Delhi High Court Slams GST Dept for Raiding Lawyer’s Office: The Delhi High Court recently issued a stinging rebuke to the Goods and Services Tax (GST) Department after it conducted a controversial raid on the office of a practicing tax lawyer—without direct evidence of wrongdoing. The incident has stirred debate nationwide, especially within the legal community, prompting questions about the limits of enforcement power and the rights of attorneys.

This pivotal case not only upholds the sanctity of attorney-client privilege, but also draws a legal line in the sand: government authorities must demonstrate concrete, admissible evidence before targeting legal professionals acting in their official capacity. At the center of the controversy is Advocate Puneet Batra, a Delhi-based tax lawyer whose Mayur Vihar office was raided by GST officials on July 25, 2025. Documents, files, and even the office’s computer CPU—containing sensitive client information—were seized during the operation. The problem? The raid was based solely on allegations against one of Batra’s clients—not on Batra himself. That’s a crucial distinction in the eyes of the law.

Delhi High Court Slams GST Dept for Raiding Lawyer’s Office

The Delhi High Court’s intervention in the GST raid on Advocate Puneet Batra’s office is more than just a legal victory—it’s a defense of the very foundations of justice. It affirms that lawyers must be free to represent clients without fear, and that enforcement agencies must follow due process, no matter how urgent or high-profile the investigation. This ruling is not just timely—it’s historic. It sends a resounding message to both the legal community and government departments: accountability, not authority, rules the day.

| Topic | Details |

|---|---|

| Incident Date | July 25, 2025 |

| Court Involved | Delhi High Court (Justices Prathiba M. Singh & Shail Jain) |

| Lawyer Affected | Advocate Puneet Batra |

| Enforcement Body | Goods and Services Tax (GST) Department |

| Court Ruling Date | August 2, 2025 |

| Legal Principle Upheld | Attorney-client privilege under Section 133, Bharatiya Sakshya Adhiniyam, 2023 |

| Next Legal Step | GST Dept must file a detailed affidavit explaining the basis for the raid by August 4, 2025 |

| Official Case Link | LiveLaw: Delhi High Court Section |

| Government Tax Info | CBIC Official GST Site |

What Led to the Controversy?

On July 25, officials from the GST Department entered Advocate Batra’s office to execute a search and seizure operation. They confiscated electronic equipment, including a CPU containing sensitive files from multiple clients. The stated reason for the raid was an ongoing investigation into alleged tax evasion by one of Batra’s clients.

However, as the Delhi High Court later noted, no material or document was presented that connected Batra personally to the alleged fraud. That’s a big deal—especially in the legal profession, where protecting client confidentiality is not only a professional obligation but a legal requirement. The raid sparked immediate backlash. Several senior lawyers and bar associations labeled it as “intimidation” and an “overreach” by enforcement bodies. The sentiment was clear: if lawyers are not protected, no one is.

What Did the Delhi High Court Say?

In its August 2 judgment, the Delhi High Court didn’t mince words. The bench, led by Justices Prathiba M. Singh and Shail Jain, described the raid as “unjustified” and bordering on “harassment.”

The court emphasized that enforcement agencies cannot, under any circumstances, presume guilt based on association with a client. The lawyer’s role as a representative does not automatically make them a co-conspirator.

The court made four clear points:

- The raid lacked prima facie justification.

- Attorney-client privilege is non-negotiable.

- All seized materials must remain sealed.

- No further action can be taken unless the department justifies the raid via affidavit.

This is not just procedural housekeeping—it’s a reaffirmation of constitutional and legal safeguards afforded to practicing advocates in India.

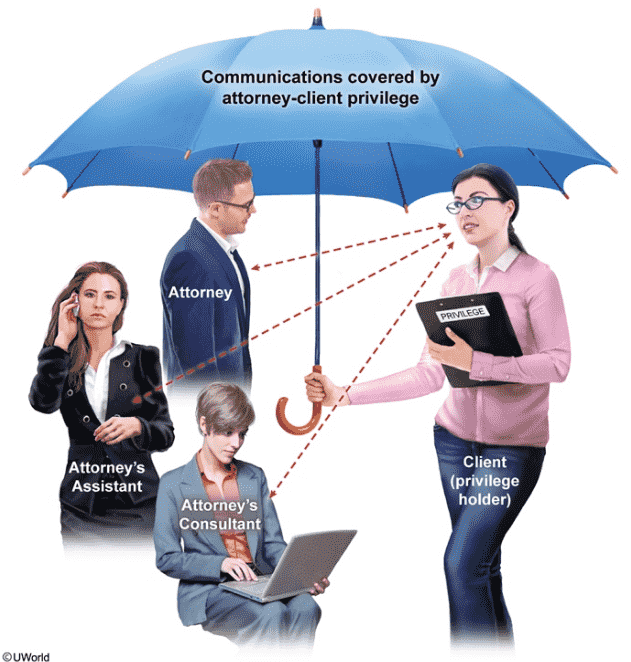

Why Attorney-Client Privilege Matters?

