CPP & OAS Payments Coming on August 27: The CPP & OAS payments coming on August 27, 2025 are some of the most anticipated deposits for Canadian seniors. If you’re living on a fixed income, you probably already have that date circled on your calendar. But here’s the truth — not everyone will get these payments, and not everyone will get the same amount. The Canadian retirement income system can feel overwhelming with its rules, income thresholds, and clawbacks. This guide breaks it all down in everyday language so you know exactly who qualifies, how much you can expect, and how to maximize your retirement benefits.

CPP & OAS Payments Coming on August 27

The CPP & OAS payments coming on August 27, 2025 will help millions of Canadians, but eligibility depends on your age, work history, and residency. CPP rewards your years of contributions, while OAS provides universal support based on residency. Together, they provide a financial lifeline for retirees. To get the most out of these programs, apply early, plan your taxes, and explore other supplements like GIS. Retirement is meant to be enjoyed — don’t let missed opportunities or paperwork keep you from the income you’ve earned.

| Category | Details |

|---|---|

| Payment Date | August 27, 2025 |

| CPP (Canada Pension Plan) | For Canadians 60+ who contributed during working years; max monthly ~$1,433, average ~$899 |

| OAS (Old Age Security) | For Canadians 65+ who meet residency rules; max monthly ~$727.67 (65–74), ~$800.44 (75+) |

| Eligibility | CPP: Must have worked/contributed; OAS: 10+ years residence in Canada after age 18 |

| OAS Clawback | Benefits reduced if income > $148,451 (65–74) or $154,196 (75+) |

| Other Supports | Guaranteed Income Supplement (GIS), Allowance for survivors and low-income spouses |

| Official Source | Government of Canada Benefits Calendar |

Why Canada Has CPP and OAS in the First Place?

Canada didn’t always have a strong safety net for seniors. The Old Age Security (OAS) program began in 1952 as a universal pension to prevent older Canadians from falling into poverty. Later, in 1965, the Canada Pension Plan (CPP) was introduced to provide a contributory pension tied to your employment history.

The idea was simple: OAS would be a baseline safety net, while CPP would be an earnings-based supplement. Together, they now form the backbone of Canadian retirement income. Today, more than 7 million Canadians collect OAS, while nearly 6 million collect CPP according to Government of Canada statistics.

Understanding CPP (Canada Pension Plan)

CPP is a monthly, taxable pension you pay into during your working years. Both you and your employer contribute a percentage of your salary, and those contributions determine how much you’ll get in retirement.

Key Details

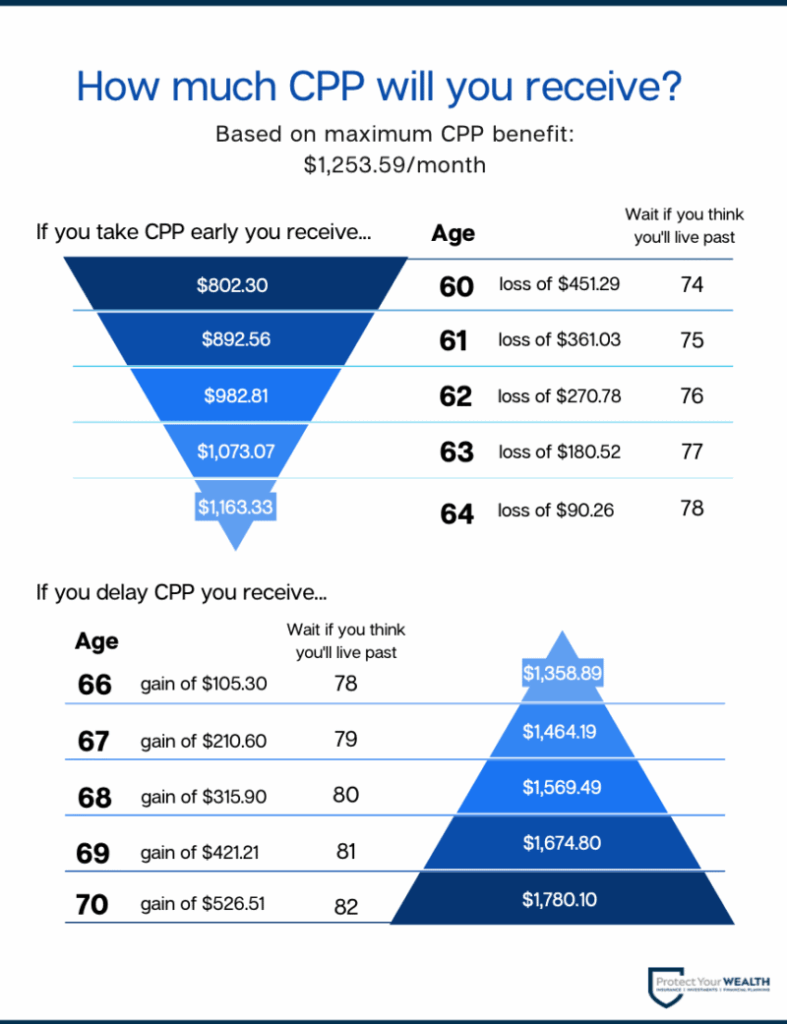

- You can start CPP at age 60 (reduced benefit).

- At age 65, you get the standard benefit.

- If you delay until 70, your monthly payment grows by up to 42%.

How Much Do You Get?

- Maximum monthly CPP (age 65): about $1,433 in 2025.

- Average monthly CPP: about $899.

Not everyone gets the maximum because it depends on how much you contributed and for how long.

Other CPP Benefits

- Disability benefits if you can’t work due to long-term disability.

- Survivor benefits for widows, widowers, and dependent children.

- Post-retirement benefits if you keep working and contributing while already receiving CPP.

Understanding OAS (Old Age Security)

OAS is a universal pension funded by taxes, not by your employment. It’s meant to ensure that seniors have a minimum income, no matter how much they worked or earned during their careers.

Eligibility Rules

- Must be 65 years or older.

- Must have lived in Canada at least 10 years after turning 18.

- For full OAS, you need 40 years of Canadian residency after age 18.

Payment Amounts for 2025

- Ages 65 to 74: Up to $727.67/month.

- Ages 75+: Up to $800.44/month.

The OAS Clawback

OAS has an income test known as the OAS Recovery Tax. If your annual net income is above:

- $148,451 (ages 65–74)

- $154,196 (ages 75+)

your OAS is reduced or eliminated.

This clawback ensures that the highest-income seniors don’t collect the benefit.

CPP vs OAS: Side-by-Side Comparison

| Feature | CPP | OAS |

|---|---|---|

| Based On | Contributions from work | Residency in Canada |

| Start Age | 60–70 | 65+ |

| Maximum Payment (2025) | ~$1,433 | ~$800.44 |

| Taxable? | Yes | Yes (with clawback) |

| Who Qualifies? | Workers who contributed | Residents who meet age/residency rules |

| Automatic? | Must apply | Sometimes automatic, often requires application |

Why August 27, 2025 Matters?

For many Canadians, August 27, 2025 is a critical date. That’s when both CPP and OAS payments hit bank accounts for eligible recipients.

- If you’re on direct deposit, payments arrive the same day.

- If you receive a mailed check, allow several extra days for delivery.

- Both CPP and OAS are paid monthly, usually near the end of the month.

This money isn’t just numbers on a page — for many retirees, it’s the difference between paying bills comfortably and worrying about making ends meet.

Tax Implications of CPP & OAS Payments Coming on August 27

Yes, both CPP and OAS are taxable income. Here’s how it works:

- CPP and OAS are added to your total annual income.

- You can request tax withholdings at the source to avoid a big tax bill at year-end.

- OAS can be reduced by the clawback if your income is too high.

