FMCG Stocks in Focus: When it comes to the stock market, FMCG stocks in focus – which companies gain the most from GST reforms is one of the hottest topics of 2025. With India’s Goods and Services Tax (GST) undergoing a major overhaul, the changes could transform how everyday products are priced and sold. We’re talking about essentials like biscuits, cooking oil, soaps, and juices—items that millions of families buy every single week. For investors, this is a game-changer. FMCG (Fast-Moving Consumer Goods) companies thrive on volume sales. The lower the price barrier for customers, the more goods they sell. By simplifying GST and cutting rates on essentials, the Indian government is setting up a scenario where FMCG companies could enjoy significant demand growth. And when demand goes up, stock prices usually follow.

FMCG Stocks in Focus

The story of FMCG stocks in focus – which companies gain the most from GST reforms is ultimately about how tax cuts ripple through the economy. By moving essentials from 12% to 5% GST, the government is giving both consumers and companies a win. Smaller players like Bikaji and Emami may see the sharpest gains, while long-term stalwarts like HUL, Britannia, and Nestlé provide stability. For investors, FMCG is shaping up to be one of the strongest defensive plays in India’s market today.

| Point | Details |

|---|---|

| Policy Reform | India reducing GST slabs from 4 (5%, 12%, 18%, 28%) to just 2 (5% and 18%) |

| Consumer Impact | Staples like ghee, butter, packaged juices, and namkeens may shift from 12% → 5%, lowering costs |

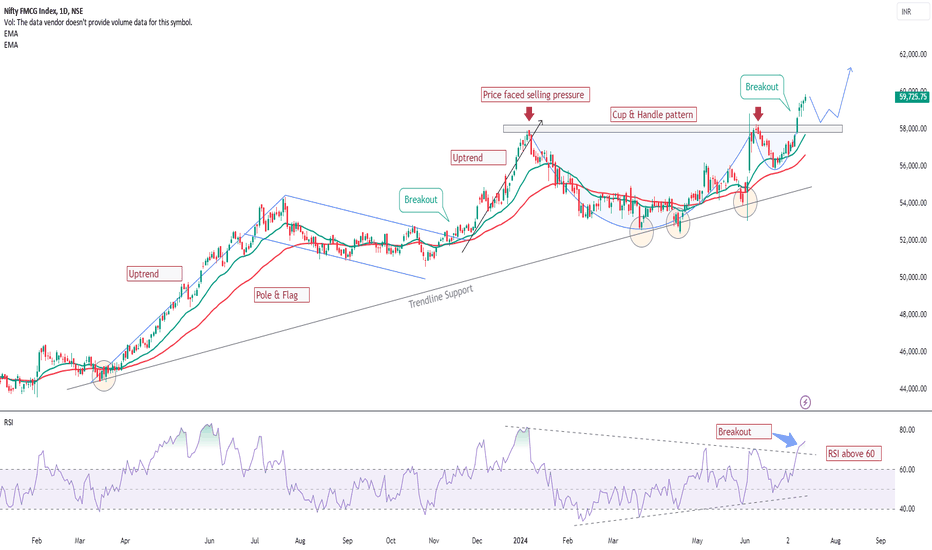

| Market Reaction | Nifty FMCG index jumped 4% in three days after reform news |

| Top Beneficiaries | Bikaji Foods (~70% of products at 12%), Emami (~60%), Nestlé (25–27%), Dabur (~24%) |

| Other Strong Picks | HUL, Britannia, Tata Consumer, Marico, Godrej Consumer |

| Economic Boost | Expected consumption surge of ₹1.98 lakh crore |

| Official Info | GST Council – Government of India |

GST Reforms Explained in Simple Terms

Think of GST as India’s version of sales tax. But instead of one simple rate, it currently has multiple slabs: 5%, 12%, 18%, and 28%. This creates confusion, compliance headaches, and pricing inefficiencies for businesses.

The reform simplifies things by bringing the slabs down to just two main ones: 5% and 18%. Most daily-use items in the 12% slab—like packaged snacks, butter, jams, juices, and even some personal-care products—are expected to shift into the 5% category.

For consumers, that means cheaper essentials. For companies, it means higher demand and smoother logistics. For the economy, it means growth, especially in consumption-heavy sectors like FMCG.

Global Comparisons: Why This Reform Matters

To understand the impact, it helps to compare India’s move to global taxation systems.

- In the United States, sales tax varies by state, usually between 6–10%.

- In the European Union, Value Added Tax (VAT) ranges from 15–25% depending on the country.

- India’s move to push essentials into the 5% slab means its tax burden on basic goods will be among the lowest globally, creating affordability for over 1.4 billion people.

That affordability translates into higher consumption per household, which is the lifeblood of FMCG growth.

Which FMCG Companies Will Gain the Most?

The big question for investors: who’s getting the biggest slice of the pie?

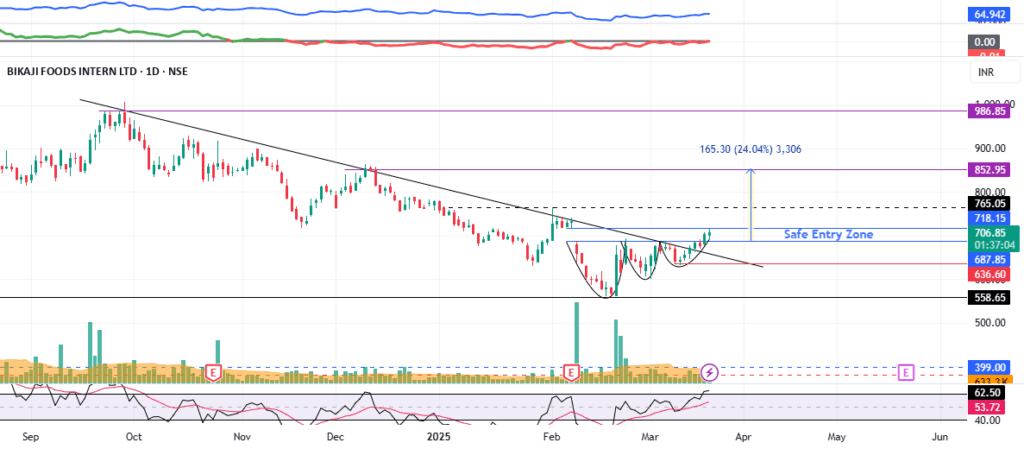

Bikaji Foods International

- Exposure: About 70% of its business falls under the 12% slab (snacks, namkeens, sweets).

- Impact: If these products move to 5%, Bikaji could see demand spike dramatically. Analysts expect volume growth to move into the double digits.

- Investor Note: Shares rallied quickly after the reform news, signaling strong investor optimism.

Emami

- Exposure: Roughly 60% of its portfolio sits at 12% (herbal oils, balms, healthcare products).

- Impact: Since much of its customer base is in rural India where pricing sensitivity is high, cheaper products could significantly expand its market reach.

Nestlé India

- Exposure: Around 25–27% of its business (dairy, chocolates, noodles).

- Impact: Lower taxes on dairy and processed food staples strengthen Nestlé’s already massive footprint in Indian kitchens.

Dabur India

- Exposure: About 24% of domestic sales are taxed at 12% (juices, honey, personal care).

- Impact: Lower GST on juices and health products improves affordability for middle-class and rural households.

Other Key Beneficiaries

While the above companies are directly exposed, several industry leaders will still gain indirectly:

- Hindustan Unilever (HUL): India’s largest FMCG player. Even small shifts in pricing trickle down to major volume growth.

- Britannia Industries: Bread, biscuits, and dairy will all benefit from price cuts.

- Tata Consumer Products: With Tata Tea, Coffee, and Starbucks India in its portfolio, it’s well-positioned to capture rising demand.

- Marico: Known for Parachute oil and Saffola, demand for staples will only grow stronger.

- Godrej Consumer Products: Home and personal care leader, indirectly boosted by higher household spending.

Who Gains the Most? Comparison Table

| Company | Exposure to 12% GST | Likely Impact |

|---|---|---|

| Bikaji Foods | ~70% | Very High |

| Emami | ~60% | High |

| Nestlé India | 25–27% | Moderate |

| Dabur | ~24% | Moderate |

| HUL | Low | Indirect |

| Britannia | Low | Indirect |

| Tata Consumer, Marico, Godrej | Low | Indirect |

Consumer Case Study: Real-Life Savings

Let’s say a family in Mumbai spends ₹2,000 every month on packaged foods and juices. With GST dropping from 12% to 5%, their monthly grocery bill falls by about ₹140. That may not sound like much in isolation, but across a year, it’s ₹1,680 saved.

Now multiply that by India’s 300 million households. That’s billions in extra disposable income, much of which gets recycled back into spending—fueling a powerful growth cycle for FMCG.

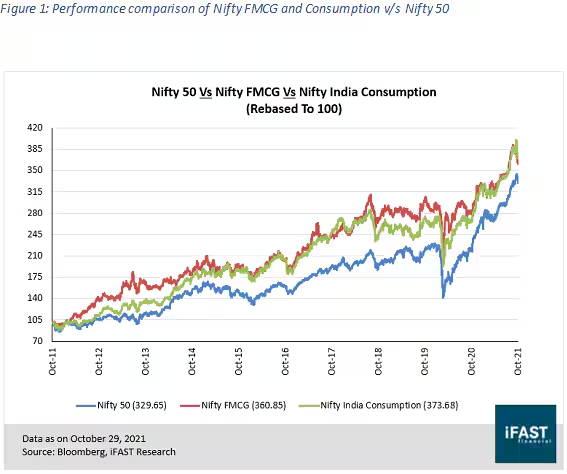

Historical Context: GST and FMCG Before

When GST was first introduced in 2017, FMCG companies faced compliance challenges and logistical disruptions. However, over time, the single tax structure improved supply chain efficiency and reduced costs.

Now, with this second big wave of reforms, FMCG companies get not just supply chain benefits but also pricing advantages. It’s like the final piece of the puzzle falling into place.

Expert Opinions

- Citi Research: FMCG remains their top “buy” recommendation post-GST changes.

- Motilal Oswal: Expects rural and festive demand cycles to accelerate growth.

- Economic Times: Projects a ₹1.98 lakh crore boost in consumption annually.

- Reuters: Reports that the Nifty FMCG Index surged 4% in just three trading days after the reform announcement.

Risks and Challenges Of FMCG Stocks in Focus

While the outlook is positive, smart investors should keep risks in mind:

- Implementation Delays: Policy rollout may take longer than expected.

- Input Costs: Rising raw material prices (milk, palm oil, wheat) could offset GST benefits.

- Rural Dependence: FMCG growth is heavily tied to rural income, which depends on good monsoons.

- Global Factors: Export demand could soften if international markets slow down.

Investor’s Guide: How to Play FMCG Now

- Target High-Exposure Players

Companies like Bikaji, Emami, Dabur, and Nestlé benefit the most directly. - Balance With Blue-Chip Leaders

Add giants like HUL, Britannia, and Tata Consumer for stability and dividends. - Watch Seasonal Cycles

India’s festive season is approaching, and historically, FMCG demand jumps significantly during this period. - Think Long-Term

FMCG stocks are “defensive plays.” They won’t double overnight, but they protect capital and grow steadily.

Cement Stocks Could Boom as Analysts Eye a Possible GST Slash

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big

Nomura Predicts 10% Jump in Car Demand If GST Rate Is Cut- Check Details