Experts Push for 40% Sin Tax: When it comes to public health and government revenue, sin taxes are back in the spotlight. Recently, experts and policymakers have been pushing for a 40% sin tax on alcohol, cigarettes, and junk food, arguing it’s a bold step to reduce harmful consumption while funding critical social programs. Sounds heavy, right? But let’s break it down in plain English—because this move has real-life effects on everyday folks, businesses, and even kids growing up in America today.

Experts Push for 40% Sin Tax

The push for a 40% sin tax on alcohol, cigarettes, and junk food is more than just another government proposal. It’s a health strategy, an economic safeguard, and a cultural debate. While it may pinch your wallet at checkout, the long-term gains—fewer preventable diseases, lower healthcare costs, and stronger communities—could make it one of the most impactful policies of our time.

| Aspect | Key Insights |

|---|---|

| Proposal | 40% sin tax on alcohol, cigarettes, and junk food |

| Purpose | To curb harmful consumption and boost government revenue |

| Health Stats | Smoking causes 480,000+ deaths annually in the U.S. (CDC). Obesity affects 42% of adults (CDC). |

| Global Precedent | Mexico’s sugary drink tax reduced consumption by 7.6% in two years (NCBI). |

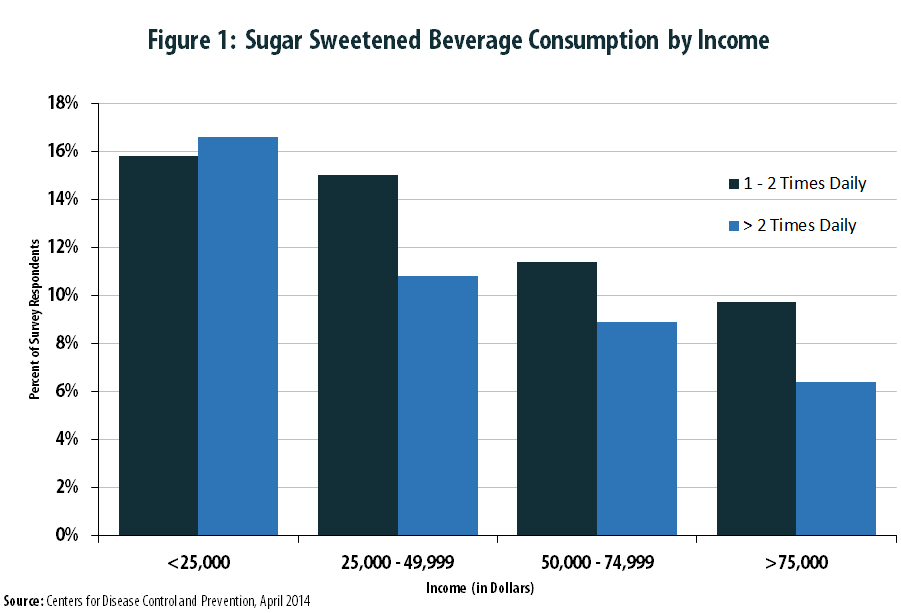

| Criticism | Sin taxes may disproportionately affect low-income families |

| Official Resource | U.S. Department of Health & Human Services |

Why Sin Taxes Are Trending?

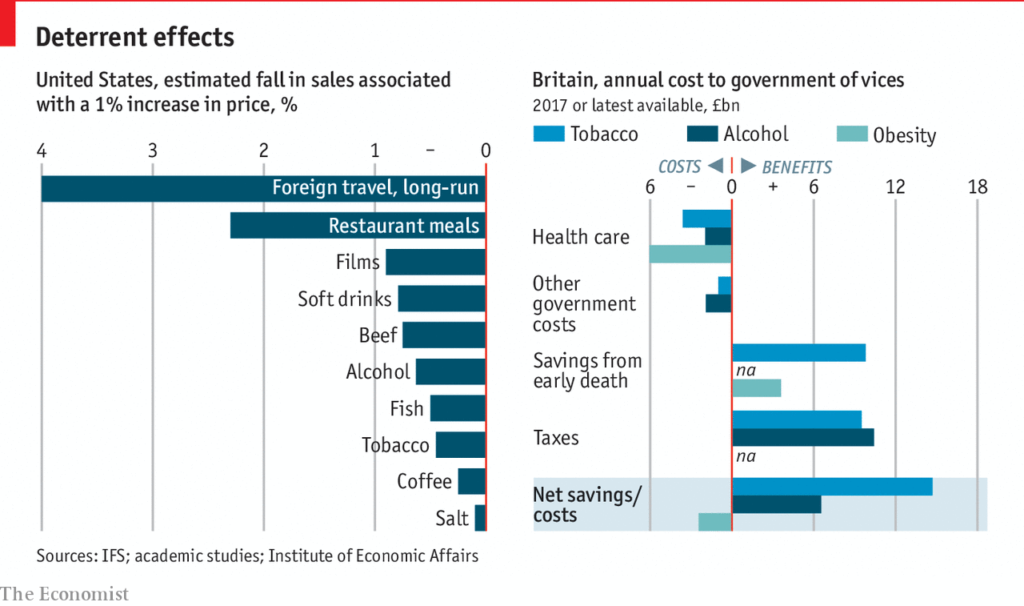

Sin taxes aren’t new. The U.S. has slapped extra taxes on tobacco and alcohol for decades. But now, with obesity, vaping, binge drinking, and junk food addiction rising, many experts believe it’s time to turn up the heat with stronger policies. The proposed 40% sin tax is designed to:

- Discourage people from over-consuming harmful products.

- Raise government revenue that can be funneled into healthcare and education.

- Level the playing field by addressing long-term health costs caused by lifestyle-related diseases.

Before you roll your eyes thinking, “Great, another tax grab,” let’s pause. There’s solid science and hard data behind this push.

What Exactly Is a Sin Tax?

Think of it this way: a sin tax is like a “behavior nudge.” It’s an extra cost slapped on stuff we know is bad for us—like cigarettes, booze, sodas, or even gambling. The idea is simple: if you make it pricier, people buy less of it.

A Real-World Example

Back in 2014, Mexico introduced a soda tax. Within two years, sugary drink sales dropped by almost 8%. That’s millions of fewer cans of Coke being gulped down—and a dent in rising obesity rates. The U.S. saw something similar in Philadelphia, where a soda tax cut sales by 38% in the first year.

So, while no tax is “fun,” history shows sin taxes do work.

A Brief History of Sin Taxes in the U.S.

- 1920s Prohibition: Instead of taxing, the government outright banned alcohol—leading to black markets and crime. Lesson: bans don’t work, but taxes do.

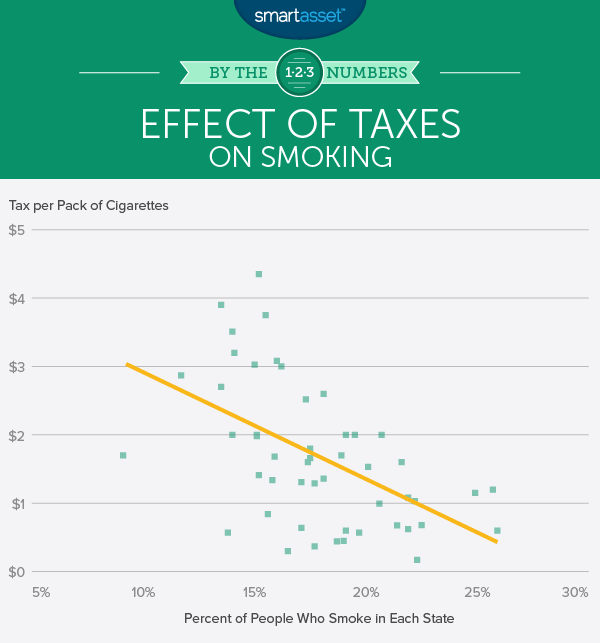

- 1960s–70s Cigarette Taxes: As evidence about smoking’s dangers grew, states raised cigarette taxes, leading to sharp declines in smoking.

- 2010s Soda Taxes: Philadelphia, Berkeley, and Seattle rolled out soda taxes—sparking heated debates but proving effective at reducing consumption.

- California Tobacco Tax (2017): Raised cigarette prices by $2 a pack, helping smoking rates drop to historic lows.

Why Experts Push for 40% Sin Tax?

Public Health at the Forefront

- Cigarette smoking kills 480,000 Americans each year.

- Alcohol contributes to 95,000 deaths annually in the U.S.

- Obesity affects 42% of adults and nearly 20% of kids—fueling heart disease, diabetes, and strokes.

Economic Impact

Lifestyle-related health issues cost the U.S. economy over $1 trillion annually in healthcare and lost productivity.

Funding the Future

A 40% sin tax could generate billions annually, supporting:

- Free school lunches and nutrition programs.

- Medicaid expansion.

- Public health campaigns and community fitness programs.

Global Lessons We Can Learn

- Nordic Countries: Sweden and Norway impose steep alcohol taxes, keeping consumption among the lowest in Europe.

- Singapore: Junk food ads aimed at children are restricted, paired with sugar taxes.

- United Kingdom: The Soft Drinks Industry Levy pushed soda makers to cut sugar, showing how taxes drive reformulation.

- Australia: Cigarette taxes skyrocketed, and smoking dropped to 11% of adults, among the lowest globally.

The message? Sin taxes work best when paired with education, access to healthier options, and cultural shifts.

How Businesses and Industries Might React?

Big industries aren’t going to just watch billions vanish. Likely moves include:

- Lobbying: Strong campaigns to water down or block legislation.

- Reformulation: Junk food companies may reduce sugar, fat, or salt to dodge higher rates.

- Rebranding: Expect more “healthy” positioning—smaller sodas, zero-alcohol beers, protein-packed snacks.

- Shifts for Restaurants & Bars: Short-term sales dips, but businesses often adjust by expanding healthier menu items.

For healthcare professionals, sin taxes could ease long-term pressure on hospitals and reduce preventable admissions.

The Behavioral Economics Angle

Here’s why price matters: people respond more to their wallets than to warnings.

- If a soda costs $1, you might grab two without thinking.

- If that soda costs $2.50, you’ll pause and maybe choose water.

Behavioral economics shows taxes alter habits more effectively than billboards or PSA campaigns.

Case Studies in the U.S.

- Philadelphia Soda Tax (2017): Soda sales dropped 38% in the first year. Critics noted small business struggles, but overall health outcomes improved.

- New York City Soda Size Ban Attempt: Courts struck down the proposed limit on soda cup sizes, showing bans are unpopular compared to taxes.

- California Tobacco Tax: Helped reduce smoking to 7% of adults—one of the lowest rates in the nation.

These examples highlight that taxes are more politically feasible and effective than outright bans.

A Step-By-Step Guide: How Sin Taxes Could Affect You

Step 1: Prices go up (a $8 pack of cigarettes → $11+).

Step 2: Consumers rethink choices (less soda, more water).

Step 3: Long-term health improves (lower obesity, fewer hospital visits).

Step 4: National healthcare savings kick in, reducing strain on taxpayers.

Policy Alternatives and Complements

Taxes alone won’t solve everything. Experts recommend:

- Subsidies for fresh produce and healthy meals.

- Education programs in schools.

- Transparent food labeling (like calorie counts).

- Community investments in wellness centers, parks, and gyms.

The Ethical Debate: Freedom vs. Responsibility

Critics ask: Should the government really be telling us what to eat or drink?

Supporters argue: It’s not about banning—it’s about balancing the books. Since taxpayers foot the bill for medical costs tied to smoking, drinking, and obesity, higher taxes make sense as a public responsibility.

It’s the classic debate between personal freedom and collective health.

Practical Tips for Consumers

- Quit Smoking: Use free resources like SmokeFree.gov.

- Drink Smart: Swap cocktails for mocktails or non-alcoholic beer.

- Cook at Home: Saves money and avoids hidden calories.

- Use Discounts: Farmers’ market vouchers and SNAP benefits stretch budgets.

Looking Ahead: The Future of Sin Taxes

As tech grows, governments may not stop at alcohol or junk food. Expect:

- AI-driven health nudges, where apps track food purchases and suggest swaps.

- Digital health monitoring tied to insurance premiums.

- Broader taxes on ultra-processed foods and energy drinks.

The 40% sin tax may be just the start of a new wave of health-first policy.

Borrowed Money From a Friend? You Might Be Hit With a Tax Penalty

Govt Plans 40% Sin Tax on Alcohol, Cigarettes and Gaming Under GST 2.0 Shock Plan

Experts Warn Dismantling Justice Department Tax Division Could Cost Billions