Chinese National and Indian Director Nabbed in ₹9 Crore Evasion Case: If you’ve been tracking financial crime news, you’ve likely come across headlines about a Chinese national and an Indian director nabbed in a ₹9 crore GST evasion case in Greater Noida, India. At first glance, it sounds like something out of a Netflix thriller, but this case is very real—and it’s a perfect example of how international business, tax fraud, and money laundering collide. This isn’t just about big numbers on paper. Tax fraud hits the average citizen by reducing government revenue that funds schools, hospitals, and public infrastructure. And when shady money is funneled abroad through underground networks, it weakens the economy and investor confidence.

Chinese National and Indian Director Nabbed in ₹9 Crore Evasion Case

The arrest of a Chinese national and an Indian director in a ₹9 crore GST evasion case is more than just another headline—it’s a stark reminder of the dangers of cutting corners in business. From misclassification of products to hawala transfers, the scheme shows how fraudulent tactics can spiral into full-blown criminal cases. For policymakers, this highlights the urgent need for tighter monitoring of cross-border ventures. For businesses, the lesson is simple: honesty isn’t just good ethics—it’s smart business.

| Aspect | Details |

|---|---|

| Company | M/s Tentech LED Display Pvt Ltd (joint venture with Indian & Chinese stakes) |

| Accused Individuals | Vinay Kumar (Indian Director), Alice Lee / Li Tengli (Chinese national) |

| Fraud Amount | Approx. ₹9 crore (~$1.1 million) GST evasion |

| Techniques Used | Misclassification of goods, under-invoicing, cash collection, hawala transfers |

| Laundered Funds | Around ₹27 crore (~$3.3 million) moved abroad since 2019 |

| Court Proceedings | Both in judicial custody till September 1, 2025 |

| Reference | Official GST Website |

What Happened: The Case Explained

The company Tentech LED Display Pvt Ltd was in the business of selling Video Display Units (VDUs). But instead of reporting them honestly, they misclassified them as “cabinets.” Why? Cabinets fall under an 18% GST slab, while VDUs are taxed at 28%.

That 10% difference might not sound like much, but when you’re selling thousands of units, the numbers stack up quickly. Add to this the under-invoicing trick—reporting goods worth ₹18,000 as only ₹1,000–₹5,000—and you have a recipe for massive tax losses to the government.

The missing money wasn’t just sitting idle. According to investigators, Alice Lee (Li Tengli), the Chinese national, allegedly handled the cash side of things, moving ₹27 crore abroad through hawala channels since 2019.

Why Chinese National and Indian Director Nabbed in ₹9 Crore Evasion Case is Serious Business?

On paper, ₹9 crore (~$1.1 million) might look small compared to billion-dollar scandals we hear about globally. But here’s why this matters:

- That money could fund rural schools, medical clinics, or local infrastructure projects.

- It creates an unfair marketplace where fraudsters have an advantage over honest businesses.

- Sending ₹27 crore abroad drains capital from India’s economy, money that could have created jobs or funded innovation.

Think of it like someone skipping out on their share of rent every month while still enjoying all the perks of living in the apartment. Everyone else ends up carrying the burden.

GST in India: Why Classification Matters

The Goods and Services Tax (GST) was launched in 2017 to replace a confusing patchwork of state and central taxes. The idea was to simplify business and create a unified tax system across India.

But GST has multiple tax slabs—0%, 5%, 12%, 18%, and 28%—depending on the product or service. Businesses sometimes try to “game the system” by misclassifying products into a lower slab.

Example: If you import gaming consoles (28%) but declare them as computer accessories (18%), you instantly save on taxes. Fraudsters think they’re being clever, but eventually, audits catch up—and the penalties are severe.

According to the Indian Finance Ministry, GST evasion in 2023–24 was pegged at over ₹1.5 lakh crore. That’s a staggering hole in public revenue.

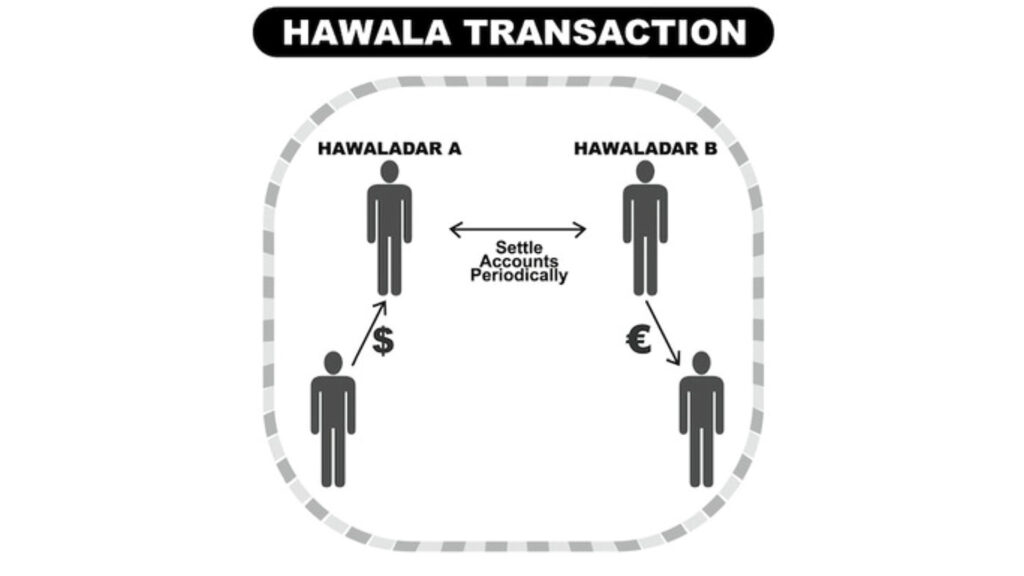

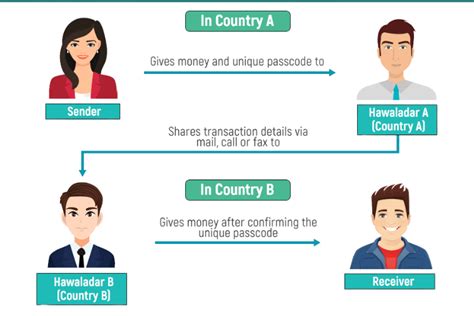

Hawala 101: The Shadow Banking System

One of the most intriguing parts of this case is the use of hawala.

