Former Oklahoma School Payroll Director Sentenced: When you hear about fraud, you might picture Wall Street scandals, big banks collapsing, or con artists running fake online schemes. But sometimes, fraud hits way closer to home. That’s what happened in Mustang, Oklahoma, where former Mustang Public Schools Payroll Services Director, Kim Weinrich, was sentenced to 18 months in federal prison for wire fraud and tax evasion. This case is more than just another crime headline. It’s a story about misplaced trust, a reminder of why financial oversight matters, and a wake-up call for communities across the United States. Whether you’re a parent, a taxpayer, or a professional in finance or education, there are lessons to learn here.

Former Oklahoma School Payroll Director Sentenced

The story of former Oklahoma school payroll director Kim Weinrich is a clear warning about the importance of financial integrity. Fraud doesn’t just cost money—it steals opportunities from students, damages trust in schools, and weakens communities. For parents, professionals, and taxpayers, the lesson is simple: oversight and accountability are not optional—they are essential. Protecting public funds means protecting the future of our children.

| Category | Details |

|---|---|

| Who | Kim Weinrich, former Director of Payroll Services, Mustang Public Schools |

| What Happened | Manipulated payroll system, stole nearly $470,000 |

| Charges | Wire Fraud, Filing a False Tax Return |

| Sentence | 18 months in federal prison, 3 years supervised release |

| Restitution | $595,970.21 – $470,385.21 to Mustang Public Schools, $125,585 to IRS |

| Timeline | Fraud from 2016–2022, charged in Dec 2024, sentenced July 2025 |

| Official Source | U.S. Department of Justice |

How the Fraud Happened?

Weinrich spent over six years in Mustang Public Schools’ payroll office. She started as a payroll supervisor and worked her way up to Director of Payroll Services in 2021. That promotion gave her greater authority and access to payroll records.

According to federal prosecutors, Weinrich manipulated the district’s payroll software by changing numbers to give herself extra pay. She also rerouted money that should have gone elsewhere into her personal account. Over several years, these fraudulent changes added up to nearly $470,000 stolen from the district.

Her scheme didn’t stop at stealing money. By falsifying payroll entries, she caused other employees’ tax withholdings to appear smaller than they really were. This meant some teachers and staff were filing inaccurate tax returns without even realizing it.

The Tax Evasion Angle

Fraudulent payroll adjustments were only part of the scheme. In April 2022, Weinrich filed her federal tax return, claiming she earned about $91,295. But that figure left out hundreds of thousands of stolen dollars.

The IRS caught the lie, and that tax return became a central piece of evidence in the case. Like many high-profile criminals in history, from Al Capone to modern-day embezzlers, tax evasion was one of the clearest charges prosecutors could prove.

An IRS Criminal Investigation report confirmed that Weinrich had been altering records for years to make it look like she was paying large tax withholdings, when in fact, she wasn’t paying those taxes at all.

Why Former Oklahoma School Payroll Director Sentenced Matters for Schools and Communities?

Public schools rely on taxpayer funding. Every dollar is supposed to go toward education—whether that’s textbooks, safe buses, teacher salaries, or student programs. When someone inside the system steals, it’s not just a financial loss—it’s a breach of public trust.

Here’s why this case matters beyond Mustang:

- Betrayal of Trust – Parents, teachers, and taxpayers depend on administrators to protect school funds. Fraud breaks that trust.

- Impact on Students – Nearly $470,000 could have paid for new technology, updated curriculum, or additional teaching staff.

- Community Ripple Effects – Fraud creates skepticism and makes communities question whether their tax dollars are being used wisely.

When schools are already stretched thin, losing almost half a million dollars can have real consequences for children’s education.

Community Reaction and Fallout

While the Mustang Public Schools district has not released a full public statement, cases like this typically lead to a mix of anger, disappointment, and calls for reform. Parents often feel betrayed knowing money that could have helped their kids went into someone’s pocket.

In similar fraud cases across the country, districts have responded by:

- Tightening payroll systems to prevent future manipulation.

- Hiring outside auditors to double-check finances.

- Increasing transparency, such as posting budgets and audits online for public review.

- Rebuilding morale among staff who may feel discouraged by leadership failures.

For Mustang, restoring public confidence will take time. Trust once broken doesn’t return overnight.

Lessons for Professionals and Businesses

This case may focus on a school district, but the lessons apply to businesses, nonprofits, and even government offices nationwide.

1. Strong Internal Controls

No single person should ever control payroll from start to finish. Duties must be split between data entry, review, and approval.

2. Regular and Surprise Audits

Annual reviews aren’t enough. Fraud often lasts years before being caught. Random, unannounced audits are crucial.

3. Safe Whistleblower Channels

Employees need a way to report suspicious activity without fear of losing their jobs.

4. Watch for Red Flags

Lifestyle changes—like sudden wealth, expensive vacations, or new luxury vehicles—can sometimes signal fraud.

Step-by-Step Guide: Preventing Payroll Fraud

Here’s a simple five-step process that schools and organizations can adopt to protect funds:

- Separate Responsibilities – Never let one employee handle payroll alone.

- Audit Trails – Use payroll software that tracks every change, including who made it and when.

- Mandatory Leave – Require staff to take vacations so their work can be reviewed by others.

- External Oversight – Bring in independent auditors to check the books regularly.

- Train Staff – Make sure employees understand payroll basics so errors or fraud are easier to spot.

Ethical Dimension: Why School Fraud Hurts More

Fraud is harmful in any setting, but in schools, it carries an extra weight. Stealing from a company might cost shareholders. Stealing from a school costs children. Public funds represent the community’s investment in its future, and when those funds are stolen, everyone suffers.

In Native American communities, there’s a saying: “When you take from the children, you steal from tomorrow.” That idea reflects why school-related fraud feels especially heavy—it damages the future of an entire community.

Historical Context: Other U.S. School Fraud Cases

Oklahoma isn’t alone. Fraud in schools has surfaced in many states:

- Georgia (2021): A school administrator stole more than $100,000 from student activity accounts.

- California (2019): Two charter school operators were accused of defrauding the state of $50 million.

- Texas (2018): A superintendent was convicted of stealing $2.6 million in federal funds meant for low-income student programs.

These examples show that fraud in schools is not a rare event—it’s a recurring problem that requires vigilance across the country.

The Long-Term Impact

Weinrich has been ordered to pay $595,970.21 in restitution, but recovering those funds may take years. Realistically, many districts never see full repayment.

The financial impact is only part of the story. Districts often face:

- Damaged Reputation – Parents and teachers may lose faith in school leadership.

- Lower Morale – Staff may feel betrayed by colleagues and discouraged by weak oversight.

- Policy Overhaul – Significant resources are spent implementing new financial controls.

In the end, the hardest part may not be recovering the money—it’s restoring community trust.

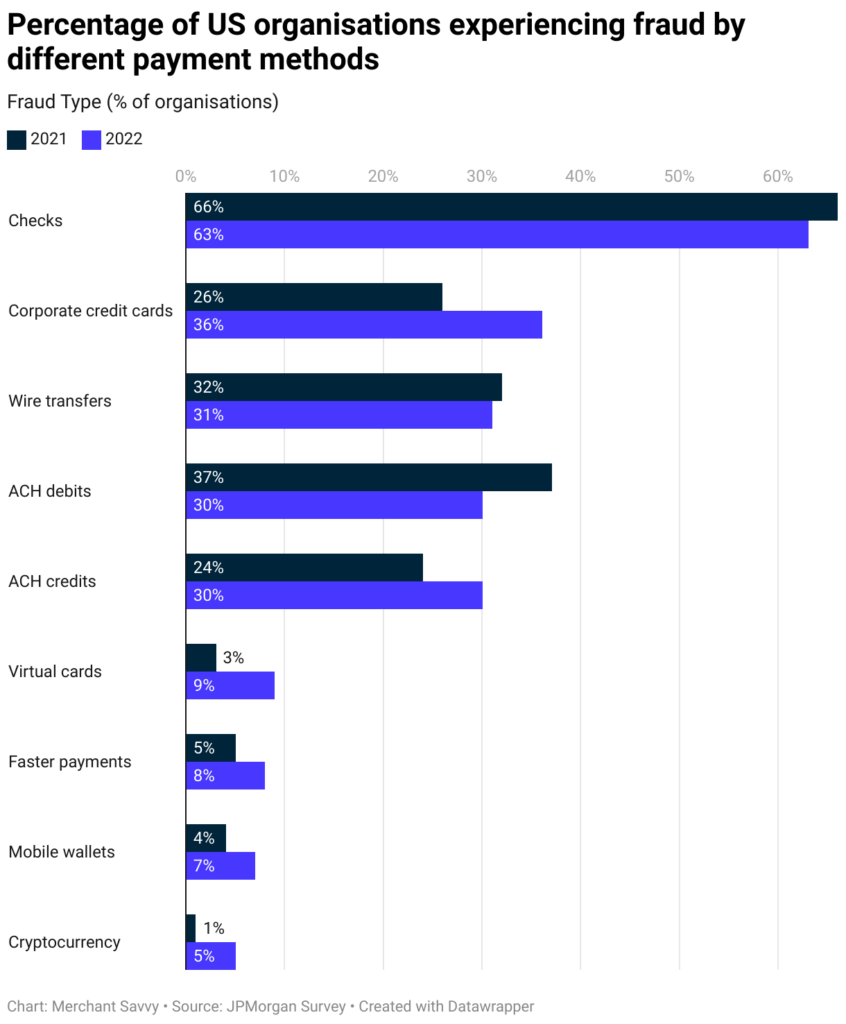

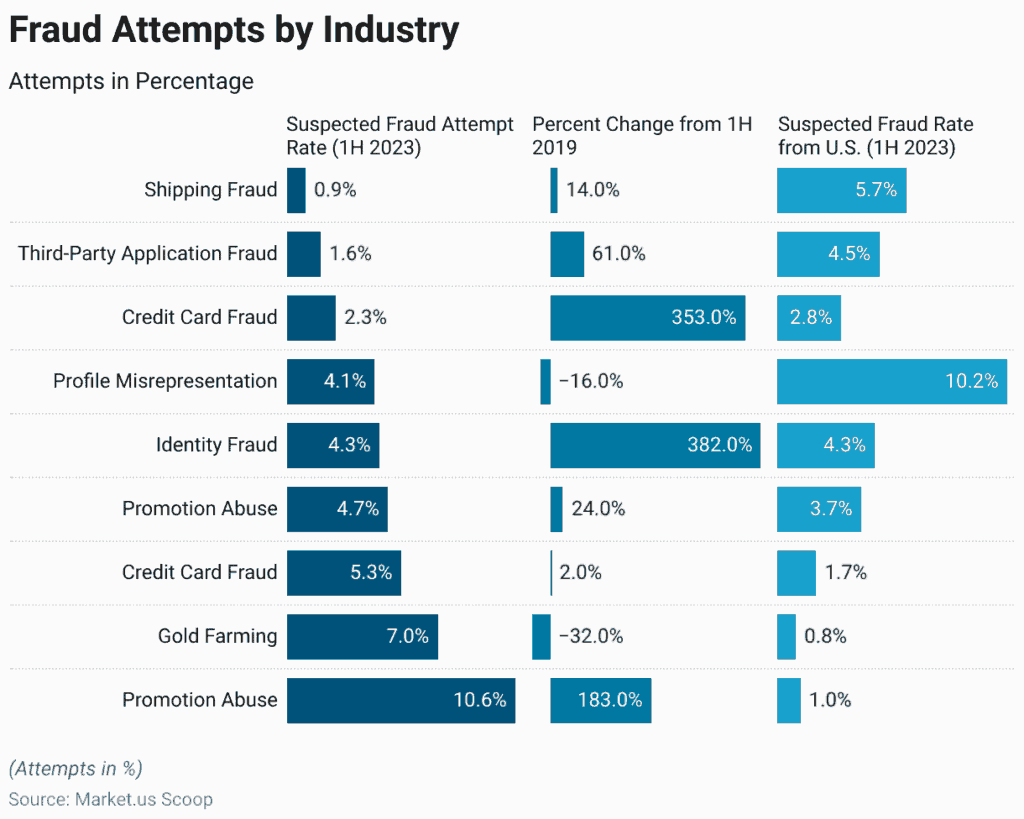

National Statistics on Payroll Fraud

Payroll fraud is not limited to schools. It’s a widespread issue across industries. According to the Association of Certified Fraud Examiners (ACFE):

- 27% of organizations experience payroll fraud during their lifespan.

- The average payroll fraud scheme lasts 36 months before detection.

- Organizations lose 5% of revenue annually to fraud, with payroll fraud being a leading contributor.

Tampa OnlyFans Star Who Made $5.4 Million Now Charged With Tax Evasion

Indian-Origin US Doctor Jailed 34 Months for $700K Tax Evasion and Medical Fraud

Rs 200 Crore Tax Evasion Case – Coke Plant Owner From Meghalaya Arrested By DGGI