Flipkart Under GST Scanner: When you hear “Flipkart under GST scanner,” it might sound like just another business headline. But behind those words is a story that mixes law, taxes, and some clever accounting maneuvers. At the center of it all: allegations that Flipkart, one of India’s largest e-commerce platforms, tried to game the Goods and Services Tax (GST) system by reclassifying its commissions in a way that—if true—could save millions. Think of GST as a nationwide sales tax in India. Normally, e-commerce platforms like Flipkart charge sellers commissions for listing, payments, and services, and those commissions carry an 18% GST rate. Investigators allege Flipkart recast some of those commissions as “transportation charges,” which are taxed at a much lower rate (5% or exempt). If accurate, this tactic would mean Flipkart drastically reduced its tax liability. Smart on paper, but regulators aren’t convinced it’s legal.

Flipkart Under GST Scanner

The Flipkart under GST scanner case is about more than one company’s accounting choice—it’s a test of India’s tax system, regulatory enforcement, and corporate accountability. If proven, Flipkart faces massive financial and reputational fallout. For everyone else, from startups to global giants, the message is crystal clear: tax shortcuts may look smart in the short run, but regulators always catch up.

| Aspect | Details |

|---|---|

| Allegation | Flipkart reclassified marketplace commissions as transport charges |

| Normal GST Rate | 18% for marketplace facilitation services |

| Investigating Body | Directorate General of GST Intelligence (DGGI) |

| Potential Consequences | Tax recovery, penalties, prosecution if confirmed |

| Official Reference | Government of India – GST Portal |

| Industry Impact | Could set precedent for how e-commerce firms are taxed |

What Exactly Is GST and Why Does It Matter?

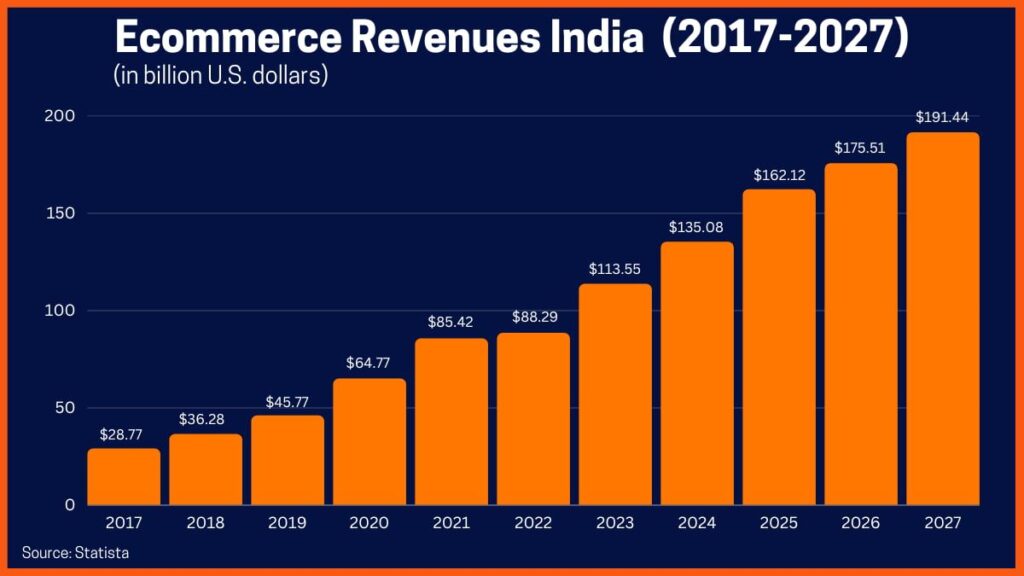

The Goods and Services Tax (GST) was introduced in India in 2017. Before that, businesses had to navigate a messy web of state taxes, service taxes, and excise duties. GST simplified that into a single system: one nation, one tax.

- Standard GST on services like e-commerce commissions: 18%

- Transport and logistics services: 5% or exempt

- Compliance: Businesses must file regular returns, track invoices, and classify services correctly

For comparison:

- In the United States, sales tax varies by state, with some states like Oregon having no sales tax and others like California charging 7.25% at the base level.

- In the European Union, the system is closer to India’s GST. The EU uses VAT (Value Added Tax), where digital services are taxed at standard national rates.

This case matters because GST is not just about money—it’s about fairness. If one company bends the rules, it creates an uneven playing field.

Why Is Flipkart Under GST Scanner?

The Allegation

According to LiveMint, Flipkart allegedly reclassified its marketplace commissions as transport charges. Marketplace facilitation services—like connecting buyers and sellers, handling payments, and promoting listings—should be taxed at 18%. By labeling them as logistics, Flipkart may have cut its GST rate to 5%.

The Law on Bundled Services

Under GST, when multiple services are bundled, the dominant service sets the rate. If marketplace facilitation is the core service, then the whole bundle (including delivery) should attract the 18% rate. Delivery is considered ancillary—an add-on, not the main business.

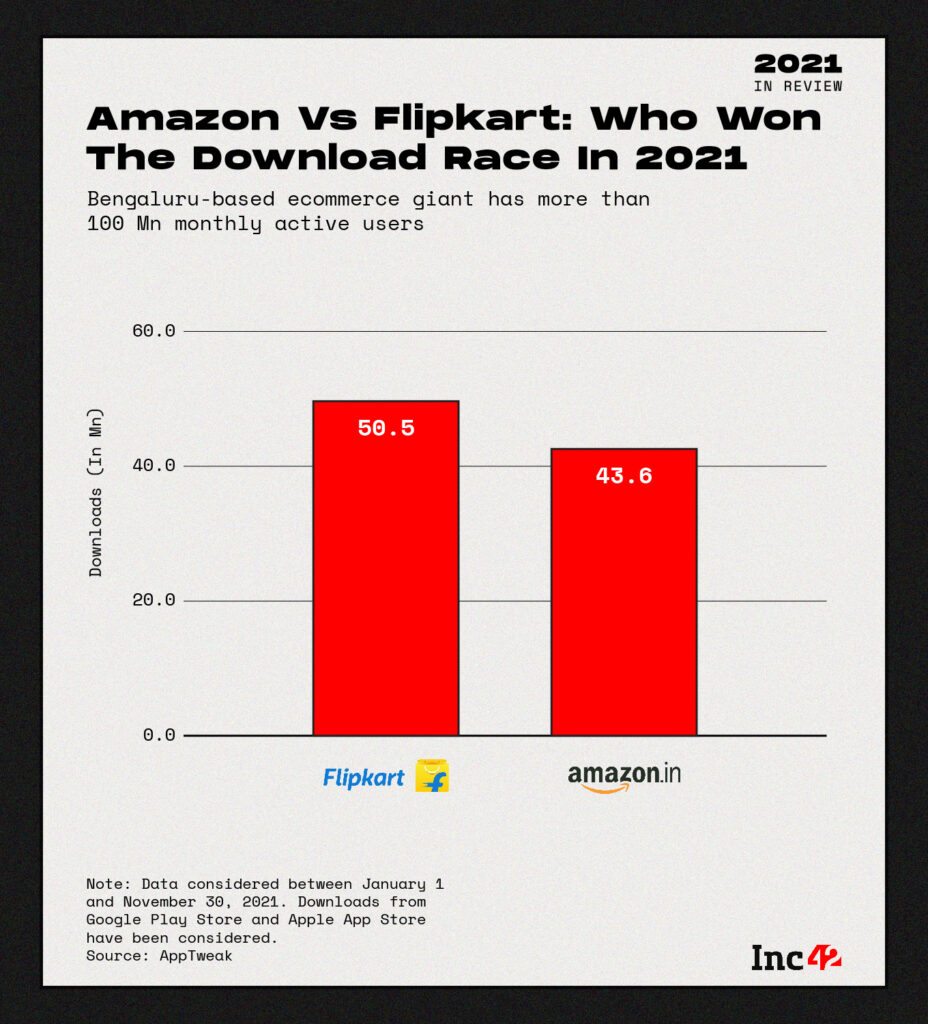

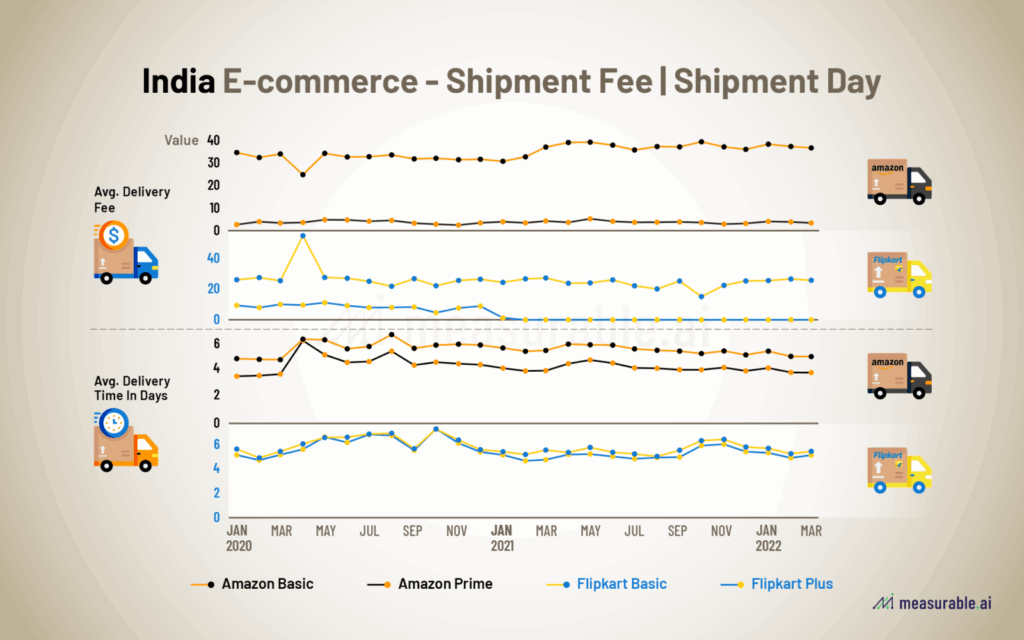

How Flipkart Differs from Competitors

Other e-commerce platforms, including Amazon India, reportedly stick with the 18% GST classification. If Flipkart took a different path, it raises questions about whether it gained an unfair advantage.

Historical Context: GST and E-commerce in India

When GST came into play in 2017, e-commerce was already booming. To regulate it, India introduced specific compliance measures:

- E-commerce companies must collect TCS (Tax Collected at Source) from sellers.

- They must file detailed returns and report service vs. goods breakdowns.

- Misclassifications can result in heavy penalties.

In fact, India has seen similar disputes before:

- In 2019, food delivery companies Swiggy and Zomato faced GST scrutiny over whether they were restaurants or aggregators.

- In 2022, India clarified that food delivery platforms must collect GST on behalf of restaurants, closing a loophole.

The Flipkart case fits into this broader trend of tightening compliance and closing gaps.

The Potential Consequences

If wrongdoing is proven, Flipkart may face:

- Tax Recovery: Repaying the difference between 18% and 5%

- Interest: Compounded, covering years of transactions

- Penalties: Often equal to or exceeding the unpaid tax

- Prosecution: Criminal charges can apply for willful evasion

This could mean hundreds of millions in liabilities, given Flipkart’s transaction volumes. For Walmart, Flipkart’s U.S.-based parent, the stakes are reputational as well as financial.

Impact on Consumers

So, what does this mean for everyday shoppers?

- Short-term: Consumers might not notice much, unless Flipkart had used tax savings to fund discounts.

- Medium-term: If Flipkart is forced to pay back taxes and penalties, it may scale back offers, raise prices slightly, or tighten its seller commissions.

- Long-term: A level playing field means fairer competition among platforms, which benefits consumers by keeping pricing and service quality consistent.

A Global Perspective: Similar Cases

This isn’t the first time a tech giant has faced scrutiny over taxes:

- Amazon in the U.S.: For years, Amazon avoided collecting state sales taxes until laws forced it to. States like New York and California sued to enforce compliance.

- Apple in the EU: Faced billions in tax claims after the EU accused it of shifting profits to Ireland for lower tax rates.

- Google: Investigated in France and the U.K. for similar profit-shifting strategies.

These cases highlight a common theme: digital platforms test tax boundaries, and regulators eventually close the gaps.

Investor and Industry Perspective

For investors, this case raises concerns about regulatory risk in emerging markets. Walmart has poured billions into Flipkart to compete with Amazon in India. If Flipkart is hit with massive penalties, it could affect Walmart’s financials and future India strategy.

For smaller e-commerce startups, the message is clear: compliance isn’t optional. Playing fast and loose with tax categories may give short-term savings, but the long-term risk is steep.

Practical Advice for Businesses

This case is a wake-up call for businesses worldwide.

- Know the Rules – Bookmark the GST portal or your local tax authority. In the U.S., that’s the IRS website.

- Classify Correctly – Always identify the principal service. Bundled services should follow the dominant service’s rate.

- Invoice Separately – If you truly provide separate services, issue separate invoices.

- Hire Experts – Bring in tax advisors early. Compliance is cheaper than penalties.

- Audit Regularly – Do quarterly tax reviews to catch misclassifications before regulators do.

Regulatory Outlook

India’s GST Council has shown it’s willing to close loopholes fast. What to expect:

- Tighter audits of e-commerce companies

- Clearer guidelines on bundled services

- Potential reforms in digital taxation to prevent similar disputes

As India’s digital economy grows, tax enforcement is becoming a central issue.

Expert Opinions

- Ranjeet Mahtani, Dhruva Advisors: “Delivery is ancillary. Marketplace services should remain at 18%.”

- Singhania & Co. Legal Advisors: “The dominant service sets the GST rate. No excuses.”

- Industry Consultants: “Other platforms follow the rules. Flipkart’s alleged approach is risky and unusual.”

Your Expenses Could Change Soon—GST Council Eyes Rationalising 12% & 18% Rates

Lower GST On Household Items – What The Council Is Planning

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties