Dismantling Justice Department Tax Division Could Cost Billions: When we talk about paying taxes in the U.S., most folks groan. But here’s the real deal: taxes are what keep our schools running, roads paved, and even our military strong. Now, experts warn that dismantling the Justice Department’s Tax Division could cost billions of dollars—money that comes straight out of taxpayers’ pockets. This isn’t just about government red tape; it’s about making sure everyone plays fair in the tax game. The Department of Justice (DOJ) is considering a reorganization that would eliminate the stand-alone Tax Division, instead scattering its attorneys across the Civil and Criminal Divisions. On paper, this might sound like “efficiency.” In reality? Experts—many with decades of experience—say it’s like benching your best quarterback during the Super Bowl. And trust me, that’s not a winning play.

Dismantling Justice Department Tax Division Could Cost Billions

The Justice Department’s plan to dismantle its Tax Division isn’t just a bureaucratic reshuffle—it’s a decision that could cost the U.S. billions in lost tax revenue. Experts warn that without a specialized team ensuring consistent enforcement, the system risks breaking down. For taxpayers, businesses, and professionals, the message is clear: fairness, consistency, and strong deterrence matter. And losing that could hit us all where it hurts most—our wallets.

| Aspect | Details |

|---|---|

| What’s Happening | DOJ plans to dismantle its Tax Division and reassign 400+ attorneys to Civil & Criminal Divisions |

| Expert Warnings | Loss of expertise, inconsistent enforcement, slower litigation |

| Potential Cost | Billions in lost tax revenue due to reduced deterrence & compliance |

| Proven ROI | DOJ Tax Division historically collects 3x its budget in recovered revenue (official DOJ site) |

| Why It Matters | Weak enforcement could embolden tax cheats, hitting honest taxpayers hardest |

A Little History: Why the Tax Division Exists

The DOJ Tax Division was established in 1934 during the New Deal era, when the U.S. government recognized the need for a specialized team to handle complex tax disputes. Before that, enforcement was scattered and inconsistent, leading to unfair rulings and missed revenue.

Since then, the Tax Division has become the backbone of federal tax enforcement, litigating around 6,000 civil and criminal tax cases annually. Whether it’s chasing down offshore accounts, fighting corporate tax shelters, or prosecuting high-profile tax evasion, this division has one mission: to ensure fairness and protect taxpayer dollars.

How Much Money Is Really at Stake?

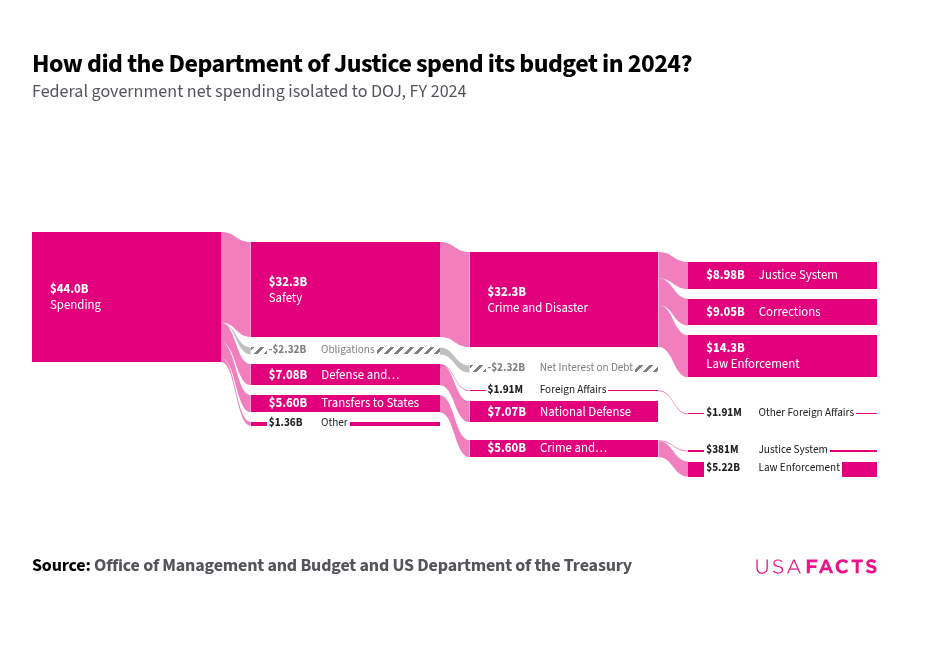

Numbers speak louder than politics. In Fiscal Year 2022, the Tax Division:

- Collected $247 million in unpaid taxes, penalties, and interest.

- Operated with a budget of around $120 million, delivering a return of more than 3-to-1.

- Assisted the IRS in criminal prosecutions, contributing to the recovery of billions more in deterrence value.

According to Citizens for Responsibility and Ethics in Washington (CREW), every $1 spent on civil audits yields up to $67 in deterrence value, while every $1 on criminal investigations yields $55. That’s not just a good deal—it’s one of the most profitable government investments.

So when experts say dismantling the division could cost “billions,” they’re not exaggerating. Weakening enforcement could easily wipe out tens of billions in revenue over the next decade.

Why Dismantling Justice Department Tax Division Could Cost Billions?

So why the push to dismantle it? DOJ leadership argues it’ll “improve efficiency” by folding tax enforcement into bigger departments. But experts say this could lead to:

Loss of Expertise

Tax law isn’t exactly bedtime reading—it’s complex, technical, and constantly changing. Imagine taking highly skilled heart surgeons and suddenly telling them to work in general practice clinics. Sure, they’re still doctors, but their specialized skills are being wasted.

Inconsistent Enforcement

A big strength of the Tax Division is consistency. Whether you live in Texas, New York, or Idaho, the same playbook applies. Break it apart, and local offices may apply tax law differently. That opens the door for unequal treatment and—yep—legal loopholes.

Billions Lost in Revenue

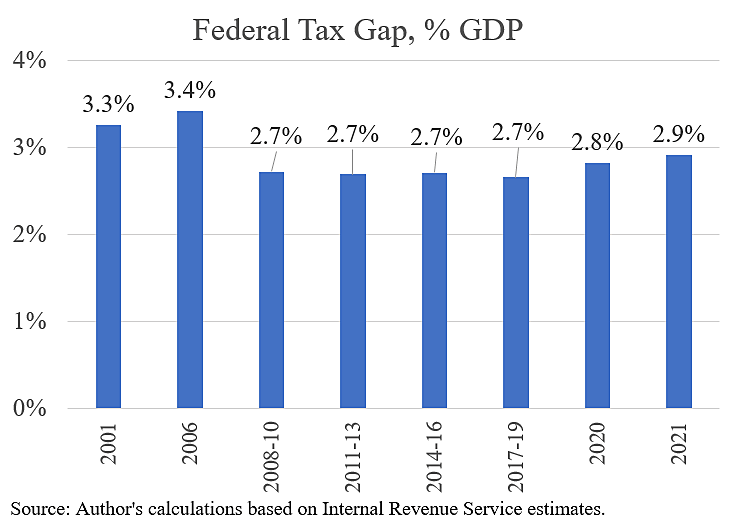

The math doesn’t lie. If deterrence weakens, more people may roll the dice on cheating. With an estimated $600 billion annual “tax gap” (the difference between what’s owed and what’s paid), even a small drop in enforcement could cost taxpayers billions.

Famous Cases That Show Why Tax Enforcement Matters

The Tax Division’s track record is full of cases that highlight why centralized expertise matters.

- Al Capone (1931) – Even though this predated the formal Tax Division, the prosecution for tax evasion set the stage for future enforcement.

- UBS Offshore Accounts (2009) – DOJ attorneys forced the Swiss banking giant to reveal thousands of secret accounts, resulting in billions in recovered revenue.

- Celebrity Prosecutions – From actor Wesley Snipes to well-known athletes, these cases showed that tax law applies equally, regardless of fame.

Without a strong division, cases like these could slip through the cracks—or never be pursued at all.

The Political Angle: Cuts and Pressure

This isn’t the first time tax enforcement has been in the crosshairs. Previous administrations have reduced IRS budgets, leading to fewer audits and prosecutions. Between 2010 and 2020, the IRS lost over 20,000 enforcement staff, and audit rates for high-income earners plummeted.

The Government Accountability Office (GAO) has repeatedly warned that cuts to enforcement cost the government more than they save. In other words, starving enforcement is like selling your fishing poles to save money—you lose the fish you could have caught.

Real-World Example: Audit Roulette

Here’s some straight talk. Think about speeding on the highway. If cops stop patrolling, more drivers push the limits. The same goes for taxes. Experts warn that without a strong DOJ Tax Division, some taxpayers will start playing “audit roulette.” Translation? They’ll risk cheating because they figure the chance of getting caught just dropped.

And who makes up the difference when big fish don’t pay up? Everyday Americans who follow the rules. That’s why dismantling the division could hurt not just the government’s wallet, but your wallet too.

Ripple Effects: IRS, Treasury, and Businesses

This move won’t just impact the DOJ. It’ll send shockwaves through related agencies and industries.

- IRS: Already stretched thin, the IRS relies on DOJ attorneys for litigation support. Without them, cases pile up and enforcement slows.

- Treasury: Tax revenue funds nearly everything the government does. A weaker enforcement system means bigger deficits or higher taxes elsewhere.

- Small Businesses: Honest operators may face unfair competition from businesses willing to cheat.

- Large Corporations: Big players with aggressive tax strategies may find more opportunities to exploit inconsistencies.

- Tax Professionals: Accountants and lawyers could face uncertainty, as inconsistent enforcement makes it harder to advise clients.

Global Perspective: What Happens Without Strong Enforcement

Other countries have learned the hard way.

- Greece, during its debt crisis, lost billions annually due to rampant tax evasion.

- Italy has battled underground economies for decades, partly because enforcement was inconsistent.

- Developing nations often struggle to fund basic services because wealthy individuals and corporations dodge taxes without strong oversight.

The U.S. risks a similar slide if enforcement weakens.

What Taxpayers Can Do?

While the debate continues in Washington, here are practical steps taxpayers and professionals can take:

- Stay Informed – Follow updates from the Department of Justice.

- File Honestly – Even if enforcement gets weaker, penalties for getting caught remain steep. Don’t risk it.

- Keep Records – Whether you’re an individual or a business, strong documentation protects you if questioned.

- Work with Pros – Tax law is tricky. Having a trusted CPA or attorney is worth the investment.

- Advocate – Contact lawmakers if you believe strong tax enforcement is essential. Public pressure has shifted policy before.

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases

New Income Tax Law Explained in Simple Terms – Who Gains, Who Loses

Planning A Second Home? These Tax Rules On Rental Income Could Cost You

Future Outlook: What Happens Next?

Congressional leaders and watchdog groups are already speaking up. Lawmakers from both parties have expressed concern, warning that this move risks undermining decades of tax law consistency. If pressure continues, DOJ may reconsider or propose alternatives, such as streamlining processes without eliminating the division entirely.

Ultimately, the question is this: do we want a tax system where compliance is the norm, or one where cheating is worth the gamble? The answer could determine billions in future revenue.