Corporates Must Pass GST Benefits to Consumers: that’s the bold message from policymakers, regulators, and the Confederation of Indian Industry (CII). The government’s expectation is simple: when GST rates drop, businesses must pass the savings to consumers instead of pocketing the difference. Sounds straightforward, right? But in practice, it’s a bit messier. Many businesses either delay price adjustments or avoid them altogether, which affects millions of everyday shoppers and weakens trust in brands. Let’s break this down in the simplest, clearest way possible — with facts, examples, and tips you can actually use.

Corporates Must Pass GST Benefits to Consumers

The message from the CII and the government is loud and clear: corporates must pass GST benefits to consumers. This isn’t just a compliance requirement — it’s a moral and economic responsibility. Businesses that pass savings forward build trust, loyalty, and brand equity while avoiding penalties. The bottom line? Transparent pricing benefits everyone — consumers, businesses, and the economy.

| Highlight | Details |

|---|---|

| GST Rate Cuts | Reduced GST on essentials like pulses, medicines, and packaged foods. |

| Potential Consumer Benefit | ₹30–₹40 crore/day if corporates comply. |

| Legal Backing | Section 171 of the CGST Act mandates passing on savings to consumers. |

| Business Impact | Builds trust, boosts sales, and prevents penalties. |

| Consumer Rights | Shoppers can file complaints against profiteering firms. |

| Official Reference | Ministry of Finance, Government of India |

Why This Matters?

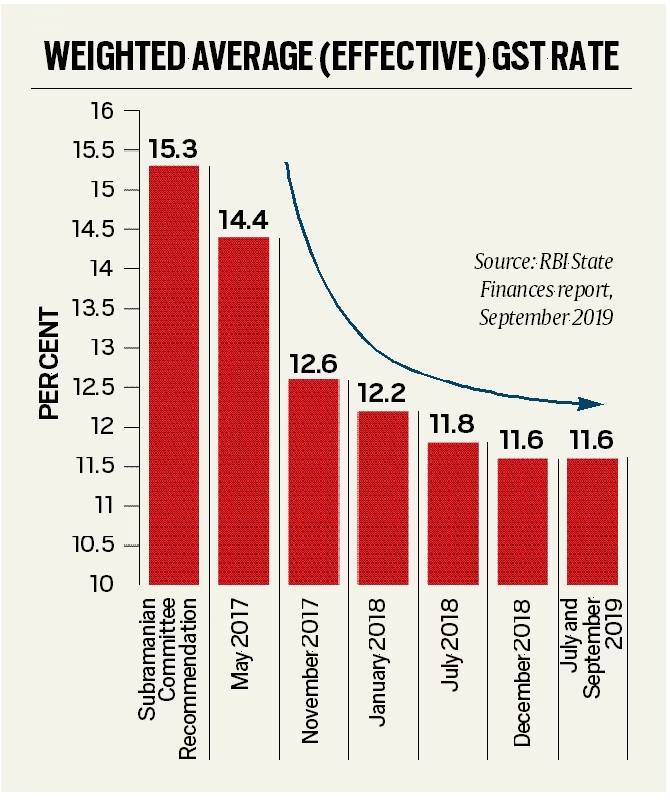

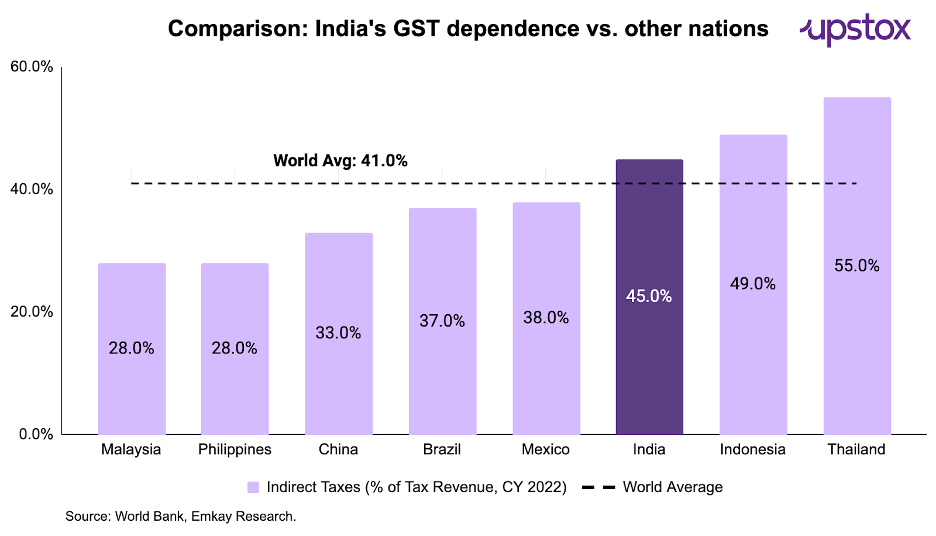

The Goods and Services Tax (GST) is India’s unified indirect tax framework. It was designed to simplify the country’s tax structure and make pricing transparent and predictable. But when businesses don’t pass on the savings from reduced GST rates, consumers lose out — and the economy doesn’t get the boost it deserves.

