Fixing GST Could Unlock a Health Insurance Boom: If you’ve ever tried buying health insurance in India and felt like the premium punched you in the gut harder than your Monday morning coffee, you’re not alone. The culprit? Goods and Services Tax (GST)—currently a chunky 18% on health and life insurance premiums. Experts believe that by the time India celebrates its centenary of independence—India@100—a smart fix to GST could make health insurance as common in households as smartphones are today. And honestly, that’s not just good news for families—it’s a game-changer for the nation’s health and financial security.

Fixing GST Could Unlock a Health Insurance Boom

Fixing GST on health insurance premiums is more than a tax tweak—it’s a potential lifeline for millions. With the right balance of affordability, trust, and accessibility, India could see a health insurance boom by India@100 that not only protects families but strengthens the healthcare ecosystem. The ball is now in the policymakers’ court. If done right, GST reform could be one of the most impactful health policy shifts in modern Indian history.

| Point | Details |

|---|---|

| Current GST Rate | 18% on health & life insurance premiums |

| Potential Reform | Reduction to 12% or 5% with Input Tax Credit (ITC) |

| Insurance Penetration | Currently ~40–50% coverage in India |

| Impact of GST Cut | Lower premiums, higher affordability, broader coverage |

| Major Supporters | IRDAI, healthcare leaders, industry experts |

| Trust Issues | 50% of policyholders face claim rejections/delays |

| Official Resource | GST Council, Government of India |

Why GST Is the Elephant in the Room?

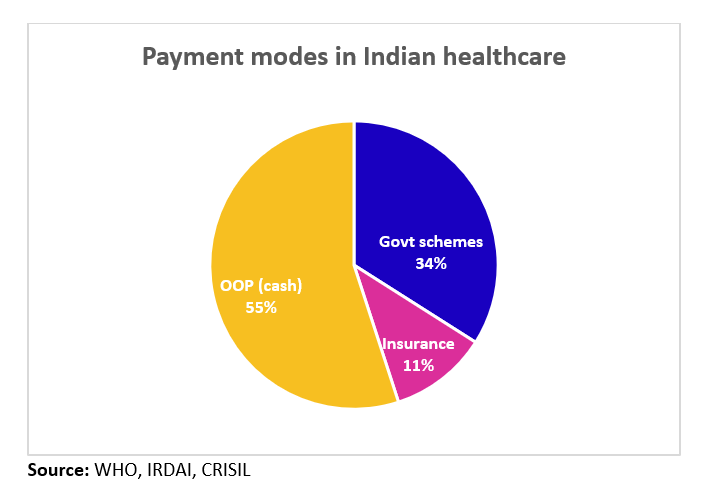

Health insurance in India is already up against rising premiums, a growing trust gap between patients and insurers, and complicated claim processes. Slap an 18% GST on top, and you’ve got a recipe for pushing middle-class families away from coverage they desperately need.

In the U.S., insurance costs are a political lightning rod—ask anyone who’s stared at a hospital bill without crying. India’s situation is different, but the math is similar: extra taxes = higher prices = fewer buyers.

Example:

If your family’s annual premium is ₹25,000, GST alone adds ₹4,500. Now imagine shaving that down to ₹1,250 with a 5% GST—that’s the difference between skipping coverage and saying, “Yeah, we can afford this.”

Case Study: The Sharma Family

Meet the Sharmas—middle-class, living in Pune, with two kids. Their family floater policy costs ₹28,000 annually. With 18% GST, they’re paying an extra ₹5,040. That’s one month’s school tuition for their daughter.

If GST dropped to 5%, they’d save nearly ₹4,300 a year—money they could use for preventive checkups or a rainy-day fund. Multiply that across millions of families, and you’ve got a huge national shift.

Fixing GST Could Unlock a Health Insurance Boom: The Promise of a GST Cut

Affordability: More Bang for Your Buck

A lower GST instantly puts money back in the pockets of policyholders. According to the Financial Express, the GST Council is weighing exemptions for senior citizens and policies up to ₹5 lakh. That means your parents could get protected without paying a “luxury” tax.

Trust: Repairing Broken Bridges

Fortis Healthcare’s Dr. Ashutosh Raghuvanshi points out that trust is eroding fast—about 50% of policyholders have faced claim rejections, delays, or partial settlements. If GST reform is paired with better claim transparency, more folks will step back into the insurance game.

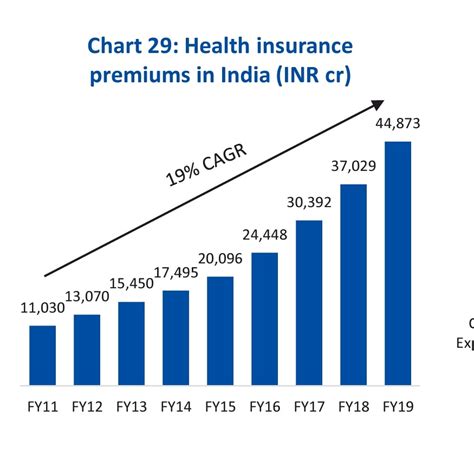

Penetration: From 40% to Everyone

India’s insurance penetration is hovering between 40–50%. Compare that with near-universal coverage in countries like the UK. Cutting GST could help close that gap by making premiums more attractive, especially for young earners.

Why Input Tax Credit (ITC) Is a Big Deal?

Reducing GST sounds great, but if insurers lose their ability to claim Input Tax Credit (ITC)—which helps them offset tax paid on their own expenses—costs might actually rise.

Think of ITC as the “cashback” of the tax world. Without it, insurers could pass their higher costs right back to you, wiping out the savings from a lower GST. The sweet spot, according to industry voices, is 12% GST with ITC intact.

Premium Impact Table

| Annual Base Premium | With 18% GST | With 12% GST | With 5% GST |

|---|---|---|---|

| ₹15,000 | ₹17,700 | ₹16,800 | ₹15,750 |

| ₹25,000 | ₹29,500 | ₹28,000 | ₹26,250 |

| ₹40,000 | ₹47,200 | ₹44,800 | ₹42,000 |

Economic Ripple Effect

- For Households: A ₹4,000–₹5,000 annual saving can be redirected to preventive health or savings.

- For Insurers: Lower GST + higher coverage rates = larger premium base.

- For the Government: While there’s short-term revenue loss from GST cuts, long-term gains come from reduced public healthcare spending and healthier citizens.

- For the Economy: Healthier citizens mean higher productivity and lower absenteeism, boosting GDP growth over time.

Expert Voices

Shobana Kamineni of Apollo HealthCo has been vocal: “Formalizing and rationalizing GST in healthcare is not just a financial decision—it’s about making essential protection accessible to all. Right now, GST isn’t being fully passed through, and that’s hurting the consumer.”

An IRDAI official, speaking to Economic Times, noted: “We have high hopes for GST reform. But it must be done in a way that doesn’t remove ITC—otherwise the consumer may not see real benefits.”

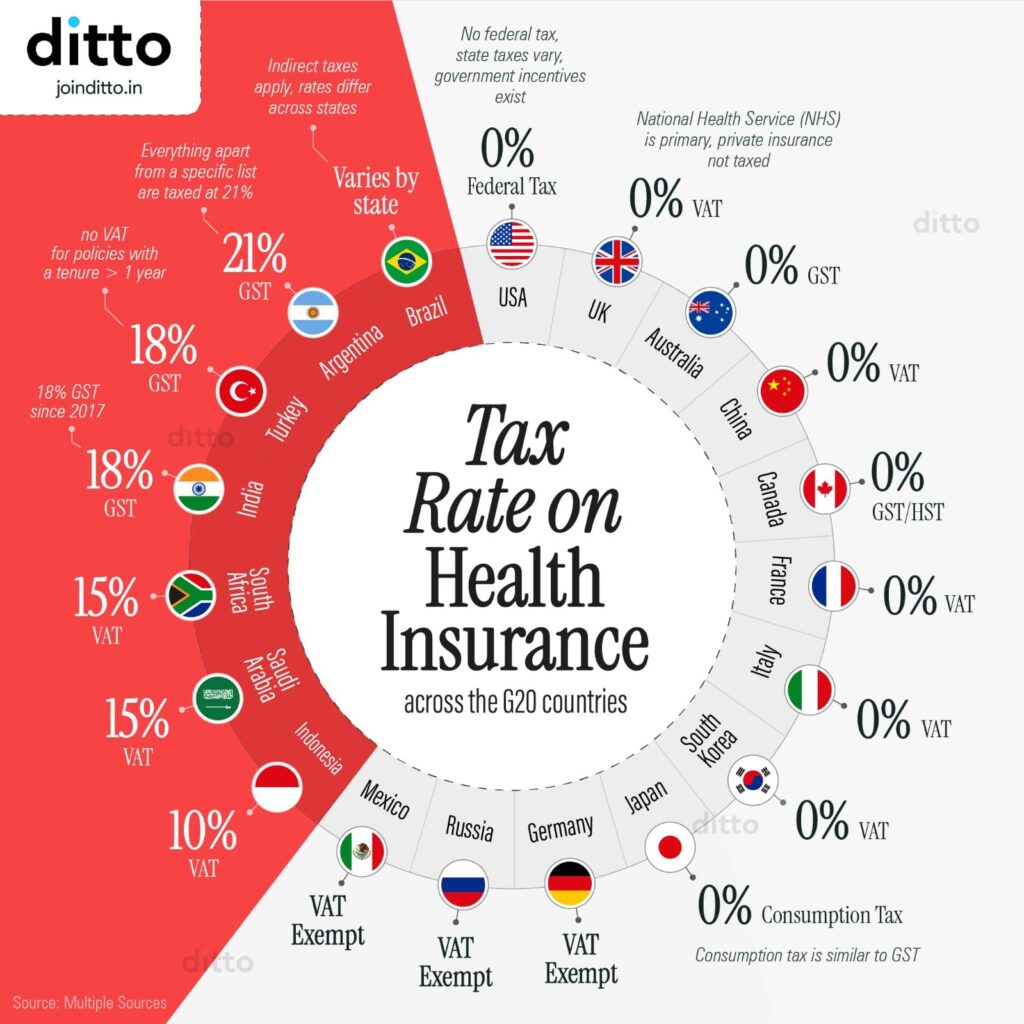

What India Can Learn from the U.S. and Others?

- U.S. Healthcare: Tax deductions on premiums make private insurance more palatable.

- UK’s NHS: Tax-funded healthcare removes direct costs at point-of-use, but higher overall taxes apply.

- Singapore’s Medisave: Citizens contribute to mandatory savings, with minimal taxes on medical spending.

- Lesson for India: Tax policy isn’t just about revenue—it’s a lever for shaping national health behavior.

Actionable Policy Recommendations

- GST Council – Reduce rate to 12% with ITC or 5% with ITC.

- IRDAI – Mandate claim transparency and timelines.

- Insurers – Pass all GST-related savings directly to consumers.

- Public Campaigns – Educate citizens on new affordability and benefits.

- Data Monitoring – Track penetration, claims settlement times, and consumer satisfaction quarterly.

Long-Term Implications for India@100

If GST reform happens in 2025 and is implemented smartly, by India@100 in 2047 we could see:

- 80–90% insurance penetration across the country.

- Drastically reduced medical bankruptcies.

- Stronger private-public health partnerships.

- A shift from reactive to preventive healthcare models.

- Lower strain on public hospitals, allowing them to focus on the most vulnerable.

Practical Tips for Consumers Right Now

- Buy Early: Younger buyers lock in lower premiums.

- Opt for Family Floaters: Often cheaper than individual policies.

- Compare Plans: Use IRDAI’s consumer portal to avoid shady agents.

- Know Your Coverage: Read terms carefully—don’t assume “hospitalization” covers everything.

- Track Policy Changes: If GST cuts come, check if your insurer adjusts premiums accordingly.

Andhra Govt Steps In to Pay GST on Handlooms—Relief or Red Flag for Weavers?

Government Appoints 33 Experts to GST Appellate Tribunal – What This Means for GST Appeals!

Supreme Court Sides with Businesses: GST Refund Rejection Overturned in Landmark Ruling