Fake ITC & Duplicate GST Demand: If you’ve been following the latest GST updates, you’ve likely come across the buzz around the Delhi High Court’s ruling on Fake ITC & Duplicate GST Demand. In short, a taxpayer claimed they were being hit twice for the same alleged GST fraud, but the court refused to step in via a writ petition. Instead, it told them to follow the proper appeal route under the CGST Act. This ruling isn’t just another line in the law books—it’s a reminder to every business, consultant, and accountant that in GST disputes, process matters as much as the facts. You can’t skip the queue, even if you think the system made a mistake.

Fake ITC & Duplicate GST Demand

The Delhi High Court’s ruling on Fake ITC & Duplicate GST Demand is a timely reminder: in GST disputes, especially fraud-related ones, the legal path starts with the Section 107 appeal—not the High Court. The judgment protects due process, ensures fact-heavy cases get a proper hearing, and keeps extraordinary remedies reserved for truly extraordinary situations. For businesses, this means keeping records airtight, vendors verified, and legal strategies realistic. If a demand notice arrives, don’t panic—appeal smart, not fast.

| Point | Details |

|---|---|

| Case Date | August 9, 2025 |

| Court | Delhi High Court |

| Core Issue | Alleged fraudulent ITC & duplicate GST demand (Central and State GST departments for the same period) |

| Petitioner’s Argument | Demands were duplicative and should be quashed |

| Court’s Ruling | Writ petition not maintainable—appeal under Section 107 required |

| Deadline for Appeal | August 31, 2025 |

| Court Direction | Department not to reject appeal as time-barred; must decide on merits |

| Official GST Portal | www.gst.gov.in |

Understanding GST and Fake ITC in Simple Terms

GST, or Goods and Services Tax, is India’s one-nation, one-tax system. If you run a business, you can claim Input Tax Credit (ITC) for the GST you’ve already paid on your purchases. That means you don’t end up paying tax twice on the same value.

Fake ITC is when someone claims this refund without actually paying the GST in the first place—often by creating fake invoices or dealing with shell companies. Imagine trying to get a refund for a plane ticket you never booked; that’s what fake ITC looks like in tax terms.

How the Case Unfolded?

Here’s a closer look at what happened:

- The Trigger: The petitioner was issued two GST demand notices for the same tax period—one by the Central GST department and another by the State GST department.

- The Complaint: They claimed this was a clear case of duplication and went straight to the Delhi High Court, skipping the normal appeal process.

- The Legal Shortcut Attempt: They filed a writ petition under Article 226 of the Indian Constitution, which allows High Courts to intervene in exceptional cases.

- The Court’s Response: The bench said allegations of fake ITC involve questions of fact—something the appellate authority, not the High Court, should examine first. The writ petition was dismissed, but the court gave them until August 31, 2025, to file an appeal under Section 107 of the CGST Act.

The court also protected the petitioner by directing the tax department not to reject the appeal as time-barred, ensuring they get a fair shot on the merits.

Why Writ Petitions Aren’t the First Stop in GST Fraud Cases?

In Indian tax law, there’s a simple hierarchy:

- Tax officer’s order →

- Statutory appeal →

- Tribunal →

- High Court/Supreme Court

Writ petitions are meant for exceptional scenarios—like when a law itself is unconstitutional or there’s a blatant violation of fundamental rights. When it comes to fake ITC, the facts are often messy: Were the invoices real? Was tax actually paid? Did the supplier exist?

Courts believe these questions are better addressed through the layered appeal process. In other words, you’ve got to play the innings before appealing to the umpire upstairs.