Attorney-client privilege is the cornerstone of the legal system. It allows clients to share sensitive information with their lawyers without fear of disclosure.

In India, this right is protected by Section 133 of the Bharatiya Sakshya Adhiniyam, 2023 (earlier Section 126 of the Indian Evidence Act), which states:

“No advocate shall be permitted to disclose communications made by a client in the course and for the purpose of his employment…”

This protection exists not just to shield clients, but also to ensure lawyers can operate freely, ethically, and without fear of state interference—provided they themselves are not complicit in a crime.

Legal and Professional Implications

This case marks a significant moment for professionals across the board—not just lawyers, but tax consultants, chartered accountants, and compliance officers.

Here’s what the ruling confirms:

For Lawyers:

- You cannot be penalized for doing your job—representing a client—unless there’s direct involvement in wrongdoing.

- Summons and raids without due cause can be challenged under Article 226 of the Constitution.

For Clients:

- Communications with your lawyer remain protected—even during investigations—unless used to further a crime.

- Your records in a lawyer’s office are not fair game for enforcement without cause.

For Law Enforcement:

- They must produce specific, credible documentation before initiating coercive action.

- Failure to do so may result in contempt proceedings, judicial sanctions, or worse.

Bar Associations and Legal Experts React

The Delhi High Court’s decision was welcomed by leading legal figures and professional bodies.

Neeraj Srivastava, a prominent tax law expert, said:

“This ruling reinforces what we’ve been advocating for years—government agencies must tread carefully when dealing with legal professionals. Representation is not participation in crime.”

The Bar Council of Delhi issued a statement calling the raid “a breach of professional independence,” urging the Central Board of Indirect Taxes and Customs (CBIC) to revise its enforcement procedures.

Senior Advocate Vikas Pahwa added:

“This isn’t just about one lawyer—it’s about preserving the rule of law. If attorney-client privilege is diluted, the justice system collapses.”

Comparison with U.S. Legal Standards

The reaction from India’s legal community echoes sentiments long held in the United States. There, the Fourth Amendment protects against unreasonable searches and seizures. Additionally, attorney-client privilege is regarded as sacrosanct.

Consider the 2018 case where the FBI raided Michael Cohen’s office, President Trump’s former attorney. That move was criticized by legal circles and required extensive safeguards, including the use of “taint teams” to ensure privileged materials weren’t misused.

In both countries, the message is clear: law offices are not fair game for fishing expeditions.

What You Should Do if You’re Targeted?

If you’re a lawyer or a professional consultant and you’re caught in a situation like this, follow these steps:

1. Understand Your Rights

Under Articles 19 and 21 of the Constitution, you have the right to practice your profession and the right to privacy. This includes protecting client data.

2. Demand Legal Grounds

Ask for a copy of the search warrant, and demand to see the reasons behind the action. If none are provided, that’s your first red flag.

3. File a Writ Petition

Approach the High Court under Article 226, seeking a stay on proceedings, sealing of seized items, and a judicial review.

4. Contact Your Bar Association

Most bar councils provide emergency legal support. Don’t hesitate to involve them. The more visibility your case gets, the better the protection you’ll have.

5. Secure Your Data

Encrypt client records, maintain access logs, and store data on secure legal platforms. Your systems should always be audit-ready.

Broader Impacts of Delhi High Court Slams GST Dept for Raiding Lawyer’s Office on Policy and Procedure

This case could be a catalyst for broader changes, including:

- Establishment of judicial review boards to oversee raids involving professionals.

- Guidelines for the seizure and handling of privileged material.

- Development of “professional immunity policies” for those providing legal, tax, or financial counsel.

- Mandatory training for enforcement officers on legal boundaries and ethics.

Future Outlook

The court has directed the GST Department to submit a detailed affidavit by August 4, 2025. That affidavit must include the precise grounds for the raid, evidence collected beforehand, and the rationale for targeting the lawyer instead of focusing solely on the client.

Depending on what that affidavit reveals, the High Court may:

- Order a return of all seized materials.

- Initiate contempt proceedings against enforcement officers.

- Recommend disciplinary actions or policy reforms.

Whatever happens next, this case is already being cited in law schools and bar association discussions as a defining moment in professional independence versus state authority.

Tripura Leads the Way in GST Collection: State’s Revenue Soars by 7.5% Year-on-Year

GST Revenue Hits ₹1.96 Lakh Crore in July — But Growth Momentum Slows

Mandatory HSN Code Reporting in GSTR-1/1A: The 2025 GST Compliance Guide You Can’t Miss