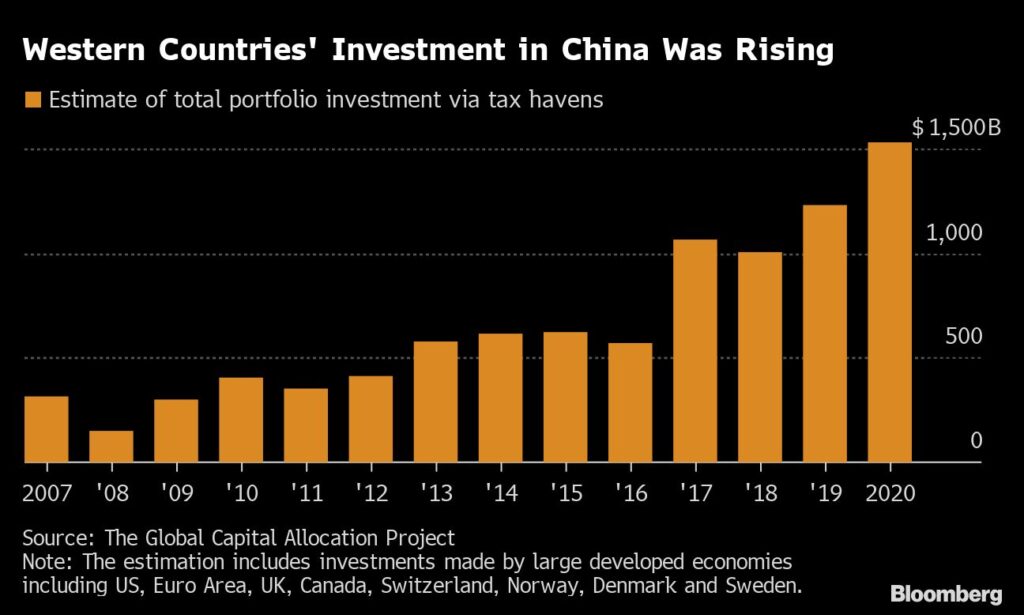

What changed in 2025 is enforcement. Thanks to the OECD’s Common Reporting Standard (CRS), Beijing now has access to account information from over 100 jurisdictions, including Hong Kong, Singapore, and Switzerland. That’s a massive change.

Before, a billionaire could hide millions in a Cayman Islands trust with little fear of exposure. Now? Automatic data-sharing beams those records straight to Chinese tax authorities.

How the China’s Super Rich Hit With Surprise Global Tax Crackdown?

China’s wealthiest citizens—estimated at over 750 billionaires in 2024 according to Forbes—are directly in the crosshairs. Many of them stashed fortunes abroad to shield assets from domestic volatility.

But under CRS:

- A Hong Kong brokerage account is no longer private.

- A Singapore trust fund is automatically flagged.

- A Swiss bank account is now visible in Beijing.

Already, cases are emerging. One investor in Shanghai was fined for failing to report overseas dividends. The penalty included not only back taxes but also daily interest charges until payment. That story is circulating widely as a warning.

The Middle Class Joins the Target List

The truly surprising part is the expansion of the crackdown beyond billionaires. Authorities are now eyeing:

- Tech workers with U.S. stock options worth tens of thousands.

- Families holding modest overseas savings accounts.

- Entrepreneurs parking profits abroad for “safe-keeping.”

A Shanghai tax bureau recently told residents earning offshore investment income—even if under $50,000—to report by June 30, 2025, or face penalties. That’s a far cry from the stereotype of “super rich.”

Lessons from the U.S. and Europe

China isn’t reinventing the wheel. The U.S. set the global standard with FATCA (Foreign Account Tax Compliance Act), which forces banks worldwide to report American accounts or risk sanctions. Europe followed suit with stricter transparency laws.

The difference is cultural. In the U.S., people grumble about the IRS but compliance is accepted as normal. In China, where offshore income was long ignored, this feels like a sudden, jarring shift.

How CRS Actually Works?

For anyone unfamiliar, CRS (Common Reporting Standard) is like an international “tax radar.” Financial institutions in participating countries collect information on non-resident accounts and send it to local authorities, who then share it with the account holder’s home country.

So if a Chinese citizen holds shares in a Hong Kong brokerage account:

- The broker reports the data to Hong Kong tax authorities.

- Hong Kong forwards it to Beijing under CRS rules.

- Beijing matches the account with the resident’s tax ID.

That’s why this crackdown is possible now: the information pipeline is global and automatic.

Impact on Businesses and Professionals

This policy shift is reshaping how businesses operate:

- CFOs of multinational firms must recalculate employee compensation packages that include overseas stock.

- HR departments need to educate staff about new tax liabilities.

- Tax advisors in Shanghai, Beijing, and Hong Kong are seeing surges in consultations.

It’s not just about filing. For companies, it’s about staying compliant and avoiding reputational damage if employees get caught under-reporting.

Practical Guide: What to Do Now

Step 1: Know If You’re a Tax Resident

183+ days in mainland China = tax resident. Period.

Step 2: Identify Taxable Income

This includes offshore stocks, options, dividends, and rental income.

Step 3: Mark the Deadline

June 30, 2025, is the filing deadline for 2024 offshore income.

Step 4: Expect Better Detection

Authorities are combining CRS data with AI-driven analytics to spot inconsistencies.

Step 5: Seek Professional Advice

Cross-border tax specialists can help navigate reporting obligations legally.

Real-Life Example

Take “Mr. Zhang,” a mid-level engineer at a multinational tech firm in Shanghai. His U.S. stock options are valued at $200,000. In previous years, he ignored them for tax purposes.

Now, under new enforcement:

- His brokerage account is flagged via CRS.

- Beijing sends him a notice demanding disclosure.

- If he delays, penalties accumulate daily.

For Mr. Zhang, the risk of ignoring offshore income is far higher than before.

Investor Reactions

Not surprisingly, wealthy Chinese are exploring alternatives:

- Shifting assets to the U.S. since Washington hasn’t joined CRS.

- Considering emigration to countries with friendlier tax regimes.

- Restructuring portfolios to focus on domestic assets.

But each move carries risks. The U.S., for example, has its own disclosure rules and might eventually share data. Emigration is expensive and politically sensitive.

Risks of Non-Compliance

Failing to report offshore income in China can result in:

- Back taxes with interest.

- Penalties for late filing.

- Possible criminal liability in severe cases.

Authorities have made it clear: voluntary disclosure now is safer than forced compliance later.

Future Outlook

This crackdown marks the start of a long-term strategy. Analysts expect:

- Higher tax rates in the future.

- More detailed reporting requirements.

- Closer cooperation between China and Western governments.

The global trend is unmistakable: offshore secrecy is disappearing. Governments want—and increasingly get—what’s theirs.

Net Direct Tax Collection Drops 4% – Should You Worry About FY26?

India’s Aggressive Investment Reforms: GST Relief, PLI Tweaks, and a Simpler Future

Infosys Fined by Singapore Over GST Payments—Here’s What the Company Just Revealed

Actionable Checklist

- Track your days in mainland China.

- Collect statements from all offshore accounts.

- Calculate 20% liabilities now, not later.

- File by June 30, 2025.

- Consult a tax advisor for cross-border planning.