French Ex-MEP Jérôme Rivière Convicted of Aggravated Tax Fraud: When news broke that French Ex-MEP Jérôme Rivière was convicted of aggravated tax fraud, it shook not only Paris but political circles across Europe and beyond. Rivière, a once-influential Member of the European Parliament, was found guilty of concealing more than €356,000 in undeclared income and laundering over €140,000 through offshore accounts in Hong Kong. The Paris criminal court’s ruling on September 2, 2025 delivered a serious blow to his political career: a three-year suspended prison sentence, a €90,000 fine, and a five-year ban from holding public office or managing companies. On top of that, he was ordered to pay for the publication of his conviction in French media—a symbolic act meant to reinforce public accountability. This isn’t just a French story. It’s a global cautionary tale about financial honesty, transparency, and the heavy price of corruption.

French Ex-MEP Jérôme Rivière Convicted of Aggravated Tax Fraud

The conviction of Jérôme Rivière for aggravated tax fraud and money laundering is more than just a headline in France. It’s a case study in how financial dishonesty destroys careers, reputations, and public trust. For professionals worldwide, the message is simple: play fair, stay transparent, and never gamble with your integrity. Because in politics, business, or everyday life, trust is the most valuable currency you’ll ever own.

| Detail | Information |

|---|---|

| Who | Jérôme Rivière – Former Member of the European Parliament (MEP) |

| Offense | Aggravated tax fraud & money laundering |

| Amount Hidden | €356,000+ undeclared (2014–2018) |

| Funds Repatriated | €140,000+ transferred back to France from Hong Kong |

| Sentence | 3 years suspended prison + €90,000 fine |

| Additional Penalties | 5-year ban from public office & company management |

| Date of Ruling | September 2, 2025 |

| Official Court Reference | French Justice Ministry |

Who Is Jérôme Rivière?

Rivière is not some backbench politician. He was a Member of the European Parliament (MEP) until 2024. A lawyer by training, he served under Marine Le Pen’s Rassemblement National before moving to Éric Zemmour’s Reconquête. For years, he was a visible figure in France’s far-right political landscape, speaking on national sovereignty, defense, and immigration.

But while he was rallying voters, prosecutors say he was also running a shadow financial operation, using companies on paper in Hong Kong to avoid paying taxes in France.

The Charges Explained

Aggravated Tax Fraud

French prosecutors proved that Rivière had knowingly hidden more than €356,000 in taxable income between February 2014 and May 2018. “Aggravated” fraud means it wasn’t an accident—it was systematic and deliberate.

Money Laundering

More than €140,000 of these undeclared funds was repatriated to France. Transfers were made through an HSBC account in Hong Kong, with money going directly to benefit Rivière and his children.

The Sentence

- 3-Year Suspended Prison Sentence: He won’t serve time unless he reoffends.

- €90,000 Fine: Significant, though critics argue it’s modest compared to the amount hidden.

- Five-Year Ban: He cannot run for political office or manage any company.

- Publication Requirement: He must pay for his conviction to be published in the press.

Why French Ex-MEP Jérôme Rivière Convicted of Aggravated Tax Fraud Case Matters?

This ruling is about more than one politician. It highlights three key lessons:

- No one is above the law – Even elected officials face serious consequences when they break financial rules.

- Public trust is fragile – Corruption cases reinforce voter cynicism about politics.

- Financial transparency is global – Hidden money trails eventually surface, whether in Paris, Washington, or Hong Kong.

Historical and Global Context

Rivière joins a long list of politicians worldwide brought down by financial scandals:

- Jérôme Cahuzac (France, 2013): The French Budget Minister convicted for hiding Swiss bank accounts.

- François Fillon (France, 2017): Former Prime Minister charged in a “fake jobs” scandal.

- Paul Manafort (U.S., 2018): Former Trump campaign chairman convicted of tax fraud and bank fraud.

- Wesley Snipes (U.S., 2008): Hollywood actor sentenced to three years in prison for failing to file taxes.

- Leona Helmsley (U.S., 1989): The hotel magnate, nicknamed “Queen of Mean,” jailed for tax evasion.

The Rivière case fits into this global pattern: financial misconduct eventually comes to light.

Legal Breakdown: France vs. United States

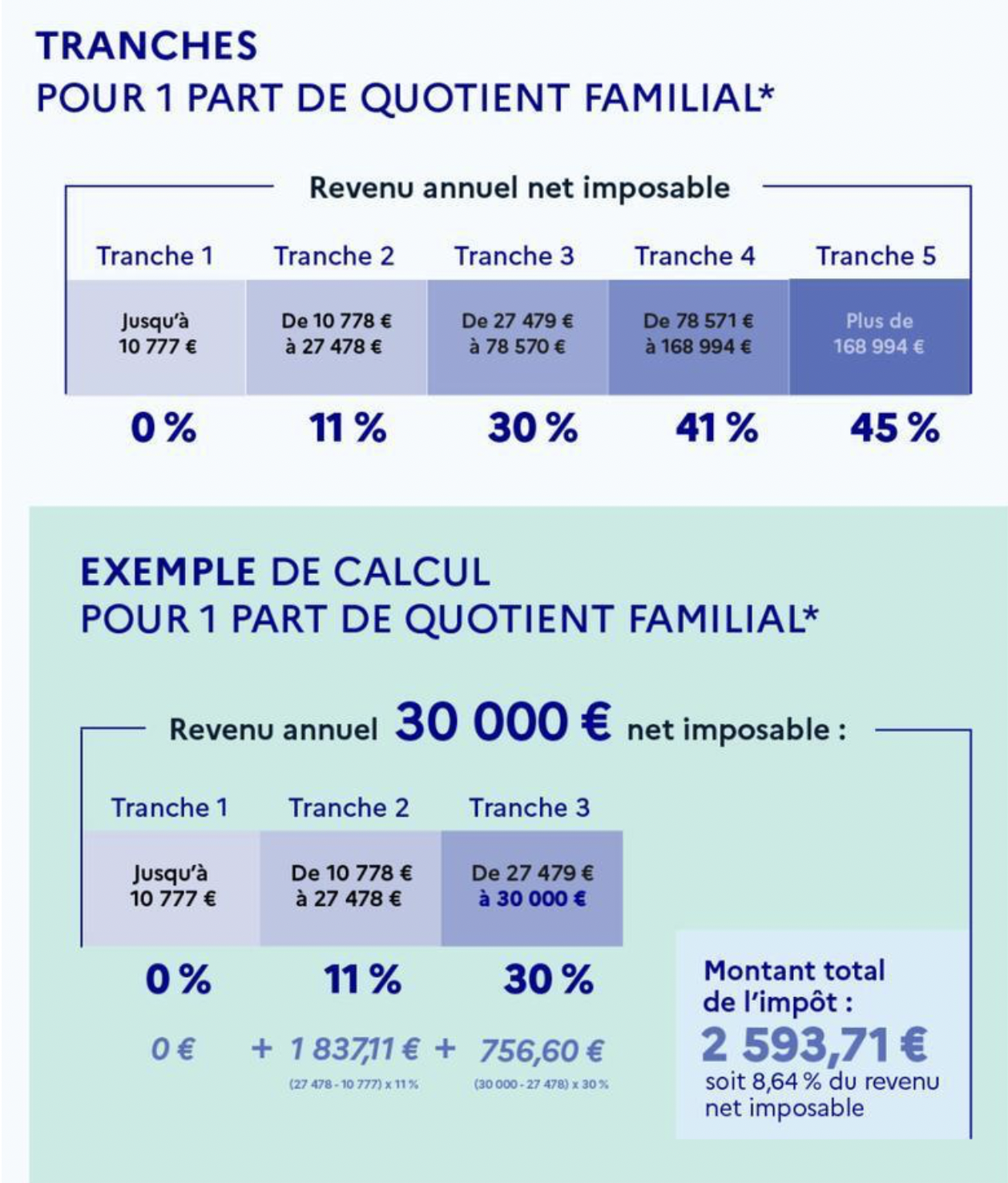

Under French law, aggravated tax fraud applies when fraud involves:

- Large amounts of money.

- Deliberate concealment (offshore companies, complex transfers).

- Multiple years of offenses.

