Europe Blocks U.S.-Bound Parcels: If you’ve been trying to send or receive packages between Europe and the United States lately, you might have noticed a major hiccup. Europe blocks U.S.-bound parcels because of a new tax rule change shaking up international shipping. That means your favorite sneakers from Berlin, the cool gadget from Tokyo, or grandma’s chocolates from Rome might not be making it across the pond—at least for now. This move is tied to the U.S. ending the “de minimis” exemption, a long-standing rule that made low-value imports cheaper and easier to ship. For businesses, consumers, and anyone relying on global e-commerce, this change is more than just paperwork—it’s a game-changer. Let’s break it all down in plain language so anyone, from a 10-year-old to a trade professional, can understand.

Europe Blocks U.S.-Bound Parcels

The U.S. decision to eliminate the de minimis exemption has global ripple effects. Europe blocking U.S.-bound parcels is just the first visible response, but Asia-Pacific countries are following. The rule is designed to boost customs revenue, crack down on smuggling, and give U.S. retailers a fighting chance—but it also means higher costs, more delays, and frustrated consumers. In the months ahead, expect new systems, clearer rules, and eventually smoother shipping. But for now, shoppers and businesses alike need to brace for delays and budget for extra duties.

| Topic | Details |

|---|---|

| New Rule | U.S. ends “de minimis” tariff exemption (under $800) starting August 29, 2025 |

