Could a 15% GST Actually Help Young Australians: When you hear “15% GST,” your first thought might be: Here we go again, another tax hike. And fair enough—taxes usually feel like money out of your pocket. But here’s the twist: some of Australia’s leading economists and policymakers believe that raising the Goods and Services Tax (GST) could actually help young Australians. Sounds upside down, right? But when you dig into the details—like the proposed rebate system, the way income taxes work, and the long-term benefits—the idea starts to make sense. This isn’t just about paying more at the checkout; it’s about reshaping a tax system that many argue is broken and unfair to younger generations.

Could a 15% GST Actually Help Young Australians

So, could a 15% GST actually help young Australians? Against all odds, the answer may be yes. With a fair rebate system, smart recycling of revenue, and a focus on efficiency, GST reform could:

- Ease the pressure on young workers facing income tax creep.

- Fund better public services and housing.

- Deliver stronger economic growth and opportunity.

The numbers add up. The challenge is political will. If Australia wants to tackle intergenerational unfairness and secure its future, bold reform like this may be the smartest path forward.

| Topic | Details |

|---|---|

| Proposed GST Rate | Increase from 10% to 15% |

| Compensation Plan | Annual rebate of $3,300 per adult (shielding first $22,000 of consumption) |

| Winners | Bottom 60% of income earners could benefit overall |

| Revenue Impact | Net revenue gain of $24 billion per year post rebates |

| Economic Growth Potential | GDP up by 6%, housing supply up 8%, business investment up 11% |

| Official GST Info | Visit the ATO GST Guide |

A Quick History of GST in Australia

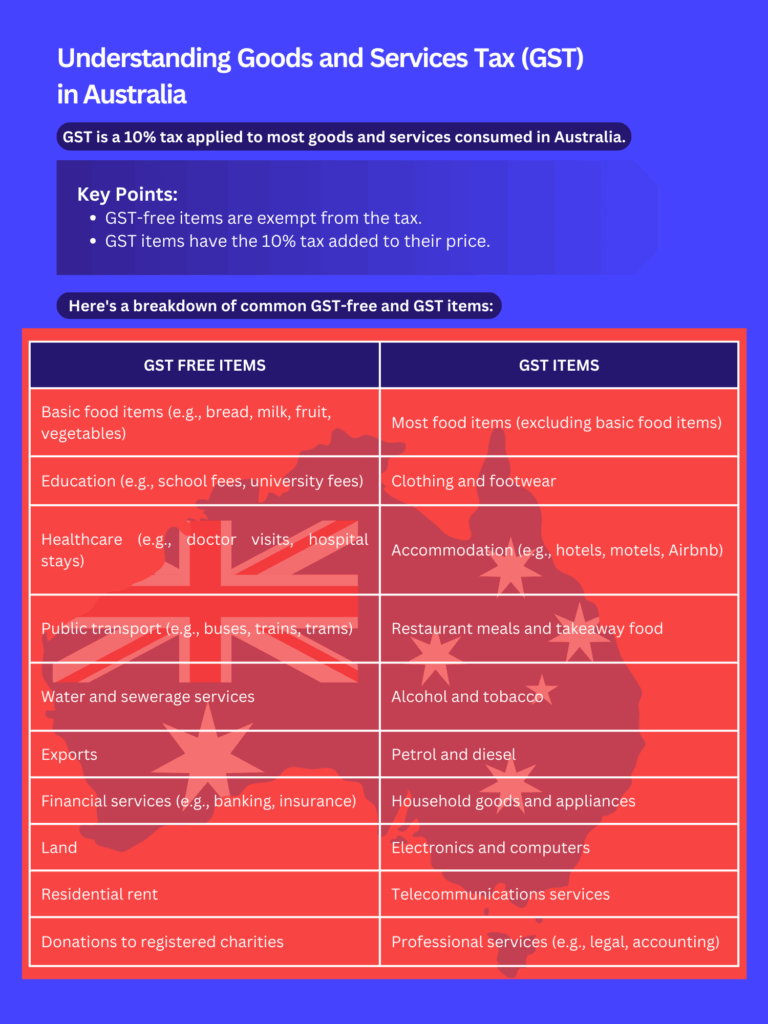

The Goods and Services Tax was introduced in July 2000 at a flat 10%, replacing a messy system of wholesale sales taxes. At the time, critics warned it would crush household budgets, while supporters argued it would simplify and modernize the tax base.

