Duped Of Millions In Digital Arrest Scam: this shocking phrase recently became the nightmare of a woman in Gurugram, India. Imagine this: You’re sitting at home, and suddenly you get a call. On the other end, someone who sounds official says your name is tied to a crime—drug smuggling, money laundering, or even terrorism. You’re warned that if you don’t cooperate, you’ll be “arrested digitally” and cut off from the outside world. That’s exactly what happened, and this woman ended up losing nearly ₹5.85 crore (about $700,000 USD). The story highlights not just her personal tragedy, but a much bigger concern: Are our banks, governments, and systems truly prepared to protect people from fast-evolving cyber scams? As the victim rightly asked, why did her bank allow such unusual transfers without raising alarms? This is where the debate begins.

Duped Of Millions In Digital Arrest Scam

The digital arrest scam that duped an Indian woman out of millions isn’t just a personal loss—it’s a signal flare for the world. Scammers are getting smarter, exploiting fear and technology in ways that challenge banks, regulators, and individuals alike. We can’t rely solely on institutions to protect us. Awareness, quick action, and smart banking habits are our best shields. As digital scams rise globally, one thing is clear: education and vigilance are the new currency of safety.

| Key Point | Details |

|---|---|

| Scam Type | Digital Arrest Scam (fraudsters posing as law enforcement/government officials) |

| Victim | Gurugram woman, duped of ₹5.85 crore (~$700,000 USD) |

| Tactics Used | Threats of jail, intimidation, fake charges, constant harassment for 5 days |

| Money Lost | ₹5.85 crore; only ₹1 crore (~$120,000 USD) recovered |

| Bank Criticism | Victim questions why “200x larger transfers” weren’t flagged |