| Impact | Europe halts shipments to U.S.; Asia-Pacific regions follow |

| Why? | Crackdown on drug smuggling, customs revenue, and fair trade |

| Affected | E-commerce giants (Temu, Shein), small sellers, consumers |

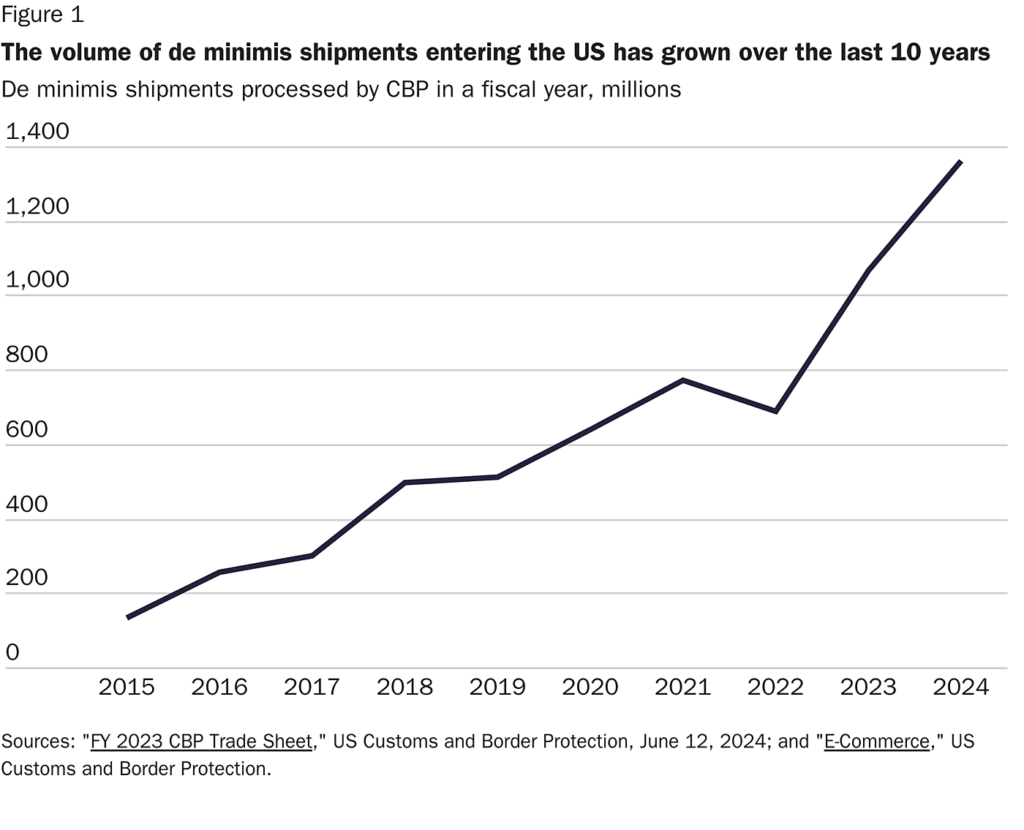

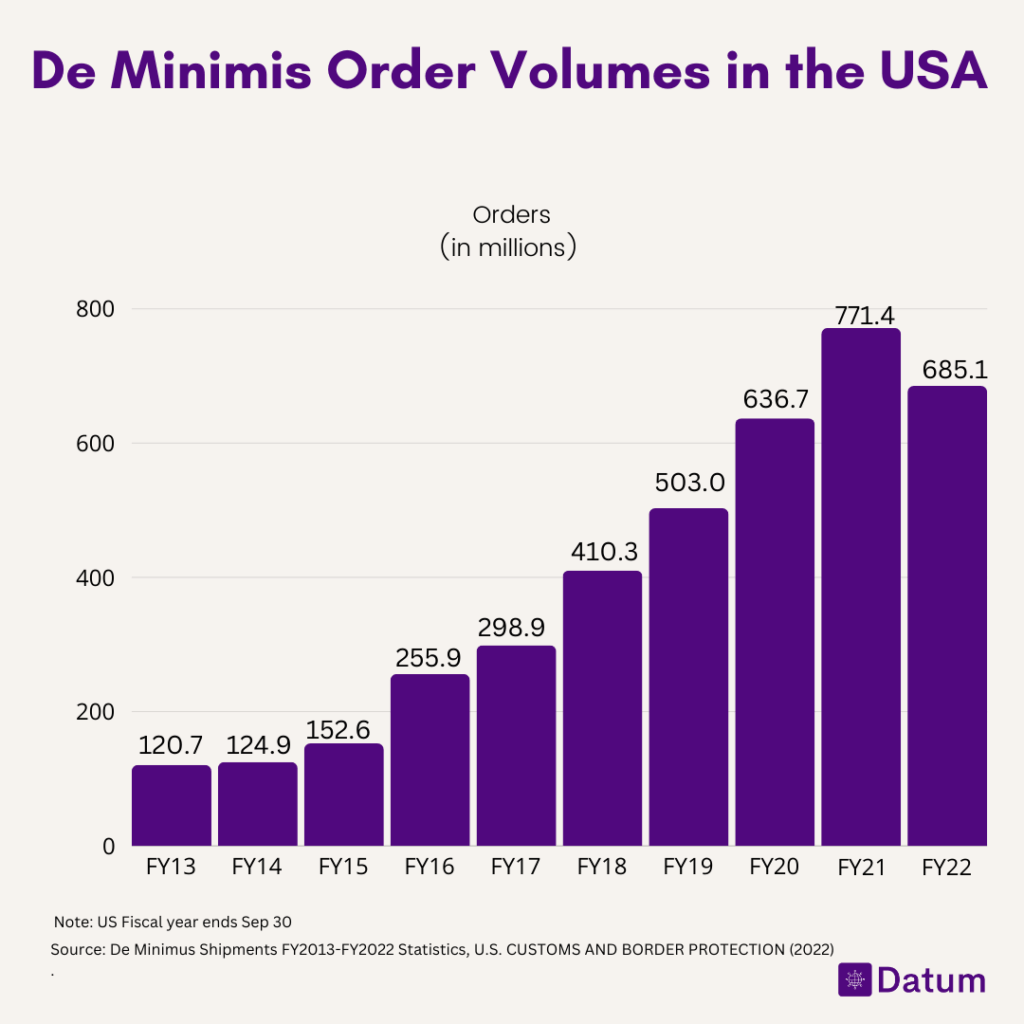

| Stats | De minimis shipments grew from 134M (2015) to 1.3B (2024) |

| Postal Services | DHL, Royal Mail, La Poste, PostNord, bpost paused shipments |

| Exceptions | Gift parcels under $100 between individuals still allowed |

| More Info | U.S. Customs and Border Protection (CBP) |

What Is the “De Minimis” Exemption?

The de minimis exemption was like a “fast pass” for small-value imports. If you ordered something worth less than $800, U.S. Customs let it slide through duty-free with almost no paperwork.

Imagine buying a $50 hoodie from London. Before this change, it sailed right into the U.S. without extra fees. Now, that same hoodie might get stuck at customs, taxed, and delayed.

- In 2015, there were only 134 million de minimis shipments.

- By 2024, that skyrocketed to over 1.3 billion thanks to e-commerce platforms like Shein and Temu.

This was a huge loophole for global sellers and a win for bargain hunters in the U.S.

Why Did the U.S. Scrap the Rule?

Officials gave three main reasons for axing the exemption:

- Drug trafficking – Smugglers were hiding fentanyl and other drugs in low-value parcels.

- Lost customs revenue – Billions in duties were slipping through without collection.

- Fairness for U.S. retailers – Domestic sellers were losing out to cheaper duty-free imports.

As reported by The Washington Post, this isn’t just about taxes—it’s about border security, economics, and fairness.