How Fake ITC Scams Impact the Economy

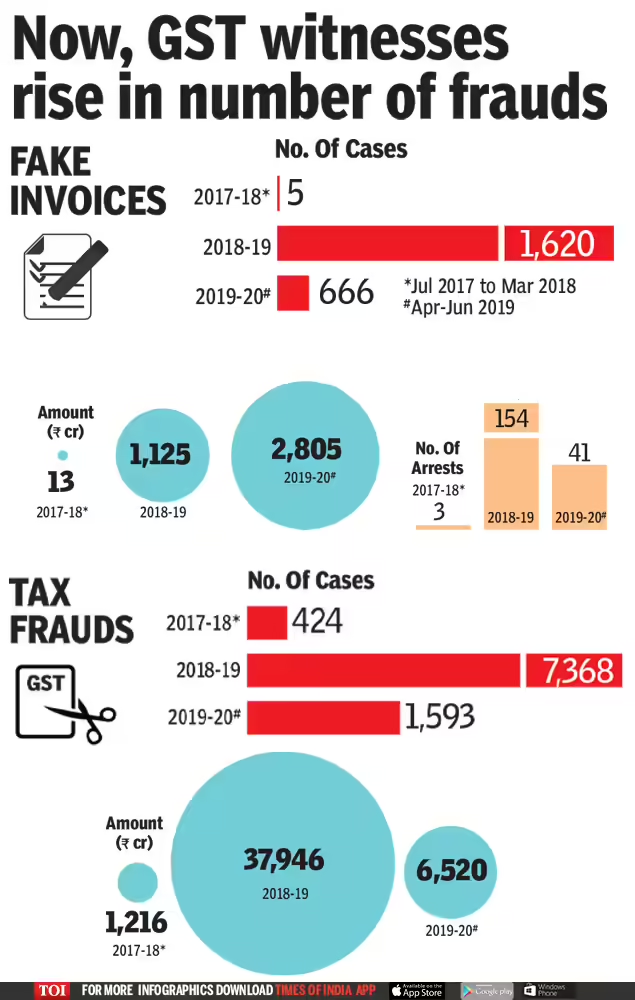

The Central Board of Indirect Taxes and Customs (CBIC) has reported that fake ITC frauds have cost India over ₹57,000 crore in just the last few years (source). These scams:

- Drain the government’s tax revenue.

- Give fraudsters an unfair edge over honest businesses.

- Increase compliance scrutiny for everyone, even the law-abiding taxpayers.

For example, in 2023, authorities busted a ₹1,200 crore fake ITC racket involving over 100 shell companies. These firms existed only on paper, issuing invoices to each other to claim refunds for tax they never paid.

Step-by-Step Guide to Filing a GST Appeal Under Section 107

If you ever receive a demand notice—whether for duplicate GST or alleged fake ITC—here’s how to file an appeal the right way:

Step 1: Confirm Eligibility

You, as the taxpayer or your authorized representative, can file the appeal.

Step 2: Note the Time Limit

You normally get 3 months from the date of the order. Delays can be condoned up to 1 additional month in special cases.

Step 3: Prepare Your Case

- Collect the original demand order.

- Draft clear grounds of appeal.

- Gather all supporting documents—GST returns, purchase invoices, payment proofs, vendor verification reports.

- Calculate and arrange the pre-deposit: 10% of the disputed tax amount (capped at ₹25 crore).

Step 4: File Online

Log in at www.gst.gov.in → “Services” → “User Services” → “My Applications” → “Appeal to Appellate Authority.”

Step 5: Attend Hearings

The appellate authority may call you for hearings—be ready to explain your case and submit any additional evidence.

Real-Life Example: The Parking Ticket Analogy

Think of GST demands like traffic tickets. If you think a ticket was wrongly issued, you don’t run straight to the Supreme Court—you first go to the local traffic appeals board. If you get two tickets for the same incident from two different officers, the board reviews the facts and decides. That’s exactly what the Delhi HC said here—follow the process.

Past Cases Show a Clear Pattern

- Sardar Auto Traders vs Additional Commissioner (CGST Ward 32): The court refused a writ in a ₹1.48 lakh fake ITC case and told the petitioner to appeal.

- GST Consultant Penalty Case: A consultant accused of enabling fake ITC claims faced penalties under Sections 122(1A), 122(3), and 125 of the CGST Act. The court upheld the penalty, saying the appeal route should have been taken first.

- Multiple State vs Central Demands: Similar duplication disputes have arisen in Maharashtra and Gujarat, with courts consistently directing taxpayers to the appellate process.

Practical Tips to Stay Clear of Fake ITC & Duplicate GST Demand Trouble

- Vendor Verification: Always check if your supplier is GST-registered and compliant. Use the GST portal’s search tool.

- Maintain Accurate Records: Store invoices, contracts, and payment proofs securely for at least 6 years.

- Reconcile Regularly: Match your purchase register with GSTR-2B each month to catch mismatches early.

- Avoid Suspicious Deals: If the price or tax benefit seems too good to be true, it probably is.

- Get Professional Help: For high-value transactions, consult a GST expert before filing returns.

Vodafone Idea Faces ₹21.39 Crore GST Penalty for Alleged Short Payment Under RCM!

Fraud Worth Crores? Group Booked for Creating Fake GST Invoices to Con Govt

Why This Case Matters for Businesses?

The Delhi HC’s decision sends a strong signal: compliance isn’t just about paying your taxes, it’s about following the process when disputes arise. Even if you believe the demand is unfair or duplicated, jumping straight to a writ petition can backfire. This ruling also underscores the growing seriousness with which Indian courts view fake ITC cases. Given the billions lost to GST fraud, expect stricter scrutiny, more audits, and fewer shortcuts in the legal process.