Full List of Daily Items Likely to Get Cheaper Under GST Changes: If you’ve been following the buzz around India’s GST reforms, you already know people are excited. Why? Because from chips to cars, a wide range of daily-use items are about to get cheaper. The Indian government is rolling out the most sweeping tax simplification since GST launched in 2017, and the ripple effects could be massive—not just for wallets, but for entire industries. This article breaks it down in plain English (with a little conversational U.S. flavor). We’ll walk through what’s changing, which items are dropping in price, what it means for you, and what’s next for India’s economy.

Full List of Daily Items Likely to Get Cheaper Under GST Changes

From butter to BMWs, India’s GST overhaul is a bold attempt to simplify taxation, reduce costs, and boost consumption. While challenges remain, the move promises to put more money back into people’s pockets and create momentum for growth. Whether you’re a student shopping for supplies, a family planning holiday purchases, a farmer buying inputs, or a professional reviewing insurance, these changes are designed to make life easier—and cheaper.

| Category | Old GST Rate | New Proposed Rate | Impact |

|---|---|---|---|

| Essential foods (butter, cheese, dry fruits, jam) | 12% | 5% | Lower grocery bills |

| Packaged staples (paneer, UHT milk, roti, paratha) | 5–12% | 0% | Could be tax-free |

| Stationery (pencils, sharpeners, atlases, notebooks) | 12% | 0% | Relief for students |

| Cement | 28% | 18% | Lower construction costs |

| Cars (small models) | 28% | 18% | Savings of ₹60K–₹1.2 Lakh |

| Insurance premiums | 18% | 5–0% | More affordable policies |

| Healthcare supplies (drugs, gloves, oxygen kits) | 12–18% | 5–0% | Cheaper medical care |

A Quick History of GST in India

The Goods and Services Tax (GST) was launched in 2017 to unify India’s fragmented tax system. Before that, every state had its own mix of VAT, octroi, excise duty, and service tax. Imagine buying a chocolate bar and paying different rates in Delhi, Mumbai, and Chennai—that was India before GST.

The GST’s promise was simple: “One Nation, One Tax.” But implementation got messy:

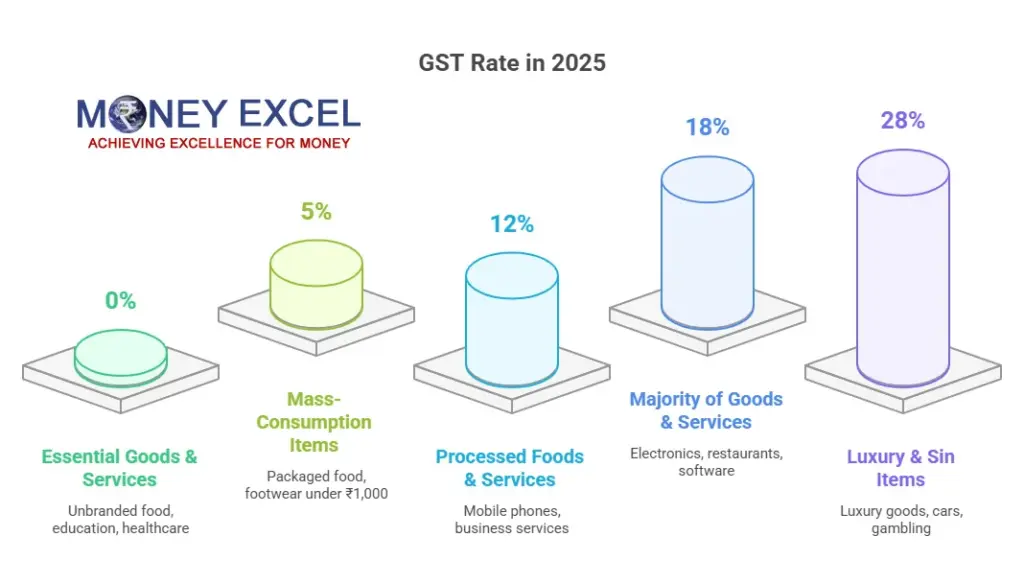

- Multiple slabs (5%, 12%, 18%, 28%) made compliance tricky.

- Frequent rate changes confused consumers and businesses.

- States often resisted changes fearing revenue loss.

In fact, since 2017, the GST Council has tweaked rates more than 900 times. This constant chopping and changing created uncertainty for investors and small businesses.

Now, in 2025, the government wants to fix it once and for all by consolidating slabs into just 5% for essentials and 18% for most goods/services, with a high 40% slab reserved for luxury or sin goods like tobacco.

Why Now?

There are two major reasons why the government is pushing reforms now:

- Boosting Growth: With India aiming for a $5 trillion economy, stimulating demand is crucial. Lowering taxes on essentials and consumer goods encourages spending.

- Political Timing: The changes are expected to kick in around Diwali 2025—a festive season when families shop heavily. That’s no coincidence; it’s a strategic move to boost consumer sentiment.