Europe’s Reaction on Europe Blocks U.S.-Bound Parcels

European postal operators weren’t ready for such a fast change. Many simply hit the pause button:

- Germany (DHL/Deutsche Post) – Suspended standard parcel shipments, though DHL Express still works.

- France (La Poste), Belgium (bpost), UK (Royal Mail) – Halted or restricted U.S. parcels.

- Scandinavia (PostNord, Posten Bring) – Suspended shipments from August 23.

- Italy, Spain, Austria – Followed with pauses in service.

- Asia-Pacific – Australia, New Zealand, India, Singapore, South Korea also hit pause.

At the moment, only gifts under $100 between individuals are exempt.

Historical Context

The de minimis exemption wasn’t always so generous.

- Before 2016: The threshold was just $200.

- 2016: Congress raised it to $800 under the Trade Facilitation and Trade Enforcement Act.

- 2025: The exemption is eliminated completely.

Compared to other countries, the U.S. was extremely lenient. For example:

- Canada: $40 CAD threshold.

- EU: €150.

- Australia: AUD $1,000.

By removing the exemption, the U.S. shifts from being one of the most generous to one of the strictest.

Expert Analysis

Trade experts are split on the move.

- Economists say it could add billions to U.S. customs revenue but warn it might also fuel inflation on imported goods.

- Retail analysts believe U.S. stores could finally compete on price against fast-fashion giants like Shein.

- Consumer advocates worry about confusion, delays, and hidden costs for everyday buyers.

Who Wins and Who Loses?

Winners

- U.S. retailers gain a fairer playing field.

- The government collects billions in new revenue.

- Customs agents have more tools to stop illegal drugs.

Losers

- Global e-commerce platforms lose their shipping advantage.

- Small sellers in Europe and Asia face higher costs.

- Consumers in the U.S. pay more and wait longer.

Real-World Example

Let’s say Emma in Ohio orders a $70 pair of sneakers from Sweden.

- Before: She pays $70 plus shipping, and the package arrives duty-free.

- Now: That same pair might be delayed at customs and hit with an extra $10–$20 in duties.

Multiply that by millions of packages, and you see the disruption.

Impact on Everyday Lifestyles

Beyond trade numbers and business strategies, this policy shift touches daily life. Families who regularly exchange small gifts across borders may face extra costs or delays. College students ordering affordable goods from overseas marketplaces will see prices climb. Even hobbyists who buy specialty items—like camera gear from Japan or handmade crafts from Europe—will feel the pinch. In short, the end of de minimis reshapes not only global commerce but also the simple, personal connections that small packages once made possible.

Consumer Protection Tips

- Check the fine print – Ask sellers about duties before you buy.

- Know your rights – Visit the FTC’s online shopping tips to avoid scams.

- Use trusted carriers – Private couriers like FedEx, UPS, and DHL Express are adapting quicker.

- Avoid hidden fees – If a seller promises “duty-free shipping,” be cautious—it may no longer be true.

Practical Advice for Businesses

- Upgrade systems: Integrate customs solutions like Zonos to calculate duties at checkout.

- Communicate with customers: Be upfront about delays and costs.

- Explore U.S. warehousing: Storing products in America can sidestep the issue.

- Diversify shipping: Rely less on standard postal services and more on express couriers.

Step-by-Step Guide: Navigating the New Rules

- Understand the cutoff – No free pass. All imports are now subject to duties.

- Pick carriers wisely – Many postal services have suspended shipments, but private couriers still move.

- Budget for extra costs – Expect 10–20% higher prices on foreign goods.

- Label packages correctly – Gifts under $100 may qualify for exemption.

- Stay updated – Bookmark CBP.gov for the latest official guidance.

Global Perspective

Other countries have stricter thresholds, so the U.S. is now aligning more closely with international norms. However, unlike Canada or the EU, the U.S. has an enormous appetite for online shopping, meaning the impact here will be far bigger.

- Canada: Imports over $40 CAD are taxed.

- EU: Duties apply above €150.

- China: Goods above ¥800 RMB require duties.

The U.S.’s sudden change sends a shockwave through global trade networks, because America is the largest consumer market in the world.

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big

Shocking Demand – Should Tax Crimes Lead to Citizenship Denaturalization?

Tampa OnlyFans Star Who Made $5.4 Million Now Charged With Tax Evasion

Future Outlook

Short-term, shipping delays and suspensions will frustrate buyers and sellers alike. Medium-term, expect postal systems to partner with customs software platforms to handle the paperwork. Long-term, higher costs will become the new normal, and e-commerce platforms may invest in U.S.-based warehouses to avoid the hassle.