Gaming Firm Caught in ₹140 Crore Tax Evasion: When the news broke that a gaming firm was caught in ₹140 crore tax evasion by DGGI Ahmedabad, it sent a shockwave through India’s financial system and the gaming world. This wasn’t just about unpaid taxes—it was about trust, regulation, and the future of one of India’s fastest-growing industries. Tax evasion on this scale doesn’t just dent government revenues—it raises questions about the credibility of businesses operating in a booming sector worth billions. To make sense of it all, let’s break down what happened, why it matters, and what lessons professionals, entrepreneurs, and even casual gamers can draw from this case.

Gaming Firm Caught in ₹140 Crore Tax Evasion

The case of the gaming firm caught in ₹140 crore tax evasion by DGGI Ahmedabad is a landmark moment in India’s gaming industry. It proves that regulators are no longer looking the other way. For companies, the message is clear: pay your taxes, comply with the law, and build trust—or risk losing everything. India’s online gaming future remains bright, but only for those who understand that transparency and compliance are the real “winning moves.”

| Aspect | Details |

|---|---|

| Tax evasion amount | ₹140 crore (approx. $16.8 million USD) |

| Voluntary payment | ₹10.6 crore already deposited by the firm |

| Bank accounts frozen | 36 accounts linked to company and associates |

| Raid dates | August 25–26, 2025 |

| Raid locations | Six addresses in Delhi, including HQ and executives’ residences |

| Sector involved | Online real-money gaming services |

| Overseas links | Chinese nationals via Singapore and China |

| Law context | New Promotion and Regulation of Online Gaming Bill, 2025 just passed |

| Official Source | Directorate General of GST Intelligence (dggi.gov.in) |

What Exactly Happened?

The Directorate General of GST Intelligence (DGGI), Ahmedabad Zonal Unit discovered that a real-money online gaming company had allegedly dodged taxes worth ₹140 crore. The company offered online games where players could deposit and win money but failed to report these services in its Goods and Services Tax (GST) filings.

Acting on intelligence, investigators carried out raids at six locations in Delhi, including the company’s headquarters and residences of key executives. They seized documents, digital evidence, and recorded statements that confirmed non-disclosure of taxable services.

Authorities also froze 36 bank accounts tied to the company and its associates. Shockingly, they traced some of the money flow through a travel and hotel booking firm that acted as a channel for siphoning funds overseas, with alleged links to Chinese nationals operating from Singapore and China.

Why This Case Matters Now?

The timing couldn’t be more important. Just three days before the raids, India officially enacted the Promotion and Regulation of Online Gaming Bill, 2025. This new law banned real-money deposits in online gaming platforms, reshaping the industry overnight.

- Lok Sabha approved the bill: August 20, 2025

- Rajya Sabha passed it: August 21, 2025

- Presidential assent: August 22, 2025

- Enforcement action: August 25, 2025

The close timing highlights the government’s zero-tolerance approach. By immediately cracking down on violators, regulators signaled that the days of loose oversight are over.