Full List of Daily Items Likely to Get Cheaper Under GST Changes

Food & Groceries

Your grocery basket is about to feel lighter on the wallet. Items shifting from 12% to 5% include:

- Butter, ghee, condensed milk, cheese

- Jam, ketchup, mayonnaise

- Packed juices, pasta, noodles

- Dry fruits and nuts

India’s packaged food market was valued at over $71 billion in 2024 (Statista). Even a 5–7% reduction in tax could translate into millions of rupees in household savings and higher consumption.

Staples & Dairy

Some essentials may actually go tax-free. Likely candidates for the 0% slab include:

- Paneer, UHT milk

- Rotis, chapatis, parathas, parottas

- Pizza bread and khakhra

These are daily staples in many households, so the relief will be immediate and noticeable.

Education & Stationery

Education costs often weigh heavy on families. Items such as pencils, crayons, sharpeners, notebooks, atlases, globes, and printed charts are expected to become GST-exempt. According to UNESCO, Indian families spend nearly 4% of household income on education—this cut can ease that burden.

Impact on Big-Ticket Buys

Cars

Currently, cars fall in the 28% GST bracket plus additional cess. Under reforms, small cars could drop to 18%, saving buyers between ₹60,000 and ₹1.2 lakh depending on the model.

This could rejuvenate India’s auto sector, which contributes 7% of GDP and employs 19 million people (SIAM, 2024).

Electronics & Appliances

Goods like air conditioners, refrigerators, washing machines, and televisions are expected to fall from 28% to 18%. For middle-class households, that could make upgrades much more affordable.

Construction Materials

Cement, which has long been taxed at 28%, could finally drop to 18%. This is big for infrastructure and housing projects. India is the second-largest cement producer in the world (World Cement Association), and this cut could make homes and commercial spaces cheaper to build.

Healthcare, Insurance & Agriculture – Relief Where It Matters Most

- Medicines & Healthcare: Over 30 cancer and rare-disease drugs may become tax-free. Items like diagnostic kits, oxygen cylinders, surgical gloves, and hospital tools could fall to 5%.

- Insurance: Individual life and health policies may see GST slashed from 18% to 5% or even zero. This could improve insurance penetration, which currently stands at just 4% of GDP in India (IRDAI, 2024) compared to 11% globally.

- Farm Inputs: Fertilizers, drip irrigation systems, pesticides, and tractor parts may be taxed at just 5%. This would lower costs for farmers and support rural consumption.

Global Comparison

- United States: No national GST, but sales taxes vary by state (4–10%).

- European Union: VAT averages 20%, though essentials like bread and milk are taxed lower.

- Australia: Flat 10% GST.

India’s move toward simplification is closer to global norms—less confusing, more predictable.

Industry Reactions

- The Confederation of Indian Industry (CII) says this will “boost consumption by 1–1.5% of GDP.”

- Economists at Goldman Sachs estimate car, cement, and appliance sales could jump 10–12% in 2026.

- Retailers expect higher demand but warn some manufacturers may not fully pass savings to customers.

Challenges Ahead

- Revenue Concerns: States worry about losing revenue as items move into lower slabs. The central government may need to increase compensation.

- Profit vs. Pass-Through: Businesses might keep the savings instead of lowering prices. Monitoring through the Anti-Profiteering Authority will be key.

- Short-Term Transition: Updating invoicing systems, adjusting supply chains, and educating small businesses may cause temporary disruption.

GST Structure Simplified – Key Changes Explained

Could a 15% GST Actually Help Young Australians? The Surprising Argument for Reform

GST Council To Hold Two-Day Meeting From September 3 – Key Decisions Ahead

Consumer Behavior – What to Expect

Economists believe cheaper goods could unleash “revenge consumption”—families buying more once prices fall. Just like Americans storm Black Friday sales, Indian shoppers might ramp up Diwali spending. Expect crowded malls, booming e-commerce, and more demand for affordable insurance and healthcare.

Government Goals

This isn’t just about economics; it’s also about politics. By reducing the GST burden, the government signals it’s listening to consumer pain points. The timing around festive shopping suggests a push to create goodwill before upcoming elections, while also strengthening India’s case as a pro-investment economy.

Practical Advice for Consumers and Businesses

- Families: Delay big-ticket buys (cars, ACs, cement) until reforms are in place.

- Parents: Time school shopping to benefit from stationery exemptions.

- Policyholders: Re-check premiums after GST cuts; it may be a good time to add coverage.

- Retailers: Advertise the GST benefits to draw foot traffic and build loyalty.

Future Outlook

The GST reform is more than a tax tweak—it’s part of India’s growth playbook. By cutting costs for households, stimulating demand in autos, real estate, and FMCG, and encouraging insurance uptake, the reform could accelerate GDP growth. Internationally, it will improve India’s image as an investment-friendly market.

If all goes smoothly, the GST 2.0 regime could become a template for other developing economies struggling with complex indirect taxes.