CMA Association Slams Income Tax Act Changes: In the world of tax, accounting, and business compliance, accountants are the unsung heroes—ensuring businesses stay on track with their tax obligations, file accurate financial statements, and adhere to regulatory frameworks. However, recent changes to the Income Tax Act of 2025 have sparked a major controversy. A change in the definition of “accountant” has now excluded one key group of professionals from conducting tax audits—Cost and Management Accountants (CMAs). This article breaks down the issue, explaining why the exclusion of CMAs is such a big deal, how it could impact the industry, and what’s being done about it. Whether you’re a CMA, a Chartered Accountant (CA), or simply someone looking to understand the complexities of the Income Tax Act, this article will provide clarity on a pressing issue in India’s accounting landscape.

CMA Association Slams Income Tax Act Changes

| Topic | Details |

|---|---|

| The Issue | The Income Tax Bill 2025 restricts tax audits to Chartered Accountants (CAs), leaving out Cost and Management Accountants (CMAs). |

| What’s New? | The updated definition of “accountant” limits the role to only CAs, creating a distinction between the roles of CAs and CMAs. |

| Why It Matters | CMAs have specialized skills in cost management, taxation, and compliance, which are valuable in tax audits and could lead to greater efficiency. |

| Impact on Tax Audits | The restriction means CMAs cannot perform tax audits, an area where their expertise could be highly beneficial. |

| CMA’s Response | The Institute of Cost Accountants of India (ICMAI) has expressed disappointment, urging the government to include CMAs in the definition. |

| Government’s Position | The government believes the role of tax auditors should be restricted to CAs under the Chartered Accountants Act, limiting CMAs’ involvement in audits. |

| Looking Forward | The debate may lead to changes in future policies, with the potential for greater collaboration between CAs and CMAs in audit-related work. |

| Official Reference | For more information, visit the official ICMAI website here. |

The Conflict: Understanding the Issue

Background of the Income Tax Bill 2025

The Income Tax Bill of 2025 brought forth several significant revisions to India’s tax law. One of the most notable changes is the narrowing of the definition of “accountant”. Section 515(3)(b) now defines “accountant” as only a Chartered Accountant (CA), effectively excluding Cost and Management Accountants (CMAs) from conducting tax audits.

This change has created a stir within the accounting community, especially among CMAs, who have historically been involved in tax-related audits, albeit in a more specialized capacity. The exclusion of CMAs from tax audits has raised concerns about professional autonomy, job opportunities, and the future of the profession.

Why Does This Matter?

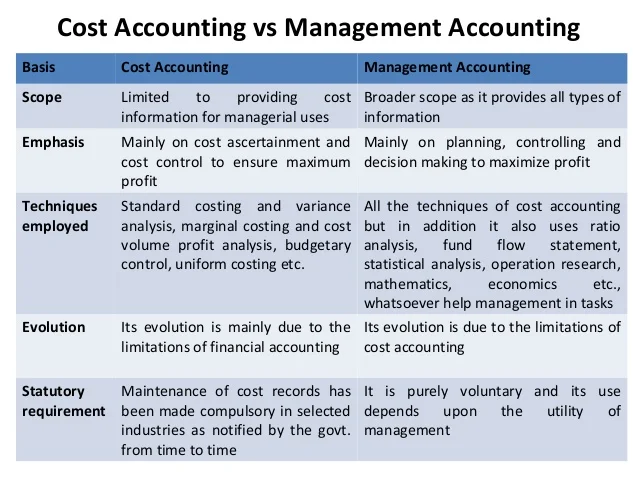

It’s important to understand that while both CAs and CMAs are accountants, their roles are distinctly different.

CAs primarily conduct statutory audits, ensuring that financial statements are accurate and in compliance with relevant laws. They also play a central role in tax planning and financial reporting. This role is backed by the Chartered Accountants Act of 1949, which gives CAs exclusive rights to conduct audits, including tax audits.

On the other hand, CMAs specialize in areas like cost auditing, cost management, and business performance evaluation. Their expertise is critical in ensuring that businesses run efficiently and within budget. CMAs are also involved in valuation audits under the Central Excise Act and cost certifications under RERA (Real Estate Regulatory Authority).

By excluding CMAs from tax audits, the government has restricted their role in areas where their specialized skills could add significant value, like tax compliance and cost control strategies.

What’s at Stake for CMAs?

Legal and Professional Argument

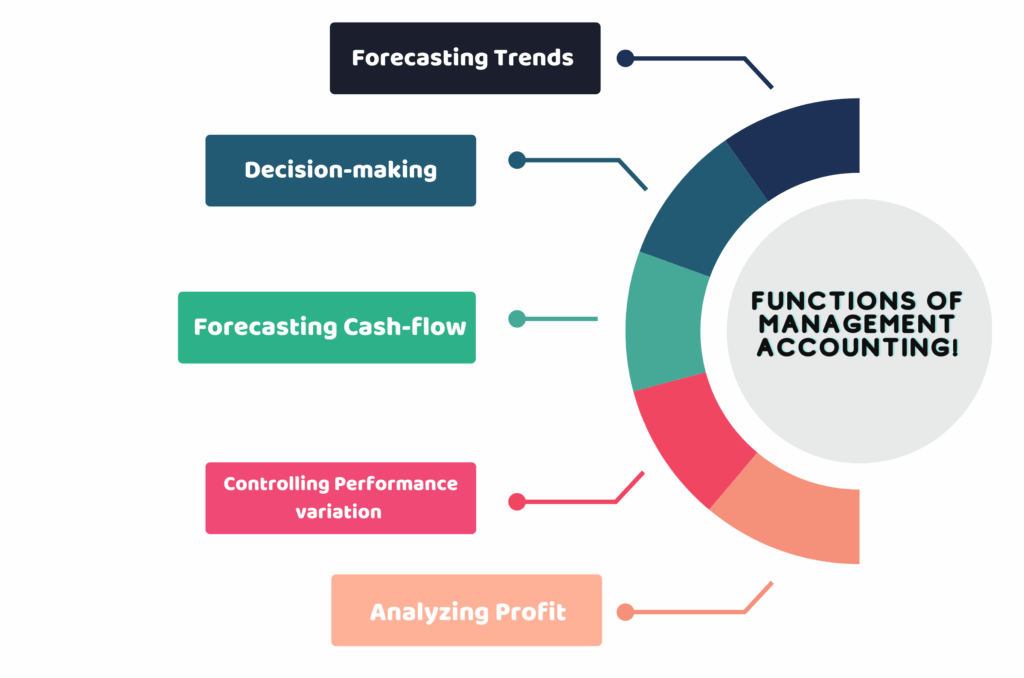

The Institute of Cost Accountants of India (ICMAI), representing CMAs, has expressed strong opposition to this change. They argue that CMAs are just as qualified to conduct tax audits as CAs, given their expertise in taxation and compliance. CMAs are also well-versed in handling issues related to cost management, a skill that can be invaluable during audits, especially when it comes to identifying areas of tax savings or business inefficiencies.

Furthermore, CMAs have traditionally been involved in cost certifications under laws such as RERA and Excise. The exclusion from tax audits, they argue, marginalizes their role in the overall audit process and limits their opportunities in business governance and financial compliance.

Key Points in the CMA Association Slams Income Tax Act Changes Debate

1. The Importance of Including CMAs

The exclusion of CMAs from tax audits has wider implications. CMAs bring a unique perspective to audits, focusing on cost-effectiveness, profit margins, and financial transparency. Their exclusion could potentially reduce the diversity of skills available in tax audits, leading to a less comprehensive audit process.

For example, CMAs often analyze business cost structures, something that CAs may not prioritize as deeply. With CMAs excluded from tax audits, businesses might miss out on valuable insights regarding cost-saving opportunities or operational inefficiencies.

2. The Government’s Position

The Indian government has defended its decision to limit tax audits to CAs, arguing that the role of a tax auditor falls within the scope of the Chartered Accountants Act, and CAs have the legal backing to perform these duties. This means that CAs are seen as the primary professionals when it comes to tax audits, and expanding this role to include CMAs would require changes to the legal framework governing both professions.

What’s Next? The Potential Impact

The future of the CMA profession is now in the hands of the government. The ICMAI has formally requested the inclusion of CMAs in the revised definition of “accountant” under Section 515(3)(b) of the Income Tax Bill. If successful, this change could open up new opportunities for CMAs in the realm of tax audits.

Additionally, this debate could pave the way for a collaborative framework between CAs and CMAs, where each group’s unique skill set could be leveraged to provide a more comprehensive approach to audit processes and tax compliance.

The outcome will likely depend on the government’s willingness to review the legal distinctions between CAs and CMAs, and whether they’ll allow for a more inclusive definition of “accountant” that reflects the growing complexity of the financial landscape.

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Big Win for Bus Services: CESTAT Grants Service Tax Exemption for Employee & School Transport

2025’s Most Important ITAT Rulings: Half-Yearly Income Tax Case Digest Reveals Critical Insights