Fake PAN 2.0 Email Alert For Card Holders: If you’ve recently come across a Fake PAN 2.0 email alert, you’re not alone. Cybercriminals have been sending official-looking emails claiming that taxpayers and cardholders must upgrade to something called “PAN 2.0.” The catch? PAN 2.0 doesn’t exist. It’s nothing more than a phishing scam designed to steal personal information, including your PAN number, Aadhaar, banking details, and login credentials. Scams like this are not just random spam. They are carefully designed to look authentic, tricking people into clicking links and handing over sensitive information. But with the right knowledge, you can avoid becoming a victim. Let’s break this down in detail so you and your loved ones stay safe.

Fake PAN 2.0 Email Alert For Card Holders

The Fake PAN 2.0 email scam is the latest in a growing wave of phishing attacks designed to steal identities and financial data. While the emails may look convincing, remember that PAN 2.0 does not exist. Protect yourself by staying vigilant, using official websites, and reporting suspicious activity. Cyber safety is not optional—it’s a responsibility we all share. By practicing good cyber hygiene, you can keep your financial identity secure and help others stay safe too.

| Point | Details |

|---|---|

| Scam Type | Fake PAN 2.0 email alerts (phishing scam) |

| Target | Cardholders, taxpayers, and general citizens |

| Method | Fraudulent emails with links to fake government-like websites |

| Official Stance | PAN 2.0 is fake — confirmed by Income Tax Department & PIB |

| Risk | Theft of PAN, Aadhaar, and bank details leading to fraud |

| Warning Signs | Suspicious email addresses, urgent subject lines, fake download buttons |

| Report Scam | Email: incident@cert-in.org.in or webmanager@incometax.gov.in |

What Is a PAN Card and Why It Matters?

A Permanent Account Number (PAN) is a unique 10-character alphanumeric code issued by the Income Tax Department of India. It acts like a financial fingerprint, ensuring every financial transaction is traceable to the right individual.

PAN is essential for:

- Filing income tax returns

- Opening or operating a bank account

- Applying for loans and credit cards

- High-value transactions like buying property, gold, or stocks

Because PAN is tied to almost every financial activity, it’s a prime target for scammers. With just your PAN details, cybercriminals can impersonate you, take loans in your name, or commit tax fraud.

How the Fake PAN 2.0 Email Alert For Card Holders Works?

Here’s a simple breakdown of how the scam is executed:

- The Email Arrives: It looks like it’s from the Income Tax Department, urging you to “upgrade” to PAN 2.0.

- Urgency is Created: The subject line might read “Final Notice: Download PAN 2.0 Today” or “Mandatory Update for PAN Holders.”

- Phishing Link Inside: The email contains a link that mimics official portals.

- Fake Website Trap: The site looks like a government website but is controlled by criminals.

- Data Theft: Victims are asked to input personal and financial details, which scammers harvest.

- Exploitation: The stolen data may be used for identity theft, fraudulent loans, or sold on the dark web.

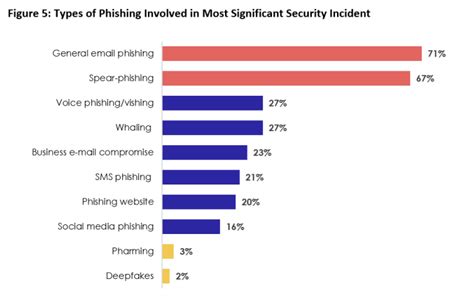

This tactic isn’t new. Similar scams happen in other countries too. In the United States, taxpayers often receive fake IRS refund emails. In the UK, criminals send HMRC phishing messages. The pattern is the same: use fear and urgency to trick people into clicking.

Why This Scam Is Dangerous?

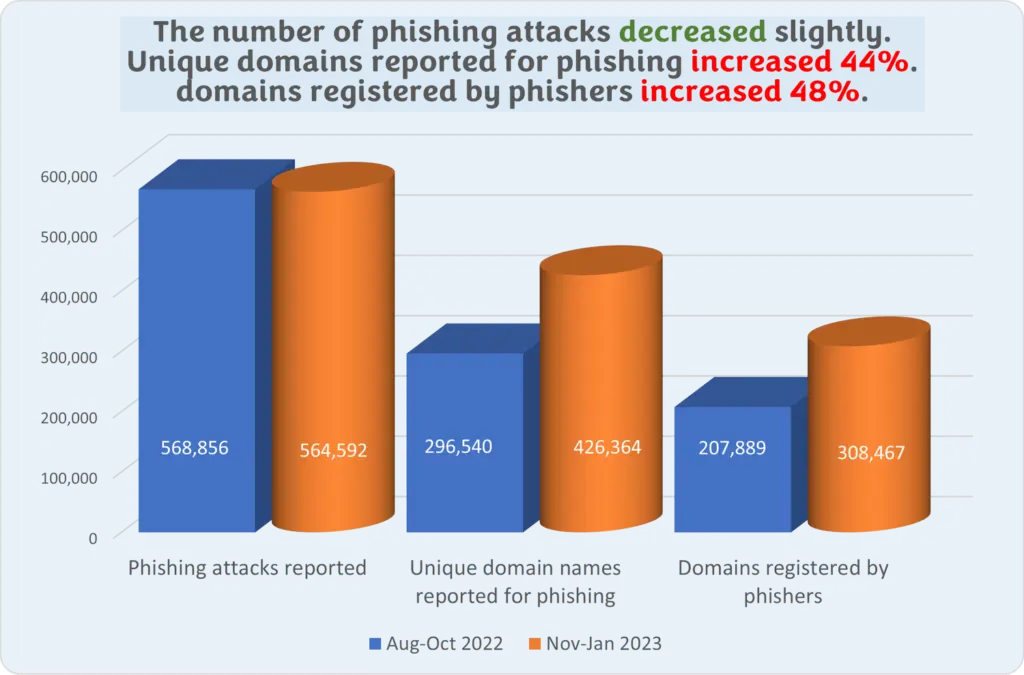

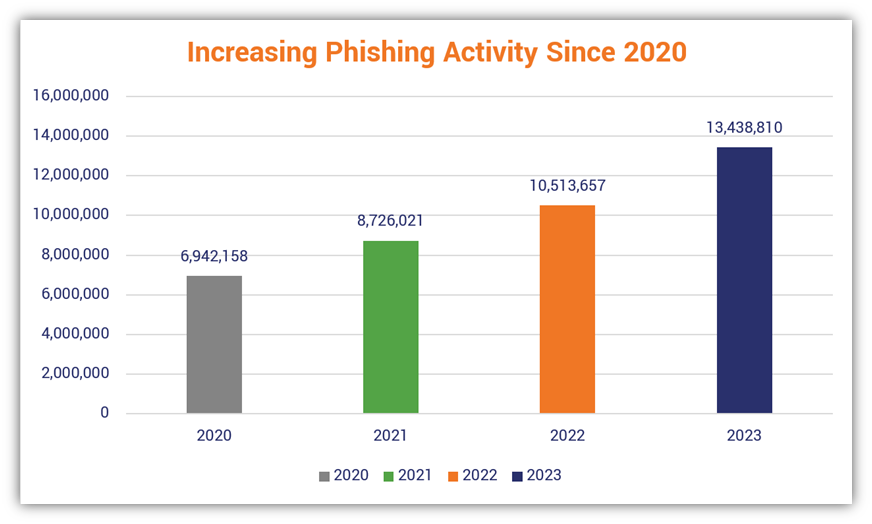

Phishing scams have been rising dramatically. According to CERT-In (Indian Computer Emergency Response Team), phishing incidents in India grew by over 300% between 2020 and 2023. Globally, reports show that more than 3.4 billion phishing emails are sent every single day.

For Indian citizens, falling for a scam like this can lead to:

- Identity Theft: Fraudsters may use your PAN to open accounts or commit crimes.

- Financial Fraud: Unauthorized transactions, drained bank accounts, or fake loans.

- Tax Fraud: Filing false tax returns to claim refunds in your name.

- Credit Score Damage: Once your credit is misused, fixing it can take years.

In short, one careless click could compromise your entire financial identity.

How to Identify a Fake PAN 2.0 Email?

The good news is that phishing scams often leave behind obvious clues. Here are some signs to watch for:

- Suspicious Email IDs: Genuine government emails always end in

.gov.inor.nic.in. Anything else is suspicious. - Urgent Language: Messages demanding “Immediate Action” or “Final Warning” are classic scam tactics.

- Attachments or Download Links: Government agencies never send sensitive documents this way.

- Grammar Issues: Many scam emails have awkward wording, spelling errors, or inconsistent formatting.

- Too Good to Be True Offers: If the message promises perks, free upgrades, or faster refunds, it’s likely fraudulent.

Step-By-Step Guide to Staying Safe

Step 1: Pause Before Clicking

Never click links or open attachments from suspicious emails.

Step 2: Verify the Source

Visit official websites directly:

- Income Tax e-Filing Portal

- NSDL PAN Services

- UTIITSL PAN Portal

Step 3: Report the Email

Forward phishing attempts to:

incident@cert-in.org.in(CERT-In)webmanager@incometax.gov.in(Income Tax Dept.)

Step 4: Secure Your Accounts

If you clicked by mistake:

- Change all passwords immediately.

- Enable two-factor authentication (2FA).

- Inform your bank and monitor accounts.

Step 5: Spread Awareness

Warn friends, colleagues, and family members, especially senior citizens who are often targeted.

Best Practices for Cyber Hygiene

Building safe online habits is the best long-term protection. Consider these measures:

- Use strong, unique passwords for all accounts.

- Enable two-factor authentication wherever possible.

- Install reliable antivirus and anti-phishing tools.

- Regularly update your operating system and apps.

- Review your bank and credit card statements monthly.

- Never save sensitive details in unsecured notes or emails.

Real-Life Case Study

In 2024, a working professional in Jaipur clicked on a phishing email related to PAN. Within 24 hours, ₹1.5 lakh was siphoned from his bank account through unauthorized transfers. Investigations revealed that the fraudsters used his PAN and Aadhaar to create a fake KYC profile, opening a new account in his name.

Cases like this highlight that even educated, tech-savvy individuals can be tricked when scams look official.

Expert Advice and Government Guidance

The Press Information Bureau (PIB) and the Income Tax Department have confirmed that there is no PAN 2.0. Citizens are urged not to click suspicious links or share sensitive details.

Cybersecurity experts recommend cross-checking alerts with PIB’s fact-check handle, which regularly debunks fake government messages.

The Reserve Bank of India (RBI) also reminds citizens that no bank or government agency will ever ask for confidential details via email, SMS, or phone calls.

Bengaluru Man’s PAN Card Misused in ₹43 Crore GST Fraud – Police Investigation Begins

PIB Warns Against Fake Emails Claiming Free e-PAN Card Download — Here’s the Truth

Shopkeeper Receives ₹141 Crore Tax Notice: Learn How PAN Misuse Can Affect You

Global Perspective

Phishing scams are a worldwide issue.

- In the U.S., the IRS warns about fake refund emails every tax season.

- In the UK, fraudsters impersonate HMRC to trick citizens into sharing tax details.

- In Australia, MyGov phishing scams target taxpayers with false login prompts.

These global cases underline a single truth: cybercriminals exploit trust and urgency. Being cautious is the best defense, no matter where you live.