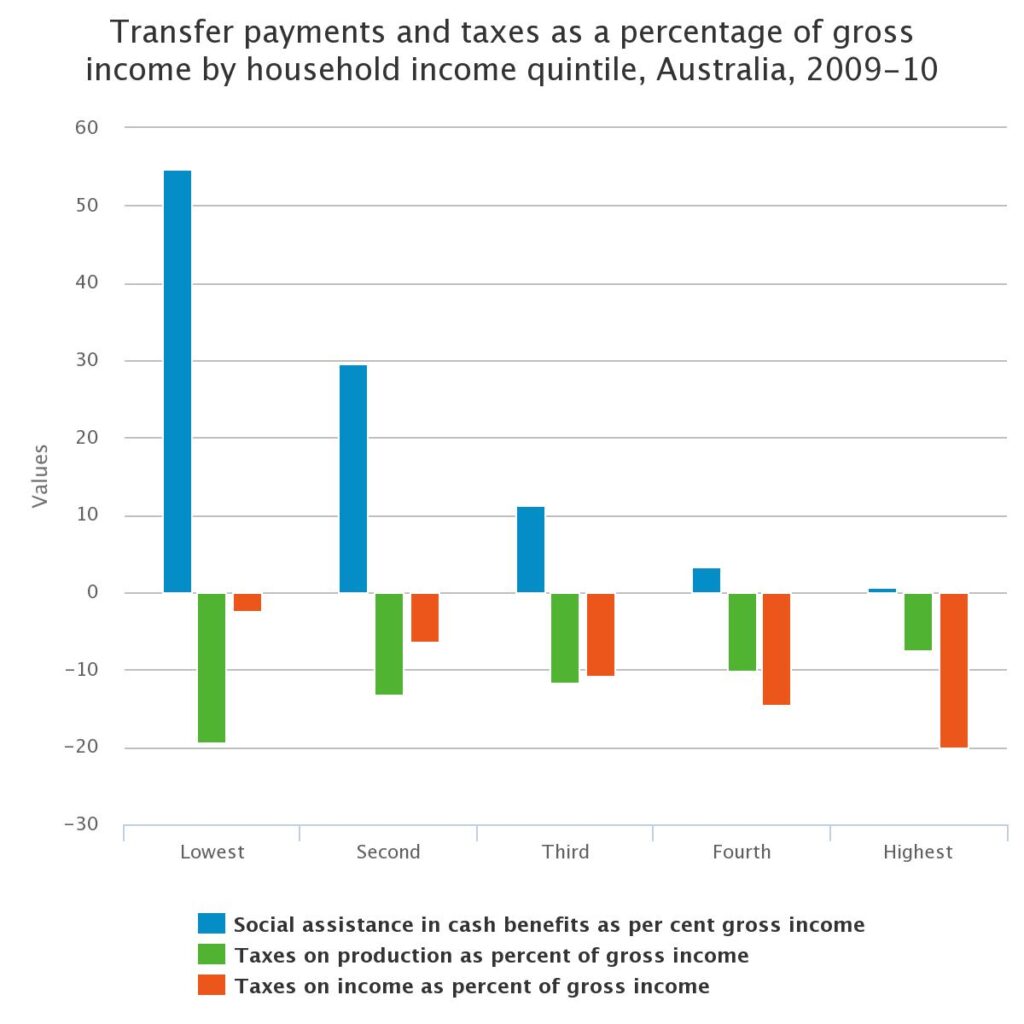

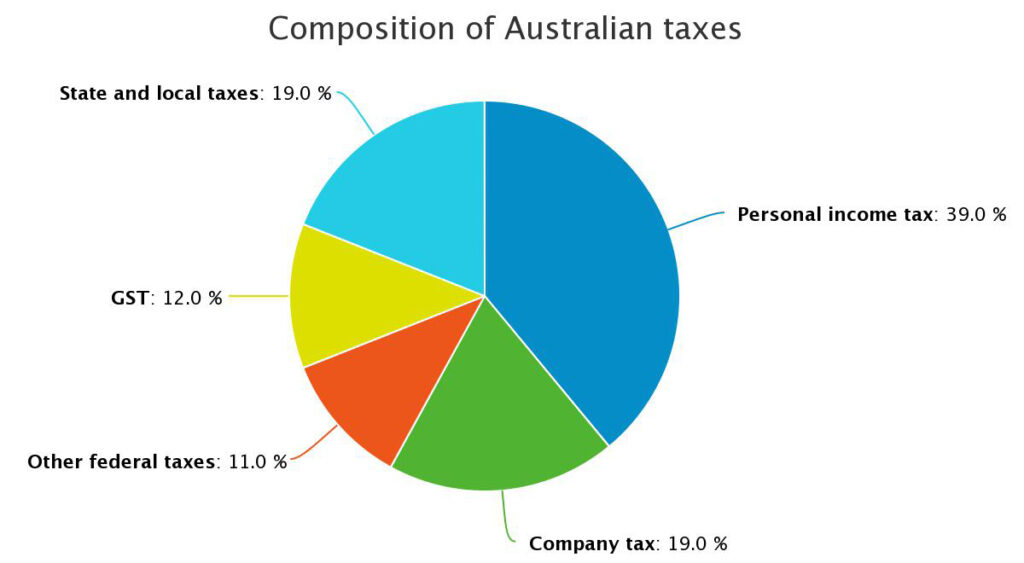

For two decades, that 10% hasn’t budged—even as other countries have lifted their consumption taxes to keep up with economic change. Meanwhile, Australia leaned harder and harder on income tax, which now makes up over 50% of federal revenue.

This reliance means that younger, working Australians shoulder most of the burden—especially since bracket creep pushes them into higher tax brackets as wages rise with inflation.

Why Talk About 15% Now?

Several reasons push this conversation into the spotlight:

- Rising Intergenerational Inequality: Young Australians are earning less (after inflation) compared to what their parents earned at the same age, while also facing housing costs that have more than doubled relative to income.

- Revenue Pressures: An aging population means higher government spending on healthcare, pensions, and aged care.

- Global Comparisons: With Australia’s GST still at 10%, the system is light compared to peers like New Zealand (15%) and most of Europe (20%+).

So reform advocates argue: if we’re going to raise more money, GST is the least damaging and most efficient way—as long as it’s paired with fair compensation.

How Would the $3,300 Rebate Work?

The rebate system is the game-changer. The proposal suggests giving every adult a $3,300 annual payment, enough to shield the first $22,000 of spending from GST.

Let’s put that into real-world examples:

- A 20-year-old student working part-time and spending $18,000 a year would see all their GST wiped out by the rebate. They’d be unaffected or even slightly better off.

- A young professional earning $60,000 and spending $35,000 would only pay GST on the portion above $22,000. Their net position might be nearly the same as today.

- A wealthier household with higher discretionary spending—say, on overseas holidays, new cars, or luxury goods—would pay more, since the rebate doesn’t cover everything.

In short, the rebate flips GST from a regressive tax (which normally hits the poor hardest) into something much closer to a progressive system, where the wealthy contribute more.

Could a 15% GST Actually Help Young Australians?

Young people often feel squeezed from all sides—student loans, high rents, rising living costs, and the near-impossible dream of buying a home. By raising GST but rebating essentials, the plan aims to:

- Lighten the income tax load that young workers face.

- Make essentials like rent and groceries less punishing compared to discretionary spending.

- Fund better services that young people rely on—healthcare, education, and infrastructure.

Think of it this way: instead of being punished for working harder or earning a raise (through higher income taxes), your contribution is based more on what you choose to spend beyond the basics.

The Economic Case

Economist Chris Murphy and others argue that GST reform is about efficiency. Taxes distort behavior—some more than others. Stamp duties, for example, discourage people from moving houses and can lock families into homes that don’t fit their needs.

By contrast, a broad-based GST is relatively efficient. According to the Productivity Commission:

- GST costs about 20 cents per dollar raised.

- Stamp duty costs about 74 cents.

- Land tax is even higher in distortion.

Replacing inefficient taxes with GST could free up the economy, encouraging investment and growth. Murphy’s projections:

- GDP could rise by 6%.

- Business investment up 11%.

- Housing supply up 8%—helping to address the housing affordability crisis.

Lessons from Overseas

New Zealand: Runs a 15% GST with almost no exemptions. It’s praised for being simple, transparent, and fair. Despite initial resistance, it’s now widely accepted as a clean tax system.

European Union: Countries rely heavily on VAT (a GST-like tax), often between 17–25%. These higher rates fund generous social services but can be politically sensitive.

United States: Lacks a federal GST, but relies on state and local sales taxes. The patchwork system is complex and often regressive, showing the value of a streamlined national approach.

These global lessons show that higher consumption taxes can work—if paired with fairness and transparency.

The Risks and Criticisms

Of course, not everyone is cheering. Critics warn of real risks:

- Inflation Shock: A sudden jump to 15% could spike prices, especially in groceries, fueling cost-of-living pressures.

- Political Backlash: Tax hikes are never popular. Prime Minister Anthony Albanese has flagged this as a “political non-starter.”

- Middle-Class Squeeze: If rebates don’t keep up with inflation, middle-income earners could end up paying more than promised.

- Trust Gap: Australians may not believe government promises that the revenue will fund tax cuts or better services.

What a Reform Path Could Look Like?

Experts suggest a staged approach:

- Phase 1: Lift GST to 12.5%, with rebates starting immediately.

- Phase 2: Expand to 15% once the system is proven fair.

- Phase 3: Use revenue to eliminate inefficient taxes like stamp duty and reduce income taxes.

This gradual rollout could soften inflation shocks and build public trust.

Practical Tips for Young Australians

If GST reform ever becomes reality, here’s how to prepare:

- Track your annual spending to see how you’d fare against the $22k rebate threshold.

- Budget essentials vs. extras—rebates shield basics, but luxuries cost more.

- Stay informed—watch for how governments recycle the extra revenue. Will it mean lower income taxes? Cheaper healthcare? Housing programs?

- Think long-term—reforms aim to make the economy more sustainable, which means more jobs, more housing supply, and less intergenerational unfairness.

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

Supreme Court Halts ₹273.5 Crore GST Demand Against Patanjali

₹50 Crore GST Fraud Busted In Mumbai – Two Directors Arrested In Mega Scam