CM Stalin On Tax Distribution: When CM Stalin on tax distribution hit the headlines recently, it stirred a national debate on how India manages money between the Union government and its states. To make it simple, think of this: if you and your buddies all chip in for a pizza, and you put in the most money but end up with the smallest slice, you’d be pretty annoyed. That’s how Tamil Nadu and some other states feel about the way taxes are collected and redistributed in India. This is not just a political soundbite—it’s a serious conversation about federalism, fairness, and the economic future of India. And while the language can get technical, we’ll break it down in a conversational, easy-to-grasp way that works for both casual readers and professionals.

CM Stalin On Tax Distribution

CM Stalin’s remarks on tax distribution and Union-State relations go beyond regional politics. They strike at the heart of India’s federal balance. With states carrying most of the spending burden but receiving less revenue, it’s time to revisit the system. History shows that when states are financially strong, the whole nation prospers. Fair distribution of taxes is not a favor from the Union—it’s the foundation of a democratic federation.

| Topic | Details |

|---|---|

| Issue | Tamil Nadu and other states argue they contribute heavily to the national tax pool but receive disproportionately less in return. |

| Data Point | Tamil Nadu contributes nearly 10% of India’s tax revenue but receives much less in central transfers. |

| Action Taken | Tamil Nadu set up a High-Level Committee chaired by Justice Kurian Joseph to study 50 years of Union-State relations. |

| Public Engagement | Citizens can provide input via hlcusr.tn.gov.in. |

| Global Parallel | Similar debates exist in the U.S. (California vs. Mississippi), Canada (Alberta vs. Ottawa), and Germany (Bavaria vs. eastern states). |

| Goal | Push for constitutional reforms to ensure fiscal fairness and protect state autonomy. |

The Historical Backdrop: How Did We Get Here?

The roots of this issue lie in India’s Constitution of 1950. The framers of the Constitution built a system where the Union collected most of the major taxes while states depended on transfers. The goal was to ensure national development and help poorer states catch up with richer ones.

Over time, this balance has tilted even more toward the Union:

- 1950s–1970s: Finance Commissions focused on equalizing resources by giving more funds to poorer states.

- 1991 Economic Reforms: Liberalization allowed industrialized states like Tamil Nadu, Maharashtra, and Gujarat to grow rapidly, increasing disparities with slower-growth states.

- 2017 GST Reform: The Goods and Services Tax replaced many state taxes with a single national tax. This reduced the states’ autonomy over taxation and made them more dependent on the Centre.

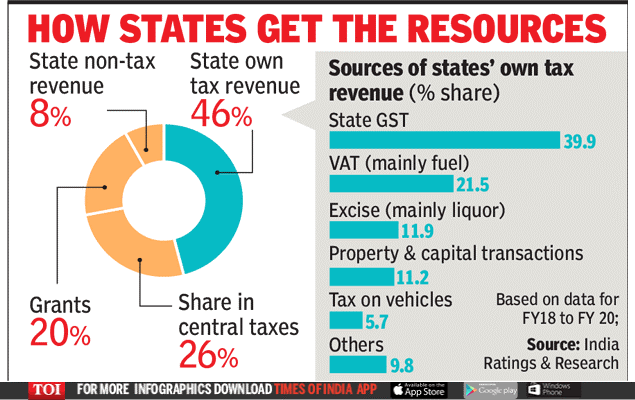

Today, the Union controls nearly two-thirds of India’s revenue, but states carry out most of the spending responsibilities, from healthcare and education to roads and welfare.

CM Stalin On Tax Distribution

M.K. Stalin, Tamil Nadu’s Chief Minister, has been vocal about what he calls “fiscal injustice.” His arguments can be summarized in three main points:

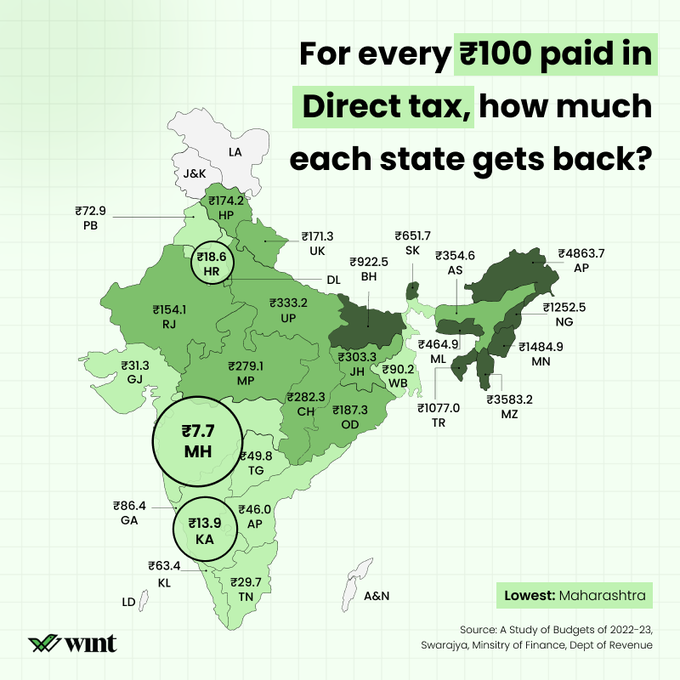

Fiscal Unfairness

Tamil Nadu contributes close to 10% of India’s total tax revenue, but when central funds are redistributed, it receives far less than states with larger populations but smaller economies. For example, Tamil Nadu receives less per person than states like Uttar Pradesh and Bihar.

Political Bias

Stalin and other opposition leaders argue that the Union government uses funding as a tool of political control. Opposition-ruled states often claim that their funds are delayed or reduced.

Federal Spirit

India is described in its Constitution as a “Union of States.” Stalin’s argument is that this spirit is being undermined. By centralizing financial power, states lose the autonomy they need to govern effectively.

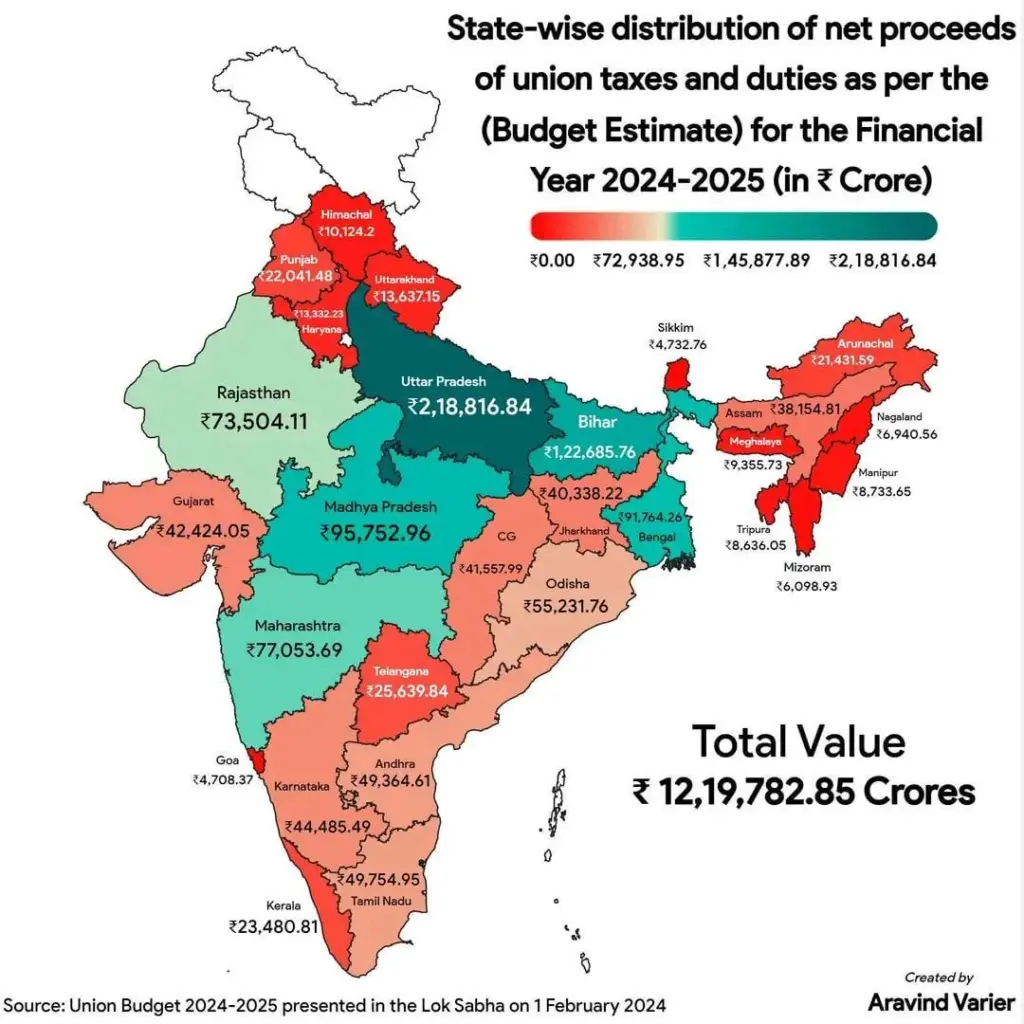

Data Deep Dive: Numbers That Tell the Story

To understand why this issue resonates, let’s look at some numbers from the Reserve Bank of India and the 15th Finance Commission:

- States like Tamil Nadu, Maharashtra, Gujarat, and Karnataka together contribute over 40% of India’s total tax revenue.

- Yet, they receive less than 30% of the redistributed funds.

- In contrast, states with lower economic contributions but higher populations receive more, as the Finance Commission formula gives 45% weight to population size.

- The Union retains control of about 62% of total revenue, but states are responsible for over 60% of total public expenditure.

This creates what economists call a vertical imbalance—where one level of government has the money and the other has the responsibilities.

Global Comparisons: India Is Not Alone

To make sense of this, it helps to see how other federal systems deal with similar problems:

United States

Wealthy states like California and New York argue they contribute far more to federal taxes than they receive back in spending. Meanwhile, states like Mississippi benefit disproportionately. The federal government balances this by funding programs like Medicaid and education grants, but resentment still exists.

Germany

Germany uses a system called “Länderfinanzausgleich” (state financial equalization). Rich states like Bavaria and Baden-Württemberg complain about sending billions to poorer eastern states. This has even led to legal battles in German courts.

Canada

In Canada, oil-rich Alberta often clashes with Ottawa over “equalization payments” that redistribute its wealth to provinces like Quebec. Alberta leaders argue they’re being punished for success.

The common thread? Federal systems everywhere struggle to balance fairness with equity.

Pros and Cons of Redistribution

To be fair, there are two sides to the story.

Pros of Central Redistribution

- Helps poorer states catch up.

- Ensures national programs like health and education reach everyone.

- Promotes unity by reducing regional inequality.

Cons of Over-Centralization

- Punishes states that have invested in good governance, industry, and population control.

- Creates dependency rather than incentivizing efficiency.

- Fuels resentment and weakens trust in the federal system.

Practical Guide: Possible Solutions

So, what can be done to fix this? Here are some ideas being floated by economists, policymakers, and leaders like Stalin:

Reform the Finance Commission Formula

Currently, the formula prioritizes population size (45%) over tax effort (15%). Reformers argue that more weight should be given to efficiency, industrial growth, and revenue contribution.

Strengthen State Autonomy

States should have greater leeway to raise their own taxes, rather than relying on central handouts. Re-examining GST and giving states more say in its structure is one possible path.

Legal and Constitutional Changes

Stalin has called for constitutional amendments to enshrine stronger state autonomy. Courts could also be used to challenge what states see as unfair practices.

Citizen Engagement

Tamil Nadu’s online platform with 234 questions invites citizens to share views on federalism, taxation, and governance. This kind of participatory democracy makes the issue more transparent.

Why This Debate Matters to Professionals?

- Policy Makers: It shapes how resources are allocated, directly influencing national development.

- Economists and Researchers: It’s a live case study in fiscal federalism, useful for comparative analysis.

- Business Leaders: Tax structures and fiscal transfers affect state-level infrastructure and investment climate.

- Students and Citizens: It impacts welfare programs, school funding, healthcare access, and even job creation.

36 Shops Sealed in Indore – Property Tax Non-Payment Crackdown Intensifies

Big Tax Bill Update – Child Tax Credit Changes Every Family Should Know About

Jane Street Tax Probe Deepens as EY Pulled Into Investigation

Actionable Takeaways

- States should collaborate to push for fairer finance commission formulas.

- Citizens should participate in surveys and demand transparency in tax allocation.

- Businesses should monitor tax changes closely as they directly affect state-level incentives.

- Policymakers should design systems that reward efficiency, not just population size.