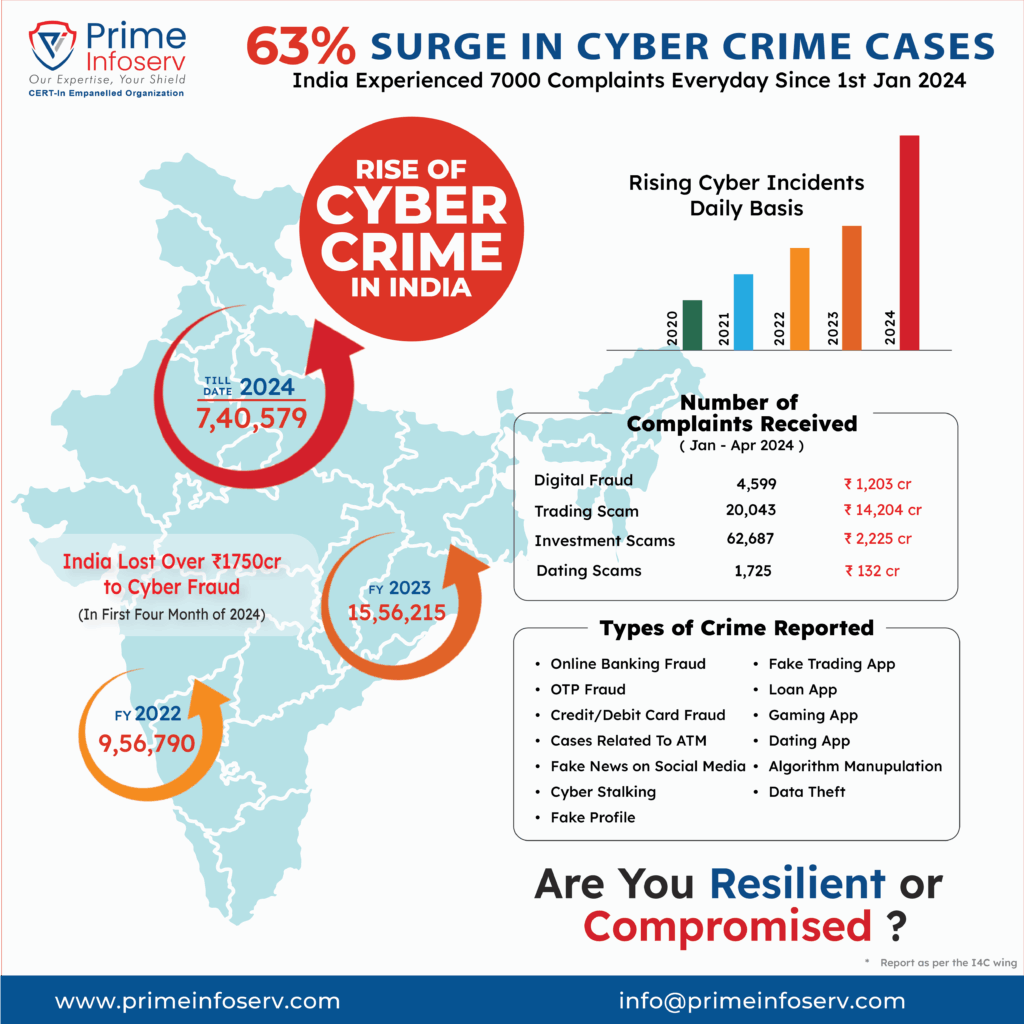

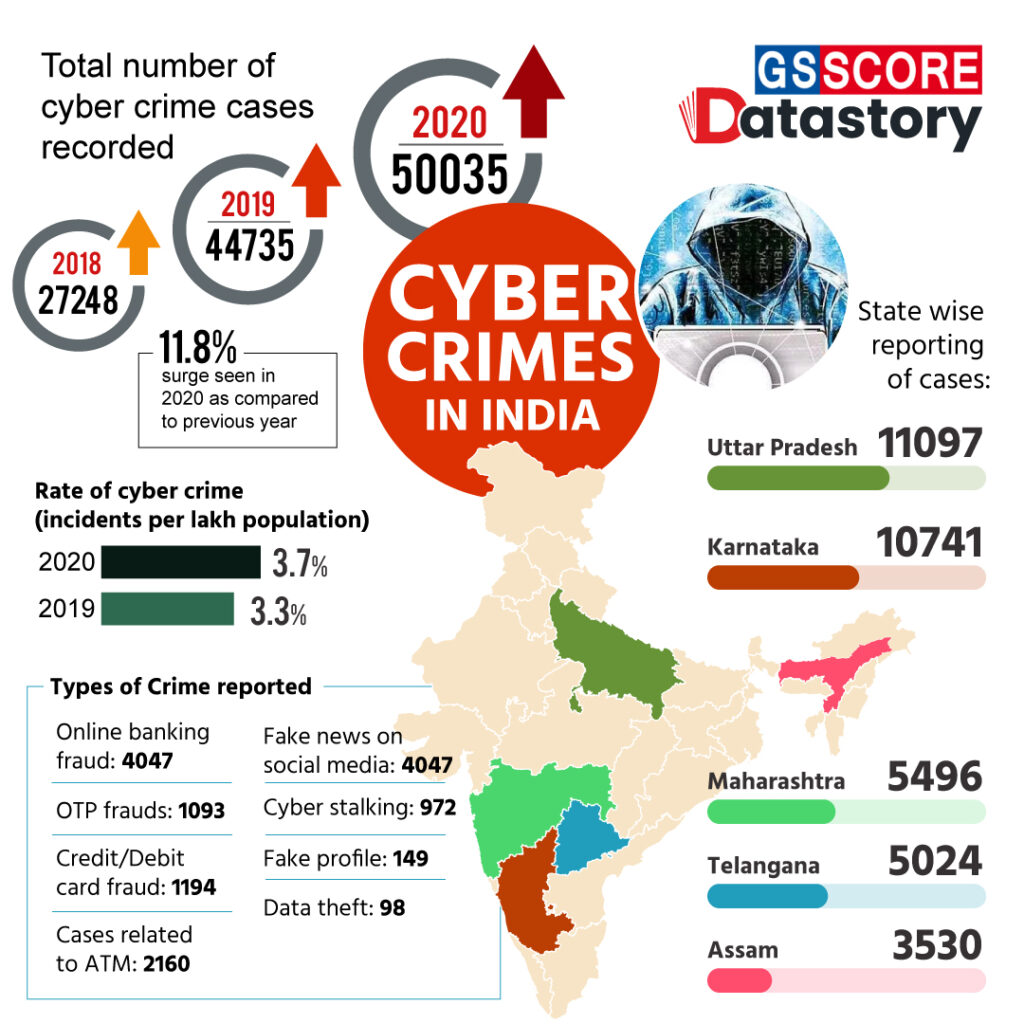

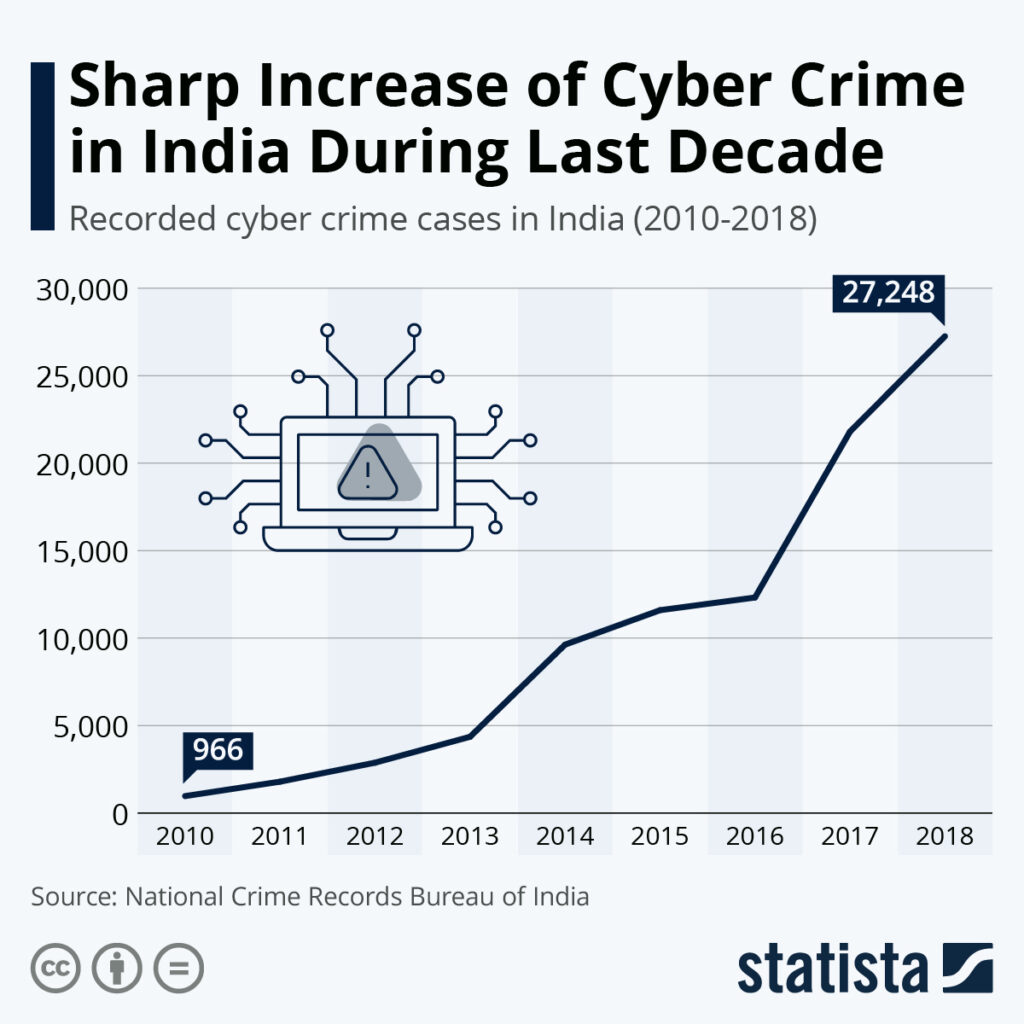

| Stats | India: 123,000+ cyber fraud cases in 2024 (tripled since 2022); U.S.: $12.5B lost to fraud in 2023 |

| Learn More | Cybercrime.gov.in, FBI.gov |

What Is a Digital Arrest Scam?

A digital arrest scam is a type of cybercrime where criminals impersonate law enforcement or government officials. They use video calls, fake IDs, and even forged documents to convince victims they are in legal trouble. The scammer then demands money to “settle” the charges, often keeping the victim online for hours or even days to maintain control.

In the Gurugram case, the scammers held the victim hostage digitally for five days. They claimed her identity was tied to illegal money transfers and drugs. They even threatened her son, creating so much fear that she made two large transfers: ₹2.8 crore on September 4, 2024, and ₹3 crore on September 5, 2024. The shocking part? These transactions were almost 200 times her usual banking activity, but her bank allowed them without challenge.

Historical Background

The roots of digital arrest scams can be traced back to China in 2017, when reports of scammers impersonating police officers exploded. Victims were told their “packages” contained contraband and that legal action was imminent unless they paid fines. Soon after, similar scams appeared in Taiwan, Singapore, and Malaysia, eventually making their way to India. By 2020, Interpol and Europol began issuing global warnings. Today, organized crime syndicates run large-scale scam call centers from Cambodia, Myanmar, and parts of Africa. These centers are often tied to human trafficking, forcing people to make scam calls under threats.

Why Duped Of Millions In Digital Arrest Scam Case Matters?

Cyber fraud has always been around, but digital arrest scams take psychological manipulation to a new level. Unlike email phishing or random text messages, these scams create an immersive, high-pressure environment. Victims are often isolated, denied a chance to verify, and subjected to mental torture until they break.

But the bigger issue here is institutional responsibility. Banks advertise themselves as guardians of our money. So when transfers worth hundreds of thousands of dollars happen overnight, why didn’t the system stop it?

In the U.S., under federal banking laws, banks are expected to flag unusual transfers. In India, the Reserve Bank of India (RBI) has similar guidelines. The failure here points to gaps not just in tech, but in accountability.

Global Perspective on Digital Arrest Scams

This isn’t just an Indian problem—it’s worldwide.

- United States: The FBI’s Internet Crime Complaint Center (IC3) recorded 880,418 complaints in 2023, with total losses exceeding $12.5 billion. Impersonation scams, including digital arrests, were a major contributor.

- United Kingdom: UK Finance reported a 21% increase in impersonation scams in 2023, with banks urging customers to treat every unexpected call with suspicion.

- Singapore: Introduced mandatory cooling-off periods for large digital transfers. Customers now get a 12–24 hour window to reverse suspicious transactions.

- Australia: The government launched the National Anti-Scam Centre (NASC) to coordinate banks, telecoms, and regulators in real time.

India is still playing catch-up, but cases like this are forcing regulators to consider similar protections.

The Psychology Behind Digital Arrest Scams

These scams work not because victims are naive, but because scammers are experts in manipulating fear and authority. Three psychological tricks stand out:

- Fear of Law Enforcement: Most people panic at the idea of being accused of a crime, even if innocent.

- Urgency and Isolation: Scammers demand immediate action and stop victims from consulting family or friends.

- Authority Bias: Fake police uniforms, forged documents, and official-sounding language convince victims to comply.

In simple terms, scammers hack the brain before hacking the bank account.

Expert Opinions

Cybersecurity professional Ritesh Bhatia explained, “Digital arrest scams succeed because they use fear, urgency, and authority to bypass rational thinking. The best defense is awareness and the confidence to hang up.”

The FBI echoes this, warning that impersonation scams are among the fastest-growing cybercrimes in the world, targeting both individuals and businesses.

Case Studies

This isn’t the first time such scams made headlines:

- Delhi (2024): A businessman was conned out of ₹25 lakh in a digital fraud case.

- Kochi (2024): A woman lost over ₹2 crore after scammers claimed her identity was used in a drug case.

- California, USA (2022): Seniors lost over $1.7 billion in impersonation scams, according to the Federal Trade Commission (FTC).

These examples prove that no one is immune, whether you’re a student, homemaker, or CEO.

How to Spot a Digital Arrest Scam?

Red Flags

- Unsolicited calls from people claiming to be police or government agents.

- Threats of immediate arrest, deportation, or asset freeze.

- Demands for secrecy—“Don’t tell anyone, or it’ll get worse.”

- Requests for payment through wire transfer, cryptocurrency, or gift cards.

Smart Moves

- Hang up immediately and call your local police or agency directly.

- Never share bank details or personal information with strangers.

- Consult a family member or friend before making any decisions.

- Contact your bank’s fraud team at once if pressured to transfer money.

Actionable Checklist: Protect Yourself

Step 1: Secure Your Banking

- Enable two-factor authentication.

- Set low daily transaction limits.

- Subscribe to transaction alerts.

Step 2: Stay Educated

- Follow updates from trusted bodies like FTC.gov in the U.S. and RBI advisories in India.

- Teach kids and seniors, who are prime targets, about scam tactics.

Step 3: Use Technology

- Install call-blocking apps.

- Choose banks offering AI-driven fraud detection.

Step 4: Know Your Rights

- In the U.S., the Electronic Fund Transfer Act (EFTA) may cover you if you report fraud quickly.

- In India, RBI’s zero-liability policy protects customers if they notify their bank promptly.

Legal and Regulatory Frameworks

- India: The RBI mandates that banks provide compensation in zero-liability cases, but recovery remains slow.

- United States: Banks face strict obligations under CFPB guidelines to flag suspicious transactions.

- Europe: The EU’s PSD2 directive introduced strong customer authentication, reducing online fraud.

Despite these rules, enforcement varies. Victims often spend months fighting banks for refunds, highlighting the need for faster, victim-friendly systems.

₹92 Crore Digital Arrest Scam Exposed – Mohali Police Nab Mastermind Gang

Admission Fraud Syndicate Busted, Two Arrested in Major Scam

Two Company Directors Arrested – Separate Tax Fraud Cases Expose New Crackdown