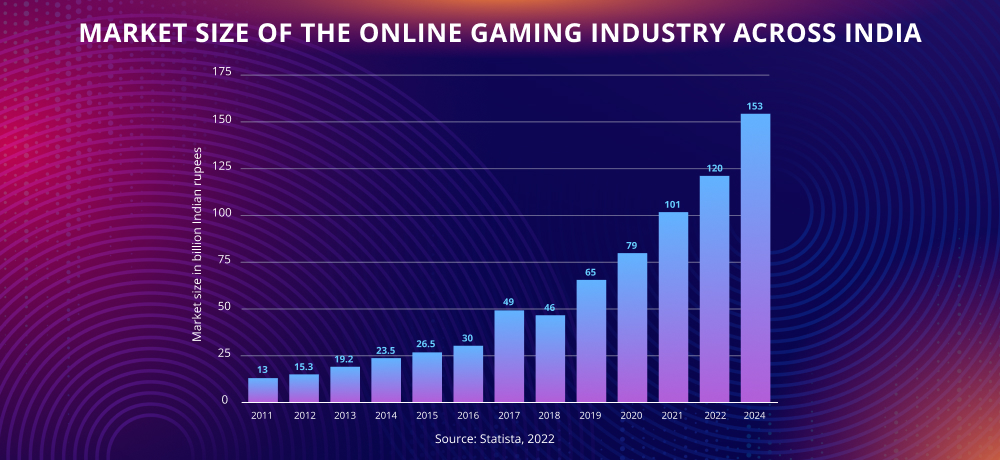

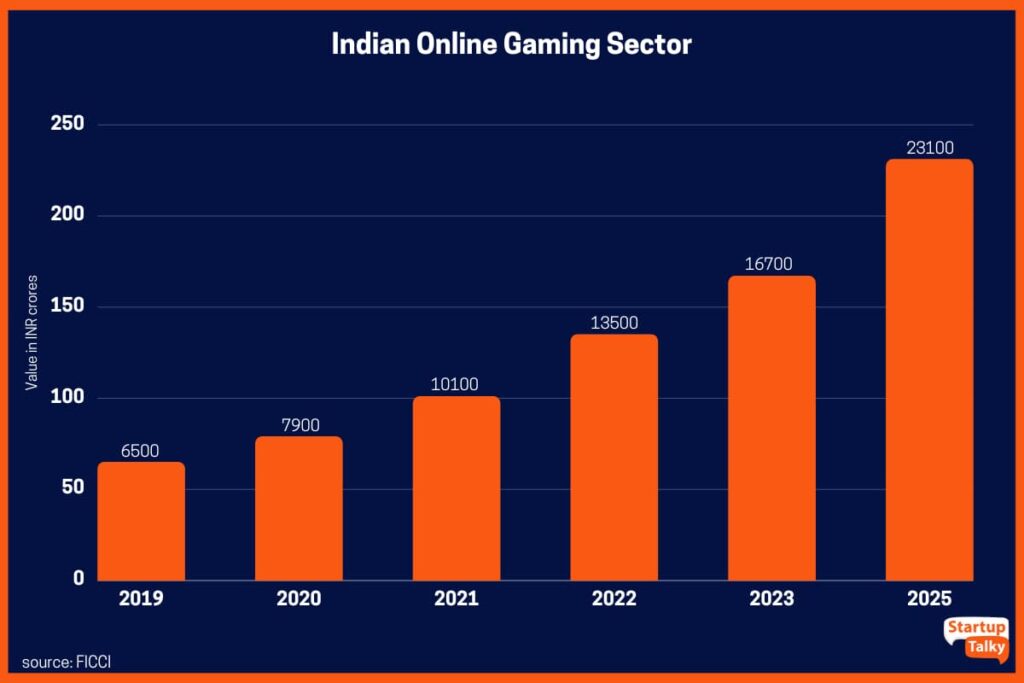

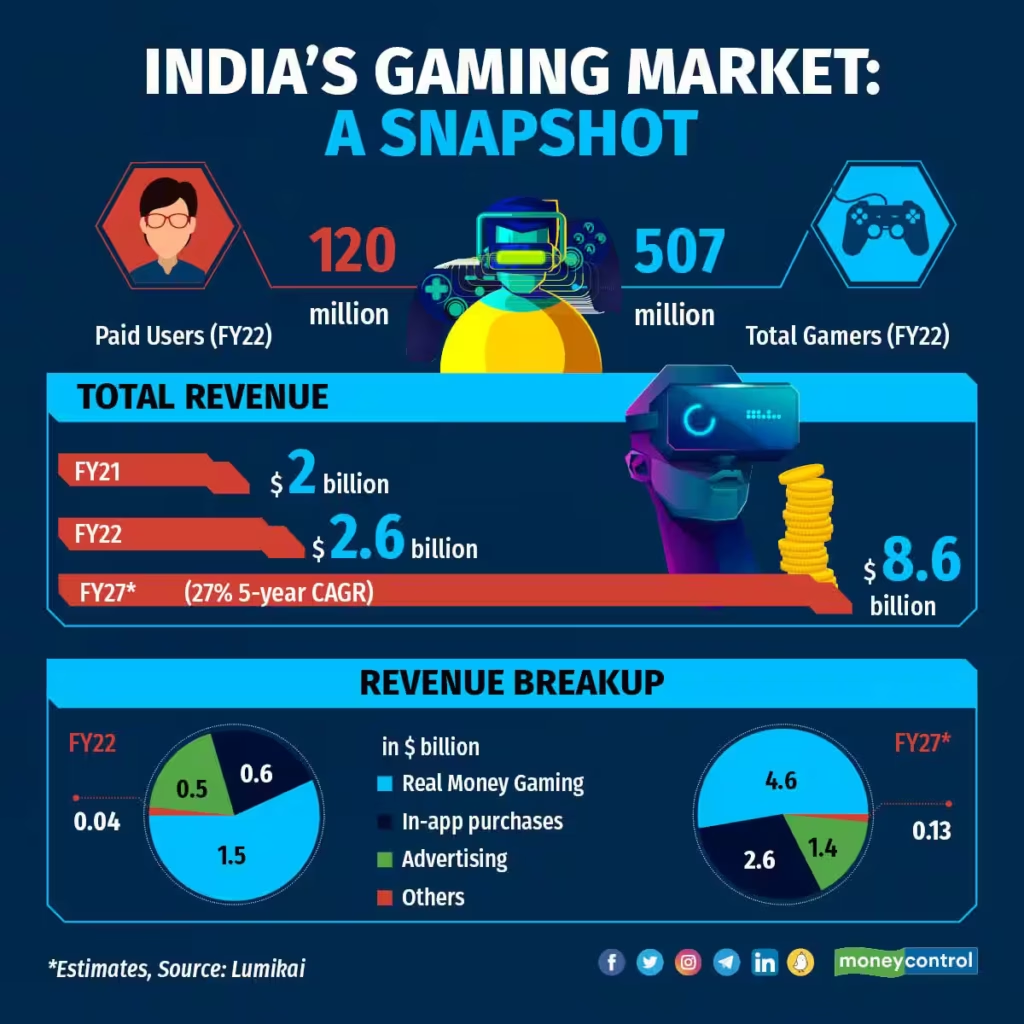

India’s Gaming Boom: The Numbers

To understand why the government is taking gaming seriously, look at the numbers:

- India’s online gaming industry is valued at $3.1 billion in 2023 and projected to reach $8.6 billion by 2027 (KPMG).