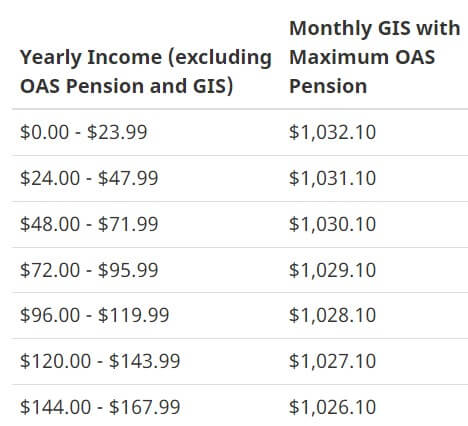

For lower-income seniors, there’s relief. The Guaranteed Income Supplement (GIS) adds extra, tax-free money for those with little or no other income. The average GIS payment can range from $600 to over $1,000/month depending on your situation.

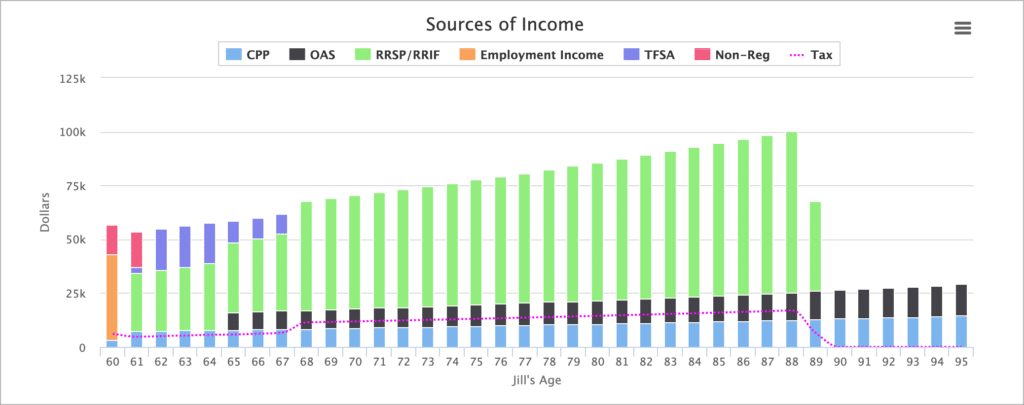

Strategies to Maximize Retirement Benefits

- Apply early and check your account. Don’t assume you’re automatically enrolled.

- Delay CPP if you can afford it. Waiting until 70 locks in much higher lifetime payments.

- Plan around the clawback. Income splitting with your spouse, TFSA withdrawals, or staged RRSP withdrawals can keep your income below the OAS clawback threshold.

- Stack benefits. Many retirees combine CPP, OAS, GIS, and workplace pensions. Don’t overlook GIS if your income is low.

- Budget carefully. Remember that the average Canadian senior gets ~$1,600/month from CPP + OAS combined, which covers basics but may not be enough without other savings.

Real-Life Examples

- Martha, age 62 → Retired early and took CPP at 60. She receives $750/month CPP but doesn’t qualify for OAS yet. She’s relying on personal savings to bridge the gap.

- George, age 68 → Worked 40 years in Canada, collecting $1,200 CPP + $727 OAS = $1,927/month. With a small workplace pension, he’s comfortable.

- Anita, age 76 → Delayed CPP until 70 and benefits from the OAS bump for seniors 75+. She gets $1,350 CPP + $800 OAS = $2,150/month. Her choice to wait paid off in bigger long-term income.

Common Mistakes to Avoid

- Not applying for CPP or OAS. Some people assume it’s automatic and miss out.

- Taking CPP too early without need. It reduces lifetime payments, so weigh carefully.

- Ignoring tax planning. Forgetting about the OAS clawback can cost you thousands.

- Overlooking GIS. Many low-income seniors never apply for GIS, leaving free money on the table.

GST 2.0 Promises Consumption Boost – Can Lower Taxes Also Tame Inflation?

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big

$496 GST/HST Credit Confirmed for 2025—Here’s Who Qualifies and When You’ll Get Paid