FHRAI Pushes GST Rationalisation: The Federation of Hotel & Restaurant Associations of India (FHRAI) has taken center stage with its call for GST rationalisation to boost Indian tourism globally. At first glance, tax reforms may sound like a boring policy issue. But here’s the truth: this proposal could change the way India is viewed as a global travel destination, putting it on par with heavyweights like Thailand, Singapore, and Vietnam. At present, India’s tourism sector contributes around 5% of national GDP. Industry veterans argue that with the right tax structure, this figure could double within the next decade, powering job growth, boosting small businesses, and helping India achieve its Vision 2047 goals of becoming a developed economy.

FHRAI Pushes GST Rationalisation

The Federation of Hotel & Restaurant Associations of India (FHRAI) is right: GST rationalisation to boost Indian tourism globally is about more than taxes. It’s about making India a travel-friendly, affordable, and competitive destination. A flat 5% GST with ITC could double tourism’s GDP share, create millions of jobs, and elevate India into the global top tier of tourism economies. For tourists, this means cheaper vacations. For businesses, easier compliance. For India, it’s a bold step toward Vision 2047.

| Point | Details |

|---|---|

| Proposal | FHRAI demands a uniform 5% GST with Input Tax Credit (ITC) across the tourism and hospitality sector. |

| Current Problem | Hotels face multiple GST slabs (12%, 18%, 28%). Food & beverage (F&B) taxation is linked to room rates, creating confusion. |

| GDP Contribution | Tourism contributes ~5% of GDP today, with the potential to double. |

| Global Benchmark | Thailand (7% VAT), Singapore (9% GST), Vietnam (10% VAT) — all lower and simpler than India’s. |

| Employment Impact | Potential creation of 10–12 million jobs in hospitality, travel, and allied services. |

| Source | FHRAI Official Website |

GST in Hospitality: A Rocky Road Since 2017

When India launched the Goods and Services Tax (GST) in 2017, it was hailed as a revolutionary step to unify indirect taxation. For manufacturers, logistics firms, and retailers, it brought relief. But the hospitality industry became a casualty of complexity.

- Rooms below ₹1,000 are exempt from GST.

- Rooms between ₹1,000 and ₹7,500 attract 12% GST.

- Rooms above ₹7,500 are taxed at 18%, with some luxury categories going up to 28%.

- Restaurants lost input tax credit (ITC), meaning they pay GST on supplies (like vegetables, furniture, electricity) but cannot offset it against tax collected.

- To complicate things further, F&B services in hotels are taxed based on room tariffs, not food bills.

The result? A system that confuses customers, burdens small businesses, and makes India look more expensive than competing Asian destinations.

FHRAI Pushes GST Rationalisation in Detail

1. Uniform 5% GST With Input Tax Credit (ITC)

This would mean one simple rate across hotels, restaurants, and resorts. Hotels could claim ITC, avoiding “double taxation.”

2. Decoupling F&B GST From Room Tariffs

If you book a luxury suite, your food currently gets taxed at a higher rate—even if you just order a sandwich. FHRAI calls this policy irrational and proposes standalone GST for F&B.

3. Regularising Past GST Payments

Ambiguity has led to hotels receiving tax notices for misclassification. FHRAI wants past disputes regularised, freeing businesses to focus on growth.

Why Tourists Care About GST?

Taxes directly affect the final cost of travel. Consider this example:

- A family of four from Chicago books a 5-night stay in a premium Delhi hotel. Under the current system, they could end up paying 18–28% GST on their rooms plus higher restaurant taxes.

- Under FHRAI’s proposal, the family would pay a flat 5% GST, saving hundreds of dollars.

For domestic tourists, cheaper stays mean weekend getaways, pilgrimages, and family vacations become more accessible. For international tourists, India would suddenly look like a value-for-money destination, much like Cancun for Americans or Phuket for Europeans.

Case Studies: Goa and Jaipur

- Goa: Competing with Bali and Phuket, Goa struggles because high GST makes luxury hotels pricier than comparable Southeast Asian resorts. Rationalisation could help Goa regain international appeal.

- Jaipur: Known for its heritage hotels and palaces, Jaipur’s luxury rooms fall into the highest GST slab, deterring European and American tourists who compare costs with cheaper Southeast Asian alternatives.

Regional Impact Across India

- North India (Himalayas & Rajasthan): Lower GST would make adventure tourism, trekking, and heritage stays more affordable.

- South India (Kerala & Tamil Nadu): Ayurveda retreats and wellness tourism could see a surge in foreign bookings if tax burdens drop.

- West India (Goa & Maharashtra): Coastal tourism and business travel in Mumbai would benefit.

- East India (Odisha & Northeast): Lesser-known destinations could attract backpackers and eco-tourists with lower costs.

Global Comparisons

- Thailand: 7% VAT, bringing in 40 million tourists annually pre-COVID.

- Singapore: 9% GST, but efficient, transparent, and paired with strong infrastructure.

- Vietnam: 10% VAT, yet consistent, helping the country become a rising tourism star.

- India: Complex, high, and inconsistent taxation — a deterrent for global travelers.

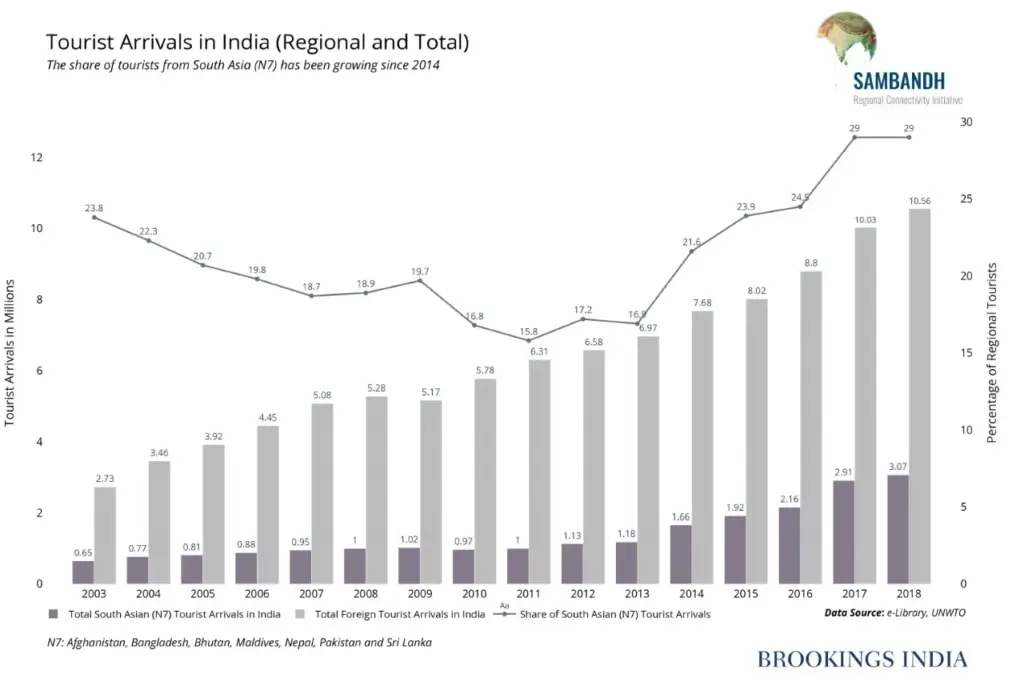

According to UNWTO data, India attracted 6.2 million international tourists in 2022, while Thailand welcomed 11 million. The gap is largely explained by tax competitiveness and perception of affordability.

Tourism Post-COVID

The World Travel and Tourism Council (WTTC) estimated a 50% global tourism revenue loss in 2020 due to COVID. India’s tourism sector, employing nearly 40 million people, was among the hardest hit. Recovery is happening, but high GST is slowing it down. Rationalisation could provide the booster needed to attract global travelers back.

Government’s Dilemma

The government sees GST as a major revenue source. Lowering GST may reduce short-term income. But FHRAI argues that reforms will increase overall revenue via higher tourist inflows. Economists cite the Laffer Curve: lower taxes encourage more spending, ultimately benefiting government coffers.

Vision 2047: Tourism as a Growth Engine

India’s Vision 2047 aims to transform the country into a developed economy. Tourism is central to this vision.

- GDP from tourism could double by 2030.

- 10–12 million jobs could be added, from hotels to handicrafts.

- India could break into the Top 5 tourism economies, rivaling Spain, France, and the USA.

Practical Tips for Hospitality Businesses

- Stay Updated: Follow GST Council announcements and FHRAI bulletins.

- Prepare Systems: Update billing software to adapt to uniform GST.

- Educate Teams: Train staff to explain simplified billing to guests.

- Marketing Angle: Use “Affordable India” as a global campaign pitch.

- Leverage ITC: If restored, strategize purchases to maximize tax benefits.

Job Creation and Career Growth

Tourism already supports 40 million jobs in India. GST reforms could add millions more:

- Hotels: Front office, chefs, housekeeping, and management roles.

- Travel Agencies: More tourists mean more bookings.

- Handicrafts & Local Businesses: Increased footfall boosts rural employment.

- Technology & Digital Tourism: Growth in booking platforms and AI-based travel services.

Expert Insights

FHRAI President K. Syama Raju:

“Linking F&B taxation to room tariffs is operationally challenging. Rationalising GST is not just about affordability, but about positioning India as a global tourism leader.”

Tourism economist Dr. Anil Bhandari:

“Every percentage point reduction in GST can add thousands of crores to India’s tourism earnings. The math is simple: cheaper trips attract more tourists.”

GST Rate Rejig to Benefit Farmers and Middle Class – FM Sitharaman Outlines Reform Gains

GST Shake-Up Sparks Tensions Between Centre and States – Can Revenue Gaps Be Bridged?

India’s Aggressive Investment Reforms: GST Relief, PLI Tweaks, and a Simpler Future