- More than 450 million Indians are active online gamers, making it one of the largest gaming markets in the world.

- The industry employs over 50,000 professionals in tech, design, customer support, and marketing.

Such a massive and fast-growing sector is a goldmine for tax revenues. Any attempt to bypass compliance directly threatens the government’s ability to regulate and monetize the industry.

How the Scam Worked: A Simple Analogy

Imagine you run a lemonade stand. You sell $100 worth of lemonade in one day. You’re supposed to give $10 in tax to the government, but instead you hide your earnings and keep the full $100.

Now scale that to millions of users depositing money into a gaming platform. The company allegedly kept massive revenues off the books and avoided paying ₹140 crore in taxes. And unlike a small lemonade stand, this wasn’t just forgotten pocket change—it was organized tax evasion with global money trails.

Historical Context: Past Cases of Gaming Tax Evasion

This isn’t the first time gaming companies in India have run afoul of the taxman.

- In 2021, a popular fantasy sports operator was accused of underpaying ₹21,000 crore in GST by categorizing bets as “games of skill.”

- In 2023, the government issued tax notices to offshore betting sites and apps, accusing them of laundering funds through India.

- In 2024, several smaller online casinos were forced to shut down after failing to comply with GST norms.

The Ahmedabad case adds to this pattern, reinforcing the government’s determination to make the gaming industry transparent and accountable.

Global Comparisons

India isn’t alone in cracking down on gaming tax evasion. Other countries have strong laws:

- United States: Online betting is regulated at the state level. Operators must collect and pay taxes upfront. Violations can lead to criminal charges.

- United Kingdom: Gambling operators are required to hold licenses and pay a 21% Remote Gaming Duty. Non-compliance can cost millions in penalties.

- Singapore: Online gambling is tightly controlled. Only a handful of licensed operators are allowed, and all revenues are strictly audited.

India’s 2025 Online Gaming Bill puts it on par with these global models, where regulation and taxation go hand-in-hand.

Expert Opinions on Gaming Firm Caught in ₹140 Crore Tax Evasion

Tax consultant Rajeev Gupta, speaking to the Indian media, explained:

“The new Online Gaming Bill combined with enforcement by agencies like DGGI will completely transform the industry. Companies that don’t comply with GST rules simply won’t survive.”

Gaming industry analyst Mehul Desai added:

“This is a signal to investors as much as to companies. Money will now flow only into firms that are transparent, tax-compliant, and legally sound.”

Lessons for Businesses and Professionals

There are practical takeaways here for startups, entrepreneurs, and established firms:

Compliance is Non-Negotiable

Trying to hide income may look profitable in the short term, but penalties, raids, and frozen bank accounts can destroy a company overnight.

Transparency Builds Trust

Regulators, investors, and even customers prefer firms that play fair. Being open with tax filings is not just about avoiding trouble—it’s about building credibility.

International Transactions Need Clean Records

Working with overseas partners is fine, but money trails to opaque jurisdictions immediately raise suspicion.

Stay Updated on Laws

Ignorance is no excuse. The Online Gaming Bill shows how quickly laws can change. Companies must adapt in real time.

Pro Tips for Startups and Investors

- Use licensed payment gateways only.

- Hire compliance officers early, especially if you’re in gaming or fintech.

- Monitor global regulations if you have cross-border investors or partners.

- Avoid DIY tax filings—hire professional accountants or tax lawyers.

Legal Remedies if You Slip Up

Sometimes, mistakes in GST filing are unintentional. If that happens:

- Make a voluntary disclosure before investigators act.

- File revised returns and pay dues quickly.

- Cooperate fully with authorities—it can lower penalties.

- Consult experienced tax lawyers to manage disputes.

Impact on Jobs and Careers

The gaming industry employs thousands of young professionals in technology, customer service, law, and compliance.

- Short-term: Crackdowns may cause layoffs in non-compliant companies.

- Long-term: Law-abiding firms will thrive, creating safer, better jobs.

For students and professionals, this opens up new career paths in gaming law, fintech compliance, and taxation consulting.

Tax Audit Evasion Crackdown Coming—Automated File Selection to Catch More Offenders

Rs 200 Crore Tax Evasion Case – Coke Plant Owner From Meghalaya Arrested By DGGI

Tampa OnlyFans Star Who Made $5.4 Million Now Charged With Tax Evasion