What is hawala?

Hawala is an informal way of transferring money without physically moving it or using banks. It works on trust. A person gives money to a hawala broker in one country, who instructs a partner in another country to pay out the equivalent amount. No receipts, no banks, no paper trail.

Why do people use hawala?

- To avoid taxes and banking regulations.

- To move money quickly across borders.

- To fund illegal activities without detection.

Why is it risky?

Hawala is often linked to money laundering, terrorism financing, and organized crime. That’s why governments worldwide crack down hard on hawala operators.

In this case, Alice Lee allegedly used hawala to send ₹27 crore overseas, which raises questions about where the money ultimately landed.

Legal Framework & Penalties

Under Section 132 of the Central GST Act, evading more than ₹5 crore in GST is considered a serious offense. Punishments include:

- Imprisonment up to 5 years

- Heavy fines

- Seizure of properties and bank accounts

Additionally, the Prevention of Money Laundering Act (PMLA) can be applied if hawala or money laundering is involved, making the case even more serious.

Both Vinay Kumar and Alice Lee are currently in judicial custody, with proceedings set to continue until at least September 2025.

Similar Cases and Global Comparisons

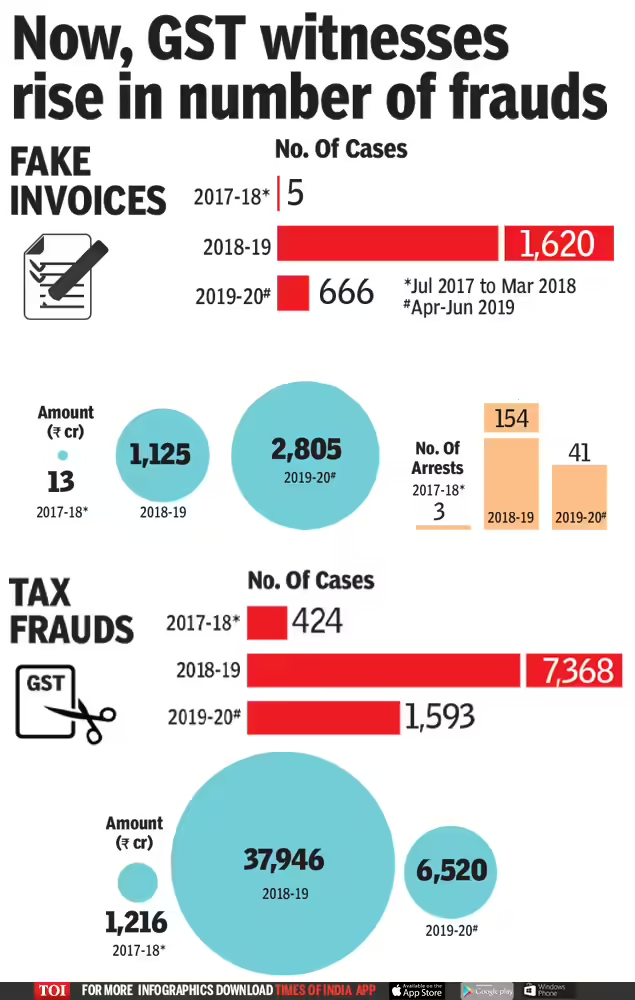

This isn’t India’s first brush with GST fraud.

- In 2023, Delhi police uncovered a ₹1,200 crore fake invoice scam involving shell companies.

- The European Union loses about €60 billion annually to VAT (Value-Added Tax) fraud, according to Europol.

- In the U.S., the IRS (Internal Revenue Service) estimates tax evasion costs the government over $600 billion every year.

The point? Tax fraud is a global epidemic, not just a local issue.

Impact on Economy and Governance

When cases like this surface, the damage goes beyond money.

- Public Trust Erodes – Citizens lose confidence in fair governance when fraudsters get away with scams.

- Foreign Investors Get Cautious – Joint ventures with foreign directors face more scrutiny. Investors wonder if their money is safe.

- More Compliance Pressure – Honest businesses get weighed down by tighter audits and paperwork because of fraud committed by others.

In the long run, frequent fraud stories can hurt India’s reputation as a business-friendly destination.

Lessons for Businesses and Professionals

What can we learn from this? Plenty.

Compliance Checklist for Entrepreneurs

- Know your GST slab: Always confirm with tax experts which category your product falls under.

- Maintain accurate invoicing: Fake or under-valued invoices can lead to arrests.

- Keep transactions digital: Minimize cash dealings to reduce audit risks.

- Vet your partners: International joint ventures need thorough due diligence.

- Invest in tax software: Use tech to avoid errors and detect suspicious activities early.

Remember, compliance is cheaper than jail.

GST Structure Simplified – Key Changes Explained

Coimbatore Trade Bodies Petition CM Against State GST Harassment

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties