Fuel Cess vs GST: When it comes to India’s economy, few topics stir as much debate as Fuel Cess vs GST. Taxes may sound boring, but let’s be real—they affect everything from the price of your morning chai to how much it costs to drive across town. And as India gears up for another round of economic reforms, the big question is: Will Fuel Cess continue to burden wallets, or will GST reforms finally deliver on their promise of simplicity and growth? Taxes aren’t just about numbers. They’re about how governments raise money, how businesses stay competitive, and how ordinary folks like us feel inflation every time we fill up at the pump. That’s why breaking down Fuel Cess and GST isn’t just an economist’s game—it’s a real-world issue that touches every pocketbook in the country.

Fuel Cess vs GST

When it comes to Fuel Cess vs GST, both matter—but in different ways. Fuel Cess is a quick revenue fix for governments but a long-term burden for businesses and households. GST, on the other hand, is the structural reform India needs to simplify taxation, lower costs, and attract global investors. Short-term: Expect Fuel Cess to keep raising your pump bills. Long-term: GST reforms, if executed smartly, will be the real game-changer. India’s economic future will be shaped not by quick fixes but by deep, structural reforms—and GST is where the smart money is.

| Topic | Details |

|---|---|

| What is GST? | Goods & Services Tax, introduced in 2017, a unified indirect tax with slabs (0%, 5%, 12%, 18%, 28%). Official GST portal |

| What is Fuel Cess? | An extra levy on fuel, not part of GST, used for roads, education, etc. |

| Why It Matters? | Fuel Cess raises inflation and costs; GST reforms could boost consumption by ₹5.31 lakh crore (1.6% of GDP). |

| Impact on States | States fear annual losses of ₹1.5–2 lakh crore with GST cuts. Example: Kerala lost ₹21,955 crore in 2024 alone. |

| Global Angle | GST reforms could attract investors; Fuel Cess often seen as inefficient. |

| Professional Insight | Businesses can’t claim Input Tax Credit (ITC) on fuel cess, leading to cascading costs up to 150%. |

| Verdict | Fuel Cess is tactical, but GST reforms hold the key to long-term growth. |

A Quick Look Back — How We Got Here

Before GST, India’s tax system was a patchwork quilt. Each state had its own VAT (Value Added Tax) rates on fuel, while the center levied excise duties. This meant petrol could be cheaper in one state and way pricier in the next. Truckers literally mapped routes to save fuel tax.

Then came 2017, the year GST promised “one nation, one tax.” It unified dozens of taxes—but fuel stayed out, mainly because states didn’t want to lose their golden goose. Enter Fuel Cess, a “temporary” measure that has stuck around like that one guest who never leaves the party.

What Exactly Is GST and Why Was It a Game Changer?

The Goods and Services Tax (GST) was designed to simplify India’s tax mess. Instead of businesses filing multiple state and central levies, GST created a single system with 5 major slabs: 0%, 5%, 12%, 18%, and 28%.

But here’s the problem—petrol, diesel, alcohol, and electricity are still out. That’s like building a brand-new smartphone but forgetting to add the camera. Without fuel in GST, one of the biggest cost drivers in the economy sits outside the system.

What’s Fuel Cess and Why Does It Sting So Much?

Think of Fuel Cess like a surcharge on your gas bill. It’s supposed to fund roads, health programs, or education. Sounds noble, right? The problem is you can’t get a tax credit on it.

For example:

- Petrol carries about ₹2.5 per litre as cess.

- Diesel has about ₹4 per litre as cess.

Now add in transport, warehousing, and retail. By the time goods reach you, the cascading effect can inflate costs by 150%.

It’s like buying a soda for $1, but after shipping, bottling, and taxes, it lands in your fridge at $2.50. And you wonder why grocery bills feel like a punch in the gut.

The Global View — How Do Other Countries Handle This?

India isn’t the only one taxing fuel, but it is one of the few that keeps it outside its main tax structure.

- In the United States, fuel taxes are part of excise duties, directly funding highways and infrastructure. Businesses account for them as a cost but don’t deal with cascading because the system is simpler.

- In Europe, fuel is included in the Value Added Tax (VAT) system. Businesses can claim credits on VAT, which reduces cost burdens and keeps pricing more competitive.

- In Australia, fuel excise exists, but businesses receive rebates for commercial use, ensuring transport-heavy industries aren’t unfairly punished.

India’s choice to keep fuel outside GST has created inefficiencies. Logistics firms in Germany or France can claim back part of their fuel tax, while Indian companies just absorb the full hit. That makes Indian exports pricier, weakening global competitiveness.

How These Taxes Hit You and Me?

Here’s how Fuel Cess and GST shape daily life:

- At the pump: Higher cess = higher petrol and diesel costs.

- On groceries: Fuel costs drive transportation costs, which raise food prices.

- In business: Without ITC, companies face higher operating costs.

- For states: More cess = more central revenue, less state autonomy.

Bottom line: Fuel Cess hurts your wallet today, GST reforms could help your wallet tomorrow.

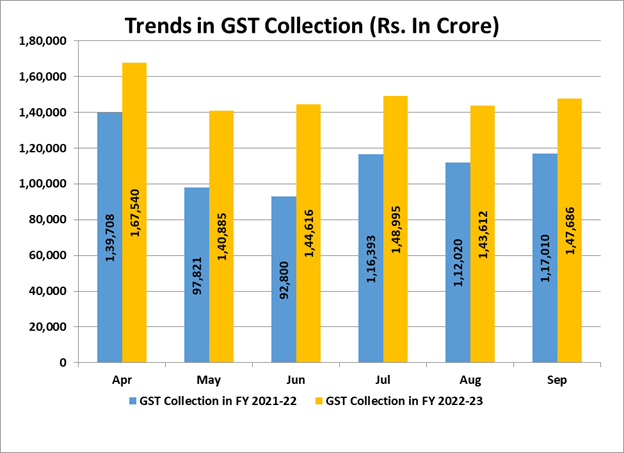

The GST Reform Push — Why Experts Are Excited

Economists and policy makers are buzzing about the GST rationalization debate.

- SBI Research estimates GST reforms could boost consumption by ₹5.31 lakh crore (1.6% of GDP).

- PwC India has recommended a simpler three-slab GST structure and gradual inclusion of petroleum, starting with aviation turbine fuel.

- Global investors prefer predictable tax systems. A cleaner GST would mean fewer disputes, better compliance, and stronger FDI inflows.

But states aren’t cheering. They expect to lose ₹1.5–2 lakh crore annually if slabs shrink.

Take Kerala: It lost ₹21,955 crore in 2024 alone, with another ₹8,000–10,000 crore expected this year. That’s money that should fund schools, hospitals, and welfare programs.

Real-World Impact — Fuel Cess vs GST

- Truckers’ Dilemma: Logistics firms spend 40% of operating costs on fuel. Without ITC, every hike eats into profits.

- Farmers’ Strain: Diesel-run tractors and irrigation pumps raise input costs, pushing food prices higher.

- Middle-Class Budget: A family driving 40 miles a day could spend an extra ₹2,000–3,000 a month when fuel prices spike.

These aren’t abstract numbers. They’re choices between expansion or layoffs, vacations or savings.

Professionals, Businesses, and Everyday Folks — What Should You Do?

For Businesses

- Factor cess into pricing models—it’s not deductible.

- Negotiate contracts that share fuel-cost risks with transporters.

- Watch for reforms: if fuel enters GST, input credits could cut costs significantly.

For Consumers

- Plan purchases: Cars, electronics, and essentials may get cheaper if GST slabs shrink.

- Track fuel prices using reliable apps and adjust budgets.

- Assume inflation spillover: Higher fuel usually means higher grocery bills.

For Policymakers

- Balance state revenue concerns with national efficiency.

- Add fuels to GST gradually to avoid shocks.

- Simplify slabs to improve compliance.

GST Reforms Update — Will Insurance Finally Get Tax Exemption?

GST Rejig – Household Items Likely To Get Cheaper Soon

Coimbatore Trade Bodies Petition CM Against State GST Harassment

The Road Ahead — What Experts Predict

Over the next 5–10 years, here’s the likely scenario:

- Fuel Cess will remain, but rates may be tweaked with oil price fluctuations.

- GST reforms will move toward a three-slab system, eventually including petroleum in phases.

- Digital compliance (like e-invoicing) will streamline GST, reducing disputes.

- States will continue negotiating compensation, possibly creating new levies to offset losses.

The shift won’t be easy, but the payoff is huge: a more competitive, transparent, and growth-friendly India.