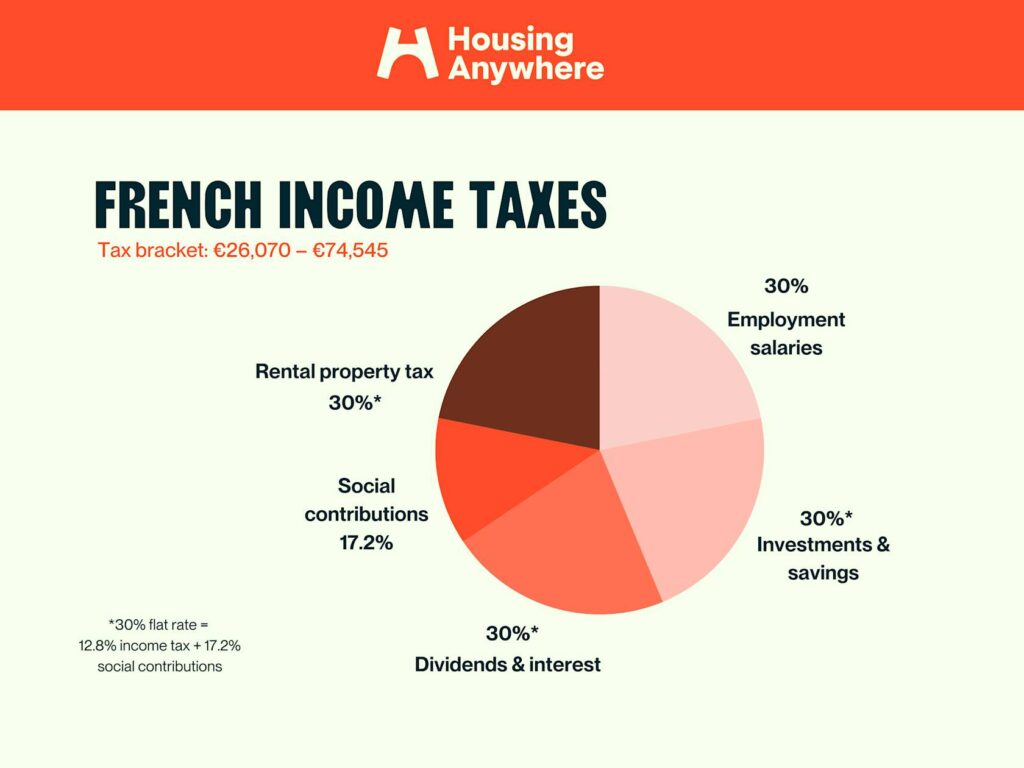

In the United States, the Internal Revenue Service (IRS) and Department of Justice (DOJ) handle similar crimes. Tax evasion alone can carry:

- Up to 5 years in prison per count.

- Fines up to $250,000 for individuals or $500,000 for corporations.

Money laundering, under U.S. federal law, can carry 20 years in prison and fines of up to $500,000 or double the value of the laundered funds.

By comparison, Rivière’s suspended sentence looks lenient.

The Economic and Social Cost of Tax Fraud

Why should the public care? Because tax fraud hurts everyone:

- Lost Revenue: When politicians hide money, taxpayers bear a heavier load.

- Public Services: Unpaid taxes mean less funding for healthcare, education, and infrastructure.

- Public Confidence: Corruption undermines democracy and erodes faith in leaders.

Every hidden euro or dollar is money that doesn’t go into fixing roads, funding schools, or supporting social programs.

Reactions in France

The verdict sent shockwaves through French politics. Opposition leaders called it proof of corruption in the far-right. Rivière’s allies, however, downplayed the ruling, arguing it was “politically motivated.”

Media outlets like Le Monde and France24 emphasized that the ruling wasn’t just about Rivière, but about restoring faith in institutions. For a country preparing for upcoming elections, the scandal could shift public opinion in meaningful ways.

Practical Lessons for Professionals

Even if you’re not a politician, there are important takeaways:

File Taxes Honestly

Don’t cut corners. The IRS and state tax authorities have sophisticated tracking systems.

Keep Clean Records

Small business owners, freelancers, and gig workers should maintain organized records to avoid red flags.

Work With Licensed Advisors

Hire certified accountants or tax lawyers, especially if you have international investments.

Think Reputation First

Your career is built on trust. A single scandal, even minor, can destroy years of work.

Teach Your Family Financial Honesty

Kids learn from what they see. Talk openly about why integrity matters with money.

Professional Comparisons: U.S. Cases

To put Rivière’s case into perspective:

- Paul Manafort – Sentenced to 7.5 years in prison for tax and bank fraud before receiving a presidential pardon.

- Wesley Snipes – Jailed three years for not filing taxes on $23 million in income.

- Leona Helmsley – Served 18 months in prison for evading millions in taxes.

These examples remind us: money trails don’t stay hidden forever.

Two Company Directors Arrested – Separate Tax Fraud Cases Expose New Crackdown

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases

₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid