CLSA Warns of GST Trap: When you read the headline “CLSA warns of GST trap: Can India cut taxes without crippling capex dreams?”, it may feel like heavy financial jargon. But if we unpack it step by step, it’s really a story about how a country decides whether to put more money into people’s pockets today or invest in building the future. This debate affects millions—from families buying groceries to businesses expanding their factories and even governments deciding how much they can spend on highways and defense. Understanding this balance is key to making sense of where India’s economy is headed.

CLSA Warns of GST Trap

The big question—“Can India cut taxes without crippling capex dreams?”—doesn’t have a simple yes or no answer. On one side, lower GST rates could fuel immediate consumption, giving households relief and boosting GDP in the short run. On the other, slashing revenue risks slowing down India’s ambitious infrastructure and defense programs that are vital for long-term growth. The best path forward lies in smart, targeted GST reform. Lower taxes on essentials, maintain or raise them on luxury goods, strengthen compliance, and ensure states are supported. That way, India can enjoy both short-term economic cheer and long-term capex-driven progress.

| Aspect | Details |

|---|---|

| The Warning | CLSA (Credit Lyonnais Securities Asia) projects a ₹1.5 lakh crore annual revenue loss if GST rates are cut (₹75,000 crore hit each for the central and state governments). |

| Why It Matters | Cutting GST slabs (from 12% & 28% to 5% & 18%) may spark spending but could squeeze funds for capital expenditure (capex) like infrastructure, defense, and transport. |

| Growth Outlook | Morgan Stanley sees tax cuts adding 50–70 basis points to GDP growth, while Bernstein estimates $12–13 billion in extra consumption. |

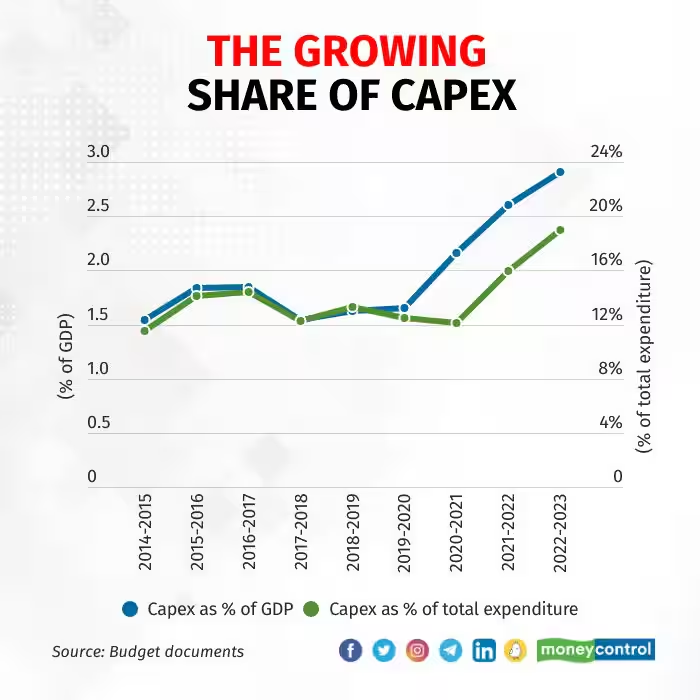

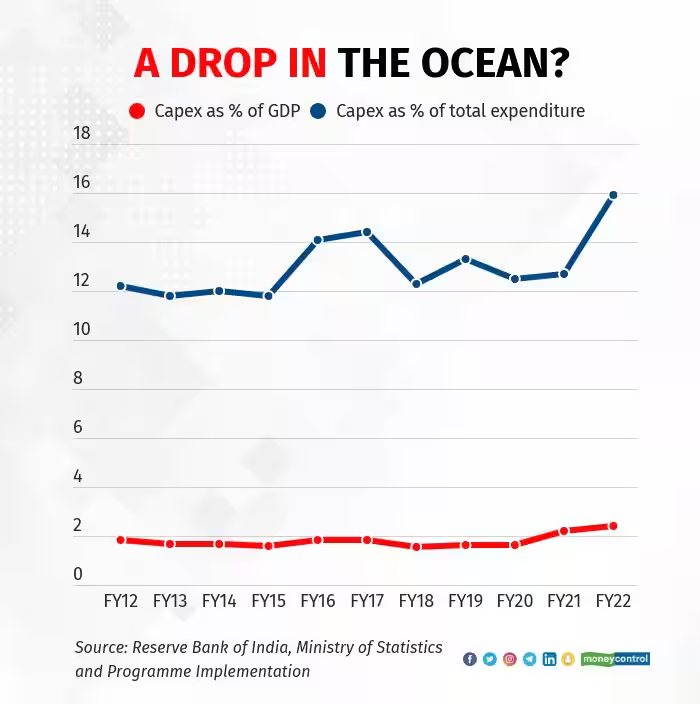

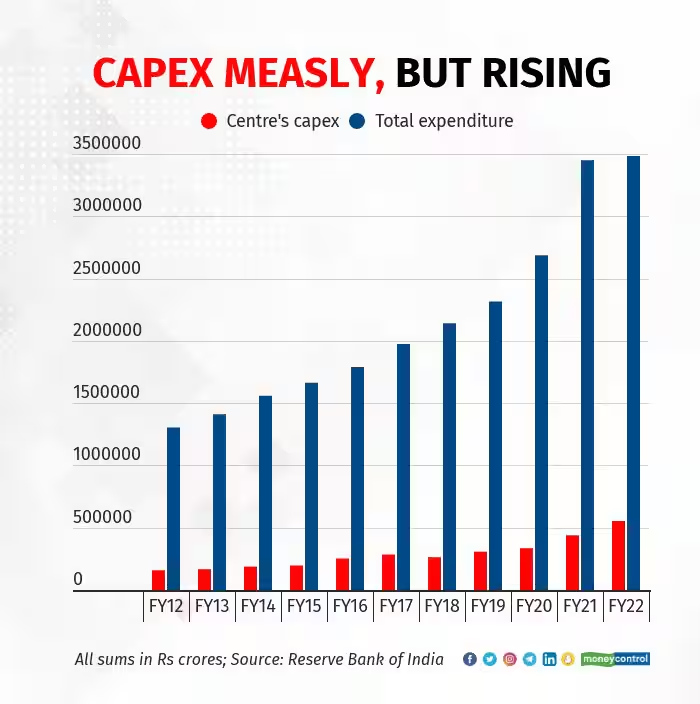

| Capex Strength | CLSA notes FY26 capex at 4.3% of GDP, the highest ever, totaling ₹15.5 lakh crore. |

| The Challenge | Balancing short-term demand (shopping, retail sales, travel) with long-term investment (roads, rail, energy, defense). |

| Official Resource | Visit the GST Council Official Website for updates. |

A Quick Flashback: GST in India

Before GST was launched in 2017, India’s tax system was a maze. Different states had their own rules, and consumers often ended up paying multiple layers of taxes. For businesses, this was a nightmare: a truck transporting goods across states had to stop at check posts, pay different duties, and file a mountain of paperwork.

GST was meant to fix this. It replaced a bundle of indirect taxes with a single, nationwide tax. The promise was “one nation, one tax”, smoother business operations, less tax evasion, and better compliance.

But here’s the catch: India introduced multiple GST slabs (5%, 12%, 18%, 28%), unlike some countries that prefer a single or dual rate system. Now, policymakers want to simplify this into just two main slabs—5% and 18%.

What’s the “GST Trap”?

CLSA calls it a trap because simplifying GST by cutting slabs looks good on paper but comes with a hidden cost: lost revenue.

Here’s the math:

- If slabs are cut, the government could lose ₹1.5 lakh crore every year.

- This loss would be split roughly half for the central government and half for the states.

- Without that revenue, governments might have to cut back on capital expenditure (capex).

Think of it like your family budget. If you take a pay cut but still want to keep renovating the house, buying a new car, and paying for college, you’ll have to borrow more—or drop some plans. India faces the same choice.

Why Cut GST at All?

The case for cutting GST is about boosting consumption.

- Bernstein estimates lower GST would free up $12–13 billion for households to spend.

- Morgan Stanley expects this to add 0.5–0.6 percentage points to GDP growth.

That means:

- Middle-class families can buy more everyday goods.

- Businesses like retail, consumer goods, and travel see higher sales.

- Short-term economic activity looks healthier.

For example, if GST on household appliances drops, more families might upgrade their refrigerators or washing machines. If GST on services falls, more people may book vacations or dine out.

Why Keep GST Rates High?

The case against cuts is about protecting investment in the future.

Capital expenditure is money spent on building things that last—roads, airports, railways, power plants, defense systems. It doesn’t give instant gratification like shopping does, but it lays the foundation for sustained growth.

CLSA points out that FY26 capex is expected to hit 4.3% of GDP—the highest ever. This equals ₹15.5 lakh crore, a massive jump of nearly 19% year-on-year.

Cutting GST could force the government to trim this spending. And if that happens, India risks slowing down on critical areas like:

- Renewable energy projects.

- Metro rail expansions.

- Smart cities development.

- Defense manufacturing under “Make in India.”

The States’ Dilemma

One of the biggest challenges is how state governments will cope. States rely heavily on GST collections to fund schools, hospitals, and local infrastructure.

If slabs are cut and revenue falls, states may be forced to:

- Reduce spending on welfare programs.

- Delay new infrastructure projects.

- Depend more on central government compensation.

But the central government itself is cautious about promising long-term compensation, especially after already providing it for the first five years of GST.

This creates political friction. States argue they should not lose out on revenue for a reform they didn’t design alone.

Global Lessons: What Other Countries Show

India isn’t the first country to face this trade-off.

- In the United States, tax cuts have often boosted short-term growth but widened the fiscal deficit. For example, the 2017 corporate tax cuts gave companies a boost but added trillions to U.S. debt.

- In Europe, austerity after the 2008 financial crisis showed the dangers of cutting public investment too sharply. Countries that slashed infrastructure budgets found it harder to recover.

The lesson: balance is everything. Tax reform must be paired with fiscal responsibility, or the economy pays the price later.

CLSA Warns of GST Trap: Middle Paths to Consider

Instead of going for a blanket GST cut, experts suggest smarter strategies:

- Targeted cuts: Lower GST on essentials like food, healthcare, and education while keeping higher rates on luxury goods.

- Improved compliance: Use digital tracking and AI to reduce tax evasion, expanding the tax base without cutting rates.

- Compensating states: Create a clear, time-bound fund to support state revenues during the transition.

- Linking cuts with reforms: For instance, cut GST for industries that commit to job creation or green investments.

Practical Advice for Professionals, Investors, and Businesses

- For professionals and households: If GST cuts happen, expect cheaper goods and services in the short run, but be mindful of possible inflation later if deficits rise.

- For entrepreneurs: Consumer-facing businesses (retail, travel, FMCG) may see higher demand. Infrastructure-linked businesses could face slower growth if capex is cut.

- For investors: Stocks in consumer and banking sectors might benefit, while infrastructure and capital goods companies may feel the pinch.

The key is to stay diversified. Balance investments across consumer growth plays and long-term infrastructure themes.

GST Overhaul Ahead Of Diwali – Relief For Consumers, Risk For Revenue

Lower GST On Household Items – What The Council Is Planning

FMCG Stocks in Focus – Which Companies Gain the Most From GST Reforms?

Broader Economic Implications

GST cuts also intersect with other economic priorities:

- Inflation: Lower GST could reduce prices temporarily, but if fiscal deficits rise and borrowing increases, inflationary pressures could return.

- Jobs: Consumption-led growth may create retail and service jobs quickly, but infrastructure spending creates more durable employment in construction, manufacturing, and logistics.

- Fiscal health: India’s fiscal deficit target is already ambitious. Any revenue shock could make it harder to maintain credibility with global investors and credit rating agencies.