For example, after the March 2024 GST rate cuts, essential goods like medicines, pulses, and packaged foods became cheaper on paper. But if sellers don’t lower prices, households miss potential savings worth ₹30–₹40 crore daily, according to the Ministry of Finance, Government of India.

GST Simplified: What You Need to Know

Think of GST as a unified pricing system that replaced a messy web of indirect taxes. Its purpose is to make pricing simple, transparent, and fair.

But here’s where many businesses slip up:

When GST rates drop, you can’t keep charging the old price — you must pass the discount to consumers.

Otherwise, customers are unfairly charged, and businesses can face regulatory action.

Step-by-Step Guide to Corporates Must Pass GST Benefits to Consumers

Step 1 — Understand the Law

Section 171 of the Central GST Act makes it mandatory to pass on benefits when GST rates are reduced. The National Anti-Profiteering Authority (NAA) monitors compliance.

Step 2 — Audit Your Pricing Process

Track how GST rate cuts affect your cost of goods and maintain proper documentation to prove compliance.

Step 3 — Train Your Team

Educate your finance, billing, and sales teams so everyone understands how GST changes affect pricing.

Step 4 — Update Price Tags and Displays

Consumers expect transparent pricing in stores and online. Ensure updated price labels and billing systems.

Step 5 — Inform Consumers

Make it clear when you pass on savings — use social media, email updates, or even in-store banners.

Step 6 — Monitor Regularly

Review your prices frequently to ensure they reflect the latest GST rate changes.

Real-World Example: GST Cuts on Essentials

In March 2024, GST on pulses dropped from 12% to 5%. That means a ₹100 packet now costs ₹105 instead of ₹112 — a savings of ₹7 per unit.

Imagine if every consumer across India benefited from such savings — it would pump hundreds of crores back into household budgets, creating more spending power and boosting overall demand.

Why Passing GST Benefits Is Good for Business?

- Builds Consumer Trust: Shoppers appreciate brands that are transparent.

- Boosts Sales Volume: Lower prices lead to increased purchases.

- Keeps You Out of Trouble: Avoid fines, penalties, and damage to your reputation.

Passing GST benefits isn’t just the ethical thing to do — it’s a smart business strategy.

The Ripple Effect on India’s Economy

When corporates pass on GST benefits, the positive ripple effects go far beyond individual savings. Lower retail prices mean consumers can buy more products with the same income. That extra spending directly fuels demand, which pushes businesses to produce more and hire more workers.

For example, if each household saves just ₹300 per month after GST cuts, across 25 crore households, that’s ₹7,500 crore injected back into the economy every single month. That spending boosts everything — from small mom-and-pop stores to large-scale manufacturing industries.

This increased economic activity also results in higher GST collections in the long run due to higher volumes, which supports government programs for infrastructure, education, and healthcare.

In short, it’s a win-win cycle: when companies comply, consumers save, demand rises, and the overall economy flourishes.

Challenges Businesses Face

While compliance sounds simple on paper, in reality, passing GST savings can be complicated:

- Technology Gaps: Small retailers may lack automated billing systems to adjust prices instantly.

- Inventory Issues: Goods purchased before rate cuts often have printed price tags at older rates, leading to confusion.

- Awareness Gaps: Many small business owners simply don’t know the latest GST rules.

- Competitive Pressures: Some companies worry about losing margins if competitors don’t comply.

That’s where adopting automation tools and better internal processes can help. Businesses can set up real-time price updates across outlets and e-commerce platforms, making compliance seamless.

The CII has also urged corporates to run internal GST audits to avoid penalties and maintain transparency.

Consumers’ Role in Ensuring Fair Pricing

Consumers aren’t just passive recipients here — you have the power to enforce fairness. If you believe a business hasn’t passed GST benefits:

- Check the Bill: Verify if GST savings are reflected in the final price.

- Ask the Store: Politely question staff about outdated prices.

- File a Complaint: Report profiteering businesses to the National Anti-Profiteering Authority (NAA) through the GST portal.

The Ministry of Finance has emphasized consumer empowerment as a key strategy in maintaining market discipline. By holding brands accountable, shoppers can collectively ensure pricing fairness.

After all, when companies know that customers are vigilant, they’re more likely to comply quickly and transparently.

Your Expenses Could Change Soon—GST Council Eyes Rationalising 12% & 18% Rates

New GST Rates Likely By Dussehra – Govt Prepares For Revenue Shortfall